MyFundedFX Review 2025

Abstract:MyFundedFX Review 2025 — unregulated prop-style broker with simulated trading, mixed trust signals, rule changes, and payout claims. Is it high risk?

What MyFundedFX is — and isnt

MyFundedFX markets itself as a prop firm/evaluation services provider: traders purchase a challenge, trade a simulated account under rules, and, if they “pass,” receive a live simulated account with a profit split; this is not a regulated brokerage offering custody of client deposits or investor protections.

Because the company is unregulated, there is no prudential oversight, capital adequacy monitoring, or formal dispute-resolution framework typical of licensed brokers, raising regulatory risk for participants.

Key offerings and features

- Evaluation accounts and scaling: coverage across 1-, 2-, and 3-step challenges; claimed scaling paths up to high six or seven figures in simulated balances.

- Instruments: access to forex, indices, crypto, metals/commodities within the simulated environment.

- Platforms: the firm references DXtrade, cTrader, Match-Trader, and previously MetaTrader; U.S. clients were restricted to DXtrade amid industry platform changes.

- Payouts and logistics: marketing materials and third-party reviews reference fast or “instant” withdrawals and profit splits; specifics vary by phase and payment rails.

Recent policy changes to know

- U.S. platform restriction: in February 2024, the company said U.S. clients could only purchase new challenges on DXtrade, with MetaTrader accounts migrating off later that month.

- Consistency rule reversal: a 50% “consistency” guideline introduced in July 2024 was rolled back two weeks later after trader backlash, alongside leverage adjustments.

- High-impact news window: trades opened/closed within a specific 3‑minute window around major news on live simulated accounts would have profits excluded (“soft breach”).

Frequent rule changes can materially affect strategies, pass rates, and payout timing—important considerations before committing to challenges.

Trust and safety assessment

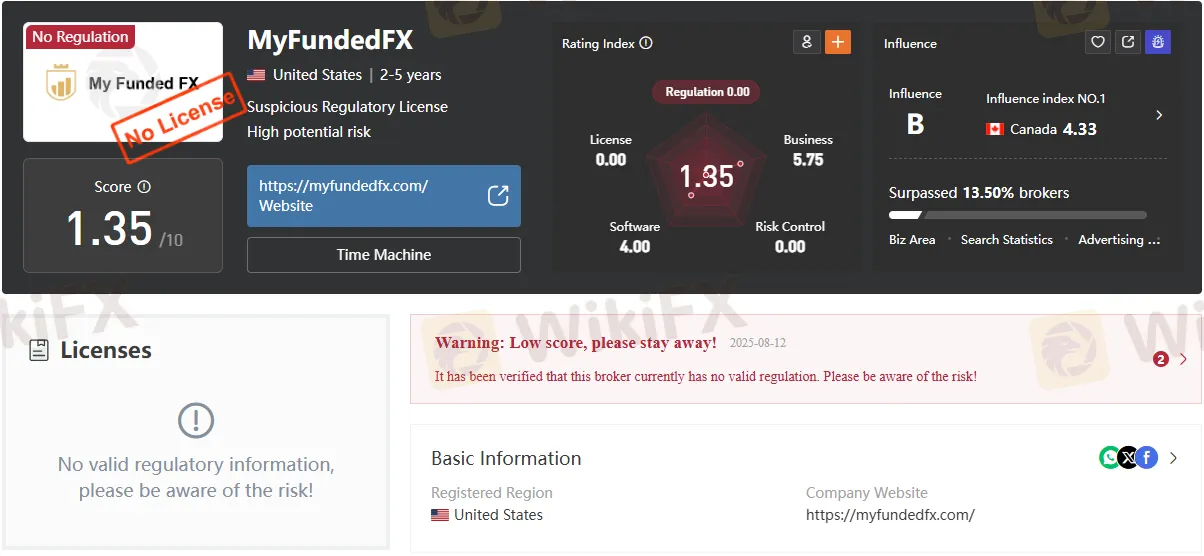

Multiple trackers list MyFundedFX as unregulated, with risk flags and mixed user reports regarding support and operations; some outlets explicitly advise caution or rate safety as low.

Unregulated status means no segregation of client funds under a regulator‘s purview; while the firm emphasizes simulated trading (so traders don’t trade real firm capital directly), fees paid for challenges and promised payouts depend on the companys internal policies and solvency rather than regulatory safeguards.

Pricing, rules, and conditions (high-level)

- Entry costs: challenge fees vary by account size; independent reviewers highlight low entry pricing tiers and headline profit splits up to 80% in funded stages.

- Risk parameters: daily and maximum drawdown limits apply; prohibited strategies include certain HFT/EAs, copy-trading/mirroring, and manipulation; breaches can void progress.

- Payout cadence and methods: third-party reviews cite frequent payouts via crypto/fintech rails, with verification steps; the firms own communications reference quick processing.

Always verify the current rulebook before buying a challenge, as enforcement details (e.g., trailing vs. static drawdown, weekend holding, news rules) materially impact outcomes.

Market sentiment and reputation

External ratings and commentary are mixed: some portals highlight convenience, platform variety, and flexible timelines, while others warn about safety and regulatory gaps; Trustpilot snapshots and aggregator scores fluctuate over time.

Risk dashboards emphasize high regulatory and fund-security risk due to a lack of oversight and uneven transparency, echoing reports of account or execution concerns from some users.

Pros

- Flexible evaluations with “unlimited time” positioning and multiple challenge formats.

- Broad instrument list across forex, indices, crypto, and commodities within simulations.

- Multiple platforms beyond MetaTrader and policy adaptations to industry shifts.

Cons

- Unregulated status with high regulatory and fund-security risk signals.

- Frequent rule/platform changes can disrupt strategies and expectations.

- Mixed external reviews and user-experience reports on support and payouts.

Who might consider MyFundedFX?

Experienced traders who fully accept prop-style evaluation risks and prefer simulated environments with flexible timelines may view MyFundedFX as a venue to test strategies, provided they track rule updates closely and size challenge purchases conservatively.

Risk-averse traders seeking regulated brokerage protections, investor-compensation schemes, and stable rulebooks should likely look to licensed brokers instead of unregulated evaluation firms.

Bottom line: Is MyFundedFX a high-risk broker?

Yes—by conventional brokerage standards, the absence of regulation, evolving rule sets, and reliance on internal payout policies place MyFundedFX in the high‑risk category, even though it frames activity as simulated prop trading rather than client-deposit brokerage.

Proceed only after reviewing the latest terms, platform availability by region, and payout conditions—and only with money that can be afforded to lose in evaluation fees.

Frequently asked questions

- Is MyFundedFX regulated? No, multiple trackers list it as unregulated.

- Can U.S. clients use MetaTrader? The firm restricted new U.S. challenges to DXtrade in February 2024, with migrations off MT later that month.

- Does it allow news trading? Profits from trades within a short window around high‑impact news may be excluded on live simulated accounts per stated rules.

- What platforms are supported? DXtrade, cTrader, and Match‑Trader are referenced; availability can vary by region and phase.

Dont miss out on the latest news on the Financial market. Scan the QR code below to download and install the WikiFX app on your smartphone.

Read more

Top 5 Warning Signs- Why You Should Avoid MTrading Broker?

Before choosing a forex broker, it's crucial to spot red flags that could cost you. MTrading has raised concerns among traders, including delayed withdrawals, poor customer support, and questionable transparency. Users also report issues like slippage and platform glitches, which can harm your trading performance. In this article, we highlight the top 5 warning signs that explain why you should avoid MTrading broker and choose a more reliable alternative.

MarketsVox Exposed: The Tactics Draining Traders’ Hard-Earned Capital

Seeing MarketsVox as a forex broker, which can help you earn monumental profit on your investments? You have set your sights on the wrong option, unfortunately. The forex broker has been disallowing withdrawals, charging a much higher spread, and duping many traders under the pretext of high returns. Read on!

Top Forex Demo Accounts for Beginners

In this guide, we will explore the top forex demo accounts for beginners. We aim to help you find the best platform for your trading practice. Let's dive into the world of forex demo accounts and discover the best options available.

Investing in OnFin? Absurd Withdrawal Conditions & Trade Manipulation May Spoil Your Trading Mood

Planning to invest in OnFin, the forex broker, which has been a nightmare for many forex traders? While withdrawal denials have remained perennial for them, trading manipulations, including the illegitimate disappearance of deposits, have put OnFin under the scanner. Traders have been vehemently expressing their frustration about the forex broker on various broker review platforms. In this article, we will share some complaints that made us expose this broker here.

WikiFX Broker

Latest News

Charles Schwab Forex Review 2025: What Traders Should Know

How 3 Simple Steps Cost a Businessman INR 4 Crore in a Forex Scam

PrimeXBT Expands FSCA Licence and Enhances Crypto Services in 2025

Quotex Broker Review 2025: Is It a High-Risk Broker?

Is CBCX a Safe and Trustworthy Broker for Traders?

TopFX Launches Synthetic Indices Trading on cTrader Platform

Is TradeEU Reliable in 2025?

How Commodity Prices Affect Forex Correlation Charts

What WikiFX Found When It Looked Into XS

The Global Inflation Outlook

Rate Calc