Professional Forex Trading: Skills, Tools, & Strategies for Success

Abstract:In the vast and fast-paced world of financial trading, the foreign exchange (forex) market reigns as the largest and most liquid market globally. Trillions of dollars are traded daily, as currencies fluctuate due to economic indicators, geopolitical events, and market sentiment. But what exactly defines a professional forex trader? What skills, strategies, and tools are essential for success in the highly competitive currency market? In this article , we’ll explore everything you need to know.

In the vast and fast-paced world of financial trading, the foreign exchange (forex) market reigns as the largest and most liquid market globally. Trillions of dollars are traded daily, as currencies fluctuate due to economic indicators, geopolitical events, and market sentiment. At the center of this dynamic environment are professional forex traders—individuals or institutions who navigate volatility with discipline, skill, and strategy. But what exactly defines a professional forex trader? What skills, strategies, and tools are essential for success in the highly competitive currency market? In this article , well explore everything you need to know.

Who Is a Professional Forex Trader?

A professional forex trader is someone who trades currencies either independently as a career or on behalf of a financial institution such as a hedge fund, investment bank, or proprietary trading firm. Unlike casual or retail traders, professional traders often undergo rigorous training, follow regulatory standards, and manage larger sums of capital. They may work as part of a team or trade solo, but what sets them apart is their commitment to consistent performance, data-driven decisions, and robust risk management.

Is Professional Forex Trading Right for You?

Becoming a professional forex trader is both challenging and rewarding. It requires discipline, analytical expertise, and a deep understanding of the markets. While the potential for profit is high, so is the risk—and only those who treat it as a serious profession will find long-term success. Whether you're aspiring to become a full-time trader or simply want to understand the world of professional currency trading, the journey starts with education, practice, and the right mindset.

Popular Forex Trading Strategies Used by Professionals

Professional forex traders choose their trading strategies based on market conditions, personal preferences, and risk tolerance. Common strategies include:

• Scalping: Executing dozens or hundreds of trades per day to capture small price movements.

• Day Trading: Entering and exiting trades within the same day to avoid overnight risk.

• Swing Trading: Holding positions for several days to capture short-to-medium-term trends.

• Position Trading: Long-term trades based on economic and fundamental trends.

• Arbitrage: Exploiting price discrepancies across different brokers or markets for profit.

Do Not Miss this Important Article- www.wikifx.com/en/newsdetail/202508126934372462.html

Essential Tools for Professional Forex Trading

To maintain a competitive edge, professional forex traders rely on high-performance tools and platforms:

• Trading platforms: MetaTrader 4/5, cTrader, or institutional-grade systems.

• News terminals: Bloomberg, Reuters for real-time financial news and updates.

• Economic calendars: Track major economic events such as interest rate decisions, GDP releases, and non-farm payrolls (NFP).

• Trade journals: Log and analyze past trades to identify patterns and areas for improvement.

• Risk management software: Automate position sizing, stop losses, and trade monitoring.

How to Become a Professional Forex Trader?

If you're aiming to go pro in forex trading, heres a step-by-step path to follow:

1. Learn the Basics

Start with foundational knowledge about currency pairs, leverage, pips, and order types. Explore free and paid forex trading courses.

2. Practice with a Demo Account

Test strategies and gain hands-on experience using virtual funds on platforms like MetaTrader.

3. Start with a Small Live Account

Transition to a real account with small capital. Focus on consistency, not profits.

4. Obtain Certifications or Licenses (If Required)

If working with a firm, licenses such as the Series 3 (U.S.), FCA registration (UK), or ASIC compliance (Australia) may be needed.

5. Decide: Work with a Firm or Trade Independently

Choose between becoming an independent professional trader or working for a financial institution.

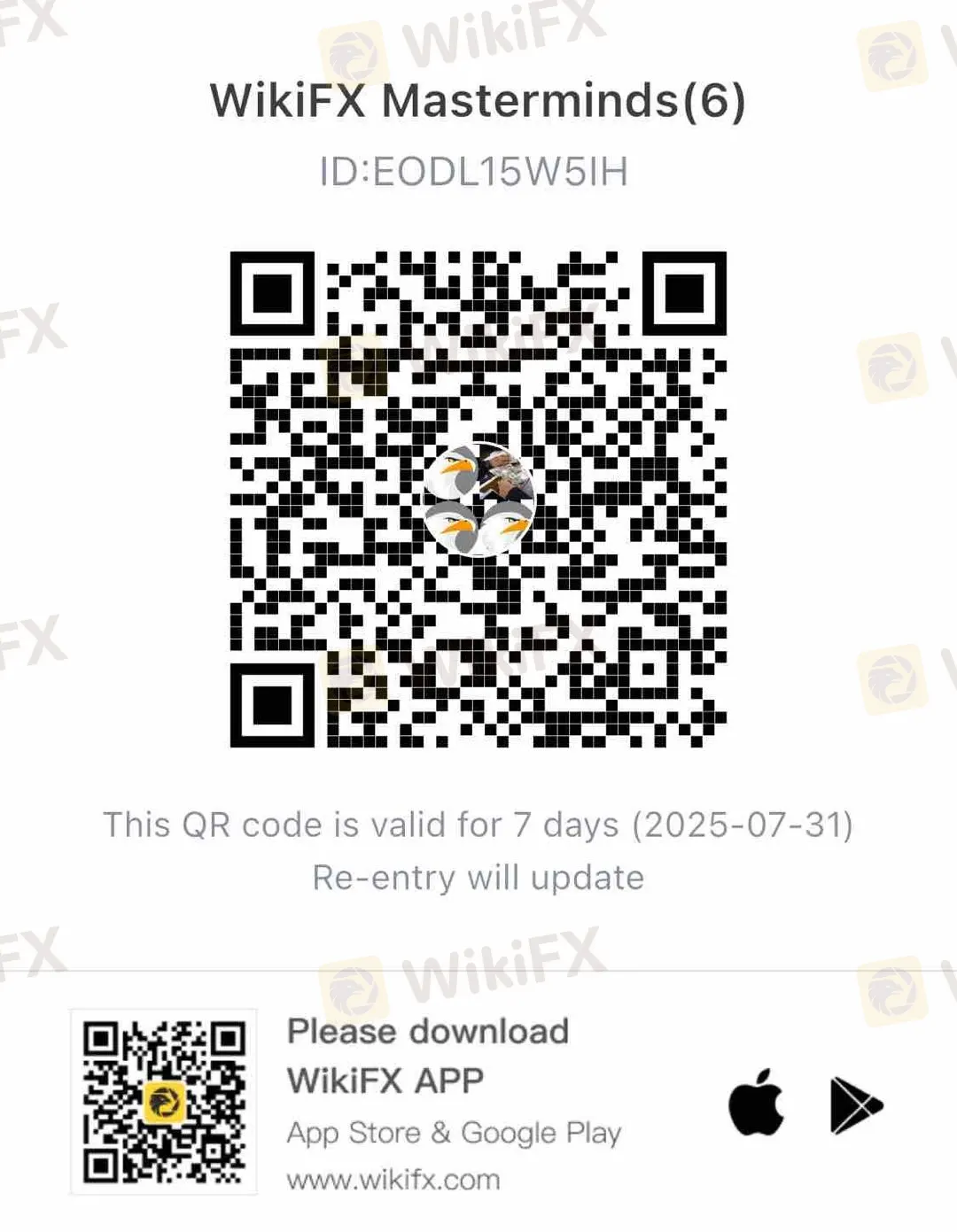

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

WARNING: 5 Legit Reasons to Avoid Envi FX at All Costs

Pay attention, traders! This is another scam alert article you must read. If you ignore it, you could easily fall prey to scam brokers active in the forex market. This article reveals 5 major red flags about Envi FX, which has now rebranded as Tradenv (formerly known as Envi FX).

Top 5 Forex Trading Risks Every Trader Must Handle Smartly

Forex trading is a dynamic market with fast-changing investor sentiments due to several economic, political and technical factors. So, while the profit avenues are massive, there is no denying the forex trading risks that can erode your capital value if not strategized properly. In this article, we will let you know of the top five forex trading risks you should handle effectively. Let’s begin!

Weekly Scam Alert: Avoid These Brokers & Protect Your Money!

If you haven’t seen the latest warnings, now’s the time. This article highlights brokers that have been reported as fraudulent. Stay updated and secure your investments.

Top Reasons Why You Should Avoid Trading with B Investor

Are you trading with B Investor and annoyed with poor withdrawal experiences? Have you been constantly made to deposit in the lure of high returns proposed by the broker officials despite results showing otherwise? Do you have to deal with unresponsive behavior from customer support executives? Wake up before it goes all wrong for you! Read on to know more.

WikiFX Broker

Latest News

WikiEXPO Global Expert Interview Spyros Ierides:Asset management and investor resilience

US Deficit Explodes In August Despite Rising Tariff Revenues As Government Spending Soars

MultiBank Group — recent exposures, complaints, and who runs the firm

Glancing at the Top 5 Forex Risk Management Tools

Everyone's Mad! | MultiBank Group's Havoc

How to Trade Forex on Your Phone: A Complete Beginner's Guide

Thinking About Investing in Trinity Capitals? Beware, It’s an Unregulated Broker!

Malaysian Traders: Stay Away From MTrading!

GMZ Global Exposed: Investors Cry Foul Play as Investment Scams Take Precedence

Disadvantages of Investing with Bulenox! Must Read

Rate Calc