What Is a Forex Spread? Learn the Basics Now!

Abstract:Learn what forex spreads are, how they impact your trading costs, and strategies to minimize them. Master bid-ask spreads with our complete 2025 guide.

If you‘re exploring forex trading, understanding “spreads” is mandatory—they’re one of the few fixed costs you encounter on every trade. This in-depth guide will explain what a forex spread is, why it matters for your trading, how it‘s calculated, what affects it, and how to choose the best broker for the tightest spreads. Let’s dive in with a clear, up-to-date approach trusted by successful traders worldwide.

What Is a Forex Spread?

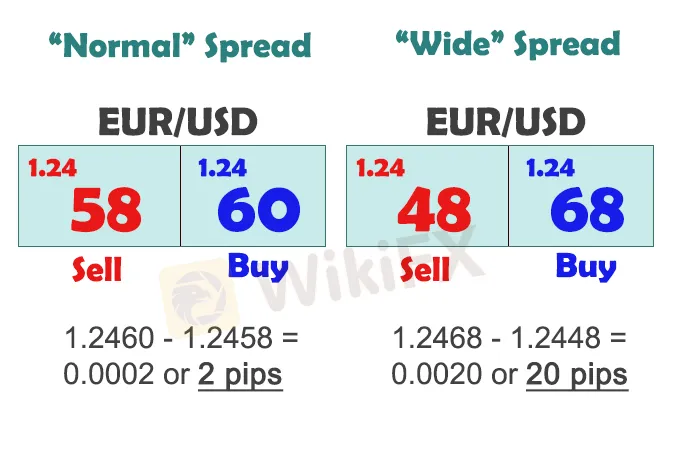

A forex spread is the difference between the bid and ask price for a currency pair. Whenever you see quotes like EUR/USD 1.1000/1.1003, the bid price (1.1000) is what buyers are willing to pay, and the ask price (1.1003) is what sellers want. The spread here is 3 pips.

In essence, the spread is the broker‘s compensation for handling your trade. It’s a transparent fee—no hidden strings.

How Do Forex Spreads Work?

Each time you open a trade, you “buy” at the ask price or “sell” at the bid price. But as soon as you open a position, youre immediately down by the size of the spread. You must overcome this gap before earning a profit. If the spread is 2 pips, your trade must move by at least 2 pips in your favor just to break even.

Brokers quote spreads in pips or fractional pips (“pipettes”). A pip, short for “percentage in point,” is usually 0.0001 for most currency pairs. “Tight” spreads are great—they reduce the hurdle to profitability.

Why Do Spreads Matter in Forex?

Spreads are a core trading cost—especially as a high-frequency trader. Every single trade puts the spread expense front and center. Lower spreads mean:

- Smaller costs on each trade

- Quicker break-even points

- Tighter risk management

Suppose you scalp 20 trades per day, each with a 1.5-pip spread. Over weeks and months, those tiny amounts can add up to hundreds, if not thousands, in direct trading expenses.

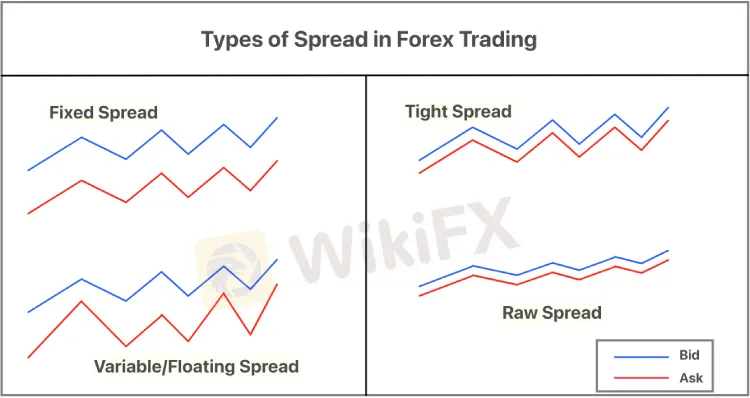

Fixed vs Variable Spreads

Forex brokers offer either fixed or variable spreads. Heres how they differ:

| Spread Type | Description | Advantages | Drawbacks |

| Fixed | Always the same, regardless of market volatility | Predictability, stability | May be slighty wider, requotes |

| Variable | Fluctuates with liquidity and volatility | Can be narrower, fairer | May suddenly widen during news |

Fixed spreads suit traders who want consistency—knowing their costs in advance. Variable spreads are favored by serious traders trading major pairs during busy times.

Typical Spreads For Major Currency Pairs

The most traded forex pairs generally attract the tightest spreads. Heres a snapshot of typical spreads for major pairs (mid-2025):

- EUR/USD: 0.1–1.2 pips

- USD/JPY: 0.2–1.5 pips

- GBP/USD: 0.3–2.0 pips

Exotic pairs (like USD/TRY, USD/MXN) can have spreads from 10 to 50 pips, reflecting their lower liquidity and increased trading risk.

You can check the real time spread comparison here: https://www.wikifx.com/en/spread.html

What Affects Forex Spreads?

Several live market factors shape spreads:

- Liquidity: When more people trade a currency pair, spreads tighten.

- Market Volatility: High drama (like news events) can make spreads balloon.

- Session Times: Spreads are smallest during the London & New York overlap; theyre usually wider at night or in the “Asian” session.

- Broker Type: ECN brokers usually offer tight, variable spreads with a commission; market makers might have wider, fixed spreads.

Understanding what impacts spreads helps you optimize timing, pair selection, and broker choice.

How to Calculate Spread Cost

The cost of a spread is easy to calculate:

Spread Cost = Spread (in pips) × Trade Size × Pip Value

Example:

If EUR/USD has a 2-pip spread and youre trading a standard lot (100,000 units), and a pip = $10, your cost is:

2 × $10 = $20 per trade.

This fee is baked-in—you pay it whether you win or lose.

How to Minimize Spread Costs

Lowering spread costs is about precision:

- Trade during busy market hours (London/New York overlap)

- Stick to major currency pairs for the tightest spreads

- Consider limit/stop orders to avoid “off-market” wide spreads

- Compare and review broker quotes frequently

Tighter spreads mean more of your money stays in your pocket.

Choosing the Right Broker

Not all brokers are created equal. Here are key criteria:

- Regulation: Always choose licensed, regulated brokers for safety.

- Spread Transparency: Reliable brokers display live spreads (not just “from X pips…”).

- Execution Speed: Fast order matching reduces slippage and requotes.

- Commission Structure: Some brokers charge low or no spreads but add a commission—calculate your true cost trade-by-trade.

- Total Fees: Watch for overnight swaps, account inactivity, and miscellaneous fees that eat into your performance beyond simple spread costs.

Major reputable brokers publish a “contract specifications” or “spread comparison” page—study these before opening an account.

Windows When Spreads Widen

Extreme spread spikes dont happen randomly. The most common causes:

- Major Economic Releases: Job reports, interest rate decisions, or political shocks.

- Low-Liquidity Windows: After NY close, before Asia opens, or during public holidays.

- Sudden Market Panic: News shocks or surprise policy announcements.

Spreads can widen 5-10x the usual amount at these times. If youre trading during these periods, use limit orders with care—or consider waiting it out.

Bid-Ask Spread vs. Commission

Some brokers publish “zero spreads,” but they add a commission to each trade. Others “bundle” their fee into the spread. Heres a quick comparison:

| Model | How Costs Appear | Best For |

| Spread-only | All in the broker's spread | Beginners, low-volume traders |

| Commission + Spread | Ultra-tight spread: flat fee | High-volume, professional traders |

The key is to compare “all-in” pricing—the sum of spread and commission for each lot traded.

What Is a Good Spread in Forex?

Theres no universal answer—it depends on the currency pair and your style:

| Pair | Tight Spread | Average Spread | Wide Spread |

| EUR/USD | 0.0-0.5 pips | 1.0-1.5 pips | 2+ pips |

| GBP/USD | 0.3-1.0 pips | 2-3 pips | 4+ pips |

| USD/JPY | 0.2-1.0 pips | 1.5-2 pips | 2.5+ pips |

| Exotics | 2-5 pips | 10-20 pips | 30+ pips |

Major pairs with spreads below 1 pip are considered excellent. Anything significantly higher should prompt a second look at broker or timing.

Why Spreads Change (and What You Can Do)

- Dynamic Market: Spreads reflect live trading activity and risk.

- Broker Model: ECN or STP brokers route trades into deep, competitive liquidity pools, producing variable, ultra-tight spreads in calm periods and wider ones during chaos.

Pro tips for avoiding bad spreads:

- Check live quotes at different times

- Dont trade during major economic calendar events unless well-prepared

- Avoid trading at session close/open

Spread Example in Action

Imagine buying USD/JPY:

- Bid: 144.905

- Ask: 144.928

- Spread: 2.3 pips

You buy at 144.928. The moment you do, you could only “sell” at 144.905, so you‘re instantly down the spread amount. If the market rises and you sell at 144.963, you’ve earned 3.5 pips in profit (after overcoming the 2.3-pip spread).

Spread and Different Trading Strategies

- Scalping: Every pip counts—low spreads are the single most important cost factor.

- Day Trading: Spreads matter, but less than for scalpers. Tight spreads and fast execution remain key.

- Swing/Position Trading: Spreads matter less, as gains or losses dwarf the cost of a few pips.

- Algorithmic Trading: Even tiny pip differences in spread can mean the difference between success and failure across hundreds or thousands of trades.

Spread Myths and Facts

- “All brokers have the same spreads.” False—there are big differences, especially in exotics or during news events.

- “If I only place winning trades, I dont pay the spread.” False—you pay every time you enter a trade, win or lose.

- “ECN is always cheapest.” Mostly, but not always. Compare your likely commission plus spread to see whats best for your volume.

How to Monitor Spreads Live

Most trading platforms show the bid and ask price by default. Some offer a “spread indicator” showing live or average spreads for various pairs—a huge help for active traders. Always monitor spreads at different sessions and right before news drops.

Spread Widening—The Key Hazards

Be vigilant for:

- Pre- and post-news volatility (NFP, central bank meetings, GDP announcements)

- Asia session (lower liquidity often means wider spreads)

- Late Friday, early Monday openings (weekend gaps can cause huge temporary spreads)

Commodity currencies (like AUD, NZD, CAD) often see more spread widening outside their respective business hours.

Brokers With the Tightest Spreads

As of 2025, leading ECN/STP brokers regularly offer spreads as low as 0.0–0.2 pips for major pairs (plus a $7-8 round-trip commission per lot). Some market maker brokers publish impressive minimums, but “fine print” often reveals higher real-world averages. Demo test brokers first to verify their claim.

Forex Spread vs. Other Costs

Dont focus only on the spread. Consider:

- Commission per trade (especially with ECN brokers)

- Swap or overnight charges

- Deposit/withdrawal fees

- Minimum account balances

- Order execution quality

Look for a broker that excels on all counts—not just the headline spread number.

Frequently Asked Questions

What is a pip?

A pip is usually the smallest price move a currency pair can make—typically 0.0001 for most pairs.

Why did my spread widen suddenly?

Usually, its due to news, illiquidity (overnight, weekends), or low trading volume.

How can I check live spreads?

Open a demo account with a reputable broker—compare their “bid/ask” prices during different times of day.

Should I only focus on spread size?

No—consider commissions, swap fees, execution quality, and regulation.

Whats an average spread for EUR/USD in 2025?

For most trusted brokers: 0.1–1.2 pips, varying by account type and session.

Spread Betting vs. Traditional Forex Trading

Spread betting is popular in the UK and offers the ability to trade forex (and more) without actually owning or exchanging currencies. Costs mirror forex trading: the “spread” between bid and ask represents your core trading cost. Spread bettors should seek the tightest markets just like spot forex traders.

Final Tips For Mastering Forex Spreads

- Always check spreads before every trade

- Trade during major sessions for best liquidity and costs

- Choose brokers for spread transparency and regulation

- Factor spreads into every risk and money management decision

- Test brokers with demo accounts to see real-world spreads, not just marketing claims

Conclusion

Understanding the forex spread unlocks a critical piece of your trading edge. Its a permanent cost—sometimes small, sometimes significant, but always present. Those who master spreads and broker selection can dramatically reduce costs and boost long-term results. Remember, tight spreads combined with smart timing, credible brokers, and strict discipline can have a bigger impact on your trading than the latest indicator or news headline.

Stay informed, compare often, and make your trading as efficient as possible. With the right moves, the forex spread becomes not an obstacle, but a stepping stone on your journey to trading success.

Disclaimer: Forex trading is risky. Always use proper risk management and seek professional advice if unsure.

Ready to boost your forex skills? Scan the QR code below to download the app and start learning and trading with confidence today!

Read more

Forex Success Stories: Lessons You Can Use to Win

There can be many ups and downs even for the world’s best forex traders. However, they remain undeterred in their vision to overcome the challenges that come their way. That’s why they form part of forex success stories that continue to inspire generations. One can inherit some lessons to be among successful currency traders. In this article, we will be sharing the lessons you can use to be successful in forex trading.

Top Forex Trading Books Every Beginner Should Read

Boost your forex trading with the best beginner books! Discover top forex books for beginners covering essential strategies, trading psychology, risk management, and success tips.

Is Forex Trading Halal or Haram? What Do Scholars Say?

For Islamic traders and investors, one of the most relevant and frequently asked questions is whether forex trading is halal (permissible) or haram (forbidden) in Islam? In this article, we will explore both sides of the debate. Keep reading to uncover the truth and make Informed & Faith-conscious decisions about your investments.

Top Forex Pairs for Scalping: Best Currency Choices Explained

Discover the best forex pairs for scalping in 2025. Learn which currency pairs offer top liquidity, tight spreads, and volatility for fast, profitable trades.

WikiFX Broker

Latest News

Euro zone inflation holds steady at higher-than-expected 2% in July

Forex Success Stories: Lessons You Can Use to Win

Scam Alert: FCA Issued Warning! Check the List of Unauthorized Brokers Below!

FCA Forex Trading Regulations Explained – What Every Trader and Broker Must Know

FIBO Group: A Closer Look at Its Licenses

Making Money with Forex Weekend Trading

Fortrade: A Closer Look at Its Licenses

FRAUD ALERT! Spanish Regulator, CNMV Exposed Scam Brokers

Euro zone economy ekes out better-than-expected 0.1% growth in second quarter

Adidas to raise prices as US tariffs cost €200m

Rate Calc