Top Forex Pairs for Scalping: Best Currency Choices Explained

Abstract:Discover the best forex pairs for scalping in 2025. Learn which currency pairs offer top liquidity, tight spreads, and volatility for fast, profitable trades.

Introduction

Picture this: you're diving into the whirlwind of forex trading, where scalping means jumping in and out of trades like a pro athlete dodging obstacles, all to snag those tiny profits that stack up big over a day. It's thrilling, but let's be real—picking the best forex pairs for scalping can make or break your game. Not every pair plays nice with this speedy style; you need ones that deliver smooth sails with high liquidity, just enough zip in volatility and spreads so tight they don't eat into your wins. In this piece, we're breaking down the top picks for 2025, chatting about what makes them tick, the sweet spots for trading them, and some clever strategies to level up your scalping. Whether you're just starting out or you've got battle scars from the markets, stick around—we'll arm you with insights to sharpen your edge and boost those results.

What Makes a Forex Pair Ideal for Scalping?

Okay, so what turns a regular currency pair into a scalper's best friend? It all boils down to a few must-haves that keep things running like a well-oiled machine. First off, killer liquidity is non-negotiable—it means your orders zip through without annoying delays or that pesky slippage that can turn a win into a flop. Then there's the spread game: keeping them super low cuts down on costs, which is huge when you're chasing those slim pip gains across tons of trades. Don't forget volatility—it's got to be there, but not over-the-top, so you can spot and grab those quick price shifts instead of sitting around for massive swings. And hey, a bit of predictability in how prices move, especially during the big trading sessions, lets you zero in on patterns that show up again and again, making your strategies way more reliable and fun to execute.

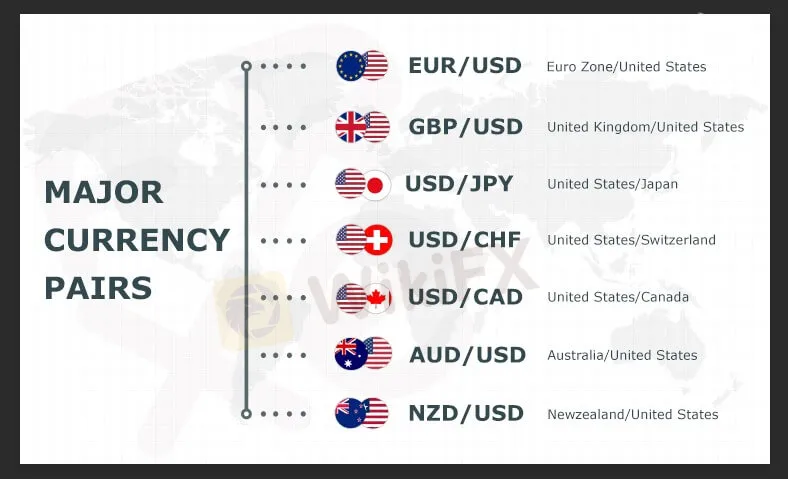

Leading Forex Pairs for Scalping in 2025

Out in the wild world of forex, a handful of pairs really shine for scalping, thanks to their rock-solid liquidity, lively action, and times that line up perfectly with busy market hours. Take EUR/USD—it's basically the superstar, pulling in massive daily volumes and boasting spreads that hug the line during that golden London-New York overlap. This pair dances to the tune of economic news from both sides of the Atlantic, dishing out solid chances for folks who love breakout plays or snuggling into ranges for quick scalps.

Then there's GBP/USD, packing more punch in volatility than its Euro cousin, which means bigger potential payouts if you can handle the ride with those occasionally wider spreads. It's a go-to for traders who get a kick out of news-driven rushes, especially when London buzzes with UK or US data drops that send prices flying in exciting ways.

USD/JPY? Oh, it's all about those smooth, steady trends and super-clean charts that make slipping up rare during Tokyo or New York hours. When US or Japanese bigwigs drop macro updates, it sparks just the right kind of predictable jolts—perfect for scalpers who dig following trends without the chaos.

USD/CHF brings a chill vibe with its balanced volatility, steady flow of trades, and that safe-haven charm from the Swiss franc, setting the stage for range plays where prices bounce back to the mean during London and New York action.

AUD/USD pulls in the crowd for Asian session fans, tying closely to commodity vibes and Aussie news that keep things moving. Sure, spreads might stretch a bit off-peak, but nailing your timing around the hot hours turns it into a goldmine for sharp, timely moves.

And for the bold ones, pairs like GBP/JPY, EUR/JPY, or other Yen crosses crank up the volatility with wild swings that can pay off handsomely. They're not for everyone, though—seasoned scalpers thrive here, but you've got to nail down tight risk controls to dodge the unpredictability and those sneaky wider spreads that can sneak up.

Optimizing Scalping Success: Timing and Strategy

Want to crank your scalping up a notch? It's all about syncing with the right sessions, where the magic happens. That London-New York crossover from 8:00 AM to 12:00 PM EST? It's a powerhouse of liquidity and energy, serving up razor-thin spreads and zippy moves for pairs like EUR/USD, GBP/USD, and USD/CHF. The full London stretch fuels those trending vibes that work wonders for GBP combos and Euro crosses. Over in Asia, from 7:00 PM to 4:00 AM EST, it's prime time for USD/JPY and AUD/USD lovers chasing calm ranges or those early bursts of momentum.

On the strategy side, breakout scalping is a blast—jumping in when prices smash out of tight spots after consolidations. Mean reversion keeps it steady, playing the back-and-forth in reliable bands. Momentum scalping? That's riding the fast waves during high-volume rushes for quick directional wins. Picking your poison comes down to how wild the pair gets, what time you're trading, and how comfy you are with the heat—match it right, and you're golden.

Risk Management and Broker Considerations

Scalping's high-speed chase amps up the risks from all those fees piling up on spreads and commissions, so hunt down brokers with the skinniest spreads and lightning-fast fills to keep your edge sharp. In those blink-and-you-miss-it timeframes, market chatter can fake you out, so stick like glue to solid signals and stay cool-headed to avoid knee-jerk moves in the frenzy. Throw in firm stop losses and cap your daily trades to protect your stack and keep your mind in the game—it's all about playing smart to last long-term.

Conclusion

As we roll through 2025, the best forex pairs for scalping are still the champs that blend deep pools of trades, skinny spreads, and that sweet spot of volatility for nabbing fast, bite-sized profits day in and day out. EUR/USD, GBP/USD, USD/JPY, and USD/CHF hold the fort as reliable picks, dishing out steady action and budget-friendly setups that scalpers crave. For the pros ready to amp it up, those feisty minors and crosses like GBP/JPY or EUR/JPY can supercharge your gains, but only if you're locked in with ironclad risk smarts. Get your pairs matched to buzzing sessions, tweak your approach to the market's rhythm, and you'll be cruising in scalping's speedy lane. Remember, it's discipline, flexibility, and always learning that pave the way to real wins. Here's to your trades—may they be swift and profitable!

Ready to boost your forex skills? Scan the QR code below to download the app and start learning and trading with confidence today!

Read more

Forex Success Stories: Lessons You Can Use to Win

There can be many ups and downs even for the world’s best forex traders. However, they remain undeterred in their vision to overcome the challenges that come their way. That’s why they form part of forex success stories that continue to inspire generations. One can inherit some lessons to be among successful currency traders. In this article, we will be sharing the lessons you can use to be successful in forex trading.

Top Forex Trading Books Every Beginner Should Read

Boost your forex trading with the best beginner books! Discover top forex books for beginners covering essential strategies, trading psychology, risk management, and success tips.

Is Forex Trading Halal or Haram? What Do Scholars Say?

For Islamic traders and investors, one of the most relevant and frequently asked questions is whether forex trading is halal (permissible) or haram (forbidden) in Islam? In this article, we will explore both sides of the debate. Keep reading to uncover the truth and make Informed & Faith-conscious decisions about your investments.

What Is a Forex Spread? Learn the Basics Now!

Learn what forex spreads are, how they impact your trading costs, and strategies to minimize them. Master bid-ask spreads with our complete 2025 guide.

WikiFX Broker

Latest News

Euro zone inflation holds steady at higher-than-expected 2% in July

Forex Success Stories: Lessons You Can Use to Win

Scam Alert: FCA Issued Warning! Check the List of Unauthorized Brokers Below!

FCA Forex Trading Regulations Explained – What Every Trader and Broker Must Know

FIBO Group: A Closer Look at Its Licenses

Making Money with Forex Weekend Trading

Fortrade: A Closer Look at Its Licenses

FRAUD ALERT! Spanish Regulator, CNMV Exposed Scam Brokers

Euro zone economy ekes out better-than-expected 0.1% growth in second quarter

Adidas to raise prices as US tariffs cost €200m

Rate Calc