What Does PrimeXBT's Offshore Regulatory Status Really Mean?

Abstract:Understanding PrimeXBT's offshore regulatory status, its implications, and what it means for traders looking for transparency and reliability in their investments.

Introduction

In the ever-evolving world of online trading, regulatory compliance is a cornerstone of trust and legitimacy. As global markets become more accessible, traders are faced with the crucial decision of selecting platforms that not only suit their needs but also provide security and regulatory assurance. One platform that has recently come under scrutiny is PrimeXBT, an entity boasting a fresh business registration with the Financial Services Regulatory Authority (FSRA) of Saint Lucia as of May 24, 2024. But what does this “offshore regulated” status truly signify, and what are the real-world implications for those considering trading on PrimeXBT? Lets dig deeper into the evidence and demystify what being “offshore regulated” really means.

Understanding “Offshore Regulated”: Beyond the Buzzword

What the Certificate Reveals

The certificate from Saint Lucias FSRA (Financial Services Regulatory Authority) identifies PrimeXBT Trading Services Ltd as an entity with offshore regulated status, effective from May 24, 2024. This status, accompanied by the license number 2024-00343, underscores that PrimeXBT is officially recognized as a business registered in Saint Lucia. Notably, the license type is categorized strictly under Business Registration, with no clear indicators of regulatory oversight for financial operations such as client fund protection, risk assessments, or ongoing compliance checks.

Regulatory Implications

Saint Lucia, like many other offshore jurisdictions, is known for promoting business-friendly environments with:

- Streamlined incorporation processes

- Low taxation

- Minimal ongoing reporting requirements

While these features attract businesses seeking operational flexibility, they also raise important questions:

- What kind of oversight does PrimeXBT undergo?

- How protected are clients compared to platforms regulated by top-tier authorities (like the FCA, ASIC, or CFTC)?

- What recourse do traders have in the event of disputes or insolvency?

In the certificate, details such as the address, website, and contact information of the licensed entity are notably absent1. The FSRA does not appear to mandate transparency or customer accessibility as a requirement for licensing. This is a pivotal distinction from onshore regulators, who typically require public disclosure of such information.

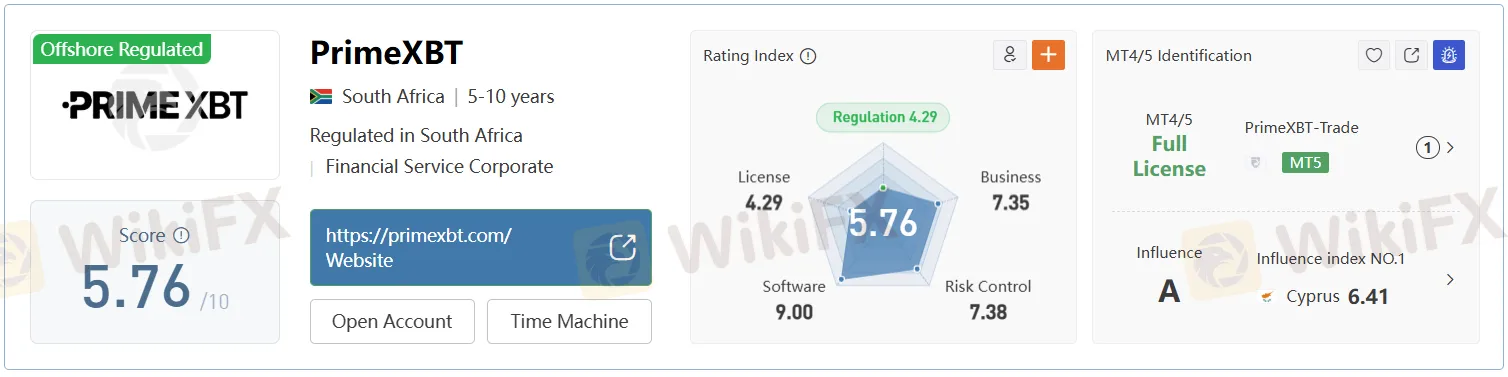

PrimeXBTs Public Profile & Community Insights

Supplemental images illustrate PrimeXBT‘s standing among online trading communities. The company is referenced across various platforms, including trading review forums, scam report aggregators, and user-led discussions2. A recurring sentiment is mixed cautious optimism: users see the appeal of global access and leverage, yet many express concern about the platform’s offshore status and lack of top-tier regulation.

Key Points From the Community

- Transparency: Review sites and community discussions often highlight the absence of transparent business practices commonly found with more rigorously regulated brokers2. Concerns are raised about customer support efficacy and the ability to resolve issues.

- Coverage: Platforms assessed cover various transaction types (forex, crypto, CFDs), reinforcing PrimeXBTs diverse service offering—but again, community members remain wary about trust.

- Due Diligence Reminders: Most reputable forums advise traders to conduct extra due diligence before depositing funds with brokers holding only offshore licenses.

Offshore vs. Onshore Regulation: Whats the Difference?

| Aspect | Offshore (Saint Lucia FSRA) | Onshore (e.g. US, UK Regulators) |

| Oversight | Minimal - focuses on business registry | Robust - includes compliance checks |

| Consumer Protectors | Limited to none | Investor compensation, strict standards |

| Transparency | Often limited | High - public registration, clear contacts |

| Dispute Resolution | Light or no taxation, less reporting | Established mechanism for complaints |

| Tax/Reporting | Light or no taxation, less reporting | Higher taxes, regular audits |

Being “offshore regulated” typically means a business has been incorporated and acknowledged by a jurisdiction with lax requirements. There is usually no continuous scrutiny to ensure that customer funds are segregated or that the business operates with fair practices. In contrast, onshore regulation (by authorities such as the Financial Conduct Authority in the UK or the SEC in the US) introduces stringent layers of oversight, consumer protection policies, and transparent dispute resolution channels.

What This Means for Traders

Risk Considerations:

- Capital safety is less guaranteed: While an offshore license is a legal document, it does not equate to a regulatory safety net for client funds.

- Limited recourse: Should disputes emerge, non-local clients may find it difficult—if not impossible—to resolve issues in their favor.

- Transparency hurdles: Lack of a legal requirement for address, contact details, or regular auditing makes it harder to independently verify the brokers bona fides.

Potential Benefits:

- Access to global markets: Offshore brokers may offer products or leverage that is prohibited elsewhere.

- Reduced bureaucracy: Account setup and verification processes are usually swift and streamlined.

Weighing the Merits

Choosing to trade with a broker like PrimeXBT is fundamentally a trade-off between opportunity and risk. For sophisticated or high-risk traders, the potential upside may outweigh the dangers, especially if operating with strict personal risk controls. However, for average or inexperienced clients, the absence of robust investor protections should not be taken lightly.

Conclusion

PrimeXBTs new offshore regulatory status, granted by the Financial Services Regulatory Authority in Saint Lucia, fulfills legal requirements to operate as a business entity but does little to assure substantial regulatory oversight or client protections. Traders must recognize that “offshore regulated” does not imply strong regulatory backing. The responsibility to assess and accept the risks of such a trading environment ultimately falls squarely on the shoulders of the user. Vigilance, self-education, and a clear-eyed assessment of potential pitfalls are crucial when dealing with any offshore-licensed financial entity.

Visit PrimeXBT's broker page for comprehensive details: https://www.wikifx.com/en/dealer/5841612105.html

Read more

7 Common Mistakes Made by Indian Forex Traders

Forex trading has become very popular among Indian traders in recent years. Every month, thousands of new traders join this market. But sadly, majority of them lose their hard-earned money because of their common mistakes. Which are these mistakes? Read below.

iFourX: So Many Red Flags You Can’t Ignore

Forex trading has become difficult nowadays due to the frequent frauds occurring every day. You can’t blindly trust any broker . They may appear genuine and authorized but end up being scams. That’s why it’s more important to stay aware. To stay alert and informed, you need to know about a particular FX broker called iFourX and recognize its red flags.

Five Unauthorised Brokers Warned by the FCA

UK’s watchdog, the Financial Conduct Authority (FCA), recently issued a fraud alert against brokers who are operating without a license but still offering financial services. The FCA has identified these scam brokers and is warning the public not to engage with them. Check out the names of those brokers below.

FXView: A Closer Look at Its Licenses

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about FXVIEW and its licenses.

WikiFX Broker

Latest News

Does XS.com Hold Leading Forex Regulatory Licenses?

Chile Bumps Up Copper Price Forecast and Flags Lagging Collahuasi Output

Treasury yields tick lower as investors look ahead to Fed's interest rate decision

Thailand-Cambodia War Pressures Thai Baht in Forex Market

Investors Accuse Duttfx Markets of Scam: What You Should Know

A breakthrough and a burden? What the U.S.-EU trade deal means for the auto sector

Treasury yields flat as investors look ahead to Fed's interest rate decision

China's latest AI model claims to be even cheaper to use than DeepSeek

Bitget Lists Caldera for Spot Trading | What Should You Know?

Jim Cramer explains what's driving the stock of Tapestry

Rate Calc