7 Common Mistakes Made by Indian Forex Traders

Abstract:Forex trading has become very popular among Indian traders in recent years. Every month, thousands of new traders join this market. But sadly, majority of them lose their hard-earned money because of their common mistakes. Which are these mistakes? Read below.

Forex trading has become very popular among Indian traders in recent years. This growing interest is one of the reasons why the Forex market has a bright future in India. Every month, thousands of new traders join this market. But sadly, majority of them lose their hard-earned money because they make common mistakes. Which are these mistakes? Read below.

1. Overtrading

Overtrading is one of the common mistakes made by Indian Forex traders. Many traders get too excited or impatient and place too many trades without a clear plan. This can lead to losses, especially if the trades are based on emotions and not proper analysis. Trading too often also increases the chances of making mistakes. It's better to take fewer trades with proper research than to trade all the time without a strategy.

2. Trading Through Unregulated or Illegal Brokers

Indian traders choose brokers that are not regulated or are operating illegally in India. Many traders dont check whether the broker is approved by any financial authority or not. Unregulated brokers can shut down without warning, block your withdrawals, or even disappear with your funds. To stay safe, always make sure the broker is authorized by SEBI (in India) or well-known international regulators like the FCA (UK) or ASIC (Australia) etc. If the broker is not regulated by any of these bodies, avoid them completely.

3. Falling for Fake Promotions

Many traders fall prey to fake Forex brokers that promise guaranteed profits, huge bonuses. These are classic scam tactics to steal your money. Always Be skeptical of offers that sound too good to be true. Check platforms like WikiFX to verify broker credibility, ratings, and user reviews before depositing any money.

4. Relying on Telegram Groups or Finfluencers

A growing number of Indian traders follow random tips from Telegram or WhatsApp groups or so called Finfluencers without verifying them. These tips often come from unqualified sources or scam groups looking to manipulate traders. Avoid “get-rich-quick” tips. Build your own trading knowledge, or rely on analysis from licensed financial advisors.

5. Neglecting Education & Strategy

Many Indian Forex traders start trading without first learning the basics. They dont take the time to understand how the market works, how to read charts, or how to use trading tools. Without proper knowledge, They make poor decisions and lose money. To trade successfully, it's important to learn, practice, and build a solid trading plan before putting real money at risk.

6. Ignoring RBI Regulations

Another serious mistake is ignoring the rules set by the Reserve Bank of India (RBI). Many traders use international brokers to trade currency pairs that are not allowed under Indian law. This can lead to legal trouble and financial penalties. RBI only permits trading in a few specific pairs involving the Indian Rupee, and only through SEBI-registered brokers. It's important to follow these rules to stay safe, legal, and protected as a trader.

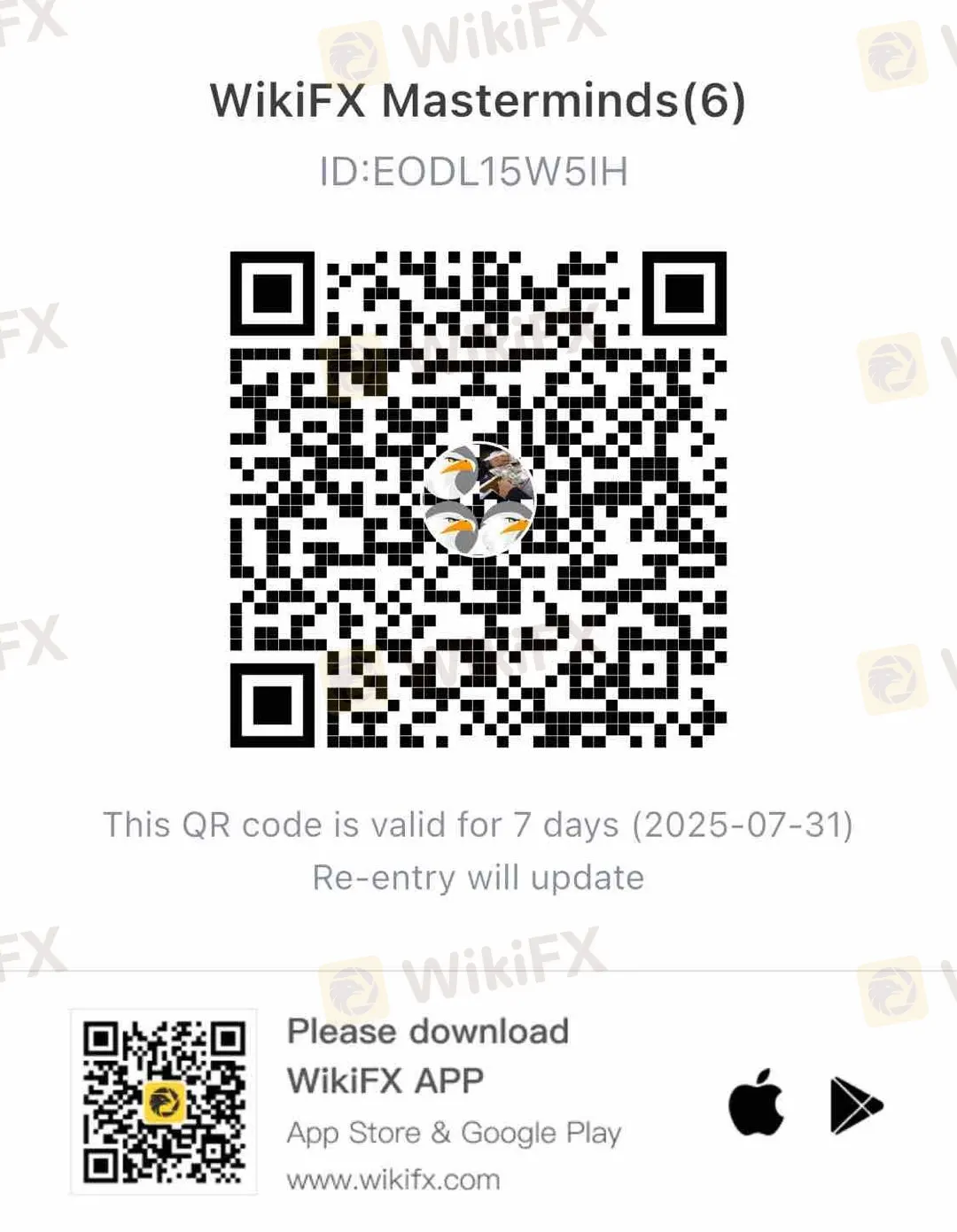

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

UNFXB Exposed: Vanishing Profits & High Spreads Frustrate Traders

Not feeling satisfied with the welcome bonus offer of UNFXB? Finding it hard to receive withdrawals from the broker despite repeated attempts? Does your trading profit vanish suddenly? Are high spreads draining your capital? Do you also face account closure issues with UNFXB? You have added to a long list of traders who have faced these issues. In this article, we will talk extensively about these issues. Take a look!

VCG Markets: An Unknown FX Broker That Deserves a Closer Look! Be Cautious

VCG Markets is not much popular among traders and investors, but it is active in the forex market and can swindle those who are not aware. So this is a broker you need to be cautious about. This broker has several major red flags you need to know about to protect your money. Read this article to know VCG Markets.

Why Are Investors Losing Trust in StoneX? What You Need to Know

StoneX is a FCA-regulated broker, but despite this, investors are losing interest. What are the key reasons behind this shift in investor sentiment?

Activity Upgraded! The 2025 WikiFX “Global Broker Review Contest” Grandly Launches!

Duration: August 26, 2025 – October 10, 2025 Eligibility: Must be a genuine account holder of a broker

WikiFX Broker

Latest News

Pip Value Calculation Guide: How Much Is a Pip in Forex Really Worth?

Spains economy keeps growing — why is the country doing so well?

OctaFX Update: Crypto Deposit Restrictions Raise Regulatory Concerns

Football Meets Finance: PSG Signs Global Partnership With WeTrade

Checkout List of 7 "FCA WARNED" Unauthorized Brokers

Trader’s Way Exposed: Where Winning Trades Turn into Losses Overnight

Activity Upgraded! The 2025 WikiFX “Global Broker Review Contest” Grandly Launches!

Why Are Investors Losing Trust in StoneX? What You Need to Know

What is Free Margin in Forex - An Insightful Guide You Can’t Miss Out

UAE Retail Investors Show Strong Preference for Local Stocks Amid Global Tensions

Rate Calc