USDCAD Rebound to Benefit from Sticky US Consumer Price Index (CPI)

Abstract:Updates to the US Consumer Price Index (CPI) may keep USDCAD afloat as the figures are anticipated to highlight sticky inflation.

Canadian Dollar Talking Points

USDCAD struggles to retain the rebound from earlier this week, but updates to the US Consumer Price Index (CPI) may keep the exchange rate afloat as the figures are anticipated to highlight sticky inflation.

USDCAD Rebound to Benefit from Sticky US Consumer Price Index (CPI)

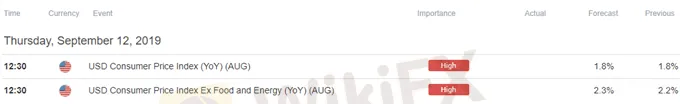

USDCAD has been under pressure following the Bank of Canada (BoC) meeting as the central bank endorses a wait-and-see approach for monetary policy, but developments coming out of the US may sway the near-term outlook for the exchange rate as the CPI is anticipated to hold steady at 1.8% for the second consecutive month.

At the same time, the core rate of inflation is projected to increase to 2.3% from 2.2% in July, and signs of stick price growth may influence the monetary policy outlook as Federal Reserve Chairman Jerome Powellasserts that the economic outlook remains “favorable.”

However, it remains to be seen if the Federal Open Market Committee will continue to insulate the US economy as Fed Fund futures still highlight overwhelming expectations for a 25bp reduction on September 18, and the central bank may come under increased pressure to implement a rate easing cycle as President tweets that the “the Federal Reserve should get our interest rates down to zero or less.”

In turn, the FOMC may continue to alter the forward guidance for monetary policy, and market participants are likely to pay increased attention to the Summary of Economic Projections (SEP) as a growing number of Fed officials forecast a lower trajectory for the benchmark interest rate.

With that said, the Canadian Dollar may outperform its US counterpart over the coming days, and the diverging paths for monetary policy may spur a broader shift in USDCAD behavior as the exchange rate snaps the upward trend carried over from the previous year.

USD/CAD Rate Daily Chart

Source: Trading View

Keep in mind, the broader outlook for USDCAD is no longer constructive as the exchange rate clears the February-low (1.3068), with the break of trendline support fostering a bearish outlook for Dollar Loonie.

At the same time, the rebound from the 2019-low (1.3016) appears to have stalled ahead of the Fibonacci overlap around 1.3410 (38.2% expansion) to 1.3420 (78.6% retracement), with the Relative Strength Index (RSI) offering a bearish signal as the oscillator snaps the bullish formation from July.

However, the lack of momentum to break/close below the Fibonacci overlap around 1.3120 (61.8% retracement) to 1.3130 (61.0% retracement) may generate range-bound conditions, with a move above 1.3220 (50% retracement) raising the risk for a move back towards the 1.3280 (23.6% expansion) to 1.3330 (38.2% retracement) region.

Read more

US Stocks Fall as Inflation Holds Pace

Dow Jones Drops 173 Points, S&P 500 Sheds 27 Points, Nasdaq 100 Closes Lower by 57 Points

Dollar stands tall as Fed heads toward taper

The dollar held within striking distance of the year's peaks on the euro and yen on Wednesday, as investors looked for the Federal Reserve to begin unwinding pandemic-era policy support faster than central banks in Europe and Japan.

Gold Price, Silver Price Jump After Saudi Arabia Oil Field Attacks

Gold and silver turned sharply higher after the weekend‘s drone attacks on Saudi oil fields saw tensions in the area ratchet higher with US President Donald Trump warning Iran that he is ’locked and loaded.

EURUSD Fails to Test 2019 Low, RSI Flashes Bullish Signal After ECB

EURUSD fails to test the 2019-low (1.0926) following the ECB meeting, with the Relative Strength Index (RSI) breaking out of the bearish formation carried over from June.

WikiFX Broker

Latest News

The "Arbitrage" Accusation: How Winning Trades Turn Into Account Reviews at ACY Securities

IC Markets Formula 1 Partnership Debuts at Abu Dhabi GP 2025

The TikTok Scam That Cost a Retiree Nearly RM470,000

QuickTrade Review: Multiple Reports of Account Freezes and Login Failures by Users

Is Tauro Markets Safe? A 2025 Deep Look into Its Risks and Openness

Tag Markets Exposed: Withdrawal Issues, Inflated Spreads & Market Manipulation Concerns

Inside the BSN Scandal: Bank Officer Stole Over RM11 Million from Victims

Trading Knowledge is Wealth! Take the Daily Quiz Challenge and Win 1,000 Points!

Is Capital.com Regulated? Full License Overview

umarkets Exposed: Explore Complaints on Fund Scams, Withdrawal Denials & Fund Transfer Issues

Rate Calc