ATFX Spreads, leverage, minimum deposit Revealed

Abstract:ATFX is a co-brand shared by a group of entities including AT Global Markets (UK) Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom with registration number 760555. The Registered Office: 1st Floor, 32 Cornhill, London EC3V 3SG, United Kingdom.

| Quick ATFX Review Summary | |

| Company Name | AT Global Markets (UK) Limited |

| Founded | 2014 |

| Headquarters | London, UK |

| Regulated By | ASIC, SFC, FCA, CYSEC, FSA, SCA, SERC, FSCA |

| Tradable Assets | Forex, precious metals, crude oil, indices |

| Demo Account | ✅ ($50,000 demo money) |

| Account Type | Standard, Demo |

| Min Deposit | $200 |

| Leverage | Up to 1:30 (retail traders)/1:400 (professional traders) |

| Spread | From 0.5 pips |

| Trading Platform | MT4 and MT5 |

| Payment Methods | Visa, MasterCard, Bank Wire |

| Deposit & Withdrawal Fees | ✅ |

| Inactivity Fee | €10 or 20% of the remaining account balance monthly if an account remains inactive for over 12 calendar months |

| Customer Support | Mon – Fri 08:00 – 18:00 GMT+2, GMT+3 during Daylight Saving Time |

| Live chat | |

| Tel: +357 25 258 774 | |

| Email: info@atfxgm.eu | |

ATFX Information

ATFX is a global online forex and CFD broker established in 2014, offering trading on various markets including forex, precious metals, crude oil, and indices. The broker also offers Standard accounts. Besides, the demo account is also provided. Regarding trading platform offerings, MetaTrader 4 (MT4) and MT5 are supported.

Pros & Cons

On the positive side, ATFX is a well-regulated broker and offers negative balance protection to protect security of clients' funds. It also offers various trading instruments with competitive spreads via the industry-leading MT4 platform. You can also test their trading conditions via risk-free demo accounts.

| Pros | Cons |

|

|

|

|

|

|

| |

| |

|

Is ATFX Legit?

Yes. ATFX operates under the oversight of multiple authoritative regulatory bodies across key financial jurisdictions, ensuring transparency, client protection, and operational integrity. Its regulatory portfolio spans global hubs (e.g., UK, Cyprus) and strategic regions (e.g., Seychelles, UAE), reflecting a commitment to compliance with diverse market standards.

| Regulatory Authority | Short Form | Regulatory Status | License Type | Jurisdiction | License Number |

| Australia Securities & Investment Commission | ASIC | Regulated | Market Maker (MM) | Australia | 418036 |

| Securities and Futures Commission of Hong Kong | SFC | Regulated | Institution Forex License | Hong Kong | 760555 |

| Cyprus Securities and Exchange Commission | CySEC | Regulated | Straight Through Processing (STP) | Cyprus | 285/15 |

| Seychelles Financial Services Authority | FSA | Offshore Regulated | Retail Forex License | Seychelles | Unreleased |

| Financial Conduct Authority | FCA | Regulated | Institution Forex License | United Kingdom | 760555 |

| Financial Sector Conduct Authority | FSCA | Exceeded | Financial Service Corporate | South Africa | 44816 |

| Securities and Commodities Authority | SCA | Exceeded | Investment Advisory License | United Arab Emirates | 20200000078 |

| Securities and Exchange Regulator of Cambodia | SERC | Exceeded | Common Financial Service License | Cambodia | 40 |

Market Instruments

ATFX supports trading on forex, precious metals, crude oil, and indices. However, in contrast to other brokers, ATFX does not enable stocks, cryptocurrencies, bonds, options, ETFs, or futures trading, and their product choices are somewhat limited.

| Tradable Assets | Supported |

| Forex | ✔ |

| Precious metals | ✔ |

| Crude oil | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Futures | ❌ |

Account Type

TFX offers a dual trading ecosystem comprising its Demo Trading Account and Standard Trading Account, designed to cater to traders at every stage of their journey—from learning to live execution.

The Demo Trading Account serves as a risk-free entry point, providing a real-time simulated environment with a $50,000 virtual balance. Ideal for novices or those refining strategies, it mirrors live market conditions across MT4 (desktop, mobile, or web), enabling users to practice trading forex, indices, and commodities; test and optimize strategies; build discipline; and master platform navigation (e.g., chart analysis, order execution) without exposing real capital. It eliminates the pressure of financial risk while fostering confidence and familiarity with trading mechanics.

For traders ready to transition to live markets, ATFXs Standard Trading Account delivers a seamless bridge to real-money trading. Linked directly to MT4, this all-in-one account supports diverse instruments (forex pairs, equity indices, commodities) with competitive spreads, minimizing transaction costs. It empowers users to manage funds (deposits/withdrawals), monitor balances, and execute trades or automated strategies, combining essential functionality with accessibility.

Leverage

ATFX offers varying levels of leverage depending on the type of trading account and financial instrument.

For forex trading, the maximum leverage available for retail clients is typically 30:1 for major currency pairs and 20:1 for minor and exotic currency pairs. Professional clients may have access to higher leverage, up to a maximum of 400:1, depending on their trading experience and other criteria.

Notably, while leverage can amplify potential profits, it also magnifies potential losses, so it's crucial to use leverage responsibly and only trade with funds you can afford to lose. Additionally, different regulations may apply in different regions and countries, which could impact the maximum leverage available to traders.

Non-Trading Fees

Aside from trading fees, ATFX also charges non-trading fees that traders should be aware of.

| Deposit Fee | ✔ |

| Withdrawal Fee | ✔ |

| Inactivity Fee | €10 or 20% of the remaining account balance monthly if an account remains inactive for over 12 calendar months |

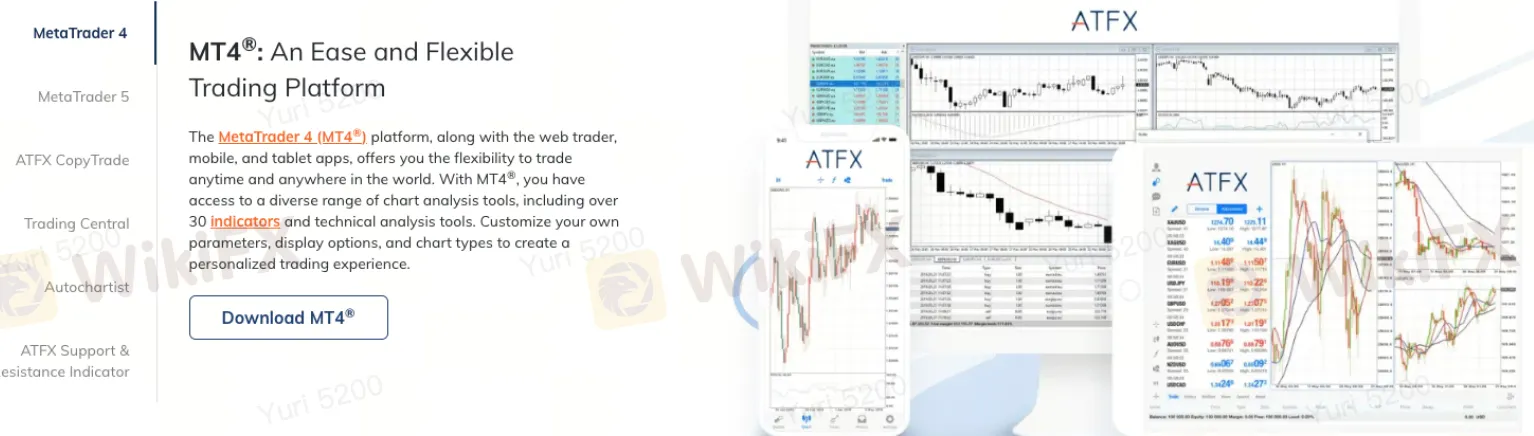

Trading Platform

ATFX supports a range of trading platforms and tools tailored to diverse trader needs: MT4® (desktop, web, mobile/tablet) stands out for flexibility, offering 30+ technical indicators and customizable charts; MT5® (same devices) expands to multi-asset trading (forex, indices, commodities) with advanced charting and professional execution.

For strategy replication, ATFX CopyTrade (web-based) lets users mirror top traders in real time, catering to both beginners and pros. Integrated into MT4/MT5 and ATFXs web platform, Trading Central provides actionable insights with real-time signals and research covering 8,000+ instruments.

Autochartist (web portal + plugins) automates technical analysis, identifying trends and support/resistance levels via pattern recognition. Lastly, ATFXs proprietary Support & Resistance Indicator (MT4-only) plots key levels directly on charts to highlight swing points. Together, these tools balance accessibility and depth, adapting to varied trading styles.

| Platform/Tool | Terminal Type/Device |

| MT4® | Desktop, Web Trader, Mobile/Tablet |

| MT5® | Desktop, Web Trader, Mobile/Tablet |

| ATFX CopyTrade | Web-Based (Browser) |

| Trading Central | Integrated (MT4/MT5, Web) |

| Autochartist | Web Portal + Plugins |

| ATFX Support & Resistance Indicator | MT4® Only |

Deposit & Withdrawal

ATFX offers a diverse range of payment and withdrawal methods to ensure convenience and security for its clients. The supported payment systems include:

- VISA: A widely recognized global payment network for credit and debit cards.

- Mastercard: Another leading global payment system, facilitating secure transactions via credit and debit cards.

- Neteller: A digital payment platform enabling fast and secure e-wallet transactions.

- Skrill: A popular e-wallet service that allows quick transfers and manages digital finances.

- Perfect Money: A financial service designed for efficient online money transfers and transactions.

- Bank Transfer: Direct banking solutions for sending or receiving funds through traditional banking channels.

These methods are supported by efficient, automated processes and undergo strict audits to guarantee the safety of users funds, ensuring a reliable and seamless experience for all payment and withdrawal needs.

Customer Support

ATFX customer support can be connected through the following channels:

- Live chat, contact form

- Phone: +357 25 258 774, the phone lines are open during Mon – Fri 08:00 – 18:00 GMT+2*, and *GMT+3 during Daylight Saving Time.

- Email: info@atfxgm.eu

- Headquarters: Maryvonne Building, 159 Leontiou A Street, Office 204, 3022, Limassol, Cyprus

FAQs

What is the minimum deposit requirement for ATFX?

$200 is required to start real trading.

What trading platforms does ATFX offer?

ATFX offers the popular MetaTrader 4 and MetaTrader 5.

Does ATFX offer demo accounts?

Yes. ATFX offers demo accounts with up to $50,000 demo money.

Latest News

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

MultiBank Group Analysis Report

NEWTON GLOBAL Legitimacy Check (Addressing fears: Is This a Fake or a Legitimate Trading Partner?)

SPREADEX Review: Reliable Broker Check

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump's tariffs

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Rate Calc