What Is LIRUNEX?

Abstract:LIRUNEX (commonly referred to as "Profit Exchange" in Chinese) is a global financial broker operated by Lirunex Limited, specializing in foreign exchange (FX) and Contract for Differences (CFDs) trading. Its core mission is to deliver a "secure, transparent, and flexible" trading environment tailored to traders of all levels, supported by three major regulatory licenses—issued by the Financial Services Commission (FSC) of Mauritius (License No. GB24203882), the Cyprus Securities and Exchange Commission (CYSEC) (License No. 338/17).

| LIRUNEX Review Summary | |

| Founded | 2022-06-20 |

| Registered Country/Region | Mauritius |

| Regulation | CYSECR and LFSA Regulations |

| Market Instruments | Forex, Commodities, Stock CFDs, Cryptocurrency CFDs, Precious Metals, Index CFDs |

| Demo Account | ✅ |

| Leverage | Up to 1:2000 |

| Spread | As low as 0.0 floating spreads |

| Trading Platform | MT4, MT5(MacOS, PC, iOS, Android), Lirunex Trading App |

| Min Deposit | $0 |

| Customer Support | support@lirunex.com |

| Facebook, Twitter, Instagram, Line, TikTok, YouTube, LinkedIn, Pinterest, WhatsApp | |

| Online Chat | |

| Legacy Capital Co., Ltd. Suite 201, 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, Mauritius. | |

LIRUNEX Information

What is LIRUNEX?IRUNEX (commonly referred to as “Profit Exchange” in Chinese) is a global financial broker operated by Lirunex Limited, specializing in foreign exchange (FX) and Contract for Differences (CFDs) trading. Its core mission is to deliver a “secure, transparent, and flexible” trading environment tailored to traders of all levels, supported by three major regulatory licenses—issued by the Financial Services Commission (FSC) of Mauritius (License No. GB24203882), the Cyprus Securities and Exchange Commission (CYSEC) (License No. 338/17), and the Financial Services Authority (LFSA) of Saint Vincent and the Grenadines (License No. MB/20/0050)—that extend its compliance coverage across Europe, America, the Asia-Pacific region, and beyond.

Beyond regulatory compliance, LIRUNEX boasts key features, including diverse payment methods (Local Transfer, Global Transfer, VISA/MasterCard, Tether, and BitPay) with no hidden fees, support for all trading strategies (such as hedging and scalping), and segregated accounts for client fund security. It caters to a broad audience: novice traders can start with 0-deposit accounts, high-net-worth professional traders can opt for LX-PRO accounts, and it is particularly well-suited for cross-border users in need of local payment or cryptocurrency deposit/withdrawal services.

Pros and Cons

| Pros | Cons |

| Regulated | Potential Third-Party Fees |

| Extensive Localized Payment Options | High Leverage Risk: 1:2000 leverage |

| $0 Minimum Deposit (LX-STANDARD/PRIME/CENT) | Restricted LX-CENT Account: Only FX and limited metals |

| Dynamic Leverage (Up to 1:2000 for balances ≤ $500) | Slow Global Transfer Processing: Takes 3–5 business days |

| 75+ Tradable Instruments | |

| Islamic Account (Swap-Free, Sharia-compliant) | |

| Copy Trading Support |

Is LIRUNEX Legit?

LIRUNEX has a legal and compliant operational foundation, though its suitability varies by regulatory levels and regional adaptability: it holds multi-regional licenses (strict EU regulation from CYSEC under MiFID II, moderate regulation from Mauritius‘ FSC, and weaker regulation from Saint Vincent’s LFSA), with license validity verifiable via regulatory official websites (e.g., CYSEC 338/17) to avoid “expired license” risks; it ensures fund security by keeping client funds “segregated” from its funds in third-party financial institutions (meeting international broker standards to reduce misappropriation risks); and it operates transparently, publicly disclosing core information like account types, fees, leverage rules, and payment methods with no hidden terms, while supporting demo accounts for trial without “mandatory deposit” traps.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Regulated | Lirunex Ltd | Cyprus | Straight Through Processing (STP) | 338/17 |

| Regulated | Lirunex Limited | Malaysia | Straight Through Processing (STP) | MB/20/0050 |

In summary, LIRUNEX is not a “scam platform,” but it is crucial to note that high-leverage trading itself is high-risk, and regional regulatory provisions on leverage (e.g., EU retail clients have a 1:30 maximum leverage) and investor compensation differ, so users should confirm the platforms regulatory adaptability to their region.

What Can I Trade on LIRUNEX?

LIRUNEX offers 6 major categories of tradable instruments with clear distinctions in eligible accounts and key trading rules:

LIRUNEX Forex (FX): includes 30 major pairs (e.g., EURUSD, GBPUSD), 7 minor pairs (e.g., AUDCAD), and 23 exotic pairs (e.g., USDZAR), available for all accounts with dynamic leverage up to 1:2000;

LIRUNEX Precious Metals: covers 11 instruments like gold (XAUUSD) and silver (XAGUSD) (9 for LX-CENT), accessible to all accounts with no instrument restrictions and leverage consistent with forex;

LIRUNEX Commodities: 3 instruments including crude oil, WTI, and natural gas,

LIRUNEX Index CFDs: 2 indices, like the Hang Seng Index and Dow Jones Index

LIRUNEX Cryptocurrency CFDs: 12 options, including Bitcoin BTC and Ethereum ETH

LIRUNEX Stock CFDs: 7 stocks like Apple AAPL and Microsoft MSFT

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stock CFDs | ✔ |

| Cryptocurrency CFDs | ✔ |

| Precious Metals | ✔ |

| Index CFDs | ✔ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

They are only available for LX-STANDARD, LX-PRIME, and LX-PRO accounts (not supported by LX-CENT), with respective leverage rules: 1:200 for Commodities, fixed 1:20 (not subject to dynamic adjustment) for Hang Seng Index under Index CFDs, 1:50 for Cryptocurrency CFDs, and 1:20 for Stock CFDs.

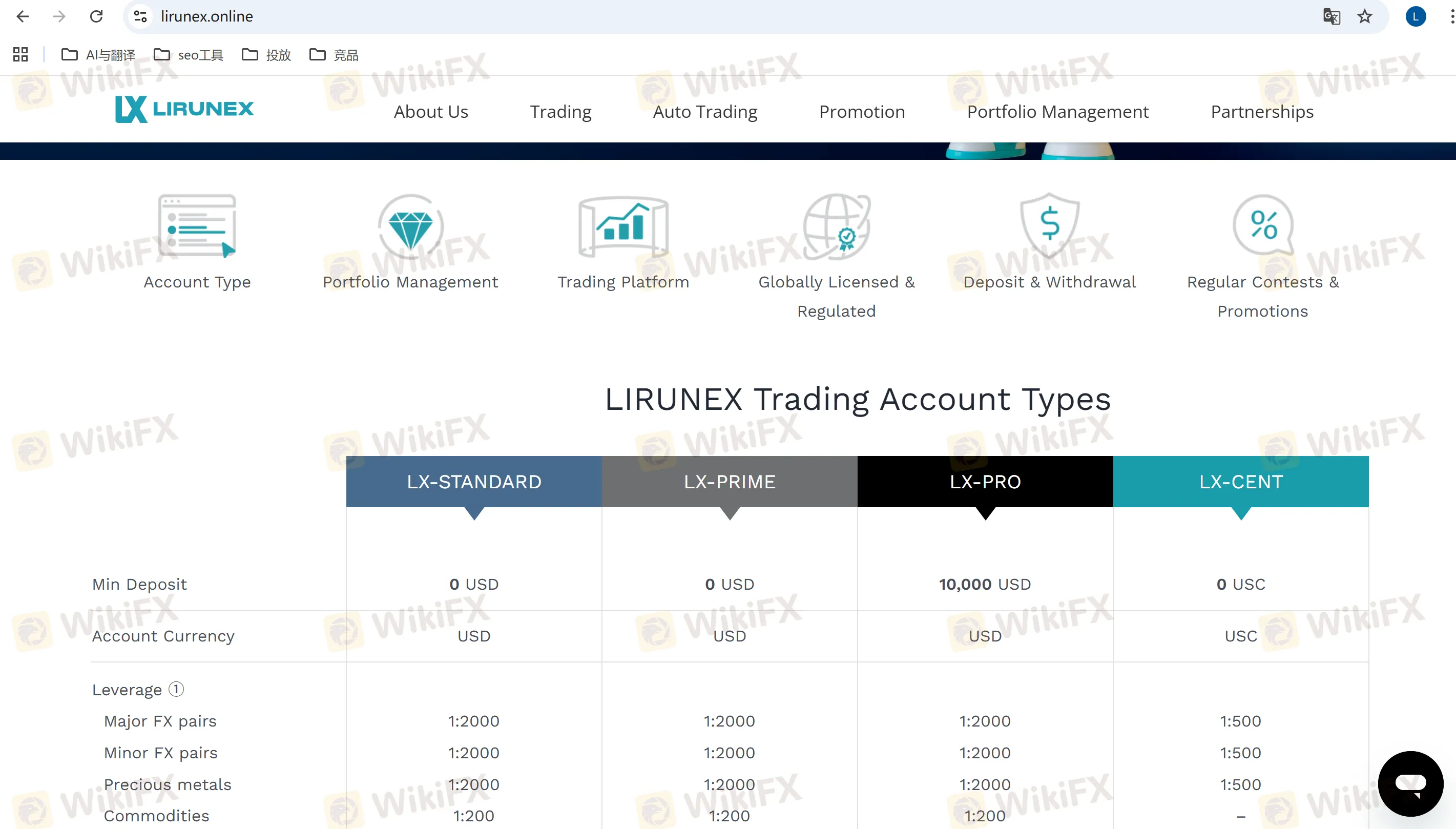

Account Type

What account types does LIRUNEX offer? LIRUNEX offers 4 types of standard accounts + 2 types of Islamic accounts, with core differences in deposit requirements, fees, and instrument coverage to adapt to different payment and trading needs:

Standard Accounts (Non-Islamic)

| Account Type | Minimum Deposit | Account Currency | Commission | Minimum Spread |

| LX-STANDARD | 0 USD | USD | 0 USD/lot | 1.5 pips |

| LX-PRIME | 0 USD | USD | 8 USD/lot | 0 pips |

| LX-PRO | 10,000 USD | USD | 4 USD/lot | 0 pips |

| LX-CENT | 0 USC | USC | 0 USC/lot | 1.5 pips |

Supplementary Rule: When the balance of the LX-CENT account exceeds 3 million USC, it will be automatically converted to a USD-denominated standard account, unlocking full-range instrument trading.

Islamic Accounts (Swap-Free)

No overnight swap interest, compliant with Sharia law, and supporting diversified payment methods for deposits:

| Account Type | Minimum Deposit | Commission | Minimum Spread |

| Islamic Standard | 25 USD | 0 USD/lot | 1.5 pips |

| Islamic Prime | 200 USD | 8 USD/lot | 0 pips |

Application Process: Open an LX-STANDARD account → Deposit via the designated payment method → Submit the Islamic Account Application Form → Approval takes effect after closing all floating orders.

LIRUNEX Fees

How about LIRUNEX fees?LIRUNEX has a transparent fee structure with no hidden costs, including trading commissions and spreads. Third-party fees may only apply to deposits/withdrawals:

What LIRUNEX Trading-Related Fees

| Fee Type | Charging Standard | Eligible Accounts | Remarks |

| Commission | LX-STANDARD / LX-CENT: 0 USD/lot; LX-PRIME: 8 USD/lot; LX-PRO: 4 USD/lot | All accounts (charged two-sided: opening + closing positions) | No additional hidden commissions |

| Spread | LX-STANDARD / LX-CENT: As low as 1.5 pips; LX-PRIME / LX-PRO: As low as 0 pips | All accounts (floating, may widen during market volatility) | Lower spreads for precious metals/forex; higher spreads for stock CFDs |

| Overnight Swap | Standard accounts: Charged according to market interest rates; Islamic accounts: 0 swap | Charged for standard accounts; waived for Islamic accounts | Swap amounts can be checked on MT4/MT5 platforms |

Does LIRUNEX Charge Deposit/Withdrawal Fees?

| Fee Type | Method(s) | Fee Details |

| Platform Fees | All Methods | Waived (Local Transfer, Global Transfer, VISA/MasterCard, Tether, Bitpay) |

| Third-Party Fees | Global Transfer (Wire) | Banks may charge $15–50 in cross-border wire transfer fees |

| Tether / Bitpay (Crypto) | Exchanges may charge 0.5%–2%; Gas fees apply for withdrawals below $200 | |

| VISA / MasterCard | Issuing banks may charge 1%–3% cross-border transaction fees (varies by card type) | |

| Local Transfer | Local banks in some regions may charge ≤ $5 transfer fees |

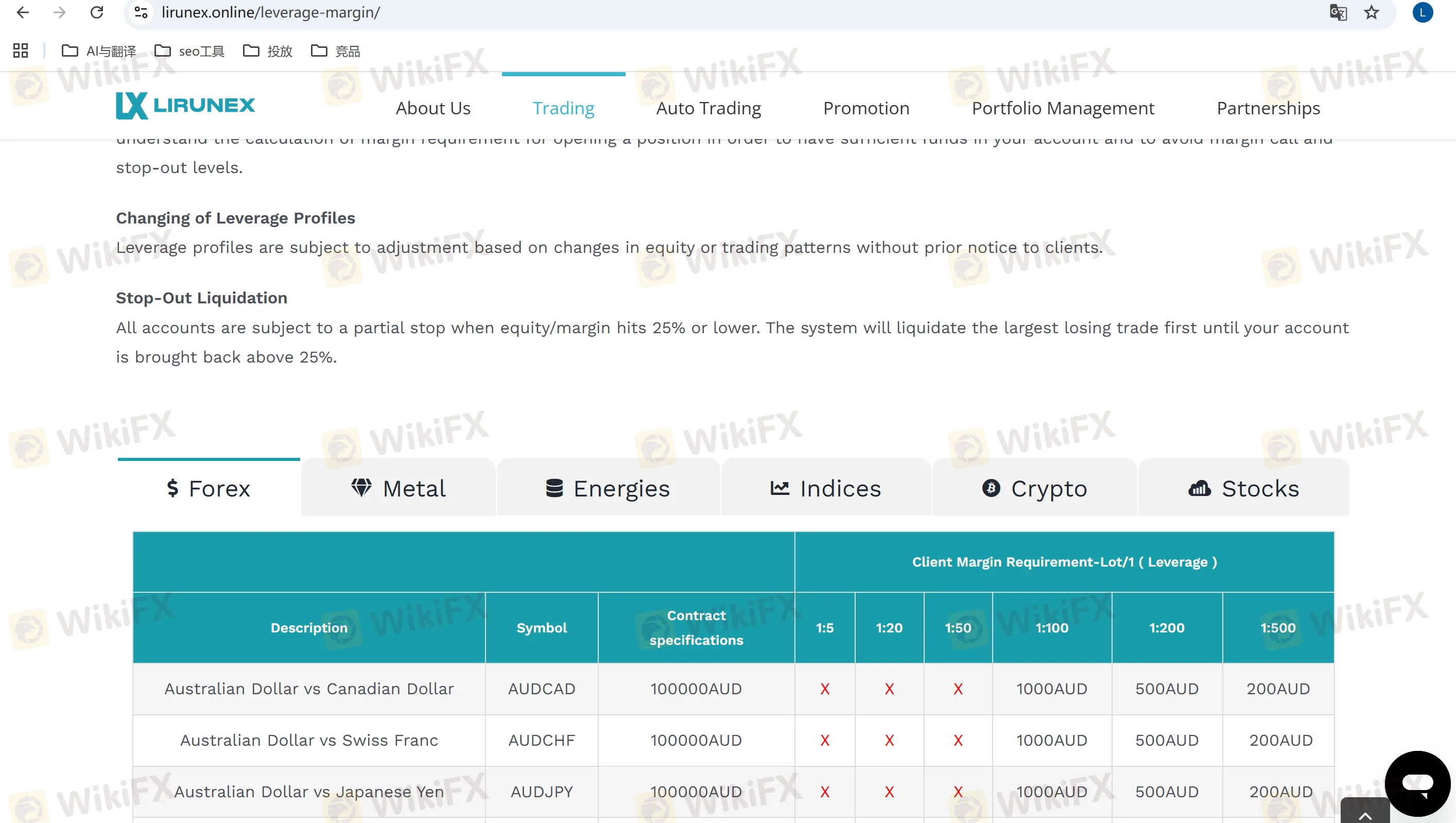

Leverage

What is LIRUNEX Leverage? LIRUNEX adopts a dynamic leverage tier system, where leverage decreases as the account balance increases. Special instruments and temporary adjustment rules also apply:

LIRUNEX Basic Dynamic Leverage (Non-CENT Accounts / USD-Denominated)

| Account Balance | Maximum Leverage | Eligible Instruments (Except Special Ones) |

| ≤ 500 USD | 1:2000 | Minor forex pairs, precious metals |

| 501–5,000 USD | 1:1000 | Same as above |

| 5,001–20,000 USD | 1:500 | Major forex pairs, precious metals, commodities, cryptocurrency CFDs |

| 20,001–40,000 USD | 1:400 | Same as above |

| 40,001–60,000 USD | 1:300 | Same as above |

| 60,001–80,000 USD | 1:200 | Same as above |

| ≥ 80,001 USD | 1:100 | All instruments |

LIRUNEX Special Leverage Rules

LX-CENT Accounts (USC-Denominated): The leverage tier system is consistent with USD-denominated accounts, except the balance unit is USC (e.g., leverage 1:2000 for balances ≤ 50,000 USC).

Fixed Leverage Instruments: The leverage for Hong Kong Hang Seng Index CFDs is fixed at 1:20, not subject to dynamic adjustment.

Temporary Reduction: One hour before market close on Fridays/holidays, leverage for all forex/precious metals is compulsorily reduced to 1:100, and restored when the market reopens on Mondays.

Regulatory Adjustment: If the users region has leverage caps (e.g., 1:30 in the EU), the platform will automatically adapt to local rules without manual adjustment by the user.

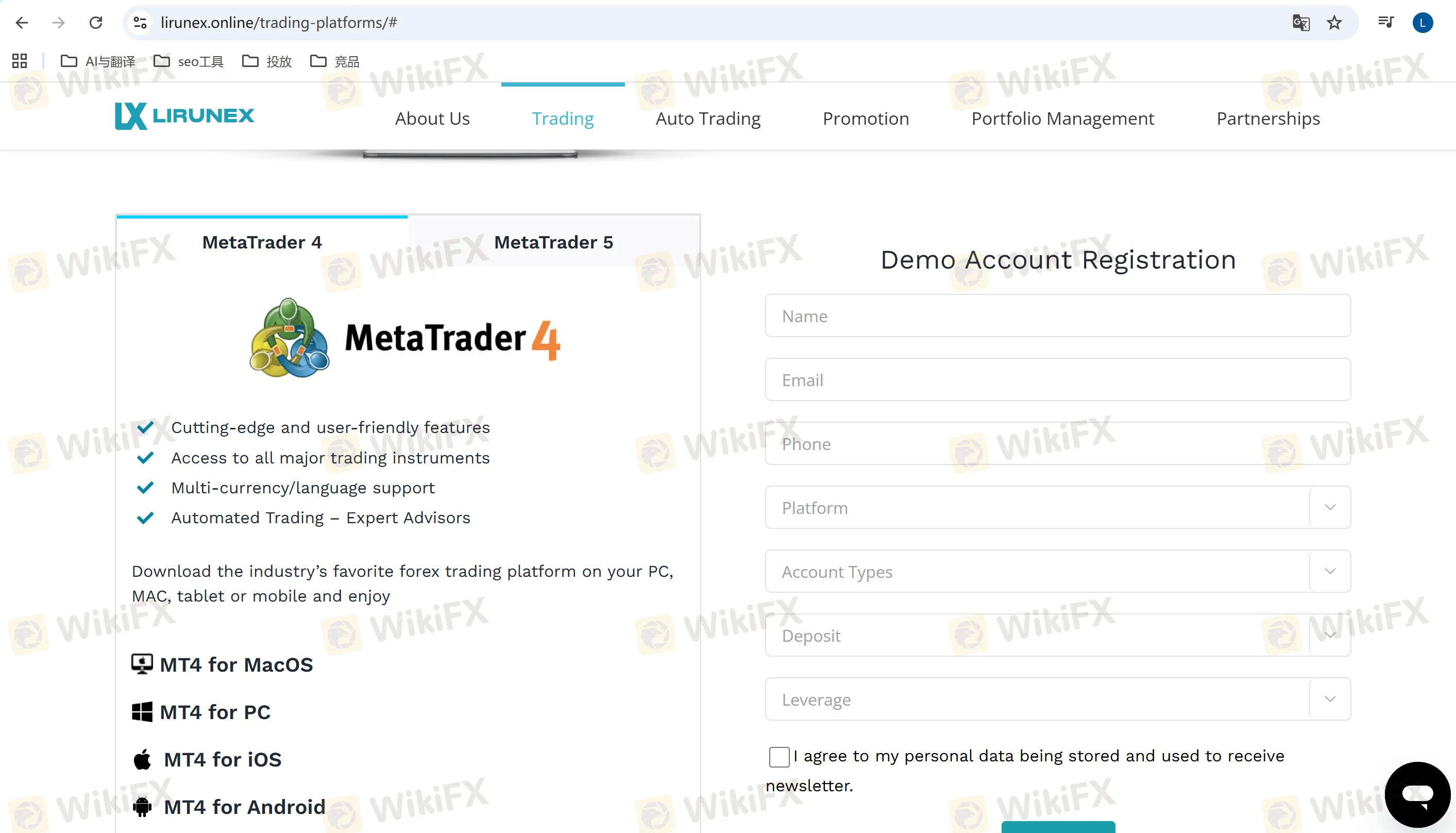

Trading Platform

Does LIRUNEX provide MT4 and MT5? Yes, it supports 3 types of mainstream platforms, covering PC, mobile, and web terminals, enabling seamless management of multi-payment accounts:

| Platform Type | Supported | Supported Devices | Adapted Scenarios |

| MetaTrader 4/5 (MT4/MT5) | ✔ | PC (Windows/Mac), iOS, Android | Professional traders requiring complex strategies and payment record queries |

| LIRUNEX Self-Developed APP | ✔ | iOS, Android (APK download) | Mobile users need quick payments and order placement |

| Web Trader (Web Terminal) | ✔ | Browsers (no download required) | Temporary operations or scenarios with no installation permissions |

Supplementary Note: All platforms support switching between “demo accounts” and “live accounts”. Demo accounts can be opened for free (for testing payment processes and trading strategies).

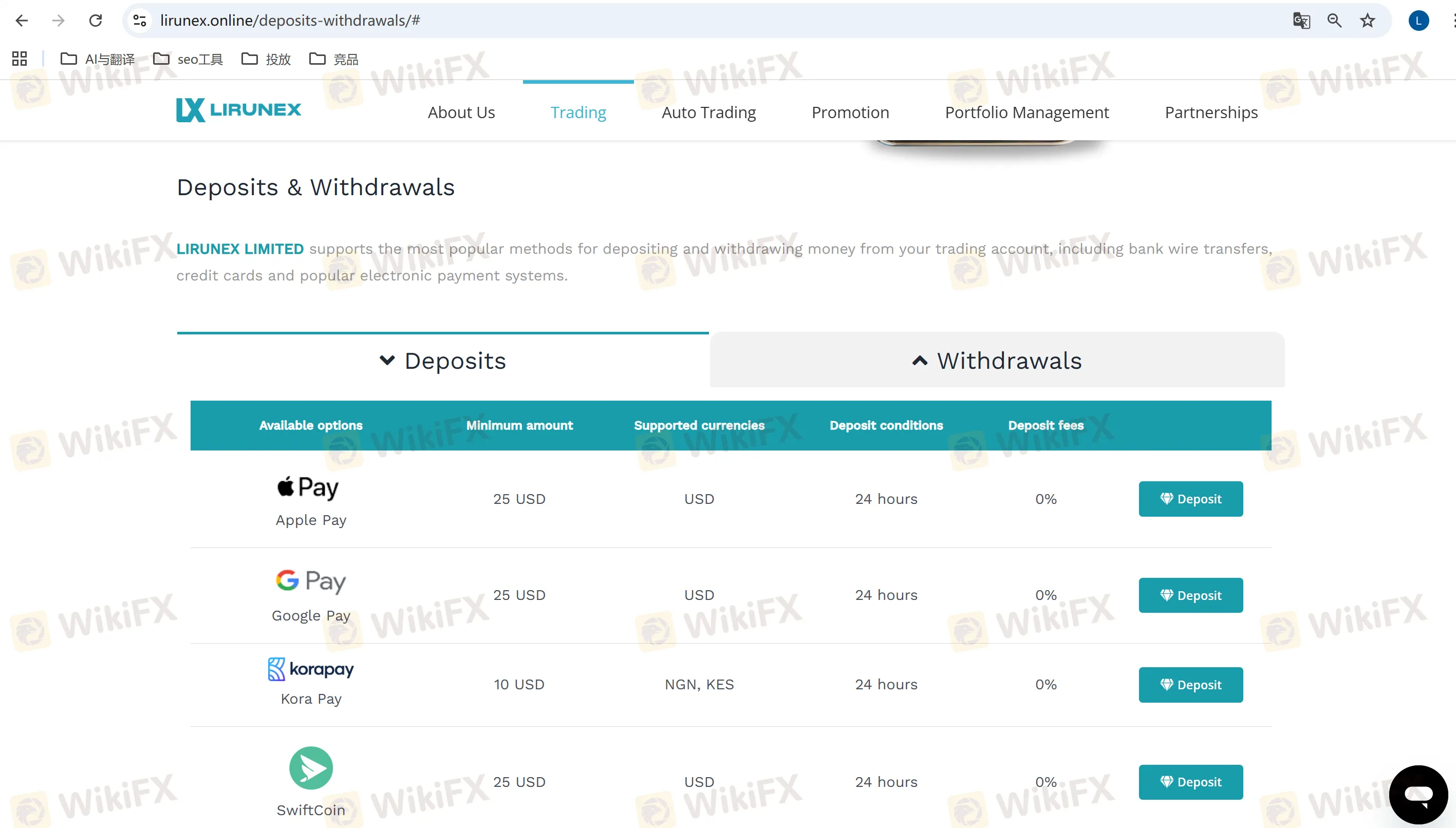

Deposit and Withdrawal (Updated Payment Methods)

What Payment Methods does LIRUNEX support for Deposit and Withdrawal? LIRUNEX focuses on “local + global + cryptocurrency” three-dimensional payments, with clear deposit/withdrawal rules. Key information is as follows:

LIRUNEX Deposit Details (5 Main Methods)

What is the LIRUNEXminimum deposit? $0 for opening accounts and $10 for payment.

| Payment Method | Minimum Amount | Supported Currencies | Arrival Time |

| Local Transfer | 25 USD | Multi-regional currencies such as PKR, THB, IDR, VND, CNY | Instant |

| Global Transfer (International Wire Transfer) | 2000 USD | USD | 3–5 working days |

| VISA/MasterCard (Credit Card) | 25 USD | USD | Within 24 hours |

| Tether (USDT) | 25 USD | USD (converted at real-time exchange rates) | Within 24 hours |

| Bitpay | 25 USD | USD (supports conversion of multiple cryptocurrency types) | Within 24 hours |

LIRUNEX Withdrawal Rules

- Same-Method Return Principle: Withdrawals must be made via the same method used for deposits (e.g., Local Transfer deposit → Local Transfer withdrawal; Tether deposit → Tether withdrawal).

- Processing Time: Withdrawal applications are reviewed within 24 hours on working days. Arrival time: Local Transfer/Tether/Bitpay ≤ 24 hours; VISA/MasterCard ≤ 8 working days; Global Transfer 3–5 working days.

- Minimum Withdrawal: Consistent with the minimum amount for the corresponding deposit method (e.g., minimum 2000 USD for Global Transfer withdrawals, minimum 25 USD for Local Transfer withdrawals).

LIRUNEX Special Notes

- The currencies supported by Local Transfer depend on the users region (e.g., CNY for users in China, MYR for users in Malaysia).

- Tether/Bitpay withdrawals require providing a compliant wallet address; the platform does not support transfers to “anonymous wallets”.

WikiFX Broker

Latest News

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Promised 30% Returns, Lost RM630,000 Instead

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Effective Stop Loss Trading Strategies

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Hits Q4 Growth

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Slams Growth

Pepperstone Review: Regulation, Licences and WikiScore Analysis

Rate Calc