User Reviews

More

User comment

23

CommentsWrite a review

2025-08-14 12:49

2025-08-14 12:49

2025-08-13 23:47

2025-08-13 23:47

Score

Above 20 years

Above 20 yearsRegulated in Australia

Market Making License (MM)

MT4 Full License

Global Business

High potential risk

Offshore Regulated

Capital Ratio

Influence

Add brokers

Comparison

Quantity 110

Exposure

Score

Regulatory Index9.52

Business Index8.00

Risk Management Index0.00

Software Index9.92

License Index9.52

ASIC Regulated

Market Making License (MM)

FCA Regulated

Market Making License (MM)

FSA Regulated

Market Making License (MM)

NFA Regulated

Forex Trading License (EP)

CIRO Regulated

Derivatives Trading License (EP)

MAS Regulated

Derivatives Trading License (EP)

FSC Offshore Regulated

Market Making License (MM)

Single Core

1G

40G

Sanction

More

Company Name

OANDA Corporation

Company Abbreviation

OANDA

Platform registered country and region

United States

Number of employees

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

Capital

Higher than 90% Japanese brokers $3,604,651(USD)

| OANDA Broker Overview | |

| Feature | Details |

| Founded | 1996 |

| Registered Country/Region | United States |

| Regulation | ASIC, FCA, FSA, NFA, CIRO, MAS |

| Market Instruments | Forex, Cryptocurrencies, Commodities, Indices |

| Demo Account | Available |

| Leverage | Up to 50:1 for Forex, No leverage for Cryptos |

| Spread | From 0.1 pips (depending on account type) |

| Trading Platforms | OANDA Web Platform, MetaTrader 4, TradingView, Mobile Apps |

| Minimum Deposit | No minimum deposit (Premium account requires USD 20,000 minimum) |

| Customer Support | Office: 17 State Street, Suite 300, New York, NY 10004-1501 |

OANDA is a global online trading platform that was established in 2001 and is registered in the United States. It is regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). OANDA provides trading services in a variety of markets, including Forex, cryptocurrencies, commodities, and indices.

The platform is widely recognized for its low spreads, user-friendly tools, and robust educational resources. These features make it suitable for both beginner and experienced traders. OANDA also offers demo accounts, allowing users to practice trading with virtual funds before trading with real money.

For Forex trading, OANDA provides flexible leverage options. Traders can access the platform through MetaTrader 4 (MT4), TradingView, or its own proprietary OANDA trading platform, giving them multiple options to execute their trades.

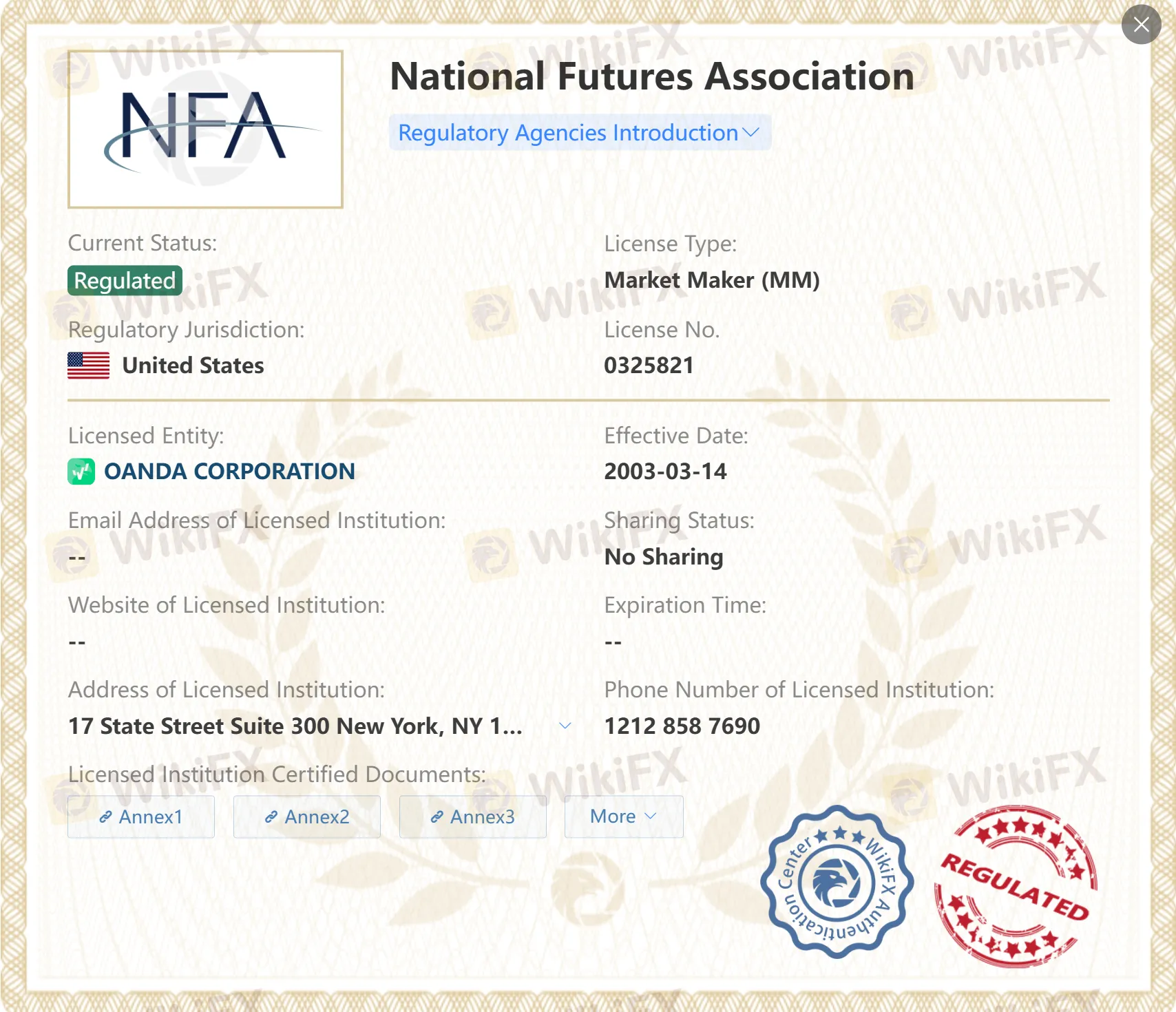

OANDA is a well-regulated broker with oversight from several major financial regulatory bodies. Here's a summary of OANDA's regulatory information:

| Regulatory Agency | Status | License Type | Regulatory Jurisdiction | License Number | Licensed Entity |

| Australian Securities and Investments Commission (ASIC) | Regulated | Market Maker (MM) | Australia | 412981 | OANDA AUSTRALIA PTY LTD |

| Financial Conduct Authority (FCA) | Regulated | Market Maker (MM) | United Kingdom | 542574 | OANDA Europe Limited |

| Financial Services Agency (FSA) | Regulated | Retail Forex License | Japan | 関東財務局長(金商)第2137号 | OANDA証券株式会社 |

| National Futures Association (NFA) | Regulated | Market Maker (MM) | United States | 325821 | OANDA CORPORATION |

| Canadian Investment Regulatory Organization (CIRO) | Regulated | Market Maker (MM) | Canada | Unreleased | OANDA (Canada) Corporation ULC |

| Monetary Authority of Singapore (MAS) | Regulated | Retail Forex License | Singapore | Unreleased | OANDA ASIA PACIFIC PTE. LTD. |

OANDA offers a variety of tradable instruments, including:

| Market Instrument | Available? |

| Forex | ✅ |

| Cryptocurrencies | ✅ |

| Commodities | ✅ |

| Indices | ✅ |

| Stocks | ❌ |

| ETFs | ❌ |

| Options | ❌ |

OANDA provides several account types tailored to different needs:

| Account Type | Minimum Deposit | Leverage | Spreads | Commission |

| Standard Account | No minimum | Up to 50:1 (Forex) | From 0.1 pips | None |

| Premium Account | USD 20,000+ | Up to 50:1 (Forex) | From 0.1 pips | Discounts on Spreads |

| Demo Account | None | None | Virtual funds | None |

OANDA supports multiple trading platforms to cater to various user preferences:

| Platform | Device | Target Audience |

| OANDA Web Platform | Web (Desktop, Mobile) | Beginner to Advanced Traders |

| MetaTrader 4 (MT4) | Desktop, Mobile, Tablet | Advanced Traders (Automated Trading) |

| TradingView | Web (Desktop, Mobile) | Chart Enthusiasts, Advanced Traders |

| OANDA Mobile App | Mobile | On-the-Go Traders |

OANDA supports a variety of deposit and withdrawal methods:

| Deposit Method | Fees | Processing Time |

| Bank Wire Transfer | No fees from OANDA | 1-3 business days |

| Debit Card (Visa/Mastercard) | No fees from OANDA | Immediate |

| ACH Transfer | No fees from OANDA | Immediate (for Instant ACH) |

Risk Disclaimer: Trading involves significant risk, and it is not suitable for everyone. You should only trade with money that you can afford to lose. Please ensure you understand the risks involved and seek independent advice if necessary. OANDA offers leverage on Forex, but be aware that leverage can magnify both gains and losses. Always trade responsibly.

Ready to start trading with OANDA? Open an account today and take advantage of their competitive spreads and advanced trading tools.

OANDA holds an impressive regulatory scorecard with oversight from top-tier bodies like the FCA, NFA, and ASIC, earning it a high safety rating of 8.24. However, a significant volume of user complaints regarding withdrawal blocks and impersonation scams necessitates a cautious approach for new traders.

WikiFX

WikiFX

Urgent warning: Over 100 complaints have been lodged in the last 3 months, with investors reporting paralyzed withdrawals and demands for "tax" or "VIP" fees. While the OANDA brand is heavily regulated, aggressive clone websites and imposter schemes are actively draining user funds.

WikiFX

WikiFX

OANDA enhances its CFD offering in Australia, adding US and European share CFDs for traders through the new OANDA One sub-account.

WikiFX

WikiFX

OANDA Japan now requires Google Authenticator codes for withdrawals and account changes to combat phishing and strengthen client security.

WikiFX

WikiFX

More

User comment

23

CommentsWrite a review

2025-08-14 12:49

2025-08-14 12:49

2025-08-13 23:47

2025-08-13 23:47