Fintrix Markets

摘要:Fintrix Markets was incorporated in Saint Lucia in 2024 and is an online trading platform that offers more than 500 trading instruments, including foreign exchange, commodities, indices, stocks and cryptocurrencies, and supports MT5. The platform supports payment methods such as Visa, Mastercard, and bank transfers, but does not currently have a regulatory license. Besides, it does not offer services for residents from certain areas.

| Fintrix MarketsReview Summary | |

| Founded | 2025 |

| Registered Country/Region | Mauritius |

| Regulation | Mauritius regulation |

| Market Instruments | Forex, Commodities, Indices,Metals, Equities, Cryptos |

| Demo Account | Available |

| Leverage | 1:1000 |

| Spread | Ultra-low |

| Trading Platform | MT4, MT5, and WebTrader |

| Minimum Deposit | $0 |

| Customer Support | Email:support@fintrixmarkets.com |

| Phone: +61 3 7042 9588 EXT#2000 | |

| Address: Level 7, 80 Collins Street, Melbourne VIC 3000 | |

| Regional Restriction | North Korea, Iran, Myanmar (Burma), United States, U.S. Outlying Islands, U.S. Virgin Islands, Belgium, American Samoa, Australia, Zimbabwe, Cyprus, Russia, Ukraine, Yemen, Syria, Iraq, Afghanistan, Palestinian Territories, Belarus, Libya |

Fintrix Markets Information

Fintrix Markets was incorporated in Mauritius in 2025 and is an online trading platform that offers more than 1400 plus trading instruments, including foreign exchange, commodities, indices, stocks and cryptocurrencies, and supports MT4, MT5, and . The platform supports payment methods such as Visa, Mastercard, and bank transfers. Besides, it does not offer services for residents from certain areas.

Pros & Cons

| Pros | Cons |

| MT4, MT5, and WebTrader support available | Regional restrictions |

| Various trading instruments | |

| 1000:1 high leverage |

Is Fintrix Markets Legit?

Yes. Fintrix Markets is regulated in Mauritius.

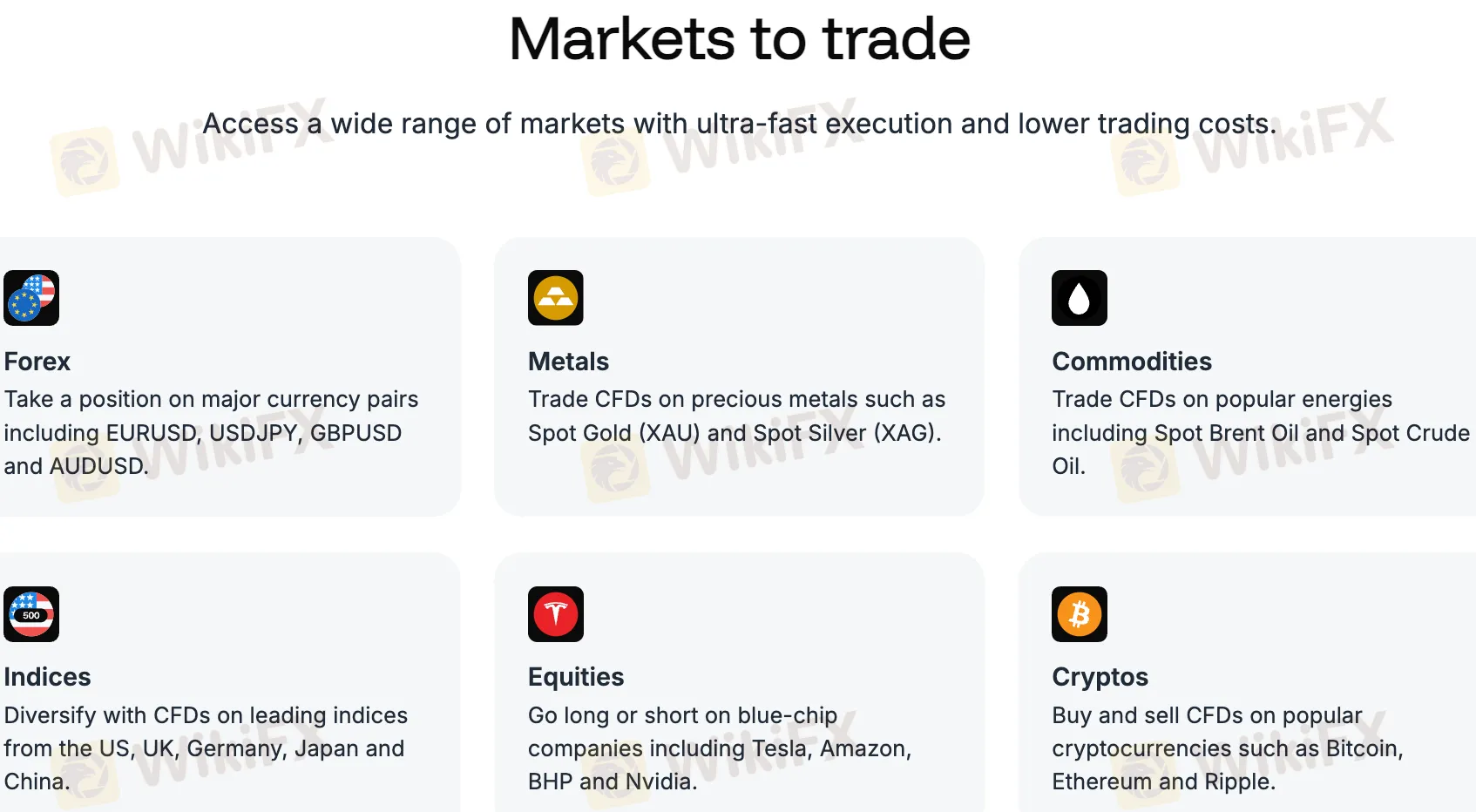

What Can I Trade on Fintrix Markets?

Fintrix Markets offers a wide range of over 1400 trading instruments, including Forex, Commodities, Indices, Commoditiesand Cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptos | ✔ |

| Metals | ✔ |

| Equities | ✔ |

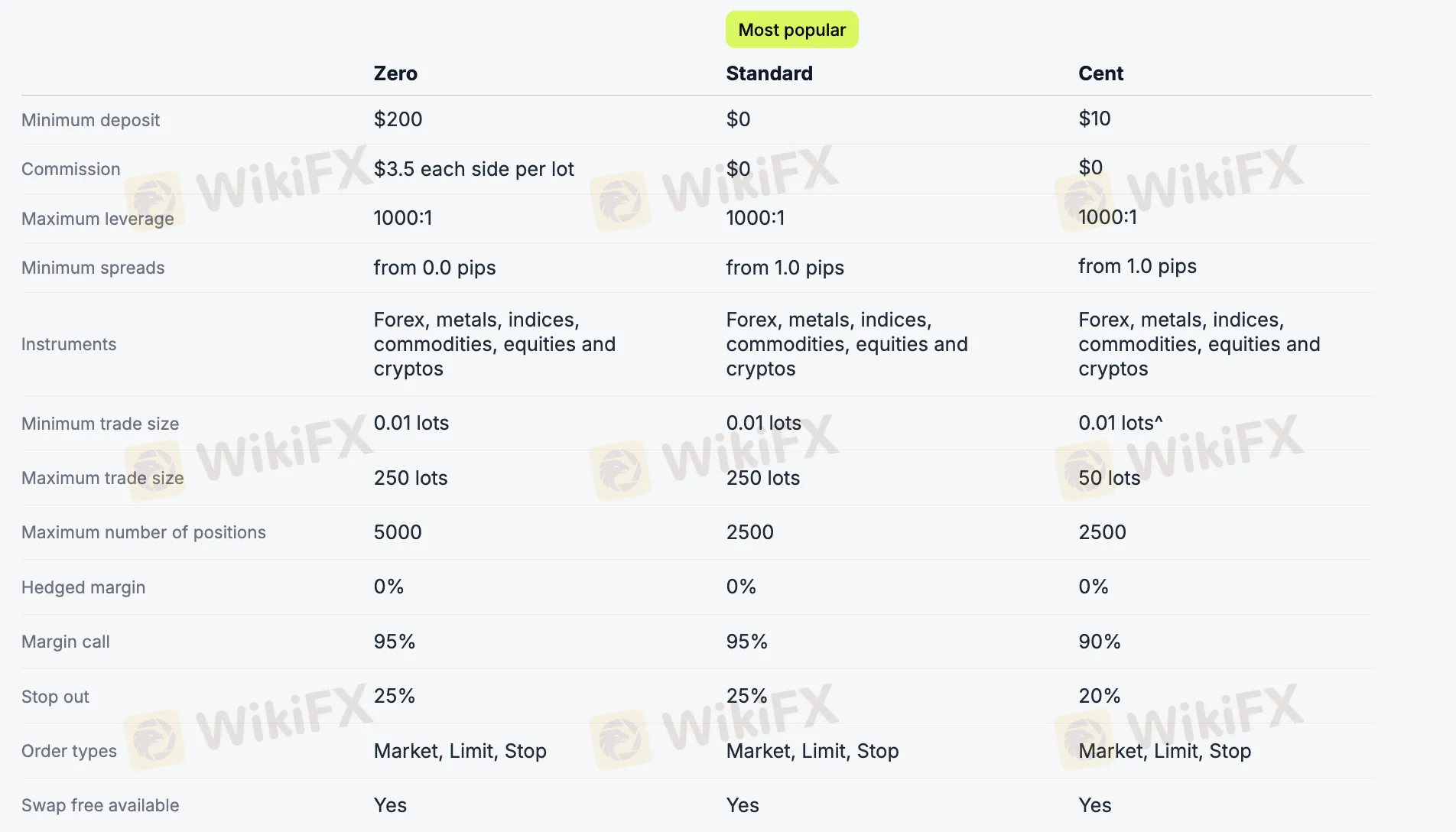

Accounts Types

| Feature | Zero | Most Popular (Standard) | Cent |

|---|---|---|---|

| Minimum Deposit | $200 | $0 | $10 |

| Commission | $3.5 each side per lot | $0 | $0 |

| Maximum Leverage | 1000:1 | 1000:1 | 1000:1 |

| Minimum Spreads | from 0.0 pips | from 1.0 pips | from 1.0 pips |

| Instruments | Forex, metals, indices, commodities, equities, cryptos | Forex, metals, indices, commodities, equities, cryptos | Forex, metals, indices, commodities, equities, cryptos |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum Trade Size | 250 lots | 250 lots | 50 lots |

| Maximum Number of Positions | 5000 | 2500 | 2500 |

| Hedged Margin | 0% | 0% | 0% |

| Margin Call | 95% | 95% | 90% |

| Stop Out | 25% | 25% | 20% |

| Order Types | Market, Limit, Stop | Market, Limit, Stop | Market, Limit, Stop |

| Swap Free Available | Yes | Yes | Yes |

Fee Structure Overview

Fintrix Markets structures its trading costs primarily through two models: commission-based and spread-based accounts, allowing traders to choose what best suits their strategy.

Account-Based Fee Models:

Zero Account: This model is geared towards high-volume or scalping traders. It offers raw spreads starting from 0.0 pips but applies a commission of $3.50 per side per lot. The total cost is the commission plus the very tight spread, which can be beneficial for strategies sensitive to spread fluctuations.Standard & Cent Accounts: These accounts use a spread-based model with no commissions. The trading cost is bundled into the spread, which starts from 1.0 pip. This creates a more predictable, all-inclusive cost structure, ideal for traders who prefer simplicity. The Cent account is tailored for beginners with minimal risk.

Other Charges to Consider:

Overnight Financing (Swap Fees): Like most brokers, Fintrix Markets charges fees for positions held overnight. These “swap” charges are based on the underlying market rates and can either be a cost or a credit.

Trading Platform

Fintrix Markets provides access to its trading services through the industry-standard MetaTrader platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

The platforms are available in multiple formats to accommodate different user preferences:

A desktop application for a full-featured experience.

A web-based version (WebTrader) accessible directly from an internet browser without installation.

Mobile applications for iOS and Android devices.

By offering both MT4 and MT5, the company provides clients with a choice between two established platforms. MT4 is widely recognized for trading forex and spot metals, while MT5 offers a broader set of instruments and more advanced built-in analytical tools. This approach allows users to select the platform that aligns with their specific trading requirements.

Deposit and Withdrawal

Fintrix Markets provides a range of global and local payment options, including Visa/Mastercard, Apple Pay, Google Pay, bank wires, and cryptocurrency. The company emphasizes a frictionless process, claiming instant deposits and 24/7 transaction access.

A key security policy requires that withdrawals can only be sent to an account under the same name as the trading account holder; third-party withdrawals are prohibited. While withdrawal requests are typically processed on the same business day, the time for funds to arrive depends on the method. Fintrix Markets states it charges no internal fees for transactions but notes that third-party providers (e.g., intermediary banks) may impose charges.All transactions are conducted via the client portal. For security and compliance with AML regulations, the company may request additional documentation to verify identity, especially for first-time withdrawals. Support is available 24/7 to assist with any issues.