Defcofx

摘要:Defcofx is a brokerage firm from Saint Lucia. At present, Defcofx's main business is to provide traders with a variety of trading products and financial services, notably supporting the use of MT5 platform, no commission, no swap fees. However, it is currently in an unregulated state and its operation is not subject to legal constraints, so the safety of the trader's funds may not be fully guaranteed and risks may arise.

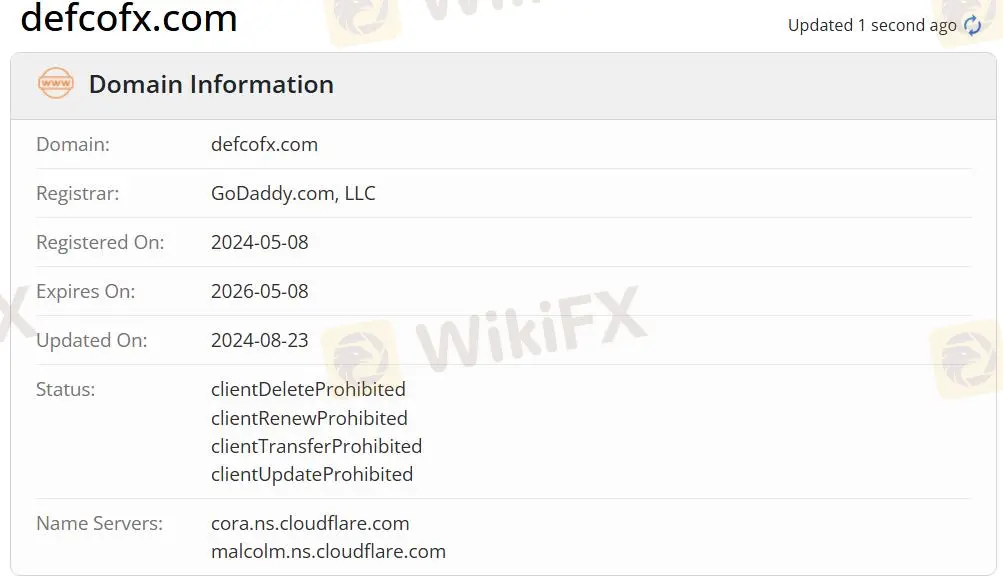

Defcofx Information

Defcofx is a brokerage firm from Saint Lucia. At present, Defcofx's main business is to provide traders with a variety of trading products and financial services, notably supporting the use of MT5 platform, no commission, no swap fees.

However, it is currently in an unregulated state and its operation is not subject to legal constraints, so the safety of the trader's funds may not be fully guaranteed and risks may arise.

Pros and Cons

| Pros | Cons |

| No commission | No regulation |

| Support MT5 | |

| Large number of tradable products | |

| Spread from 0.3 | |

| No swap fee |

Is Defcofx Legit?

Defcofx, a broker, is currently unregulated and operates outside the laws and regulations. For traders, there are certain risks.

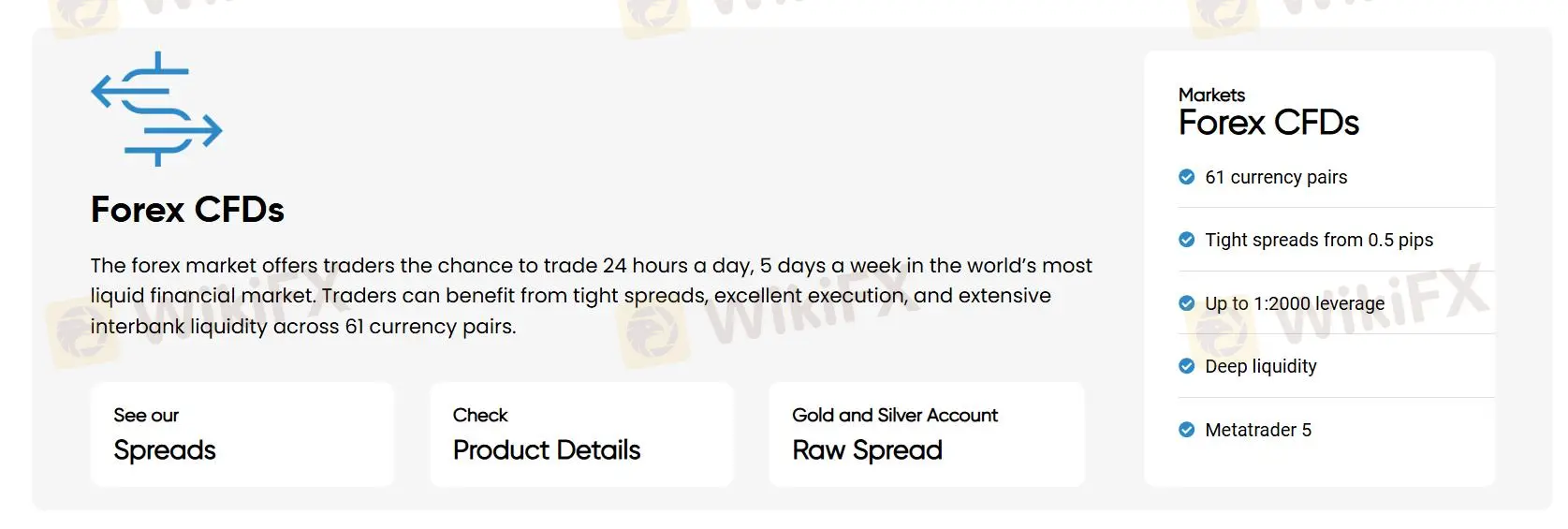

What Can I Trade on Defcofx?

Defcofx offers traders 61 currency pairs, low spreads from 0.5 points, and leverage up to 1:2000. It offers global index CFDS, with spreads on 11 indices starting at 0.5 points. There are also over 55 US stocks available for trading, i.e. over 55 large cap CFDS traded on the ASX, NYSE and NASDAQ stock exchanges. It also offers the popular cryptocurrency, a 24/7 trading market that supports bulls or bears. In addition, it provides access to a variety of metals, including precious metals such as gold and silver, as well as base metals such as platinum and platinum.

| Tradable Instruments | Supported |

| CFDs | ✔ |

| Forex | ✔ |

| Precious Metals | ✔ |

| Energies | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| ETF | ❌ |

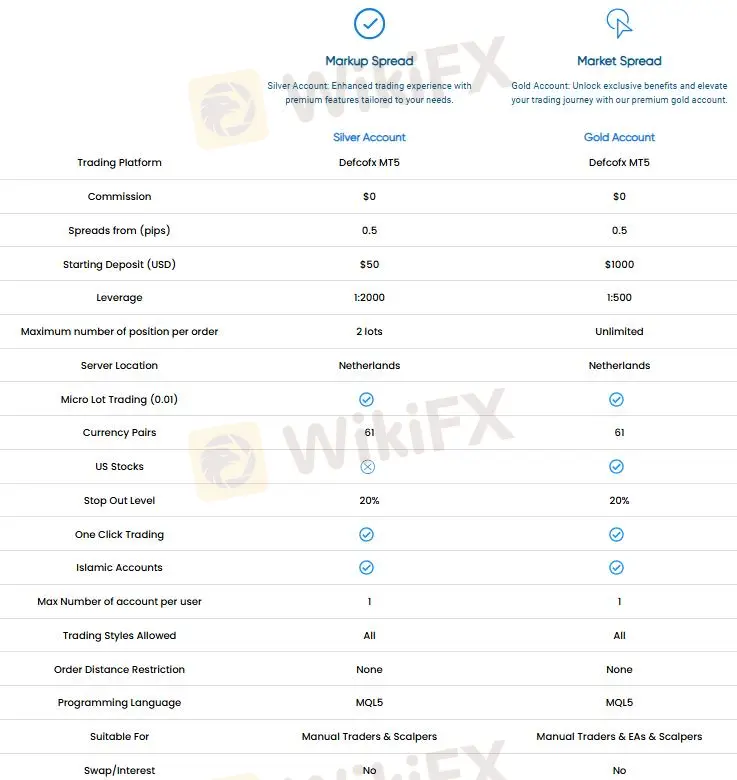

Account Types

Defcofx offers 2 account types: Silver account and Gold account.

Among them, the silver account has a minimum deposit of $50 and a leverage ratio of 1:2000, and the gold entry threshold seems to be friendly to novices, but the higher the leverage, the higher the risk. In contrast, gold accounts have a minimum deposit of $1,000 and a leverage ratio of 1:50.

Both account types support the use of the Defcofx MT5 trading platform and offer commission-free trading with spreads starting at 0.5 points. They also don't charge swaps or interest fees, which is beneficial for traders looking to keep costs to a minimum.

| Account Types | Silver Account | Gold Account |

| Trading Platform | Defcofx MT5 | Defcofx MT5 |

| Commission | $0 | $0 |

| Spreads from (pips) | 0.5 | 0.5 |

| Starting Deposit (USD) | $50 | $1,000 |

| Leverage | 1:2000 | 1:500 |

| Maximum Number of Positions per Order | 2 lots | Unlimited |

| Server Location | Netherlands | Netherlands |

| Micro Lot Trading (0.01) | √ | √ |

| Currency Pairs | 61 | 61 |

| US Stocks | Not available | √ |

| Stop Out Level | 20% | 20% |

| One Click Trading | √ | √ |

| Islamic Accounts | √ | √ |

| Max Number of Accounts per User | 1 | 1 |

| Trading Styles Allowed | All | All |

| Order Distance Restriction | None | None |

| Programming Language | MQL5 | MQL5 |

| Suitable For | Manual Traders & Scalpers | Manual Traders, EAs, Scalpers |

| Swap/Interest | No | No |

Defcofx Fees

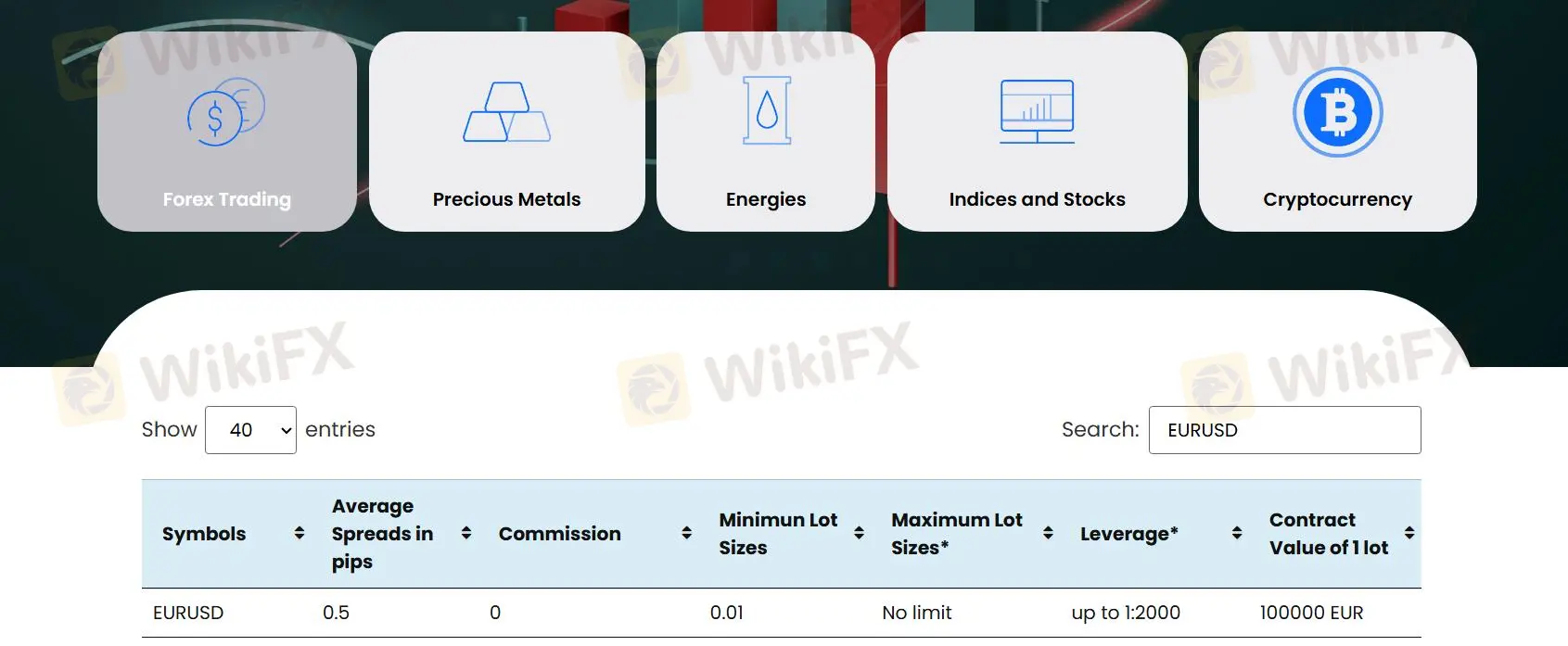

Defcofx Spreads & Commissions

Defcofx says it offers low spreads. Both types of account spreads start at 0.5pips.

In Forex pairs, the fixed spread between the euro and the US dollar is 0.5pips, which is favorable for traders and has low trading costs. For the remaining foreign exchange pairs, the spread remained at 0.5 pips to 6000 pips.

The precious metal spread is between 0.03 and 4.00 pips, which is in the basic reasonable range due to the liquidity and volatility of the metal.

The energy spread remained between 0.05 and 0.08 pips.

The spread between the index and stocks ranged from 0.01 points to 33pips. The upper limit of this range is quite high and is not suitable for cost-sensitive traders.

The spread of cryptocurrencies is 110 points, which is significantly higher than the usual level of the forex market, with high volatility.

In addition to the above spread, the two account types provided by the broker have no commission, which reduces the cost consumption of traders to a certain extent.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Web, Desktop, Mobile | Professional trader |

| MT4 | ❌ |

Deposit and Withdrawal

Defcofx says it does not charge extra fees for deposits and withdrawals. Additional information to note is that certain banking institutions may charge additional fees.

The trader must ensure that the funds in the account are used exclusively for trading purposes, and if the deposit is still not used for trading, there may be a certain withdrawal fee.

To initiate a fund withdrawal, the trader must maintain a minimum 250% margin available. In addition, the minimum deposit is $50.

Deposit Options

| Deposit Options | Accepted Currencies | Processing Time |

| Bitcoin | USD, EUR, GBP | INSTANT |

| Instacoins | USD, EUR, GBP | INSTANT |

| Tether | USD | INSTANT |

Withdrawal Options

| Withdrawal Options | Accepted Currencies | Processing Time |

| Bitcoin | USD, EUR, GBP | Up to 3 hours only |

| USDT | USD | Up to 3 hours only |

Customer Service

Defcofx offers traders 24/5 customer support. In addition, you can also consult through email and offline address to get services and help. You can also find them on social media.

| Contact Options | Details |

| support@Defcofx.comaccounts@Defcofx.comsupport@Defcofx.com | |

| Online Chat | 24/5 |

| Social Media | Facebook, Instagram, Twitter, Youtube |

| Physical Address | Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia. |

The Bottom Line

For traders who want to choose a broker, Defcofx offers a wide choice of trading products, supports the use of the MT5 platform, with spreads starting at 0.3 and no swap fees. All of these factors are advantages that attract traders. However, unfortunately, its unregulated status greatly reduces the advantages of this broker, traders please think carefully.

FAQs

Is Defcofx safe?

No, it's not safe. Defcofx, because of its unregulated status, brings risks and losses to traders.

Is Defcofx good for beginners?

No, Defcox is not a platform for beginners to use and trade. Its unregulated status and the complexity of some products, these factors are significant risks and obstacles for novice traders.

Is Defcofx suitable for day trading?

No, Defcofx is not suitable for day trading. Day trading requires a secure and reliable platform, but Defcofx's current unregulated status and associated risks make it unsuitable for day trading.

天眼交易商

熱點資訊

11/4-11/10最新外匯詐騙券商示警名單

MC Prime提供首次入金100%贈金,這家交易商是否安全可靠?

Blueberry Funded 更新外匯交易符號

踢爆Fruitful假交友投資騙局!誆稱掛單交易無風險高獲利,拒絕提領申請更逼繳納稅金

外匯天眼示警:小心誤用仿冒FXTRADING.com格倫外匯釣魚網站,入金前請比對官方網址是否無誤

匯率計算