Yoo Trade

摘要:Based in United Arab Emirates, Yoo Trade is an unregulated forex broker that was established in 2017. Yoo Trade provides various financial products to trade via MT5 platform, including CFDs, Forex, Indices, Commodities, Metals, and more. The minimum deposit requirement to open a live account is as low as USD 50.

| Yoo Trade Review Summary | |

| Founded | 2024 |

| Registered Country/Region | United Arab Emirates |

| Regulation | Unregulated |

| Market Instruments | CFDs, Forex, Indices, Commodities, Metals, etc. |

| Demo Account | ❌ |

| Leverage | Up to 1:500 |

| Spread | From 0.2 pips |

| Trading Platform | Yoo Trade Platform |

| Min Deposit | $50 |

| Customer Support | Contact form |

| Tel: +971542288006 | |

| Email: support@yootrade.app, info@yootrade.app | |

| Facebook, Instagram, Twitter, YouTube, WhatApp | |

| Address: Office 412, Sony Building, Al Raffa, Bur Dubai, UAE | |

| Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St. Vincent and the Grenadines | |

| Saint Lucia Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia | |

| Regional Restrictions | Syria, North Korea, Iran, Iraq, Mauritius, USA, Canada, Sudan, Myanmar, Yemen, Afghanistan, Vanuatu, and EEA countries |

Based in United Arab Emirates, Yoo Trade is an unregulated forex broker that was established in 2017. Yoo Trade provides various financial products to trade via MT5 platform, including CFDs, Forex, Indices, Commodities, Metals, and more. The minimum deposit requirement to open a live account is as low as USD 50.

Pros and Cons

| Pros | Cons |

| Various trading options | Not regulated |

| Tiered accounts | Quite new in the market |

| No commissions | No demo accounts |

| Affordable minimum deposit | Unclear fee struture |

| Popular payment options | No MT4/5 supported |

| Multiple contact channels | Do not service clients from several regions |

| 24/7 customer support |

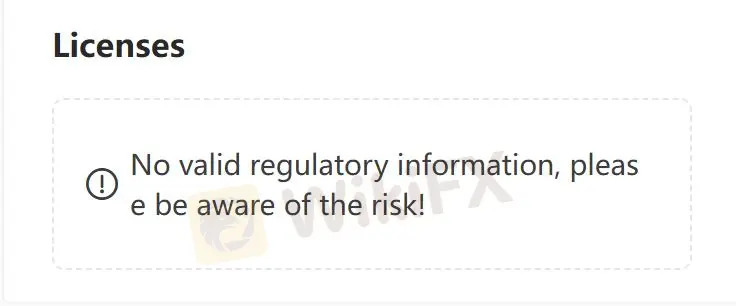

Is Yoo Trade Legit?

No, Yoo Trade is not regulated by any reputable financial body. Please be aware of the risk!

What Can I Trade on Yoo Trade?

YooTrade provides access to various financial instruments such as CFDs, Forex, Indices, Commodities, Metals, and more.

| Tradable Instruments | Supported |

| CFDs | ✔ |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Metals | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

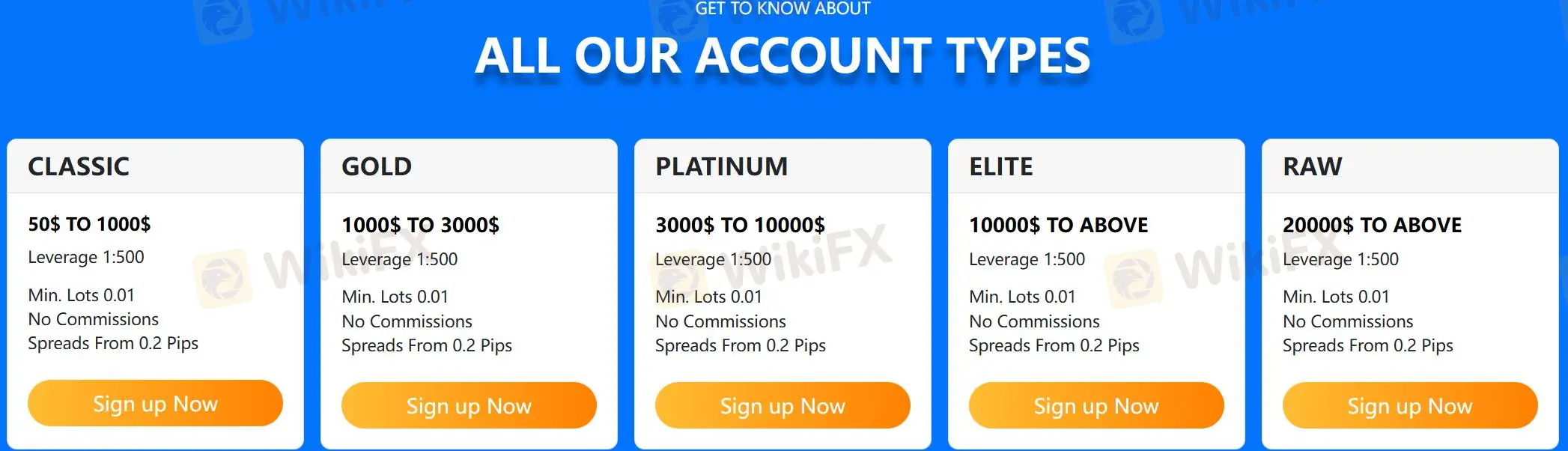

Account Type

Yoo Trade offers five accounts to choose from, including CLASSIC, GOLD, PLATINUM, ELITE and RAW accounts. Moreover, Yoo Trade provides traders with PAMM (Percentage Allocation Management Module) and MAM (Multi-Account Manager) systems to help traders manage multiple client accounts.

| Account Type | Min Deposit | Max Deposit |

| CLASSIC | $50 | $1,000 |

| GOLD | $1,000 | $3,000 |

| PLATINUM | $3,000 | $10,000 |

| ELITE | $10,000 | Unlimited |

| RAW | $20,000 | Unlimited |

Leverage

Yoo Trade offers a leverage of up to1:500 for all account types, which is quite high.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spread and Commission

Yoo Trade offers spread from 0.2 pips and no commissions for all five account types.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Yoo Trade Platform | ✔ | Web, Desktop, Mobile | / |

| MT5 | ❌ | / | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

Yoo Trade accepts payments via Skrill, Mastercard, Visa, Neteller, and others.

熱點資訊

WinproFx遭控沒收用戶利潤、限制帳戶功能,疑為詐騙黑平台

Exinity UK(FXTM)儘管營收下滑,2024年利潤大幅成長

Selftradeinv遭英國FCA列入警示名單!缺乏有效監管牌照,宣稱超高報酬涉非法吸金

到底怎麼加倉才是對的操作?

最近不少人討論的券商Autu Securities值得信賴嗎?監管情形、展業區域、網站概況一次看

Top First Group遭加拿大CSA示警!查無監管牌照、網站雙雙失效,疑似已爆雷潛逃

比複利更厲害的4個交易法則!

匯率計算