KesslerKoch

摘要:KesslerKoch offers a variety of financial products for online trading, including CFDs, stocks, and bonds. They satisfy different experience levels with Silver, Gold, and VIP accounts, each with a minimum deposit requirement. Leverage can be as high as 1:500, but be careful as this can magnify both profits and losses. The MT4 MarginWebTrader platform allows trading from any device. While they mention educational resources and customer support, there is no clear information on a demo account or their regulatory status, which is a major concern for financial trading.

| Aspect | Information |

| Company Name | KesslerKoch |

| Registered Country/Area | Switzerland |

| Founded Year | 2024 |

| Regulation | Not regulated |

| Market Instruments | CFDs, Stocks, ETFs, funds, bonds, options, futures, structured products |

| Account Types | Silver, Gold, VIP |

| Minimum Deposit | $5,000 |

| Maximum Leverage | 1:500 |

| Spreads | From 0 pips |

| Trading Platforms | MT4 MarginWebTrader |

| Demo Account | N/A |

| Customer Support | Phone: +41275087654 (Mon-Fri, 9:00-17:00), Email: support@kesslerkoch.com |

| Deposit & Withdrawal | Credit/Debit Cards, Bank Transfers, Check24, Scoutter, Bitcoin |

| Educational Resources | Market analysis & commentary, Trading tools |

Overview of KesslerKoch

KesslerKoch offers a variety of financial products for online trading, including CFDs, stocks, and bonds. They satisfy different experience levels with Silver, Gold, and VIP accounts, each with a minimum deposit requirement. Leverage can be as high as 1:500, but be careful as this can magnify both profits and losses. The MT4 MarginWebTrader platform allows trading from any device.

While they mention educational resources and customer support, there is no clear information on a demo account or their regulatory status, which is a major concern for financial trading.

Pros and Cons

| Pros | Cons |

| Wide range of financial instruments | Not regulated |

| Account types for different experience levels | Minimum deposit can be high ($5,000+) |

| Competitive leverage options | Demo account not clearly available |

| MT4 MarginWebTrader platform for mobile and desktop trading | Limited customer support hours |

| Educational resources |

Pros

Wide Range of Financial Instruments: KesslerKoch boasts a diverse selection of investment options. You can trade CFDs on stocks, forex, commodities, indices, and cryptocurrencies. Additionally, they offer access to traditional investment instruments like stocks, ETFs, funds, bonds, options, futures, and structured products. This variety allows you to potentially tailor your portfolio to your specific trading goals.

Account Types for Different Experience Levels: KesslerKoch satisfies traders of varying experience levels by offering three account types: Silver, Gold, and VIP. Each account comes with different minimum deposit requirements, features, and benefits. This allows beginners to start with a lower initial investment while experienced traders can access advanced features like higher leverage and personalized guidance.

Competitive Leverage Options: KesslerKoch offers leverage options ranging from 1:300 up to 1:500, depending on the account type. Leverage can amplify your returns, but it also magnifies potential losses. This feature can be beneficial for experienced traders comfortable with managing risk, but it should be approached carefully by beginners.

MT4 MarginWebTrader Platform: KesslerKoch utilizes the MT4 MarginWebTrader platform, known for its reliability and user-friendly interface. This platform allows you to trade from any mobile or desktop browser, regardless of the operating system. Additionally, it offers a feature-rich interface with tools to support your trading decisions.

Educational Resources: KesslerKoch claims to prioritize user experience by offering market analysis and commentary from experienced traders. This can provide valuable insights into market trends and potential opportunities for users. Additionally, the platform might include essential trading tools like technical indicators and charts, empowering users to make informed decisions.

Cons

Not Regulated: This is a major red flag. Financial trading carries inherent risks, and a lack of regulatory oversight raises serious concerns. Without proper regulation, there's no guarantee of the platform's legitimacy or the security of your funds.

Minimum Deposit Can Be High: The minimum deposit requirement starts at $5,000 for the Silver account. This can be a significant barrier for entry, especially for new traders starting with smaller investment amounts.

Demo Account Not Clearly Available: There's no clear information on whether KesslerKoch offers a demo account. A demo account allows you to practice trading with virtual funds in a simulated environment. This is a crucial tool for new traders to learn the platform and test their trading strategies before risking real money.

Limited Customer Support Hours: Customer support is only available from Monday to Friday, 9:00 AM to 5:00 PM. This limited timeframe might not be suitable for traders who require assistance outside of these hours, especially those in different time zones.

Regulatory Status

While they claim to be a “tried, tested, and proven broker” with a reputation recognized by top institutions, there's no mention of specific regulatory bodies overseeing their activities. This lack of transparency regarding regulation should be a red flag, especially since financial trading carries inherent risks.

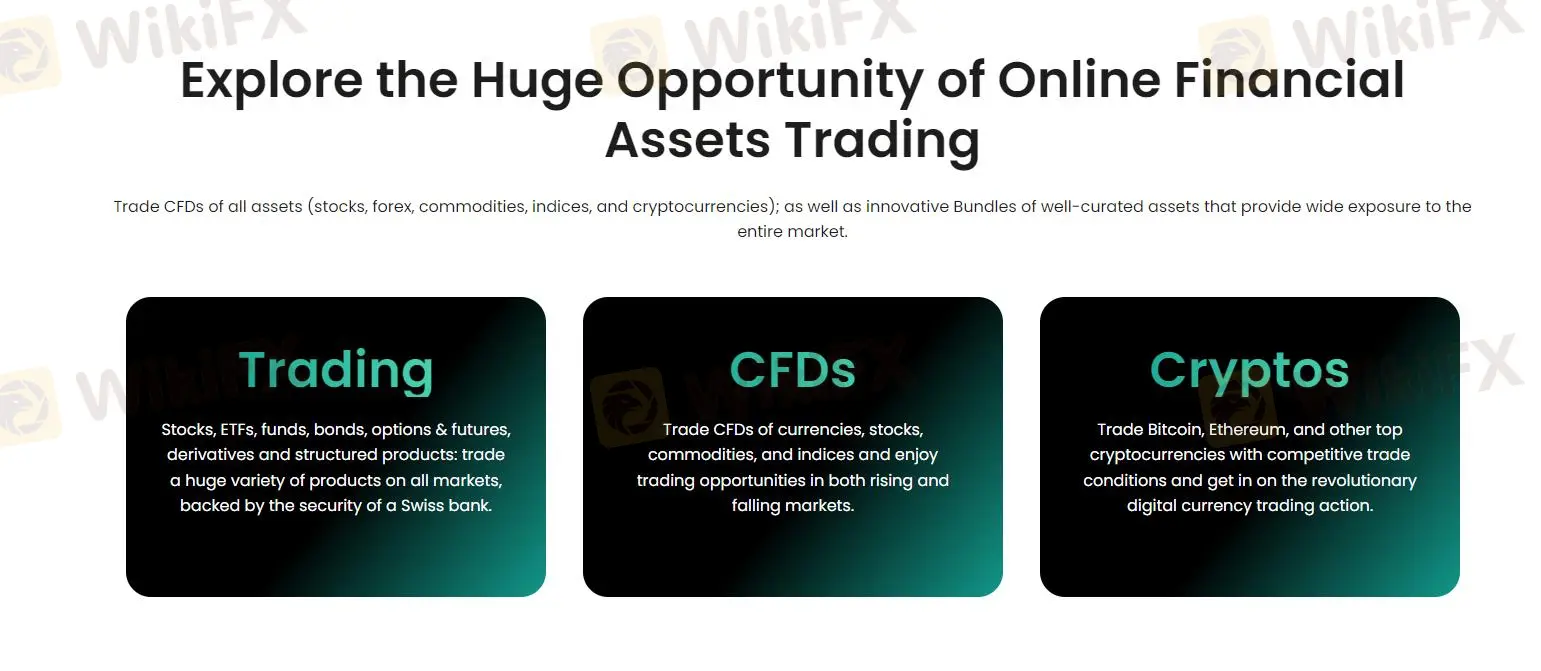

Market Instruments

KesslerKoch offers financial products tailored for online trading. Their offerings include CFDs covering stocks, forex, commodities, indices, and cryptocurrencies, satisfying both rising and falling market conditions. Additionally, they provide access to a diverse array of traditional investment instruments such as stocks, ETFs, funds, bonds, options, futures, and structured products, all backed by the security of a Swiss bank. With competitive trade conditions and a focus on innovation, KesslerKoch enables traders to seize opportunities across various asset classes and participate in the evolving landscape of digital currency trading.

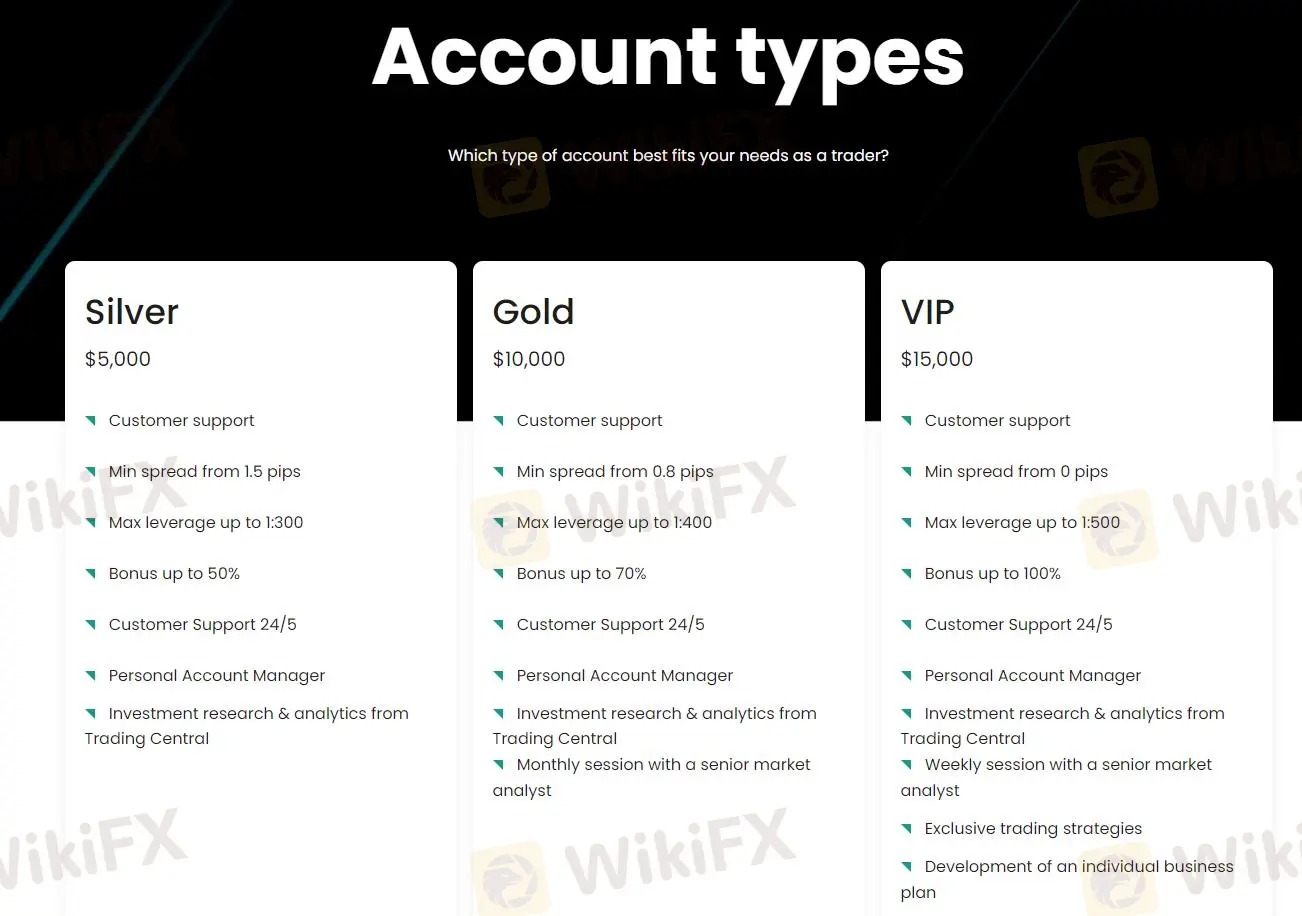

Account Types

KesslerKoch offers three distinct account types to satisfy the diverse needs of traders: Silver, Gold, and VIP.

The Silver account is ideal for new traders, requiring a minimum deposit of $5,000. It offers access to customer support, a personal account manager, and investment research from Trading Central. With spreads starting from 1.5 pips and leverage up to 1:300, traders enjoy competitive conditions. Additionally, bonuses of up to 50% provide an edge, and 24/5 customer support ensures assistance is readily available.

The Gold account provides advanced trading features for experienced traders with a minimum deposit of $10,000. It offers tighter spreads starting from 0.8 pips and leverage up to 1:400. In addition to customer support and a personal account manager, traders receive monthly sessions with a senior market analyst for valuable insights. Bonuses of up to 70% enhance trading opportunities, while research from Trading Central aids informed decision-making.

The VIP account offers top-tier privileges and benefits for high-level traders. With a minimum deposit of $15,000, traders access unparalleled advantages. They enjoy spreads from 0 pips and leverage up to 1:500, along with bonuses of up to 100%. In addition to 24/5 customer support and a personal account manager, VIP traders receive weekly sessions with a senior market analyst for deeper insights and strategic guidance. Exclusive trading strategies and personalized business plans further enhance the trading experience, ensuring VIP traders have every advantage in the market.

How to Open an Account?

Heres how to open a trading account with KesslerKoch:

Sign up for a KesslerKoch live account: Visit the KesslerKoch website (https://kesslerkoch.com) and locate the option to sign up for a live trading account. Follow the prompts to provide your personal information, including your name, contact details, and any other required information.

Fill out a KesslerKoch live account form: Once you've signed up, you'll need to fill out a KesslerKoch live account form. This form requires additional details such as your address, financial information, and trading preferences.

Contact your account manager to start trading: After completing the account signup and form submission, you'll be assigned an account manager by KesslerKoch. Contact your account manager to finalize the account setup and begin trading. They will guide you through any additional steps required.

Leverage

KesslerKoch offers maximum leverage that varies depending on the account type you choose. The leverage ranges from 1:300 up to 1:500. This means you can control a position worth much more than your initial deposit. For example, with 1:500 leverage, a $1,000 deposit would allow you to control a position worth $500,000.

Spreads & Commissions

The minimum spreads offered by KesslerKoch vary depending on the account type. These range from 1.5 pips up to 0 pips. A pip is a unit of measurement for price changes in currencies. Lower spreads indicate a smaller difference between buying and selling prices, potentially reducing your trading costs.

| Account Type | Minimum Spread (pips) |

| Silver | 1.5 |

| Gold | 0.8 |

| VIP | 0 |

Trading Platform

KesslerKoch's trading platform, the MT4 MarginWebTrader, provides a secure trading experience. With this platform, traders can access diverse assets conveniently from any mobile or desktop browser, regardless of the operating system. It offers a feature-rich interface tailored to meet all trading needs, ensuring a reliable and trusted environment for executing trades. Whether on the go or at a desktop, traders can rely on the MT4 MarginWebTrader to experience trading excellence.

Deposit & Withdrawal

KesslerKoch offers a wide range of payment options to suit your needs. You can use popular methods like credit and debit cards, or opt for bank transfers including traditional and electronic options. They also accept the German platform Check24 and a regional payment method called Scoutter. Even cryptocurrency enthusiasts are covered with Bitcoin support.

Customer Support

For KesslerKoch's customer support, you can reach out via phone at +41275087654 or email at support@kesslerkoch.com. Support is available from Monday to Friday, 09:00 to 17:00, ensuring assistance during standard business hours. Whether you have inquiries, need assistance with your account, or require help with trading, KesslerKoch's dedicated support team is ready to provide prompt and reliable assistance to address your needs effectively.

Educational Resources

KesslerKoch prioritizes user-friendly trading by offering market insights and a range of trading tools. Through market analysis and commentary from experienced traders, users gain valuable insights into market trends and potential opportunities. Additionally, the platform provides essential trading tools such as technical indicators and charts, empowering users to make informed decisions.

Conclusion

KesslerKoch offers a tempting combination of diverse financial instruments, account types for various experience levels, and a user-friendly platform. However, the lack of regulatory oversight is a major drawback, raising concerns about safety and fair practices. While the high leverage options and educational resources might be appealing, it's crucial to prioritize security.

FAQs

Question: Are there different account types available?

Answer: Yes, KesslerKoch has three account types (Silver, Gold, VIP) tailored to different experience levels. Each offers varying minimum deposits, features, and benefits.

Question: How much do I need to start trading with KesslerKoch?

Answer: The minimum deposit requirement depends on the account type you choose. It starts at $5,000 for the Silver account and increases for Gold and VIP accounts.

Question: What platform do I use to trade with KesslerKoch?

Answer: KesslerKoch utilizes the MT4 MarginWebTrader platform, known for its user-friendly interface and accessibility from various devices.

Question: Does KesslerKoch have educational resources for traders?

Answer: They offer market analysis and commentary, potentially providing valuable insights for informed trading decisions. Additionally, they might have essential trading tools like technical indicators and charts.

Question: Is KesslerKoch a regulated platform?

Answer: There is no mention of specific regulatory bodies overseeing KesslerKoch's activities. This lack of transparency regarding regulation is a major concern.

天眼交易商

熱點資訊

早盤黃金市場解析|震盪加劇,行情正在醞釀新方向

黃金早盤行情解析|市場洗盤後,下一步怎麼走?

慎防高風險平台SPEC TRADING!半年三度改名、交易糾紛不斷、監管資訊模糊,建議投資人高度警惕

Legacy Bitfundex被列入英國FCA警告名單,網站存在資訊造假問題,請留意相關詐騙風險

OANDA 將自營交易客戶轉移至 FTMO,經紀業務重新聚焦

LONG ASIA又陷出金爭議!協議稱可任意處置客戶資金,遭多國監管機構示警,疑為高風險平台

專業操盤手都在用的七大技術分析

匯率計算