JOJO MARKETS

摘要:JOJO MARKETS is an unregulated brokerage company registered in the xx. The broker's official website has been closed, so traders cannot obtain more security information.

Note: JOJO MARKETS's official website: https://www.jojofxz.com is currently inaccessible normally.

JOJO MARKETS Information

JOJO MARKETS is an unregulated brokerage company registered in the xx. The broker's official website has been closed, so traders cannot obtain more security information.

Is JOJO MARKETS Legit?

After a Whois query, we found that this company's domain name is for sale, which shows that this company has not registered it securely.

Downsides of JOJO MARKETS

- Unavailable Website

JOJO MARKETS's official website is inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since JOJO MARKETS does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

JOJO MARKETS is not regulated by any institutions, which increases the possibility of fraud.

- Withdrawal Difficulty & Scams

According to a report on WikiFX, users encountered significant difficulties with fund withdrawals and thought it was a scam. The issue remained unresolved despite the request being pending for a long time.

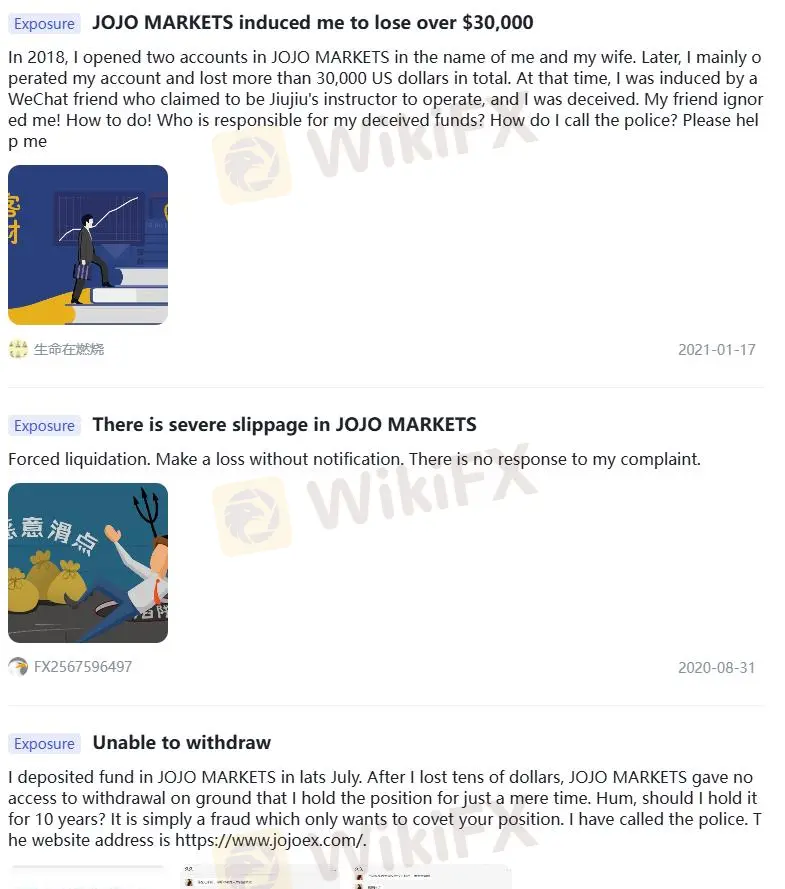

Negative JOJO MARKETS Reviews on WikiFX

On WikiFX, “Exposure” is posted as a word of mouth received from users.

Traders must review information and assess risks before trading on unregulated platforms. Please consult our platform for related details. Report fraudulent brokers in our Exposure section and our team will work to resolve any issues you encounter.

As of now, there are three pieces of JOJO MARKETS exposure in total.

Exposure. Cannot withdraw & Scams

| Classification | Unable to Withdraw & Scams |

| Date | 2020-2021 |

| Post Country | Hong Kong, China |

You may visit: https://www.wikifx.com/en/comments/detail/202101162352915280.html

https://www.wikifx.com/en/comments/detail/202007145132848496.html.

Conclusion

JOJO MARKETS Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status and unregistered domain name indicate that this brokers trading risks are high. It is advisable to choose regulated brokers with transparent operations to ensure the safety of your investments and compliance with legal standards. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

天眼交易商

熱點資訊

6個「無知」將令你身陷交易誤區!

華爾街「長線交易大師」的23條核心理念!

投資人請注意!JustMarkets遭爆惡意操縱行情、強制平倉,客服答非所問,維權難如登天

外匯天眼快訊:高風險券商DtcPay已跑路,網站失連證實為詐騙平台

Lutex Options官網疑點重重,監管資訊缺失,安全性堪憂!

ProfitWave缺乏有效監管、展業區域存疑,遭加拿大CSA示警,疑為外匯詐騙平台

匯率計算