Primapro

摘要:Primapro, based in Seychelles, is an unregulated broker offering a range of account types. They provide Standard, Premium, and VIP accounts with varying minimum deposits and spreads. Traders can access the MetaTrader 4 (MT4) platform and trade Forex, Metals, Futures, and Stocks. The broker offers high leverage up to 1:3000 and Islamic (Swap-Free) accounts. However, they do not provide educational resources, and it's unclear if a demo account is available. Customer support is exclusively via email, and payment methods include local banks, wire transfers, UnionPay, Skrill, and debit/credit cards. Traders should exercise caution due to the lack of regulation.

| Aspect | Information |

| Registered Country/Area | Seychelles |

| Company Name | Primapro |

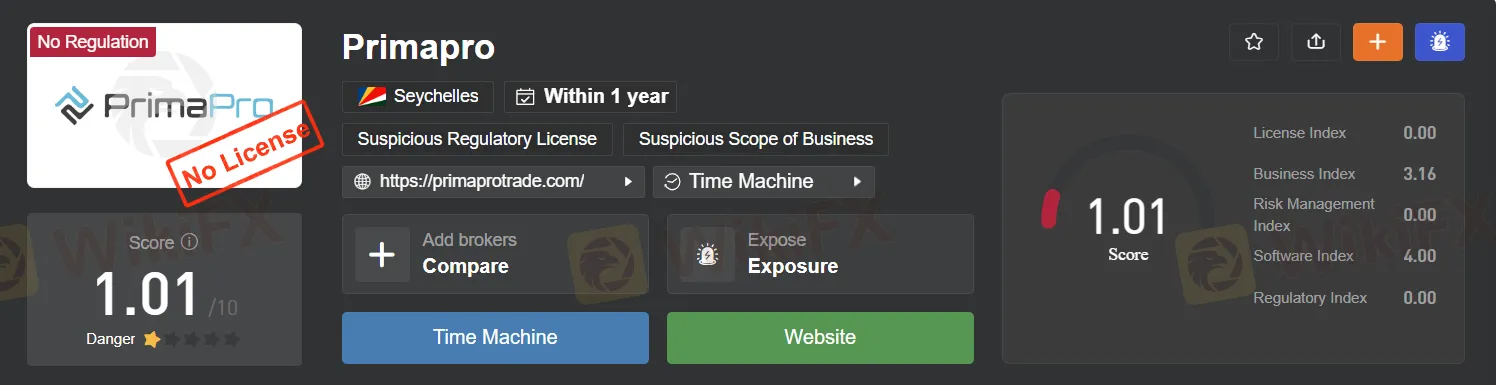

| Regulation | Unregulated |

| Minimum Deposit | USD 100 (Standard Account), USD 1,000 (Premium Account), USD 10,000 (VIP Account) |

| Maximum Leverage | Up to 1:3000 |

| Spreads | Standard Account: 1 pip, Premium Account: 0.6 pips, VIP Account: 0.3 pips |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, Metals, Futures, Stocks |

| Account Types | Standard, Premium, VIP |

| Demo Account | Information not provided |

| Islamic Account | Available (Swap-Free) |

| Customer Support | Email support@primaprotrade.com (Global Clients, Chinese Speaking, Indonesian Speaking) |

| Payment Methods | Local Banks, Bank Wire Transfers, UnionPay, Skrill E-Wallet, Debit/Credit Cards |

| Educational Tools | Not provided |

Overview

Primapro, based in Seychelles, is an unregulated broker offering a range of account types. They provide Standard, Premium, and VIP accounts with varying minimum deposits and spreads. Traders can access the MetaTrader 4 (MT4) platform and trade Forex, Metals, Futures, and Stocks. The broker offers high leverage up to 1:3000 and Islamic (Swap-Free) accounts. However, they do not provide educational resources, and it's unclear if a demo account is available. Customer support is exclusively via email, and payment methods include local banks, wire transfers, UnionPay, Skrill, and debit/credit cards. Traders should exercise caution due to the lack of regulation.

Regulation

Primapro is an unregulated broker, which raises several concerns for potential investors:

Lack of Regulation: Unregulated brokers operate without oversight, potentially leading to non-compliance with industry standards and investor protection.

Fraud Risk: The absence of regulatory oversight increases the risk of fraudulent activities, including misrepresentation and fund misappropriation.

Transparency Issues: Unregulated brokers often lack transparency, making it difficult for clients to understand costs and risks.

Security Concerns: Weak security measures can expose investors to data breaches and identity theft.

Financial Loss Risk: Unregulated brokers may not follow best practices, increasing the likelihood of significant financial losses.

Limited Recourse: Resolving disputes with unregulated brokers can be challenging due to a lack of regulatory support.

Questionable Practices: Unregulated brokers may employ aggressive sales tactics and unethical practices to maximize their profits.

Investors should exercise caution, conduct thorough due diligence, and consider regulated alternatives to mitigate these risks when dealing with unregulated brokers like Primapro.

Pros and Cons

| Pros | Cons |

| Wide Range of Account Types | Unregulated Broker |

| High Leverage Options | Lack of Regulatory Oversight |

| Islamic (Swap-Free) Accounts | Potential Fraud and Security Risks |

| Multiple Deposit and Withdrawal Methods | Lack of Educational Resources |

| Competitive Spreads and Commission Structure | Limited Customer Support Channels |

| MetaTrader 4 Platform | No Demo Account |

| Absence of Phone Support or Live Chat | |

| Lack of Tailored Language-Specific Support Channels |

Primapro, an unregulated broker, offers various account types with different features and benefits. The broker provides high leverage and Islamic (Swap-Free) accounts, accommodating different trading preferences. Multiple deposit and withdrawal methods, along with competitive spreads and commission structures, enhance the trading experience. The availability of the MetaTrader 4 platform adds to the broker's appeal.

However, Primapro has notable drawbacks. The lack of regulatory oversight raises concerns about transparency, security, and potential fraudulent activities. The absence of educational resources limits traders' access to valuable knowledge and market insights. Customer support is exclusively through email, with no alternative communication channels such as phone support or live chat. Additionally, there is no mention of a demo account, which could hinder traders' ability to test strategies and platforms before committing real funds.

In conclusion, while Primapro offers some positive features, traders should approach this broker with caution due to its lack of regulation and potential limitations in customer support and educational resources. Careful consideration of the pros and cons is essential when evaluating Primapro as a potential trading partner.

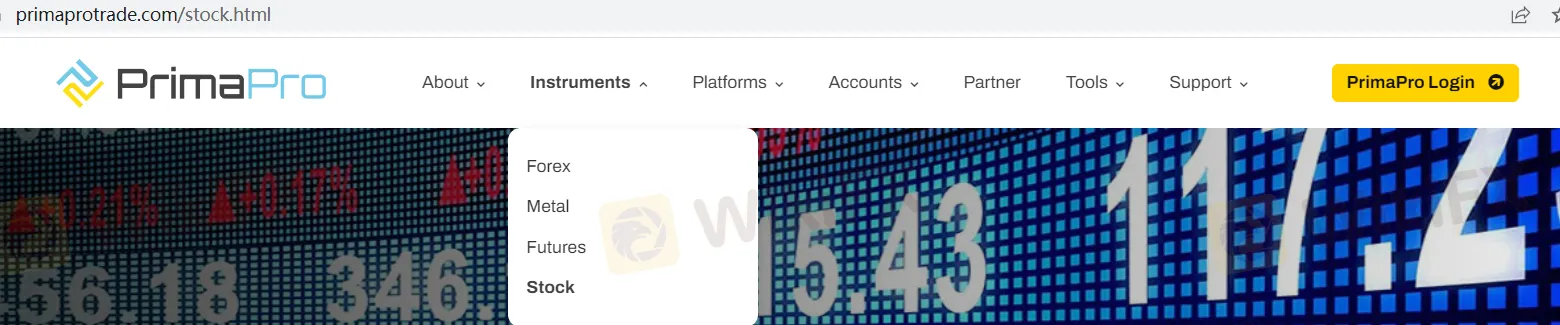

Market Instruments

The broker offers a variety of trading instruments across different financial markets, allowing clients to diversify their investment portfolios and explore various trading opportunities. These instruments include Forex, Metals, Futures, and Stocks.

Forex (Foreign Exchange): Forex trading involves the exchange of one currency for another in the foreign exchange market. It is one of the largest and most liquid markets globally, with traders speculating on currency pairs' price movements. These pairs can include major currencies like EUR/USD (Euro/US Dollar) and exotic currencies like USD/TRY (US Dollar/Turkish Lira).

Metals: Metals trading typically encompasses precious metals like gold and silver, as well as industrial metals such as copper and aluminum. Investors can trade these metals either as physical assets or through derivatives like CFDs (Contracts for Difference), allowing for both speculative and hedging strategies.

Futures: Futures contracts represent agreements to buy or sell a specific quantity of an underlying asset at a predetermined price and future date. Common underlying assets for futures trading include commodities like oil, natural gas, agricultural products, financial instruments like stock indices, and even cryptocurrencies like Bitcoin.

Stocks: Stock trading involves buying and selling shares of publicly-traded companies. Stocks are typically classified into various sectors, such as technology, healthcare, or energy, and investors can choose to focus on specific industries or diversify their portfolios across sectors. Stock trading often provides opportunities for long-term investment or short-term speculation.

| Market Instrument | Description | Examples |

| Forex | Currency pairs traded in the FX market | EUR/USD, USD/JPY, GBP/CHF |

| Metals | Trading in precious and industrial metals | Gold, Silver, Copper, Platinum |

| Futures | Contracts for future delivery of assets | Crude Oil Futures, S&P 500 Futures |

| Stocks | Equities representing ownership in companies | Apple Inc. (AAPL), Microsoft (MSFT) |

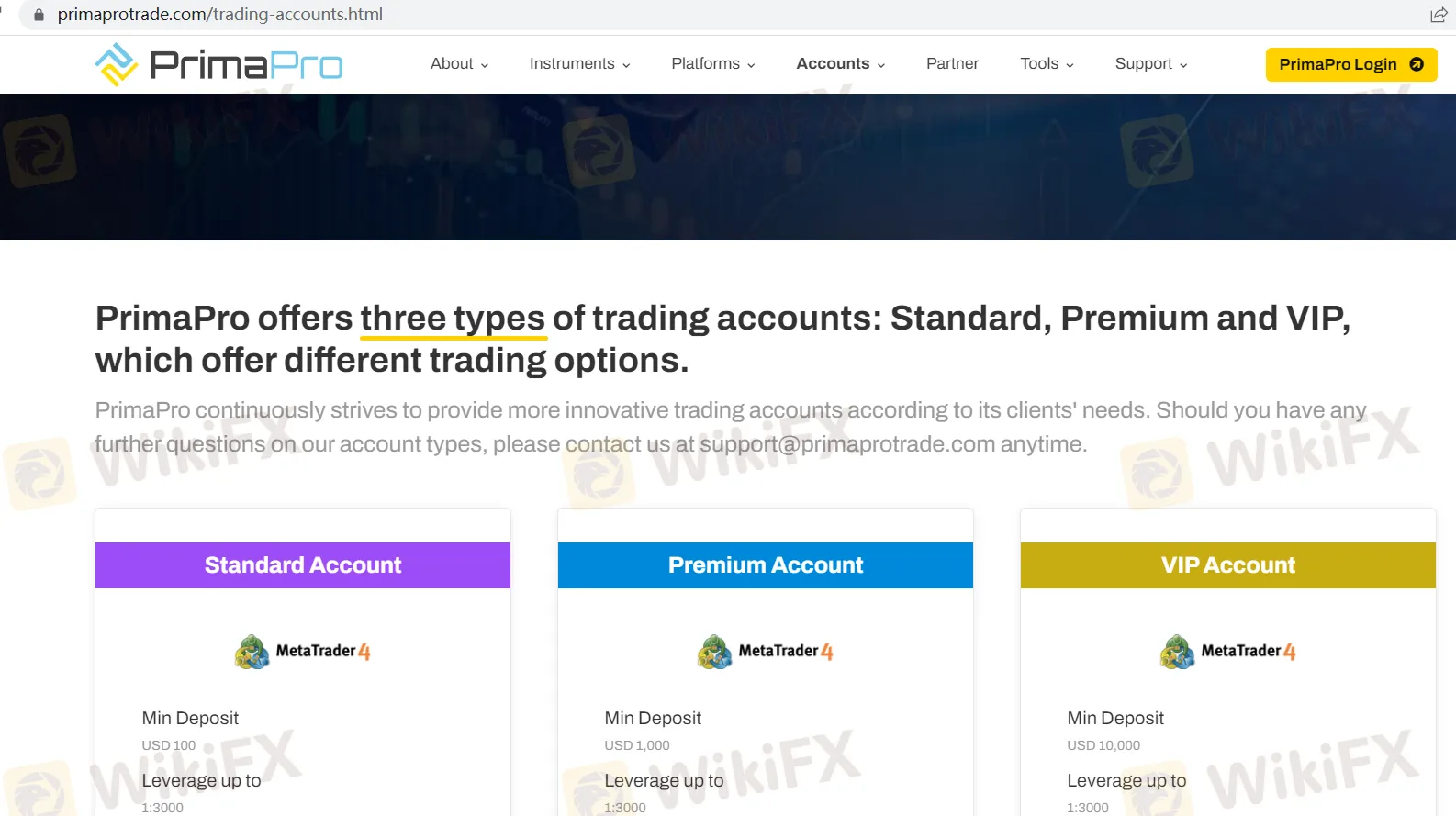

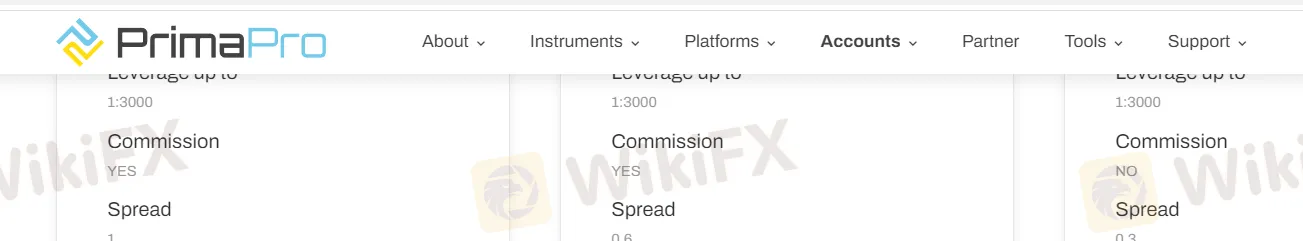

Account Types

The broker offers three distinct tiers of trading accounts, catering to traders with varying experience levels and preferences: the Standard Account, Premium Account, and VIP Account.

Standard Account:

The Standard Account is an excellent choice for traders looking to start their journey with a relatively low minimum deposit of USD 100. It provides leverage of up to 1:3000, allowing traders to amplify their trading positions. While there is a commission associated with this account, the spread is competitive at just 1 pip. The Standard Account also offers the convenience of swap-free trading, ideal for those who need to adhere to Islamic financial principles. With a maximum of 500 orders allowed, traders can actively manage their positions, and margin calls are set at 60%. This account is suitable for beginners and those who prefer a straightforward trading approach.

Premium Account:

The Premium Account is designed for traders who are willing to invest a bit more, with a minimum deposit requirement of USD 1,000. It shares the same high leverage of up to 1:3000 and offers a lower spread of 0.6 pips, making it appealing to traders seeking tighter spreads. Similar to the Standard Account, it features swap-free trading, a maximum of 500 orders, and a margin call level of 60%. This account suits traders who want to enhance their trading experience with improved trading conditions.

VIP Account:

For experienced traders and those with substantial capital, the VIP Account stands out. It demands a higher minimum deposit of USD 10,000 but comes with several advantages. Unlike the other two accounts, the VIP Account does not have a commission, offering commission-free trading. The spread is ultra-competitive at just 0.3 pips, making it highly attractive to traders who prioritize cost efficiency. Like the other accounts, it supports swap-free trading, a maximum of 500 orders, and a margin call level of 60%. The VIP Account is suitable for traders seeking premium trading conditions and are ready to make a significant investment.

Here's a concise table summarizing the key features of these three trading accounts:

| Account Type | Min Deposit | Leverage | Commission | Spread | Margin Call | Swap Free | Max Orders | Max Volume/Order | Max Volume/Lots | Max Pending Orders |

| Standard | USD 100 | 1:3000 | YES | 1 pip | 60% | YES | 500 | 1 | 25 | 100 |

| Premium | USD 1,000 | 1:3000 | YES | 0.6 pip | 60% | YES | 500 | 1 | 25 | 100 |

| VIP | USD 10,000 | 1:3000 | NO | 0.3 pip | 60% | YES | 500 | 1 | 25 | 100 |

These three account types offer flexibility to traders, allowing them to choose the one that best aligns with their trading objectives, risk tolerance, and capital availability.

Leverage

This broker offers traders a maximum leverage of up to 1:3000. Leverage is a tool that allows traders to control larger positions with a smaller amount of capital, potentially amplifying profits. However, it also increases the risk of significant losses if market movements are unfavorable. Traders should exercise caution and have a robust risk management strategy when using high leverage.

Spreads & Commissions:

The broker provides a variety of spreads and commissions that vary based on the chosen trading account. Spreads represent the difference between the buying (ask) and selling (bid) prices of financial instruments, while commissions are the fees imposed by the broker for facilitating trades.

In the Standard Account, traders can take advantage of a competitive spread of 1 pip, and trading in this account incurs a commission.

For the Premium Account, a tighter spread of 0.6 pips is offered, making it an attractive choice for traders who prefer narrower spreads. Similar to the Standard Account, this account also involves a commission.

In contrast, the VIP Account differentiates itself by offering commission-free trading and an exceptionally low spread of just 0.3 pips. This account is particularly suitable for traders who prioritize cost-effectiveness and premium trading conditions.

It's essential for traders to carefully consider their trading style and preferences when selecting an account type, as the spreads and commissions can impact the overall cost of trading and potential profitability. Furthermore, traders should be aware of any additional fees or charges that may apply to specific trading activities or account features.

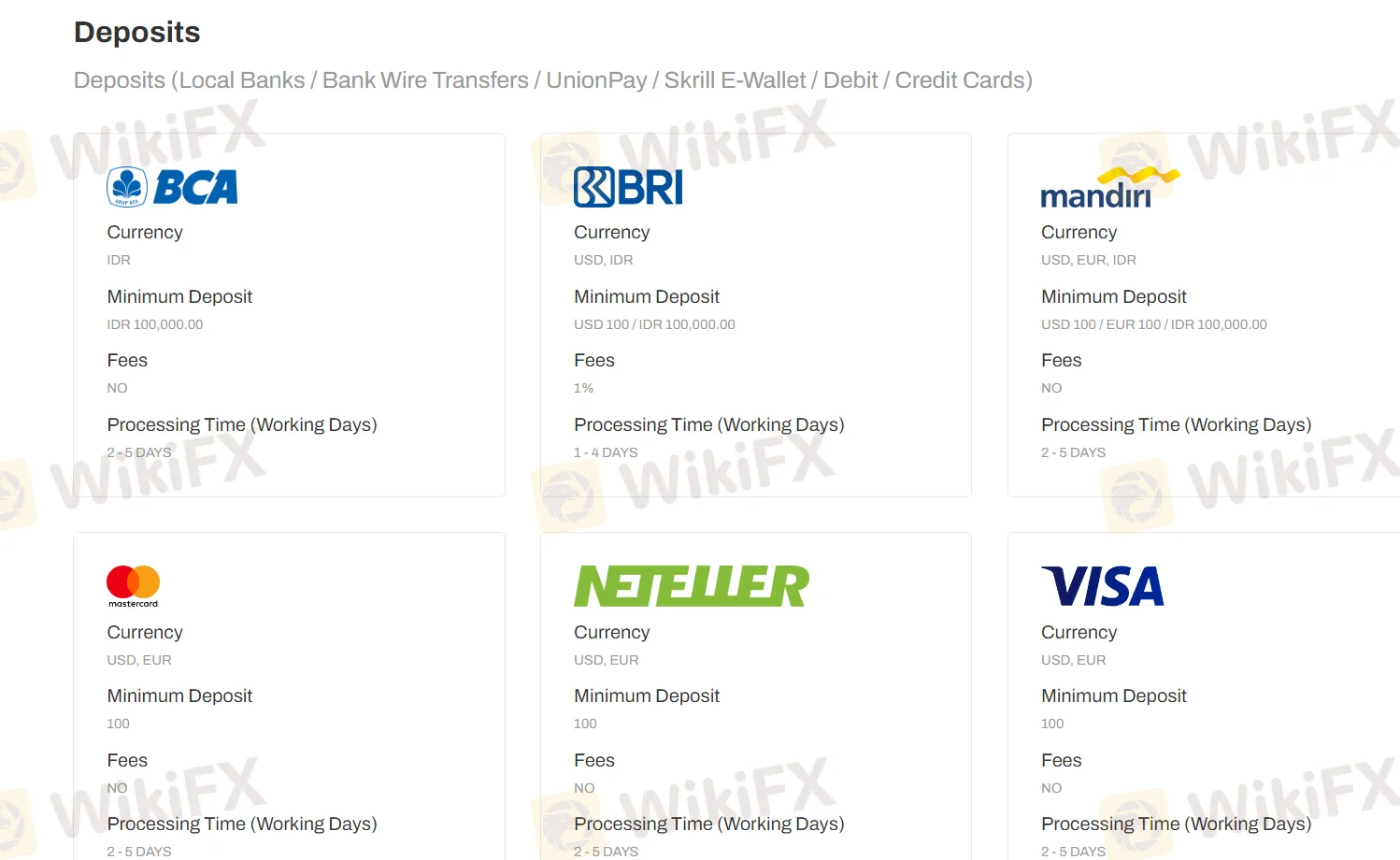

Deposit & Withdrawal

Deposits:

Traders can fund their accounts through various methods, including local banks, bank wire transfers, UnionPay, Skrill E-Wallet, as well as debit and credit cards. These options cater to a wide range of preferences, allowing traders to choose the method that best suits their needs.

Local Banks: This option allows traders to transfer funds directly from their local bank accounts to their trading accounts.

Bank Wire Transfers: Bank wire transfers are a reliable method for transferring larger sums of money to and from the trading account.

UnionPay: UnionPay is a popular payment method, particularly in regions where it is widely accepted.

Skrill E-Wallet: Skrill is an electronic wallet that offers a quick and convenient way to deposit and withdraw funds.

Debit/Credit Cards: Traders can use their debit or credit cards to make deposits, providing a familiar and straightforward payment option.

Withdrawals:

Withdrawals from the trading account can also be made through a similar set of options, ensuring traders have access to their funds when needed.

Local Banks: Withdrawals can be processed directly to local bank accounts, providing a straightforward way to access funds.

Bank Wire Transfers: Bank wire transfers are a secure method for withdrawing funds, particularly for larger sums.

UnionPay: UnionPay can be used for convenient and secure fund withdrawals.

Skrill E-Wallet: Skrill E-Wallet facilitates quick and hassle-free withdrawals.

Debit/Credit Cards: Traders can receive withdrawals on their debit or credit cards, making it a convenient option for many.

It's worth noting that while most of these methods do not involve fees for deposits or withdrawals, there is a 1% fee associated with USD and IDR withdrawals via bank wire transfers. Additionally, processing times for both deposits and withdrawals may vary, ranging from 1 to 5 working days, depending on the selected method.

Traders should carefully review the specifics of each deposit and withdrawal option to choose the one that aligns with their preferences and needs.

Trading Platforms

This broker provides the MetaTrader 4 (MT4) trading platform. MT4 is a renowned and user-friendly platform known for its advanced charting tools, technical analysis capabilities, and customization options. It supports various trading instruments, including forex and commodities, and offers automated trading through Expert Advisors (EAs). With real-time market data, historical charts, and mobile accessibility, MT4 is a versatile choice for traders, catering to both beginners and experienced traders.

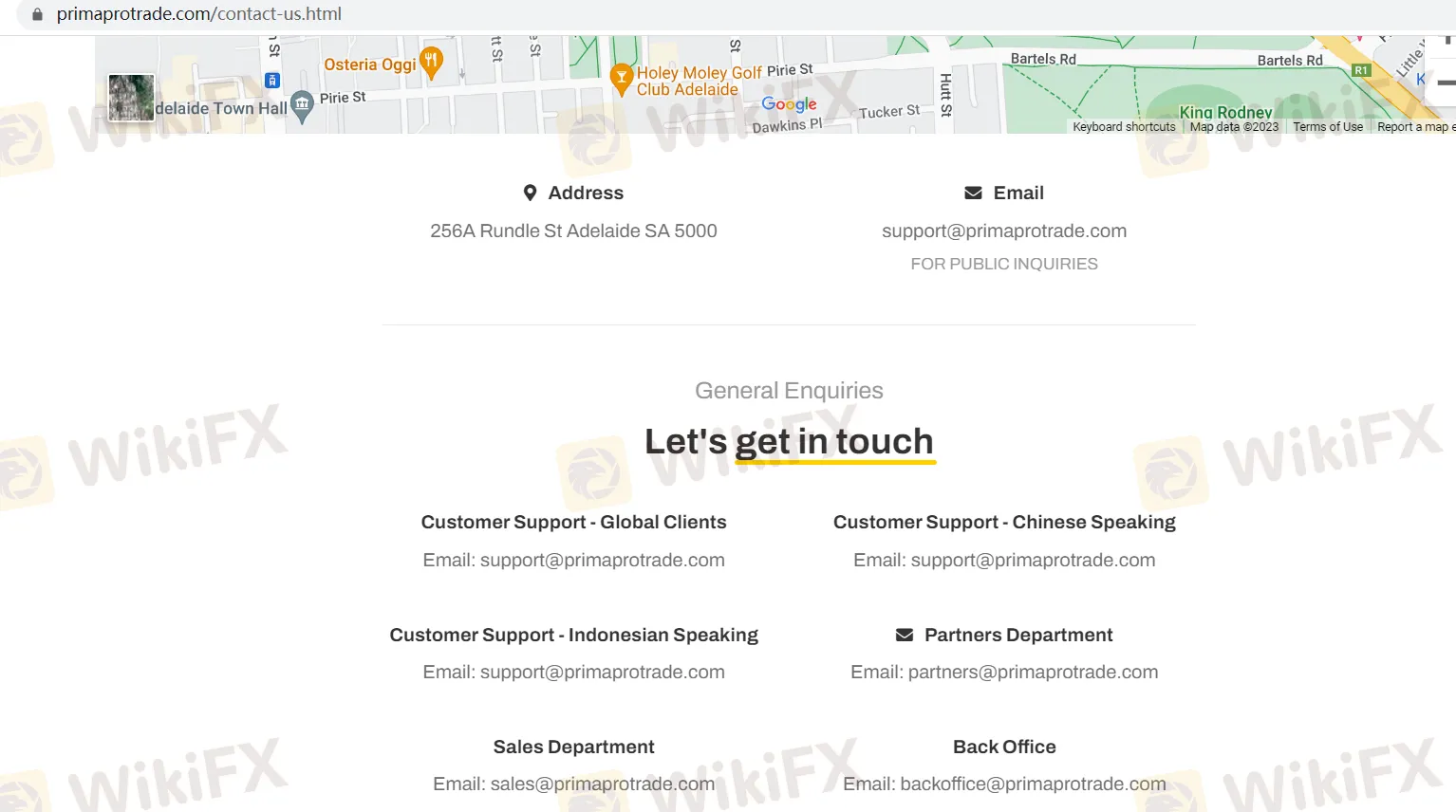

Customer Support

The Customer Support of this broker can be reached solely through email, which is a limitation in itself. Furthermore, there are no dedicated email addresses for different language preferences or specific inquiries. Instead, all inquiries are directed to the generic email address, support@primaprotrade.com. This lack of tailored communication channels can result in slower response times and potential language barriers for clients seeking assistance.

Additionally, the absence of alternative contact methods such as phone support or live chat can be frustrating for clients who prefer more immediate and interactive forms of communication. This limited accessibility may hinder clients' ability to quickly resolve issues or get timely responses to their questions.

Overall, the broker's customer support approach appears to be less accommodating and less client-centric due to the exclusive reliance on email and the lack of specialized support channels.

Educational Resources

The broker does not offer any educational resources, which can be seen as a drawback for traders who value access to educational materials, tutorials, webinars, or market analysis to enhance their trading knowledge and skills. This absence of educational resources may limit the ability of traders, especially beginners, to gain insights and make informed trading decisions, potentially impacting their overall trading experience.

Summary

Primapro is an unregulated broker that offers a variety of trading instruments, including Forex, Metals, Futures, and Stocks. They provide three account types, each with its own features, catering to traders with different experience levels. The broker offers a high leverage of up to 1:3000 and a range of spreads and commissions depending on the chosen account type. While they offer multiple deposit and withdrawal options, customer support is exclusively through email, lacking specialized channels for different languages or inquiries. Additionally, there are no educational resources provided. Potential investors should be cautious due to the lack of regulation, which can pose risks related to transparency, security, and dispute resolution.

FAQs

Q1: Is Primapro a regulated broker?

A1: No, Primapro is an unregulated broker, which means it operates without oversight from regulatory authorities.

Q2: What trading instruments are available on Primapro?

A2: Primapro offers Forex, Metals, Futures, and Stocks as trading instruments for clients to trade and diversify their portfolios.

Q3: What is the maximum leverage offered by Primapro?

A3: Primapro provides a maximum trading leverage of up to 1:3000, allowing traders to control larger positions with a smaller amount of capital.

Q4: How can I contact Primapro's customer support?

A4: You can reach Primapro's customer support team through email at support@primaprotrade.com. They offer support for global clients, Chinese-speaking clients, and Indonesian-speaking clients.

Q5: Does Primapro provide educational resources for traders?

A5: No, Primapro does not offer educational resources, which means they do not provide tutorials, webinars, or market analysis materials to assist traders in improving their knowledge and skills.

天眼交易商

熱點資訊

6個「無知」將令你身陷交易誤區!

華爾街「長線交易大師」的23條核心理念!

投資人請注意!JustMarkets遭爆惡意操縱行情、強制平倉,客服答非所問,維權難如登天

外匯天眼快訊:高風險券商DtcPay已跑路,網站失連證實為詐騙平台

Lutex Options官網疑點重重,監管資訊缺失,安全性堪憂!

ProfitWave缺乏有效監管、展業區域存疑,遭加拿大CSA示警,疑為外匯詐騙平台

匯率計算