Aron Groups Broker-Overview of Minimum Deposit, Spreads & Leverage

摘要:Aron Groups Broker, a trading name of Aron Groups LLC, is an online broker registered in Saint Vincent and the Grenadines that has been offering diverse trading instruments to the financial markets. It offers variable spreads and flexible leverage up to 1:1000 on the MetaTrader5 trading platforms.

| Aron Markets Review Summary | |

| Founded | 2020 |

| Registered Country/Region | Marshall Islands |

| Regulation | Not regulated |

| Market Instruments | Forex, Indices, Commodities, Crypto (CFDs) |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | Fixed spread on Nano account; Floating spread on Standard/VIP (e.g., EUR/USD) |

| Trading Platform | MetaTrader 5 (MT5) |

| Min Deposit | $1 |

| Customer Support | UK: +44 2037475808 |

| Cyprus: +357 25654181 | |

| Email: aronsupport@arongroups.co | |

| Address: 59 Agios Athamasios Ave, Limassol, Cyprus | |

Aron Markets Information

Aron Markets, established in 2020 and registered in the Marshall Islands, is an unregulated broker offering CFD trading across Forex, commodities, indices, and cryptocurrencies. While it provides flexible account types with very low entry costs and high leverage, it lacks oversight from reputable regulatory bodies.

Pros and Cons

| Pros | Cons |

| Very low minimum deposit ($1) | Not regulated by any trusted authority |

| Islamic and demo accounts available | No stock or ETF trading options |

| Supports MetaTrader 5 | MT4, WebTrader, and proprietary apps not supported |

Is Aron Markets Legit?

Aron Markets is not a regulated broker. Although registered in the Marshall Islands, it lacks oversight from any recognized regulators like FCA, ASIC, or CySEC.

The domain arongroups.co was registered on July 15, 2020, last updated on July 25, 2024, and is active until July 15, 2025. Its current status is “ok”, indicating its operational but not evidence of legitimacy.

What Can I Trade on Aron Markets?

Aron Markets offers a diverse range of CFD instruments across major asset classes. Users can trade 7+ forex pairs, 5+ indices, 5+ commodities, and 6+ cryptocurrencies. No information is available regarding stocks or ETFs.

| Tradable Instruments | Supported |

| Forex | ✅ |

| Commodities | ✅ |

| Crypto | ✅ |

| CFD | ✅ |

| Indexes | ✅ |

| Stock | ❌ |

| ETF | ❌ |

Account Types

Aron Markets offers four types of live accounts: Nano (Islamic), Standard (ECN), Islamic (Swap-Free), and VIP (ECN)—each tailored to different trader needs. The Nano account starts from just $1, making it ideal for beginners. Both Nano and Islamic accounts are swap-free, aligning with Islamic finance principles. Additionally, a demo account is available for users to practice trading in a risk-free environment.

| Account Type | Min Deposit | Leverage | Spread Type | Swap-Free | Best For |

| Nano (Islamic) | $1 | Up to 1:1000 | Fixed | ✅ | Beginners, Islamic traders |

| Standard (ECN) | $50 | Up to 1:400 | Floating | ❌ | Intermediate traders |

| Islamic (Swap-Free) | $100 | Up to 1:400 | Fixed | ✅ | Traders seeking swap-free options |

| VIP (ECN) | $2,500 | Up to 1:200 | Floating | ❌ | Advanced or high-volume traders |

| Demo Account | Free | Customizable | Simulated | ✅ | Practice & learning |

Leverage

Aron Markets offers flexible leverage based on account type and trading instrument. The maximum leverage goes up to 1:1000 for Nano accounts, while Standard and Islamic accounts can access up to 1:400, and VIP accounts offer up to 1:200. Leverage also varies depending on the trading volume and asset class (e.g., Forex, Metals, Crypto, Shares). While high leverage can increase profits with little capital, it also increases the danger of significant losses without appropriate risk management.

Aron Markets Fees

Compared to industry standards, Aron Markets trading fees are relatively low, especially on higher-tier accounts. They offer tight spreads, zero commissions on some accounts (especially Nano and Islamic), and provide discounted or zero swap fees on Islamic accounts.

| Account Type | Spreads (EUR/USD) | Commission | Notes |

| Nano | Fixed | No | Ideal for micro traders |

| Standard | Floating | Yes | Commission rate not specified clearly |

| Islamic | Fixed | No | Swap-free with grace period |

| VIP | Floating | Yes | Lower commission (e.g., 0.035%) |

Non-Trading Fees

| Non-trading Fees | |

| Deposit Fee | Ziraat Bank: 3% fee (minimum $2); other methods may be free |

| Withdrawal Fee | IRT Exchange: 0.5% (min $2); Iraq Exchange: 1% (min $1); Tether TRC20/BEP20: refer to platform-specific rates |

| Inactivity Fee | Not mentioned |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| MetaTrader 5 (MT5) | ✔ | Windows, macOS, Android, iOS | Traders seeking multi-asset access, advanced tools, and automation |

| MetaTrader 4 (MT4) | ❌ | – | – |

| Web Trader | ❌ | – | – |

| Proprietary App | ❌ | – | – |

Deposit and Withdrawal

Aron Markets does charge deposit and withdrawal fees depending on the method used. The minimum deposit required is $1.

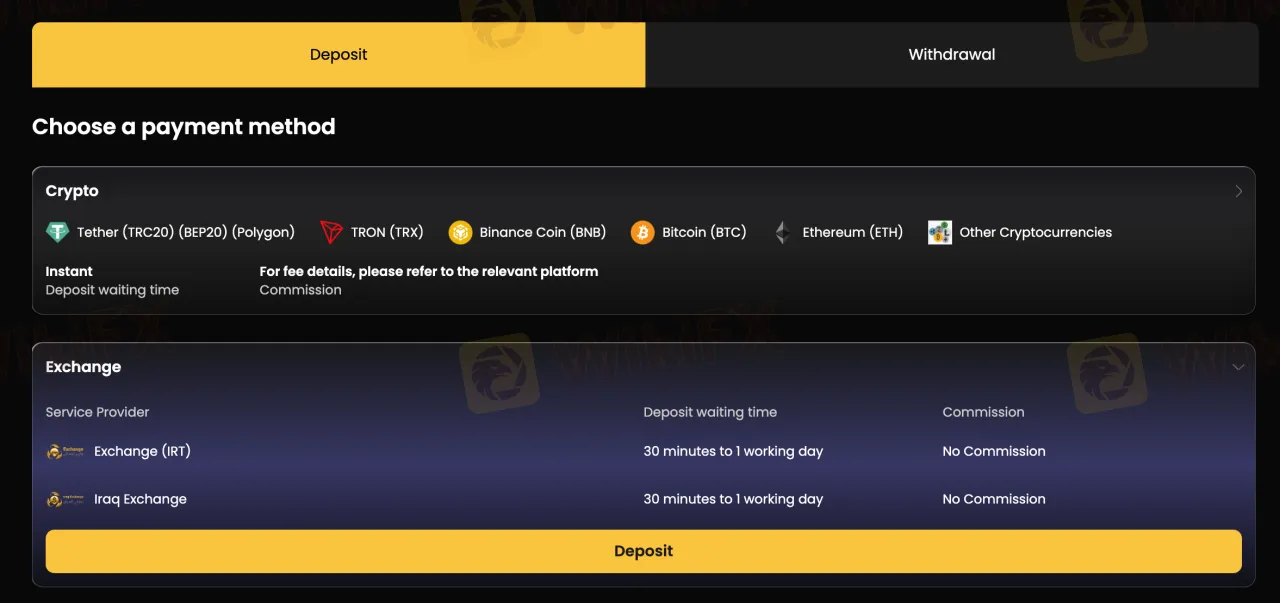

Deposit Options

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Tether (TRC20/BEP20) | $25 | Refer to platform | Instant |

| Bitcoin, Ethereum, BNB | $25 | Refer to platform | Instant |

| Ziraat Bank | $50 | 3% (min $2) | Not stated |

| Toman Platform | 1 million tomans | Not specified | Not stated |

| Exchange (IRT) | Not stated | No Commission | 30 min to 1 working day |

| Iraq Exchange (Dollar) | $200 | No Commission | 30 min to 1 working day |

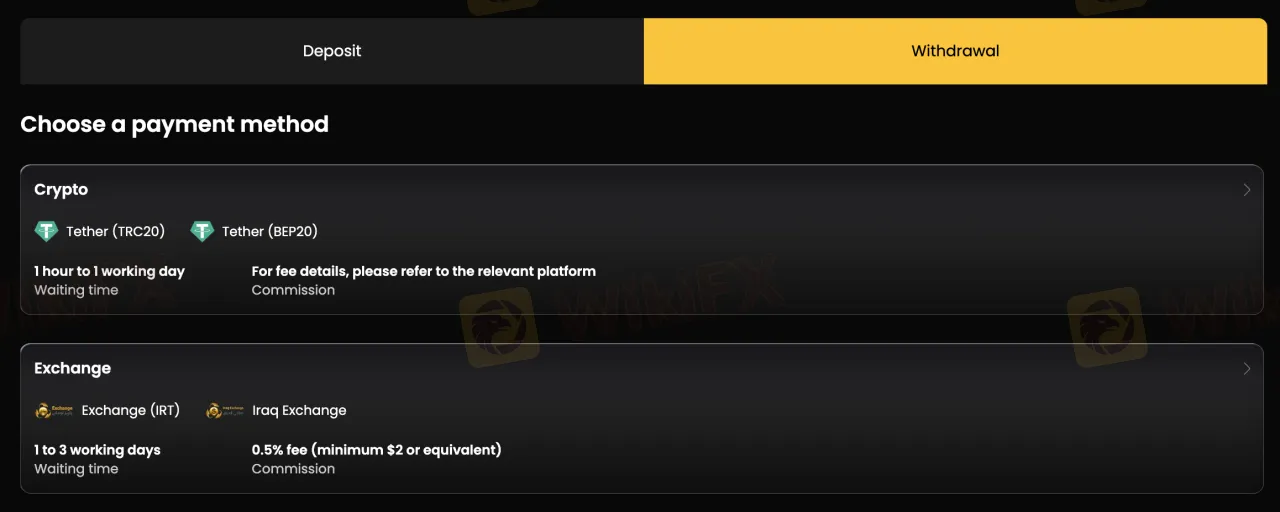

Withdrawal Options

| Withdrawal Method | Min–Max Withdrawal | Fees | Processing Time |

| Tether (TRC20/BEP20) | $20 – $15,000 | Refer to platform | 1 hour to 1 working day |

| Exchange (IRT) | 1 million – 100 million IRT | 0.5% (min $2 or equivalent) | 1–3 working days |

| Iraq Exchange | $100 – $3,000 | 1% (min $1 or equivalent) | 1–3 working days |

相關閱讀

殺死MT4,邁達克強推MT5的“帝國”隱憂!

无论你选择哪个平台,喜欢交易什么品种,都离不开MT4平台的支持。而诞生近20年之后,随着MT5的出现,MT4的命运和迈达克的前程,正在经历一次深刻的变革。

Daily Market Recap - Bitcoin continues to attract attention

Denigrated by its opponents for its volatility and speculative nature, Bitcoin, which keeps breaking records, can have its uses within a multi-asset portfolio, says Robeco.

Daily Market Recap - Bitcoin Reaches All Time High Above 50,000 USD

Bitcoin, the world's largest cryptocurrency, has been booming since the end of 2020, with BTCUSD showing no signs of slowing down on the charts.

Daily Market Recap - Tesla's Bitcoin Purchases Leaked On Reddit A Month Before They Were Made Official

A member of the Reddit community posing as a developer at Tesla revealed a month ago that the Californian company had started buying bitcoin.

天眼交易商

熱點資訊

高手都是如何「聽懂」市場的?

澳洲外匯券商KFGDFS共富金融安全嗎?點擊查看平台運作情況

Saxo盛寶金融實施新的密碼複雜度要求

【工程師Tommy平台評測】Hantec Financial亨達國際金融外匯券商評價:從開戶到出金完整實測解析!

塞浦路斯外匯券商EXANTE為何存在高詐騙風險?一文了解監管情形、實勘狀況、網站運作

【就是123 - 就是玩真的評測】Moneta Markets億匯黑平台深度揭露報告

交易商測評行動:用真實交易說話

分享交易失誤與成長,讓每一次失誤都成為通往精進的墊腳石

交易的最高境界原來是這個!

受模里西斯FSC監管的CapitalXtend好用嗎?平台營運情形、潛在風險一次看

匯率計算