Yamagata Securities-Some Important Points about This Broker

摘要:Founded in 2006, YAMAGATA is an FSA-regulated securities broker registered in Japan, offering trading services in U.S Stock (U.S. Equity Brokerage), Stocks (Spot Trading of Domestic Stocks, Foreign Stocks. etc), Bonds, Futures (JGB Futures), Investment Trusts, and Life Insurance.

| YAMAGATAReview Summary | |

| Founded | 2006 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Trading Products | Stocks, ETF (Exchange-Traded Fund), REIT (Real Estate Investment Trust), Bonds, Futures, Options |

| Demo Account | ✅ |

| Commission | Depending on the products, from 2,750 yen to 588,500 yen |

| Customer Support | Tel: 023-631-7720 |

| Email: soumu@yamagatashoken.co.jp | |

| Company address: 990-0042 yamagata city nanika-machi 2-1-41 (〒990-0042 山形市七日町2-1-41) | |

Founded in 2006, YAMAGATA is an FSA-regulated securities broker registered in Japan, offering trading services in U.S Stock (U.S. Equity Brokerage), Stocks (Spot Trading of Domestic Stocks, Foreign Stocks. etc), Bonds, Futures (JGB Futures), Investment Trusts, and Life Insurance.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Japanese reading threshold |

| Variety of trading products | |

| Demo accounts | |

| Clear fee structure |

Is YAMAGATA Legit?

Yes. YAMAGATA is currently regulated by Financial Services Agency (FSA).

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Financial Services Agency (FSA) | Regulated | 山形證券株式会社 | Retail Forex License | 東北財務局長(金商)第3号 |

What Can I Trade on YAMAGATA?

| Tradable Instruments | Supported |

| Stocks | ✔ |

| ETF (Exchange-Traded Fund) | ✔ |

| REIT (Real Estate Investment Trust) | ✔ |

| Bonds | ✔ |

| Futures | ✔ |

| Options | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

YAMAGATA Fees

Fees for Stocks:

- Domestic Stocks & Bonds: The Minimum fee of 2,750 yen (including tax) applies if the calculated fee is less than this amount. Fractions of a yen are rounded down.

- Foreign Stocks: Same minimum fee as domestic stocks, plus additional fees for foreign market transactions.

- ETFs & Securities with Stock Acquisition Rights: Follow the same fee structure as domestic stocks.

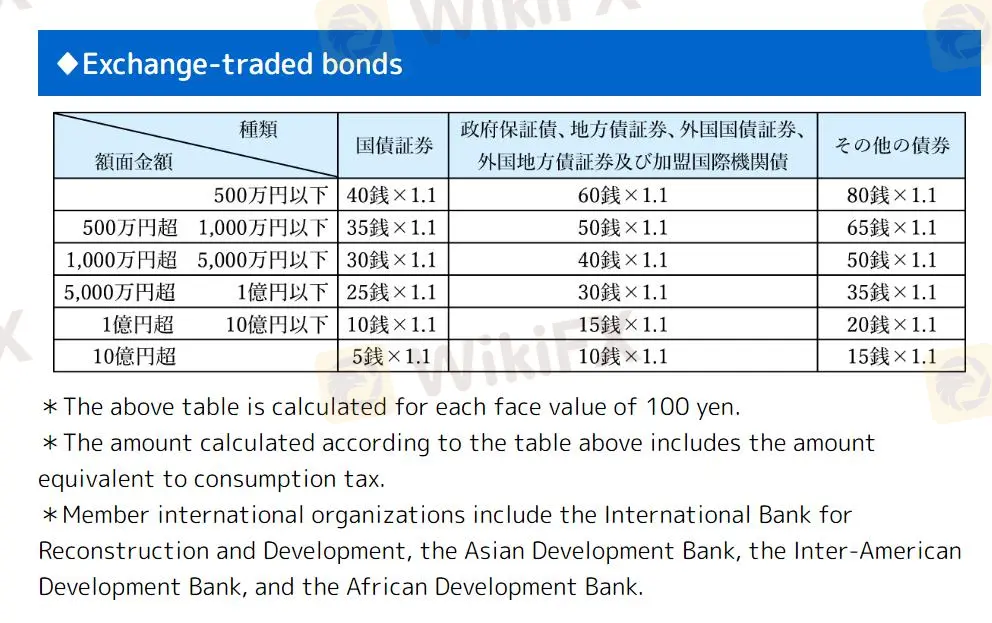

Fees for Bonds:

- Exchange-Traded Bonds: Fees calculated per 100 yen face value, including consumption tax.

Fees for Futures and Options:

- Stock Index Futures: Fees include consumption tax.

- Stock Index Options & Stock Options: Minimum fee of 2,750 yen (including tax) if the calculated fee is less than this amount.

Margin Trading Expenses:

- Include interest on purchase prices for purchases and stock lending fees for sales, plus consumption tax.

Additional Fees:

- Apply for opening specific accounts like stock transfer or foreign securities accounts.

- Apply to non-transferable securities.

- Include fees for mailing address designation and dividend-related documents.

- May include additional fees for services provided by the Securities Depository Corporation.

熱點資訊

HFM 聘請 ATFX 前高層 Ahmad Qutaishat 擔任資深業務發展經理

Dukascopy Bank杜高斯貝銀行再度發出警告:請留意仿冒的詐騙釣魚網站

外匯券商LMAX Group值得信任嗎?立即查看監管背景、交易環境與用戶評價

StoneX 2025財年第2季外匯與差價合約(FX/CFD)收入下滑

外匯天眼維權服務始終免費,守護每一位投資者權益!

英國外匯券商CXM爆多起交易糾紛!投資人控遇惡意爆倉、扣除本金、凍結帳戶、客服失聯

LiteForex交易環境評級不佳,塞浦路斯辦公室未通過天眼實勘

公布6/9-6/15最新外匯詐騙平台示警清單

eToro e投睿2025年第一季用戶增長強勁,資產管理規模達148億美元,但利潤略微下滑

匯率計算

USD

CNY

當前匯率: 0

請輸入金額

USD

可兌換金額

CNY

開始計算