Travelex-Some Detailed Information about the broker

摘要:Travelex is a regulated service provider of premier brokerage and financial services, which was founded in Australia in 1976. It offers products and services for currency, travel cards and travel insurance.

| Travelex Review Summary | |

| Founded | 1976 |

| Registered Country/Region | Australia |

| Regulation | ASIC |

| Products & Services | Currency, travel card, travel insurance |

| Demo Account | ❌ |

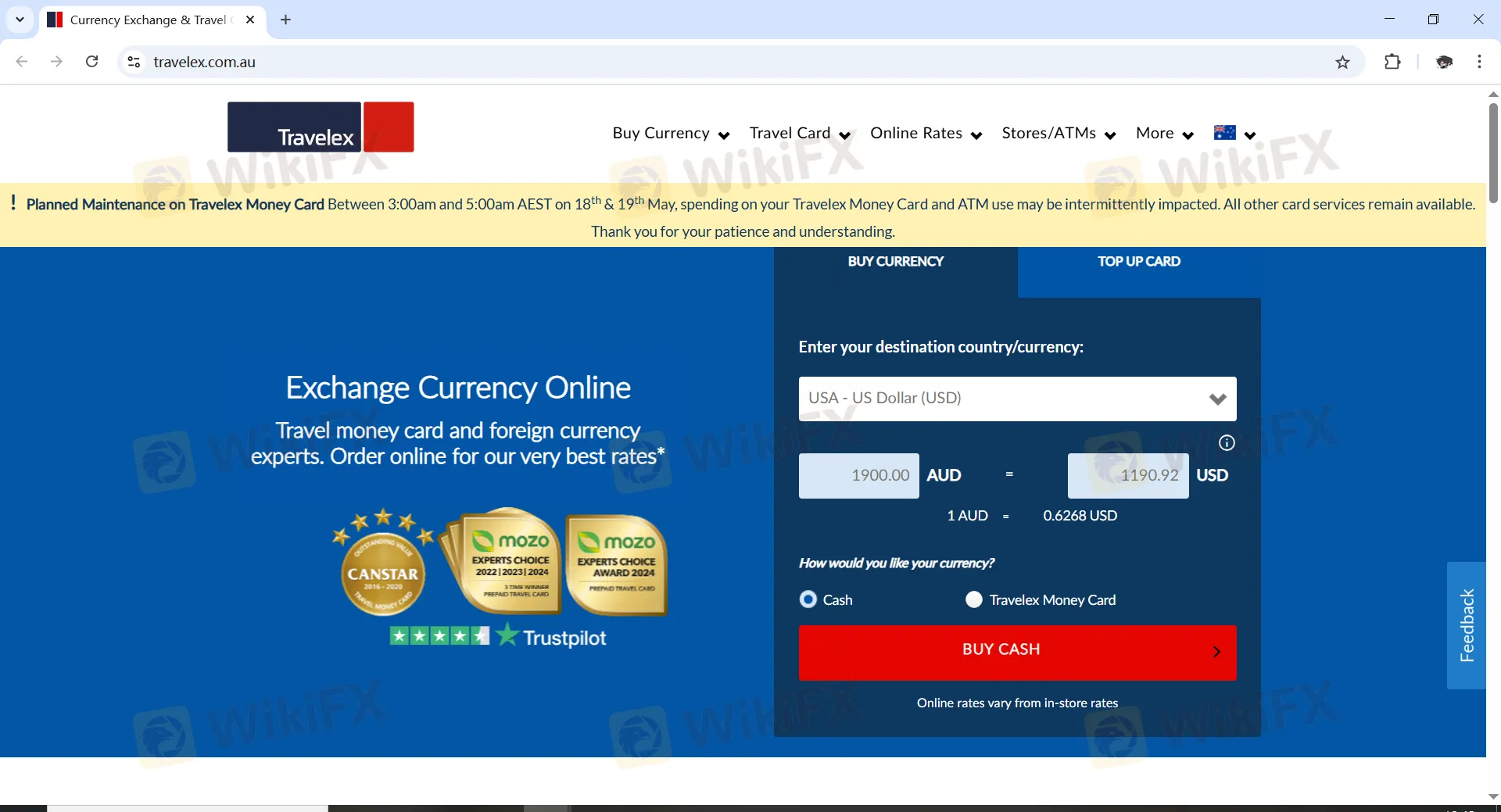

| Trading Platform | Travelex Money APP, Travelex web |

| Minimum Deposit | AUD 100 |

| Customer Support | 24/7 support |

| Tel: 1800 440 039 | |

| Email: retailcscaust.nz@travelex.com | |

| Address: Suite 45.01, Level 45, 25 Martin Place, Sydney NSW 2000 | |

| Facebook, Instagram | |

Travelex Information

Travelex is a regulated service provider of premier brokerage and financial services, which was founded in Australia in 1976. It offers products and services for currency, travel cards and travel insurance.

Pros and Cons

| Pros | Cons |

| Long operation time | Commission fees charged |

| Various contact channels | |

| Regulated well | |

| Various payment options |

Is Travelex Legit?

Yes. Travelex is licensed by Australia Securities & Investment Commission to offer services. Its license number is 000222444. The Australian Securities and Investments Commission (ASIC) is an independent Australian government body that acts as Australia's corporate regulator, which was established on 1 July 1998 following recommendations from the Wallis Inquiry.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| Australian Securities and Investments Commission (ASIC) | Regulated | Travelex Limited | Market Maker (MM) | 000222444 |

Products and Services

| Products & Services | Supported |

| Currency | ✔ |

| Travel card | ✔ |

| Travel insurance | ✔ |

Travelex Fees

| Fee Type | Amount |

| Initial Card Fee (charged at the time of purchase) | Online: FREE via travelex.com.au or the Travelex Money App |

| In-Store: FREE for loads of foreign currency (loads of AUD incur a fee of 1.1% of the amount or $15 whichever is greater) | |

| Top up Fee | Online: FREE via travelex.com.au or the Travelex Money App |

| In-Store: FREE for top-ups of foreign currency (top-ups ofAUD incur a fee of 1.1% of the amount or $15 whichever is greater) | |

| BPAY: Top-ups not made via travelex.com.au or the Travelex Money App incur a fee of 1% of the amount | |

| Replacement card fee | ❌ |

| International ATM withdrawal and EFTPOS fee (outside Australia) | FREE (Note: some ATM operators may charge their own fees or set their own limits) |

| Domestic ATM withdrawal and EFTPOS fee -when you use your card to make withdrawal or purchase in Australia and you have AU$ currency on your card (for more details refer to clause 9.4 of the Terms and Conditions) | |

| Cash over the counterfee (where cash is obtained over the counter) | ❌ |

| Monthly inactivity fee: Charged at the start of each month if you have not madeany transactions on the card in the previous 12 months unless your card is used again, or reloaded. This fee applies each month until the card is closed or the remaining card balance is less than the inactivity fee. | AU$4.00 per month |

| 24/7 Global Emergency Assistance | ❌ |

| Closure/withdrawalfee: Charged when you close your card or withdraw from your Card Fund. This fee is set and charged by Mastercard Prepaid. | AU$10.00 |

| Currency to Currency foreign exchange rate: This is applied when you move your funds from one currency to another currency. | At the then applicable retail foreign exchange rate determined by us. The broker will notify you of the rate that will apply at the time you allocate your funds from one currency to another. |

| Currency Conversion Fee: Applied when a purchase or ATM withdrawal is conducted in a currency either not loaded or suffcient to complete the transaction and the cost is allocated against the currency used to fund the transaction. | FREE (The Spend Rate will apply to foreign exchange transactions inaccordance with the Terms and Conditions) |

Trading Platform

| Trading Platform | Supported | Available Devices |

| The Travelex Money APP | ✔ | Mobile |

| Travelex web | ✔ | PC, laptop, tablet |

Deposit and Withdrawal

Travelex accepts payments done via Mastercard, VISA, BPAY, Pay ID, GPay and ApplePay.

| Minimum amount | AU$350 or currency equivalent, online and via the app |

| AU$100 or currency equivalent in-store | |

| Maximum amount | AU$50.000 or currency equivalent |

天眼交易商

熱點資訊

Aximtrade匯勝監管遭撤銷、展業場所造假、網站全部失效,證實為爆雷詐騙平台

想在短線交易中賺錢?盯住這三個關鍵訊號

CMC Markets澳洲高淨值客戶收到假冒稅務信件

交易的困難並不在於制定計畫,而在於貫徹計畫

GDFSTRADE牌照形同虛設?投資人控帳號遭封、資金消失,幕後黑手疑似詐騙集團

AdvanTrade爆無法出金爭議、用戶評價不佳,監管牌照存在問題疑似詐騙

匯率計算