Some Detailed Information about Kimura Securities

摘要:KIMURA SECURITIES (Kimura Securities) is an established financial institution in Japan. Headquartered in Nagoya with 5 branch offices, it is regulated by Japan's Financial Services Agency (FSA) and holds the No. 6 license from the Commissioner of the Tokai Local Finance Bureau. Its services cover Japanese, US, and Hong Kong stock trading, fixed/floating-rate individual government bonds, multi-theme investment trusts, and family property/earthquake insurance.

| KIMURA SECURITIES Review Summary | |

| Founded | 1999 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Trading Products | Stocks, Bonds, Investment Trusts, and Insurance |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Phone: (052)241-4211 (Main) |

| Fax: (052)262-7284 | |

| Address: 8-21 Sakae 3-chome, Naka-ku, Nagoya 460-0008 | |

KIMURA SECURITIES Information

KIMURA SECURITIES (Kimura Securities) is an established financial institution in Japan. Headquartered in Nagoya with 5 branch offices, it is regulated by Japan's Financial Services Agency (FSA) and holds the No. 6 license from the Commissioner of the Tokai Local Finance Bureau. Its services cover Japanese, US, and Hong Kong stock trading, fixed/floating-rate individual government bonds, multi-theme investment trusts, and family property/earthquake insurance.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Limited service scope (mainly the domestic Japanese market) |

| Multiple trading products | No info on deposit and withdrawal |

| A large number of branch offices | |

| Long operation time |

Is KIMURA SECURITIES Legit?

KIMURA SECURITIES operates legally and compliantly. It is strictly regulated by the Financial Services Agency (FSA) of Japan and holds the No. 6 certification license from the Commissioner of the Tokai Local Finance Bureau (Kinsho), indicating that it must adhere to a series of strict laws, regulations, and industry standards in its operations.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Financial Services Agency (FSA) | Regulated | 木村証券株式会社 | Japan | Retail Forex License | 東海財務局長(金商)第6号 |

What Can I Trade on KIMURA SECURITIES?

KIMURA SECURITIES provides securities and stock trading, bond products, investment trusts, and insurance products.

| Trading Products | Supported |

| Domestic Stocks | ✔ |

| Foreign Stocks | ✔ |

| Bonds | ✔ |

| Investment Trusts | ✔ |

| Insurance Products | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

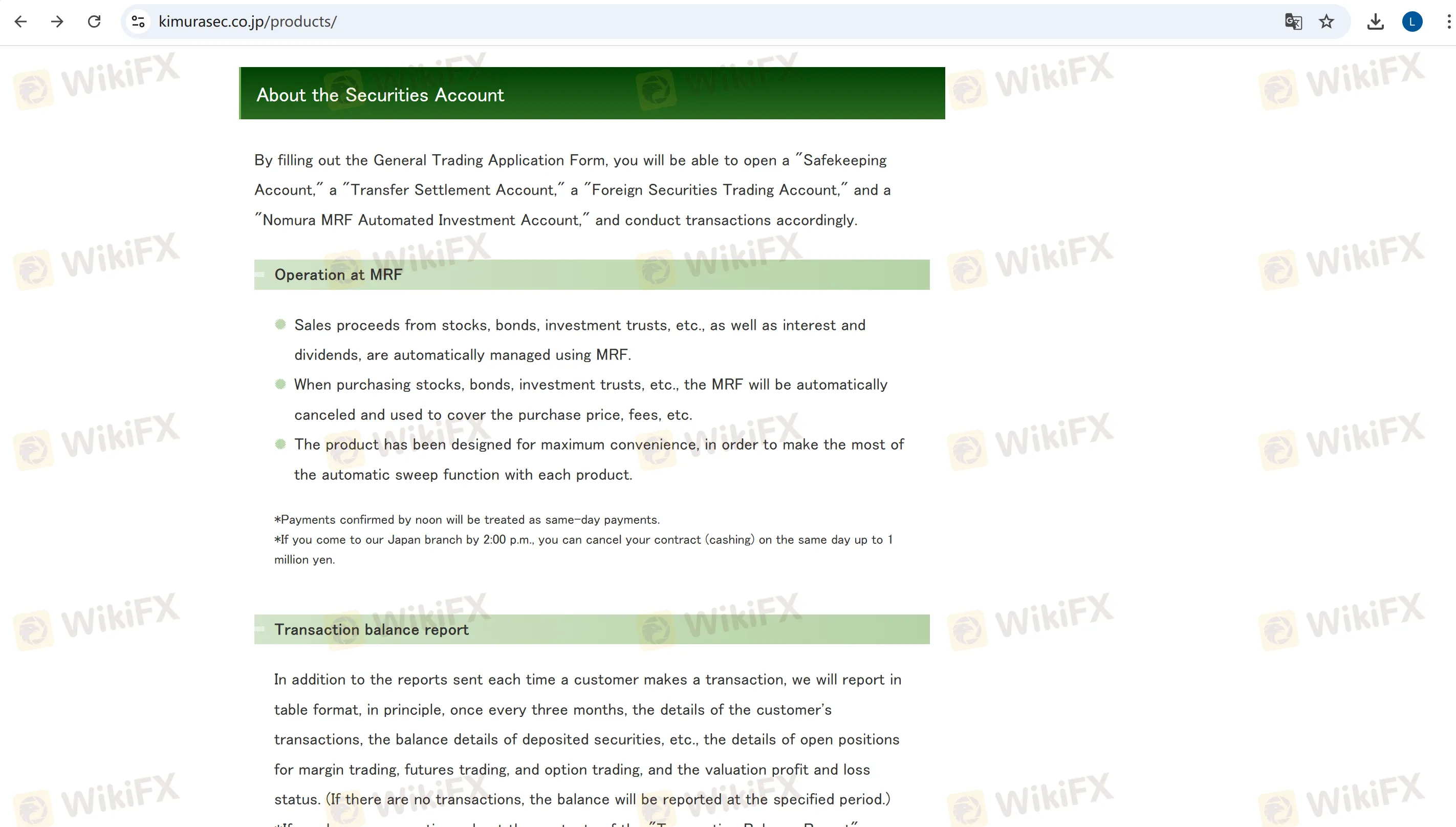

Account Type

It mainly provides a comprehensive securities account, through which sub-accounts with different functions, such as “safekeeping account”, “transfer settlement account”, “foreign securities trading account”, and “Nomura MRF automatic continuous (accumulative) investment account” can be opened.

KIMURA SECURITIES Fees

The upper limit of commission fees for foreign stock trading is 11% (10% excluding tax). The maximum subscription fee for investment trusts is 3.30% (3.00% excluding tax), and the maximum trust fee is 2.42% (including tax).

熱點資訊

小心高風險平台Tyrell Markets:無監管牌照、網站註冊日期短,極具投資疑慮

你能分清趨勢與波動嗎?告訴你如何理解並利用趨勢!

【蔡菲特平台評測】Tickmill使用心得:開戶簡單、入金迅速、交易體驗穩定

XTB延長高層任期三年,原班人馬持續領軍

在交易中什麼時候可以自信,什麼時候不能自信?

YCHpro優惠活動贈金3000美元?平台缺乏有效監管,慎防非法吸金詐騙陷阱

匯率計算