A1 Capital外匯交易平臺怎麽樣,正規靠譜嗎?

摘要:A1 Capital Yatirim Menkul Degerler A.S., more commonly referred to as A1 Capital, specializes in forex brokerage services, indicating a significant focus on foreign exchange markets. As a Member of the Direction.Kur.Yrd., A1 Capital is involved in financial activities and operations. However, it is important to note that the company does not appear to be regulated by any recognized regulatory authority, suggesting potential considerations for prospective investors.

| A1 Capital Review Summary | |

| Company Name | A1 Capital Yatırım Menkul Degerler A.S. |

| Registered Country/Region | Turkey |

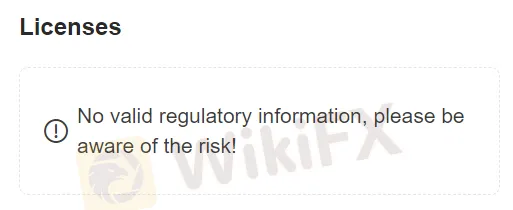

| Regulation | Non-regulated |

| Products & Services | Brokerage of Stock and VIOP transactions, Investment Consultancy, Portfolio Management, Initial Public Offerings (IPO), Debt Instrument Issuances, Company Valuation, Company Acquisition and Merger, Project Finance, Capital Raising and Mediation of Call Transactions, Forex Trading |

| Leverage | 1:10 |

| Minimum Deposit | $2,000 |

| Trading Platforms | MT5 |

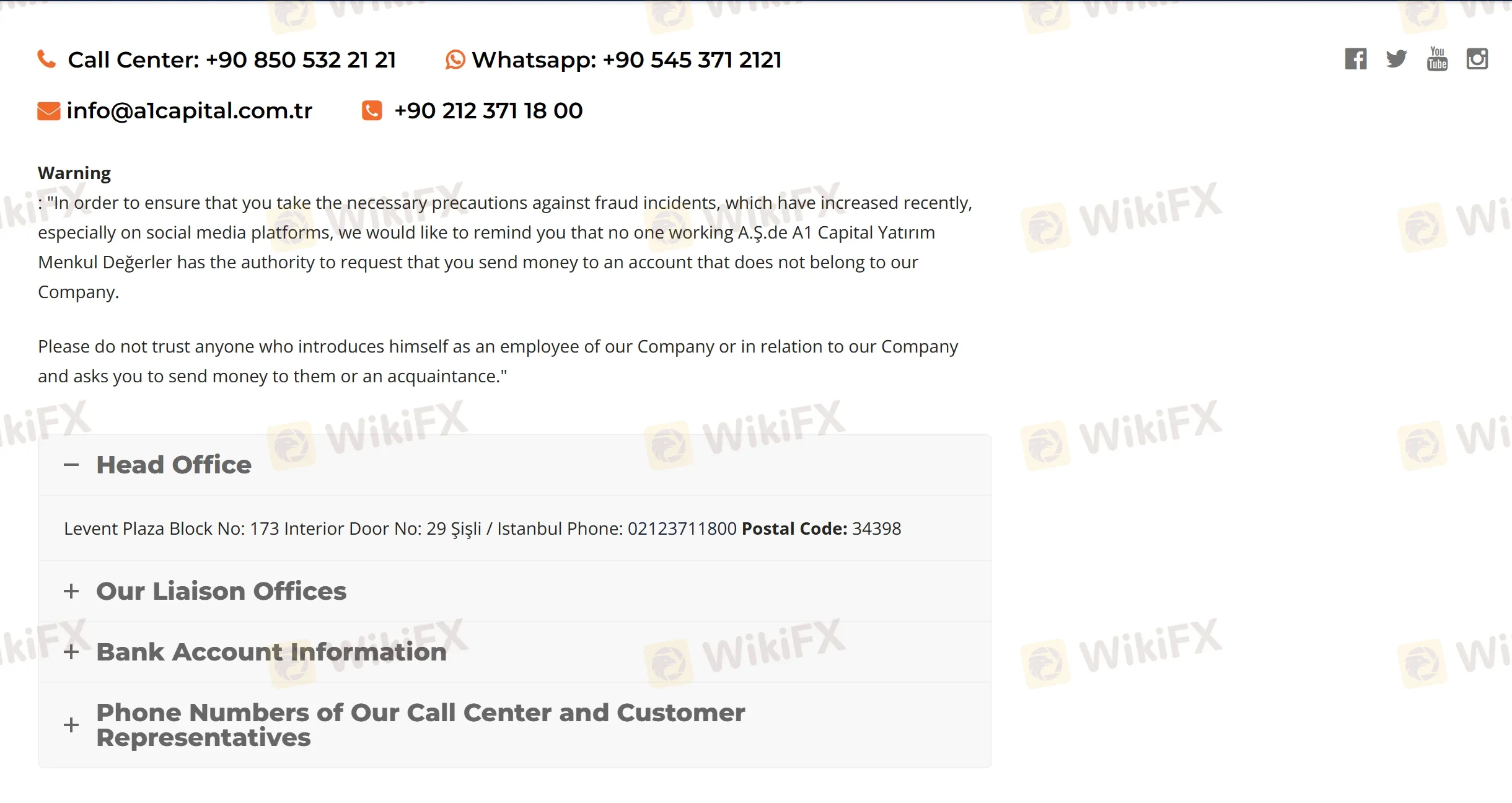

| Customer Support | Phone: +90 850 532 21 21; Fax: +90 212 371 18 00 WhatsAPP: +90 545 371 2121; Email: info@a1capital.com.tr; Social Media: Twitter, Instagram, Youtube, LinkedIn, Facebook. |

What is A1 Capital?

A1 Capital Yatirim Menkul Degerler A.S., more commonly referred to as A1 Capital, specializes in forex brokerage services, indicating a significant focus on foreign exchange markets. As a Member of the Direction.Kur.Yrd., A1 Capital is involved in financial activities and operations. However, it is important to note that the company does not appear to be regulated by any recognized regulatory authority, suggesting potential considerations for prospective investors.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Cons:

Non-regulated Status: A1 Capital lacks regulation, which can result in increased risks.

Official Website Only in Turkish: The platform's website is exclusively available in Turkish.

Not Well-made Interface: The interface is somewhat confusing and not so well-made, which imposes difficulties on users to search for the information they need.

Is A1 Capital Safe or Scam?

A1 Capital, based in Istanbul, operates under a non-regulated status, meaning it isn't overseen or audited by any recognized financial authority. This lack of regulatory oversight signifies potentially heightened risks for investors deciding to engage with their services. So users should be aware of this point, and conduct wise actions.

Products & Services

Brokerage of Stock and VIOP transactions: A1 Capital provides services for buying and selling of stocks and futures contracts at the Istanbul Stock Exchange (Borsa Istanbul).

Investment Consultancy: The company offers investment advice and strategies to help clients make informed decisions on their investments.

Portfolio Management: A1 Capital provides portfolio management services to manage clients' investments based on their risk tolerance, financial goals, and investment preferences.

Initial Public Offerings (IPO): A1 Capital assists companies looking to go public by facilitating their initial public offerings.

Debt Instrument Issuances: They also support the issuance of debt instruments such as bonds and notes.

Company Valuation: The firm provides company valuation services, which is essential during mergers, acquisitions, and other corporate actions.

Company Acquisition and Merger: A1 Capital plays a role in the processes of business mergers and acquisitions, offering advice and directions.

Project Finance: The firm provides financial services for large-scale projects, including risk assessment and funding strategies.

Capital Raising and Mediation of Call Transactions: A1 Capital assists businesses in raising capital and acts as an intermediary for call transactions.

Forex Trading: The company offers forex trading services, allowing clients to trade different currencies.

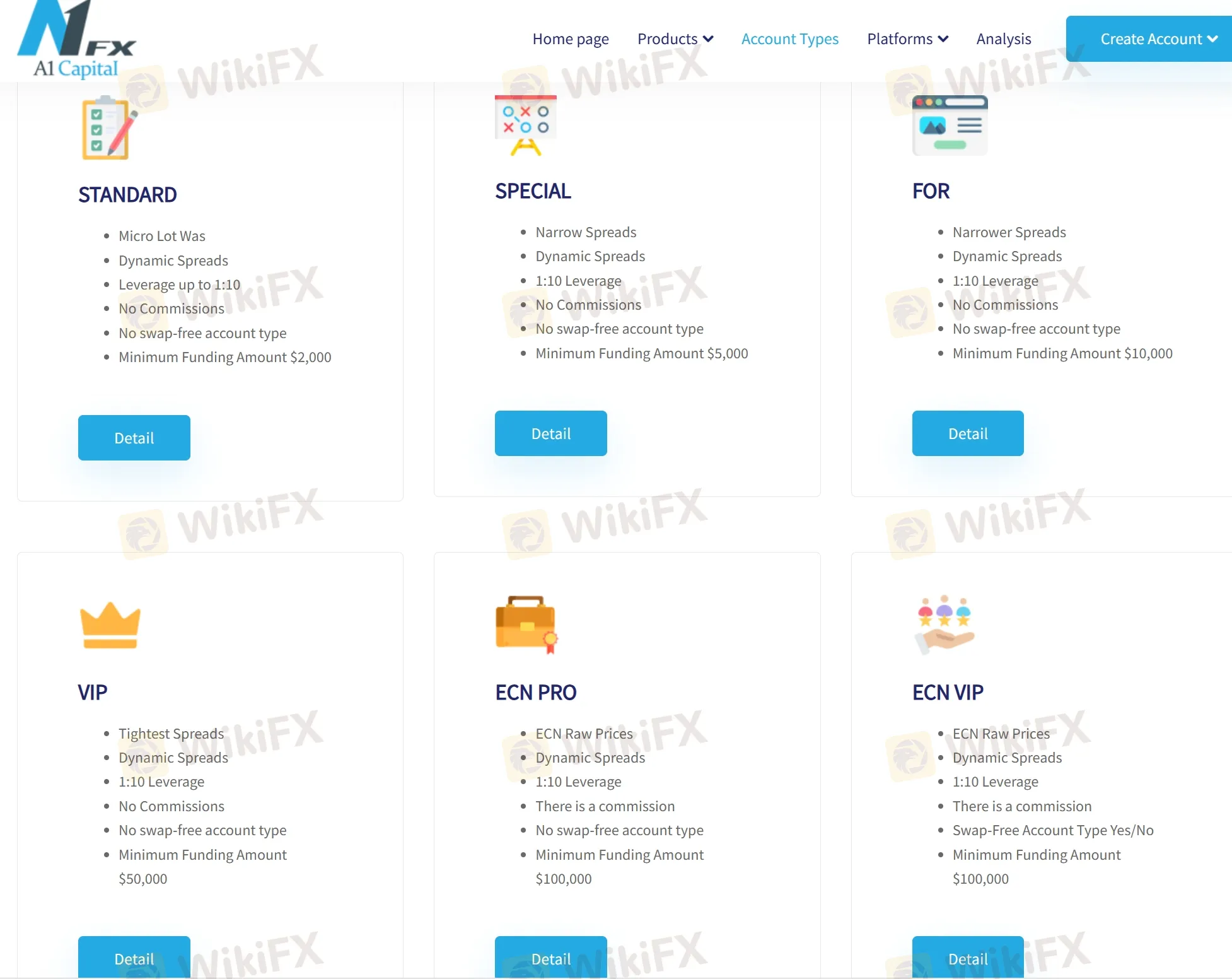

Account Types

A1 Capital provides users with numerous account types: Standard, Special, FOR, VIP, ECN PRO, and ECN VIP, and the minimum deposit for each is $2,000, $5,000, $10,000, $50,000, $100,000, and $100,000 respectively. Each account has its own features and offerings, so users should check the account details to make the best choice for themselves.

Leverage

A leverage of 1:10, as offered by A1 Capital, means that for every dollar deposited in an account, a trader can invest or trade $10 in the market. Compared to other brokers that offer higher leverage, it may not seem very competitive. However, with lower leverage, potential losses are also lower, which might be appealing to more conservative traders or those with less experience.

Spreads & Commissions

| Account Type | Spread Type | Commission |

| Standard | Dynamic Spreads | No Commission |

| VIP | Tightest Spreads | |

| Special | Narrow Spreads | |

| FOR | ||

| ECN Pro | ECN Raw Prices (Potentially Tightest Spreads) | Commission Charged |

| ECN VIP |

Except for ECN Pro and ECN VIP accounts, A1 Capital does not charge any commission. And different spreads are applied among the six types of accounts.

Trading Platforms

A1 Capital offers MetaTrader 5 trading platform. This advanced trading system is used worldwide and features top-tier tools for technical analyses, automated trading systems, and flexible trading operations, making it suitable for traders of all experience levels.

In addition to the desktop version, A1 Capital also provides a MetaTrader mobile app, allowing clients to manage their accounts and trade on-the-go via their smartphones. This ensures that traders can stay connected to the markets at all times, regardless of their location.

Customer Support

A1 Capital provides comprehensive customer service through various methods to address the needs of its clients. Their support can be reached by calling either +90 850 532 21 21 or via fax: +90 212 371 18 00. For those who prefer to use messaging, a WhatsApp service has been set up at +90 545 371 2121. Email support is also available at the info@a1capital.com.tr address.

Moreover, they maintain a strong social media presence on platforms such as Twitter, Instagram, Youtube, LinkedIn, and Facebook. Clients can also reach out to them through a Contact Form provided on their website, which could be a suitable channel for more detailed queries. This range of communication options should contribute to efficient and responsive customer service.

Conclusion

A1 Capital provides a wide array of financial services, but its non-regulated status raises significant concerns about investor protection and fair practices. The language barrier, with its official website available only in Turkish, limits accessibility for international clients. While users are attracted by the products and services provided by A1 Capital, they should be aware of the non-regulation and the potential risks it might bring.

Frequently Asked Questions (FAQs)

Q: What financial products and services does A1 Capital offer?

A: A1 Capital offers a wide range of financial services, including forex trading, brokerage of stocks and futures contracts, portfolio management, and investment consultancy among others.

Q: Is A1 Capital regulated?

A: Currently, A1 Capital is not regulated by any recognized financial regulatory body.

Q: What trading platforms does A1 Capital offer?

A: A1 Capital provides MT5 trading platform, offering web trading and mobile applications.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

熱點資訊

踢爆Fruitful假交友投資騙局!誆稱掛單交易無風險高獲利,拒絕提領申請更逼繳納稅金

外匯天眼示警:小心誤用仿冒FXTRADING.com格倫外匯釣魚網站,入金前請比對官方網址是否無誤

EBC與牛津WERD活動帶來氣候與全球經濟的新觀點

COINEXX遭控詐騙9萬美元!熱心網友帶領炒匯賺大錢?獲利夢碎資金凍結領不回

投資最重要的是避免失敗,而非抓住每一次成功

Equitrade Capital傳出77萬美元交易糾紛,存在投資安全疑慮

評分7.63的GD International Group金點國際集團是怎樣的外匯券商?監管資訊、用戶評價、網站概況一次看

匯率計算