YORK FX外匯交易平臺怎麽樣,正規靠譜嗎?

摘要:Established in Canada in 2015, YORK FX offers a range of forex trading instruments, including major, minor, and exotic currency pairs. With a foundation of 5-10 years, the platform boasts competitive spreads, a minimum deposit of $100, and diverse payment methods. While providing personalized customer support and acting as an authorized Western Union agent, YORK FX lacks regulatory information, raising concerns about its compliance. Additionally, the absence of an online trading platform and limited educational resources may impact accessibility and user learning, making it imperative for traders to weigh the advantages and disadvantages before engaging with the platform.

| Aspect | Information |

| Company Name | YORK FX |

| Registered Country/Area | Canada |

| Founded year | 2015 |

| Regulation | Unregulated |

| Tradable assets | Major, minor, and exotic currency pairs |

| Account Types | Standard Account (No leverage) |

| Minimum Deposit | $100 |

| Maximum Leverage | Not offered |

| Spreads | Starts at 0.8 pips for major pairs |

| Trading Platforms | No online platform; Offline trading |

| Customer Support | Phone: (647) 349-0980, Fax: (647) 349-1012 |

| Deposit & Withdrawal | Diverse methods including bank notes, drafts, wire transfers |

| Educational Resources | Limited on-site |

Overview of YORK FX

Established in Canada in 2015, YORK FX offers a range of forex trading instruments, including major, minor, and exotic currency pairs. With a foundation of 5-10 years, the platform boasts competitive spreads, a minimum deposit of $100, and diverse payment methods. While providing personalized customer support and acting as an authorized Western Union agent, YORK FX lacks regulatory information, raising concerns about its compliance. Additionally, the absence of an online trading platform and limited educational resources may impact accessibility and user learning, making it imperative for traders to weigh the advantages and disadvantages before engaging with the platform.

Is YORK FX legit or a scam?

YORK FX is not regulated by any authorities, which increases the risk of fraud, theft, and other financial losses for customers. Investors should always do their research before opening an account with any broker, and be wary of brokers that are not regulated.

Pros and Cons

| Pros | Cons |

| Wide range of forex trading instruments | Unregulated |

| Competitive spreads and commissions | Limited educational resources |

| Minimum deposit of $100 | No online trading platform |

| Diverse payment methods | No leverage offered |

| 24/5 customer support |

Pros:

Wide Range of Forex Instruments: YORK FX offers a diverse selection of forex trading instruments, allowing clients to choose from major, minor, and exotic currency pairs, providing flexibility in trading choices.

Competitive Spreads and Commissions: The platform provides competitive spreads, starting at 0.8 pips for major pairs, and commissions as low as 2.5 pips for minor currency pairs, potentially offering cost-effective trading opportunities.

Minimum Deposit of $100: YORK FX maintains a relatively low minimum deposit requirement of $100, making it accessible to a broader range of traders with varying capital levels.

Diverse Payment Methods: Clients can leverage various payment methods, including bank notes, drafts, and wire transfers, enhancing convenience and flexibility in funding their accounts and making withdrawals.

24/5 Customer Support: YORK FX offers customer support services five days a week, providing assistance and guidance during the standard trading hours.

Cons:

Unregulated: One notable concern is the lack of regulatory information provided for YORK FX, which may raise questions about the platform's adherence to industry standards and client protection.

Limited Educational Resources: The platform falls short in providing comprehensive educational resources, potentially leaving traders with fewer learning materials and tools to enhance their skills and knowledge.

No Online Trading Platform: YORK FX operates without an online trading platform, relying on offline channels like in-person counter visits and phone transactions, which may limit the accessibility and convenience for some traders.

No Leverage Offered: The absence of leverage options can be a drawback for traders who seek to amplify their positions and potentially increase their market exposure and profit potential.

Market Instruments

YORK FX provides a diverse array of forex trading instruments to cater to various investor preferences and strategies.

The platform offers major currency pairs such as EUR/USD, USD/JPY, GBP/USD, AUD/USD, and NZD/USD, providing opportunities for traders interested in widely traded and highly liquid markets.

For those seeking more specialized options, YORK FX includes minor currency pairs like EUR/GBP, EUR/CHF, EUR/CAD, AUD/JPY, and NZD/JPY, allowing for a nuanced approach to forex trading.

Additionally, the inclusion of exotic currency pairs such as EUR/TRY, USD/CNH, AUD/CAD, and NZD/CAD demonstrates YORK FX's commitment to offering a comprehensive range of instruments, appealing to traders looking for unique and potentially higher-risk opportunities.

This diverse selection empowers investors to build diverse portfolios and execute trading strategies across various market conditions.

Account Types

YORK FX offers a Standard Account featuring a conservative trading model. This account type does not provide leverage, emphasizing risk management and financial stability. The spreads begin at 0.8 pips for major currency pairs. The minimum deposit required is $100, providing accessibility to a broad range of traders. Withdrawals can be executed through various methods, including bank notes, drafts, and wire transfers. However, the absence of a demo account limits practice opportunities. The trading tool is offline, conducted through in-person visits to their counter and phone transactions, emphasizing a traditional and personal approach to currency trading.

| Aspect | Standard Account |

| Leverage | No leverage offered |

| Spread | Starts at 0.8 pips for major pairs |

| Minimum Deposit | $100 |

| Withdrawals | Through various methods (bank notes, drafts, wire transfers) |

| Demo Account | No |

| Trading Tool | Offline trading through counter and phone transactions |

| Customer Support | Contact via phone (647) 349-0980 |

How to Open an Account?

Initiating Your YORK FX Account - Step-by-Step Guide:

Contact YORK FX:

Initiate the account opening process by contacting YORK FX through their provided phone number: (647) 349-0980. This step allows you to express your interest in opening an account and sets the foundation for further instructions.

2. Provide Recipient Information:

When speaking with YORK FX, supply the necessary details, including the name of the recipient and their location. This information is crucial for processing your currency request accurately and efficiently.

3. Place Currency Order:

Inform YORK FX of the specific currency and amount you wish to trade. They may require you to place the order over the phone, securing your request and ensuring that your preferred currency is available for the desired transaction.

4. Hold Order :

YORK FX may put your order on hold, especially for larger transactions. If a deposit is required for larger orders, they will communicate this during the process. This step is designed to secure the transaction and manage the logistics of fulfilling substantial currency requests.

5. Visit the Office:

As YORK FX operates offline, plan a visit to their physical office located at Suite 102, 69 Yorkville Ave., Toronto, ON M5R 1B8, Canada. This step may be necessary for completing account formalities, providing identification, and fulfilling any in-person requirements.

6. Complete Deposit:

If a deposit is necessary for larger orders, ensure that you complete this step during your visit to YORK FX's office. This deposit may be required to confirm and facilitate the larger currency transaction you've requested.

By following these steps, you can navigate the account opening process with YORK FX, taking into account their offline and personalized approach to currency trading.

Leverage

YORK FX operates without providing leverage, offering a trading environment where clients do not have the option to amplify their positions beyond their initial investment. This approach aligns with a more conservative trading model, emphasizing risk management and financial stability for its users.

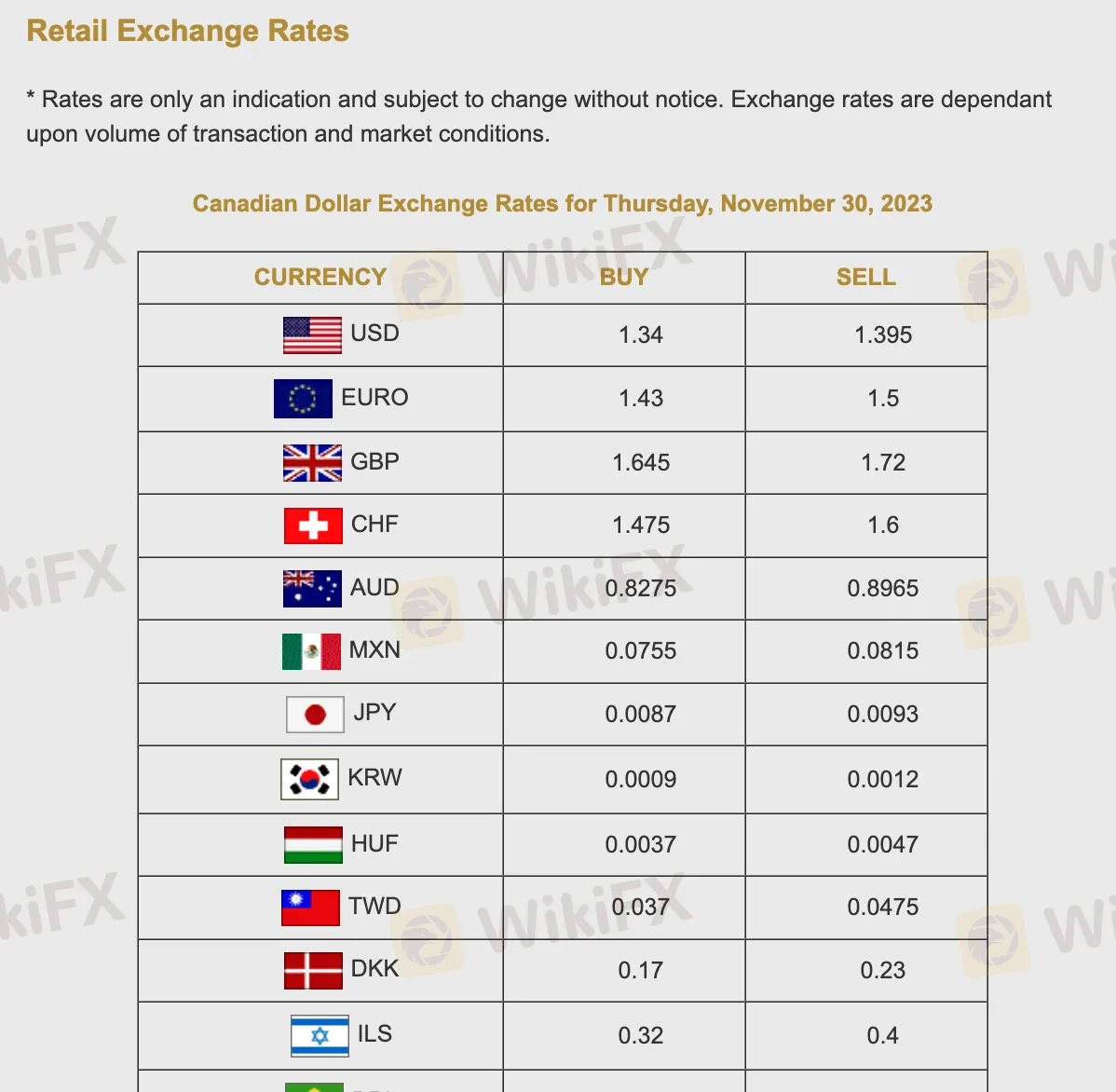

Spreads & Commissions

YORK FX offers competitive spreads and commissions on its forex trading services. The spreads on major currency pairs start at 0.8 pips, and the commissions on minor currency pairs start at 2.5 pips.

Trading Platform

YORK FX does not offer an online trading platform. Instead, trading is conducted through offline channels, including in-person visits to their counter and phone transactions. To secure a currency order, clients are instructed to call ahead, provide recipient details, and orders may be held with a deposit for larger transactions. The physical address for YORK FX is Suite 102, 69 Yorkville Ave., Toronto, ON M5R 1B8, Canada, emphasizing the offline nature of their trading services. This approach may appeal to clients who prefer personal interactions and a more traditional trading experience.

Deposit & Withdrawal

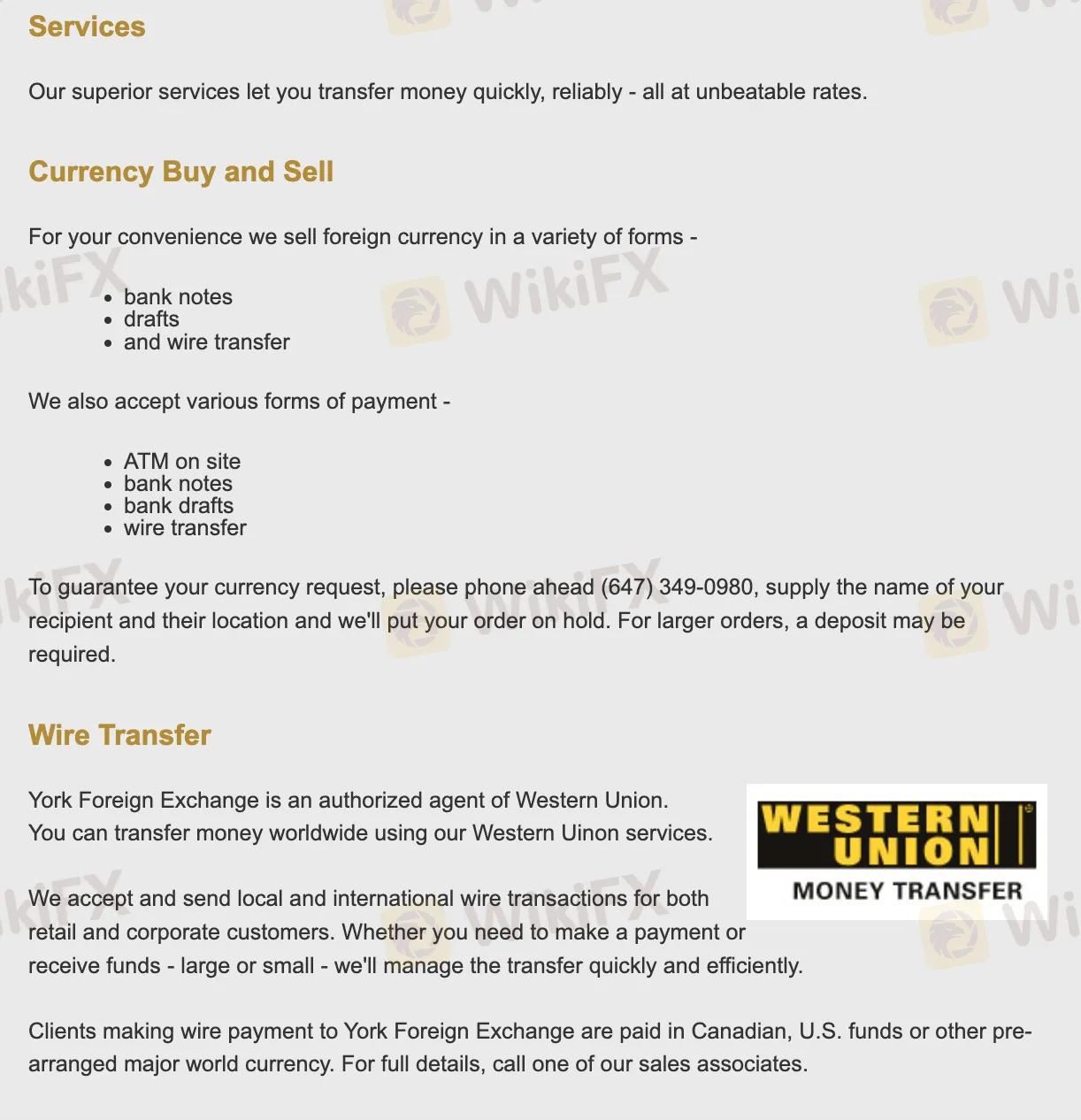

YORK FX provides diverse payment methods for efficient money transfer, including bank notes, drafts, and wire transfers. Clients can conveniently use on-site ATMs, bank drafts, or initiate wire transfers to facilitate transactions.

Bank Notes:

YORK FX facilitates currency transactions through the exchange of physical bank notes. Clients can engage in the purchase and sale of foreign currency using this traditional and widely accepted form of payment.

Drafts:

For added convenience, YORK FX accepts drafts as a form of payment. This method allows clients to engage in foreign currency transactions using negotiable instruments, providing a flexible and secure option for transferring funds.

Wire Transfer:

YORK FX supports wire transfers, allowing clients to transfer funds domestically and internationally. This electronic form of payment provides a swift and efficient way for both retail and corporate customers to make payments or receive funds, with options available in Canadian, U.S. funds, or other major world currencies.

ATM on Site:

The inclusion of on-site ATMs further enhances convenience for clients, providing access to cash and facilitating currency transactions. This on-the-spot accessibility adds an additional layer of flexibility to the payment methods offered by YORK FX.

Western Union Services:

As an authorized agent of Western Union, YORK FX enables clients to conduct secure and rapid money transfers worldwide. This service extends to both local and international wire transactions, enhancing the platform's global reach for clients making payments or receiving funds.

Forward Contracts:

YORK FX offers forward contracts, allowing clients to lock in exchange rates for future business transactions. This proactive approach helps mitigate the impact of currency rate fluctuations, providing stability and predictability for clients engaged in international commerce.

International Drafts:

International drafts present a cost-effective and convenient method for clients to pay international business partners in their domestic currency. YORK FX facilitates these transactions, streamlining international business dealings and supporting a seamless flow of funds across borders.

The minimum deposit for a YORK FX account is $100. This is a relatively low minimum deposit, which makes YORK FX an accessible platform for beginners.

YORK FX processes deposits instantly. This means that you can start trading as soon as your deposit has been processed. Withdrawals are typically processed within 24 hours. However, it may take longer for your funds to reach your bank account, depending on the payment method you choose.

Customer Support

YORK FX provides efficient and responsive customer support from their location at Suite 102, 69 Yorkville Ave., Toronto, ON M5R 1B8, Canada.

Clients can reach them via phone at (647) 349-0980 or fax at (647) 349-1012. The dedicated support team is committed to addressing inquiries promptly, ensuring a seamless trading experience for users.

Their physical address and contact details demonstrate transparency and accessibility, essential for fostering trust in the financial services industry. Whether assisting with account management or addressing queries, YORK FX's customer support strives to deliver a high standard of service to meet the needs of their clients.

Educational Resources

YORK FX's educational offerings are limited, with its website providing only fundamental information on forex trading. Unfortunately, the platform currently lacks extensive courses or tutorials for clients seeking a more in-depth understanding of trading strategies and market dynamics. As a result, users may need to explore external educational sources to supplement their knowledge and skills in navigating the complexities of the financial markets.

Conclusion

YORK FX presents a comprehensive forex trading experience with major, minor, and exotic currency pairs. The platform offers competitive spreads, a $100 minimum deposit, and diverse payment methods. Despite personalized customer support and authorization as a Western Union agent, the absence of regulatory details raises concerns. Furthermore, the platform's offline trading approach and limited educational resources may affect accessibility and user learning. Prospective traders must carefully consider these factors to make informed decisions about engaging with YORK FX.

FAQs

Q: Does YORK FX offer leverage for trading?

A: No, YORK FX operates without providing leverage, prioritizing a conservative trading model.

Q: What is the minimum deposit required to open an account with YORK FX?

A: The minimum deposit is $100, providing accessibility to a broad range of traders.

Q: Is there a demo account available for practice?

A: No, YORK FX does not offer a demo account for simulated trading.

Q: How can I contact YORK FX's customer support?

A: Customer support can be reached via phone at (647) 349-0980 during standard trading hours.

Q: Are there educational resources available on YORK FX?

A: Educational resources are limited; however, clients can seek external learning materials.

Q: Is YORK FX regulated?

A: The regulatory status of YORK FX is not provided, raising concerns about compliance and oversight.

熱點資訊

外匯券商BRUNSDON疑雲重重!監管資訊存疑、交易糾紛頻傳,爆雷風險極高

揭露仿冒IG假交友詐騙套路:誆稱黃金波段交易輕鬆賺,指控涉嫌洗錢逼繳保證金

金融交易是心性的博弈

ConneXar Capital天眼評分低卻好評如潮?網軍留言洗版、牌照疑雲重重,存在極大詐騙風險

PU Prime 宣布即將進行 MT4、MT5 伺服器升級

Berniston監管不明、官網異常、遭加拿大CSA示警,疑似詐騙黑平台

做好交易,真的有想像中那麼難嗎?

匯率計算