Oubo Global Pty. Ltd外匯交易平臺怎麽樣,正規靠譜嗎?

摘要:Oubo Global Pty. Ltd is a forex broker based in Canada, operating for approximately 1-2 years. The company offers its services under the name Oubo Global Pty. Ltd. However, it is worth noting that there are concerns regarding its regulatory license, which has raised suspicions.

| Oubo Global Pty. Ltd | Basic Information |

| Registered Country/Area | Canada |

| Founded year | 1-2 yearss ago |

| Company Name | Oubo Global Pty. Ltd |

| Regulation | Suspicious regulatory license |

| Minimum Deposit | $1,000 |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Not specific |

| Trading Platforms | Not specific |

| Tradable assets | Forex, CFDs on stocks, indices, commodities, cryptocurrencies |

| Account Types | Standard (only) |

| Demo Account | No |

| Islamic Account | No |

| Customer Support | cs@wintersoubo.com |

| Payment Methods | VISA, MASETRCARD, cryptos |

| Educational Tools | No |

Overview of Oubo Global

Oubo Global Pty. Ltd is a forex broker based in Canada, operating for approximately 1-2 years. The company offers its services under the name Oubo Global Pty. Ltd. However, it is worth noting that there are concerns regarding its regulatory license, which has raised suspicions.

The minimum deposit required to open an account with Oubo Global is $1,000, providing access to the Standard account type. While the maximum leverage offered is up to 1:1000, specific information about spreads and trading platforms is not disclosed, leaving traders with limited insights into the trading conditions and available features.

Oubo Global provides a range of tradable assets, including forex, CFDs on stocks, indices, commodities, and cryptocurrencies. This diverse selection allows traders to access various markets and potentially diversify their investment portfolios.

It is important to highlight that Oubo Global does not offer a demo account for traders to practice and test their strategies in a risk-free environment. Additionally, the absence of an Islamic account option means that traders seeking Sharia-compliant trading may need to explore alternative brokers.

Customer support for Oubo Global can be reached via email at cs@wintersoubo.com. However, it is advisable to consider the limitations of email-based support and potential delays in response times. Traders interested in Oubo Global should approach its offerings with caution, considering the suspicious regulatory license and the lack of transparency regarding trading conditions, spreads, and trading platforms.

Is Oubo Global legit or a scam?

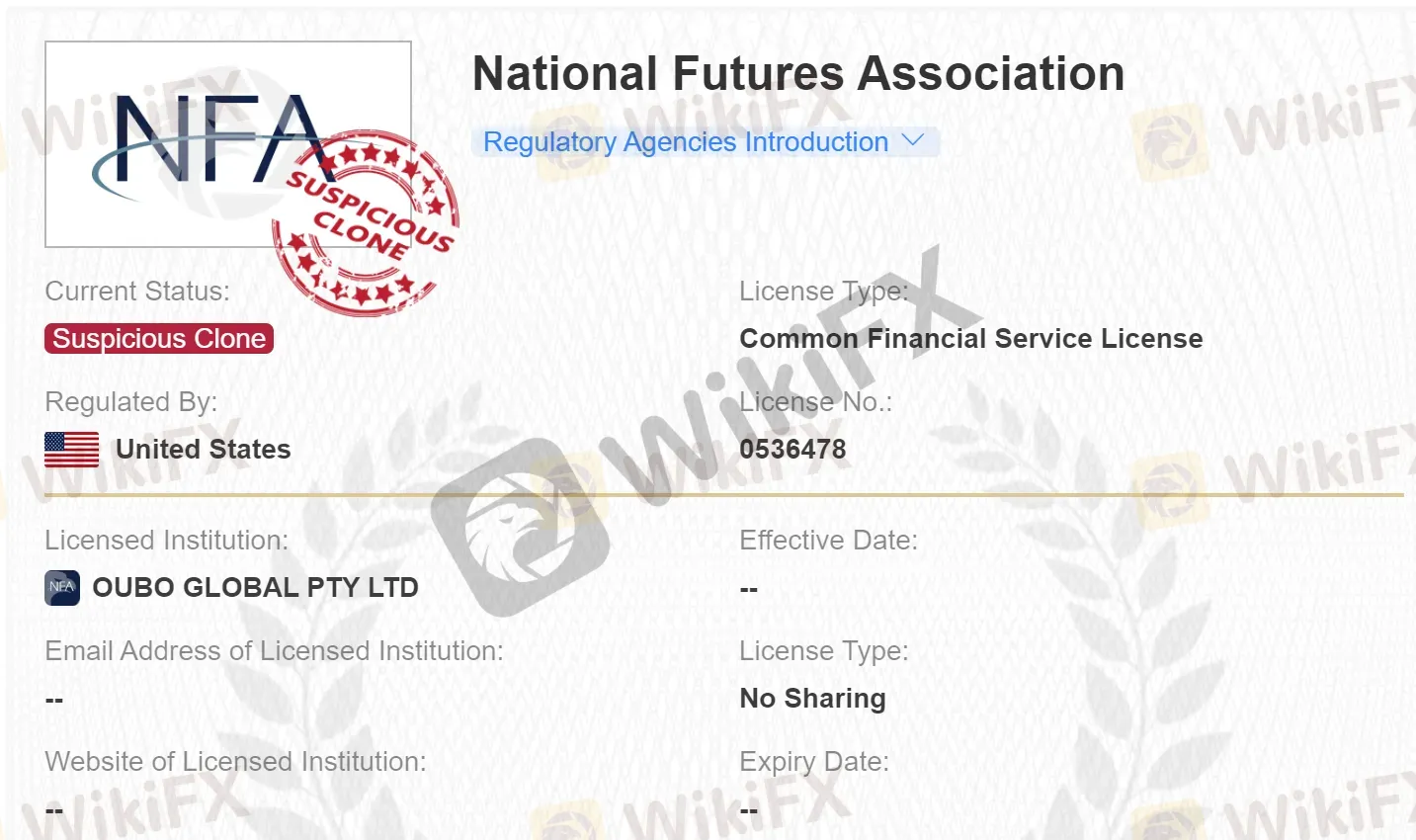

Oubo Global claims to be regulated by the NFA (National Futures Association) and holds a financial service license with license number 0536478. However, upon conducting a verification check on the NFA website, it becomes apparent that this broker is not listed as a member of the NFA. This discrepancy raises doubts about the regulatory status and oversight of Oubo Global.

Pros and Cons

| Pros | Cons |

| Up to 1:1000 leverage offered | Lack of regulatory transparency |

| Suspicious regulatory license | |

| Higher minimum deposit requirement | |

| Limited customer support options | |

| Absence of demo accounts and comprehensive education | |

| Only one account supported | |

| Numerous details concerning spreads, trading platform missing |

Market Intruments

Oubo Global offers a diverse range of market instruments, allowing traders to access various financial markets and broaden their investment opportunities. The available instruments include Forex, CFDs on stocks, indices, commodities, and cryptocurrencies.

Forex, the largest and most liquid market globally, enables traders to engage in currency trading. Oubo Global provides access to major, minor, and exotic currency pairs, allowing traders to speculate on exchange rate fluctuations and potentially benefit from currency movements.

In addition to Forex, Oubo Global offers CFDs (Contracts for Difference) on stocks, providing traders with exposure to a wide range of company shares. By trading CFDs on stocks, traders can speculate on price movements without owning the underlying asset. This allows for flexibility and the potential to profit from both rising and falling markets.

Indices CFDs are another market instrument available through Oubo Global. Traders can access a selection of global stock market indices, such as the S&P 500, FTSE 100, or Nikkei 225. Trading indices CFDs allows traders to gain exposure to the overall performance of specific markets, offering diversification and opportunities based on market trends.

Commodity trading is also accessible through Oubo Global. Traders can engage in CFDs on various commodities, including precious metals like gold and silver, energy products like oil and natural gas, and agricultural products such as wheat and corn. Commodities provide traders with the opportunity to participate in markets influenced by global supply and demand dynamics.

Furthermore, Oubo Global includes cryptocurrencies as part of its market instruments. Traders can trade CFDs on popular cryptocurrencies like Bitcoin, Ethereum, or Ripple. The cryptocurrency market offers unique opportunities for traders seeking potentially high volatility and alternative investment options.

Account Types

Oubo Global presents traders with a singular account option known as the Standard account, which serves as the primary gateway to their trading platform. While specific details about the features and advantages of this account remain undisclosed, it is important to note that the account operates under a minimum deposit requirement of $1000.

The minimum deposit threshold acts as a foundational step for traders, allowing them to initiate their trading journey with Oubo Global. However, it is worth mentioning that the absence of a demo account limits traders' ability to practice and acquaint themselves with the platform's functionalities without the need to risk real capital. Demo accounts serve as invaluable tools for traders, particularly those new to the markets, seeking to refine their strategies and build confidence.

How to open an account?

Visit the official Oubo Global website and click on “Open Account” or “Sign Up.”

Fill out the registration form with accurate personal information.

Agree to the terms and conditions presented by Oubo Global.

Submit any required verification documents for identity and address verification.

Upon completion, your account application will be processed, and you will receive further instructions from Oubo Global for funding and accessing the trading platform. Keep your account details secure and follow any recommended security measures.

Leverage

Oubo Global offers leverage of up to 1:1000 to its traders. Leverage, in the context of forex trading, is a mechanism that allows traders to control larger positions in the market with a smaller amount of capital. This high leverage ratio of 1:1000 implies that for every dollar of capital invested, traders can access up to a thousand times that amount in trading volume.

While leverage can potentially amplify profits, it is important to recognize that it also increases risk exposure. Trading with high leverage carries the potential for significant gains but equally significant losses.

Spreads & Commissions (Trading Fees)

Oubo Global does not disclose specific details regarding spreads and commissions on its platform, leaving traders with limited transparency regarding these crucial aspects of trading.Given the absence of information about spreads and commissions, there may be an assumption that Oubo Global intentionally hides its trading fees.

Non-Trading Fees

Oubo Global does not provide specific information about non-trading fees on its platform, leaving traders with limited visibility into the potential costs associated with various non-trading activities. Non-trading fees typically include charges related to account maintenance, deposits, withdrawals, inactivity, and other administrative or operational aspects.

Trading Platform

Oubo Global does not provide specific information about its trading platform, which leaves traders with limited visibility into the features and functionalities of the platform. The trading platform is a vital component of a trader's experience, as it serves as the interface through which trades are executed, market analysis is conducted, and account management takes place.

Many reputable brokers in the industry offer the popular MetaTrader 4 (MT4) or MetaTrader 5 (MT5) trading platforms. These platforms have gained widespread recognition and popularity among traders due to their advanced features, user-friendly interfaces, and extensive range of trading tools and indicators.

Deposit & Withdrawal

Oubo Global allows clients to make deposits and withdrawals using various payment methods, including VISA, MASTERCARD, and cryptocurrencies. However, the broker does not provide specific details regarding associated fees, processing times, or any other relevant information regarding these transactions.

The minimum deposit requirement of $1000 may be a significant consideration for potential clients. Such a high minimum deposit could limit accessibility for traders with smaller capital amounts or those who prefer to start with a lower initial investment. Without detailed information about deposit fees, traders are unable to assess the potential costs associated with funding their trading accounts.

Customer Support

Oubo Global's customer support appears to be limited, as the only available contact method provided is through an email address: cs@wintersoubo.com. The absence of alternative communication channels such as live chat or phone support raises concerns about the level of customer assistance and responsiveness offered by the broker.

Is Oubo Global suitable for beginners?

Oubo Global may not be ideal for beginners due to the following reasons. Firstly, the relatively high minimum deposit requirement of $1000 could pose a significant financial commitment for novice traders. Additionally, the absence of a demo account deprives beginners of a risk-free learning environment. Furthermore, the lack of comprehensive educational resources hinders beginners from acquiring essential knowledge and developing effective trading strategies.

To ensure a smooth and supportive start in trading, beginners are encouraged to explore alternative brokers that offer lower minimum deposit requirements, provide demo accounts for practice, and offer comprehensive educational resources.

Is Oubo Global suitable for experienced traders?

Oubo Global may not be the most suitable choice for experienced traders due to certain factors. Firstly, the broker's lack of transparency in terms of regulation raises concerns about the reliability and credibility of its services. Experienced traders often prioritize working with regulated brokers that provide a level of oversight and protection for their investments.

Furthermore, the absence of detailed information about spreads, commissions, and non-trading fees limits the ability of experienced traders to assess the overall cost and competitiveness of trading with Oubo Global.

Moreover, the limited customer support options, solely relying on email communication, may not meet the expectations of experienced traders who prefer timely and responsive assistance

Educational Resources

Oubo Global, unfortunately, does not provide any educational resources to support traders in their journey.

Conclusion

In summary, Oubo Global raises significant concerns that warrant careful consideration from traders. The lack of regulatory transparency and the presence of a suspicious regulatory license undermine the broker's credibility and reliability. The absence of detailed information regarding spreads, commissions, and non-trading fees leaves traders uncertain about the overall cost and competitiveness of trading with Oubo Global. Moreover, the limited customer support options, relying solely on email communication, may fail to meet the expectations of traders seeking prompt and effective assistance. Considering these substantial concerns, traders are advised to exercise caution and thoroughly evaluate alternative brokers.

FAQs

Q: Is Oubo Global a regulated broker?

A: Oubo Global's regulatory status is not transparent, as it provides a suspicious regulatory license without disclosing the regulatory body.

Q: What is the minimum deposit requirement for opening an account with Oubo Global?

A: The minimum deposit requirement for Oubo Global is $1000.

Q: Does Oubo Global offer a demo account for practice trading?

A: Unfortunately, Oubo Global does not provide a demo account.

Q: Are Islamic accounts available with Oubo Global?

A: No, Oubo Global does not offer Islamic accounts tailored to the needs of Muslim traders who adhere to Islamic finance principles.

Q: What customer support options are available with Oubo Global?

A: Oubo Global offers customer support exclusively through email communication. Traders can reach the support team at cs@wintersoubo.com.

熱點資訊

投資人請小心Trin Wealth!缺乏有效監管、官網資訊造假,已遭加拿大CSA示警

在交易中什麼時候可以自信,什麼時候不能自信?

勿因利小而不為,勿因損大而持之

黑平台KVB昆侖國際換殼KVB PRIME與KVB行騙!投資人怒控滑點爆倉,血虧數萬美元

SkylineInvesthub疑似免洗詐騙站!英國FCA示警無牌經營,投資人慎防高風險陷阱

Fxcess遭控操縱交易、惡意爆倉!平台詐騙風險高,建議投資人盡速遠離

匯率計算