中達證券外匯交易平臺怎麽樣,正規靠譜嗎?

摘要:Established in 2014, Central Wealth Securities Investment Limited (CWSI), a subsidiary of Central Wealth Group Holdings Limited (00139.HK), offers a diverse range of trading assets, including online stock trading, margin accounts, and participation in Initial Public Offerings (IPOs).

| CWSI Review Summary | |

| Founded | 2014 |

| Registered Country/Region | China Hong Kong |

| Regulation | SFC (Revoked and Exceeded) |

| Products & Services | Securities brokerage, securities underwriting, margin financing, securities research, asset management (private funds set-up and management), structured products, and other integrated financial services |

| Demo Account | ✅ |

| Leverage | 1:10 |

| Spread | From 0.05% (Cash Account) |

| From 0.10% (Margin Account) | |

| Trading Platform | Stock trading systems |

| Min Deposit | HK$1,000 |

| Customer Support | Service time: 24/7 |

| Tel: (852) 3958 4688 | |

| Email: cwsi1888@cwsi.com.hk, cs@cwsi.com.hk | |

| Facebook: https://www.facebook.com/cwsi.com.hk | |

| YouTube: https://www.youtube.com/channel/UCqhLmt5qBg8j2yy6bqoYLYQ | |

| Address: Rm1801-1802, Far East Finance Centre, 16 Harcourt Road, Admiralty, Hong Kong | |

Established in 2014, Central Wealth Securities Investment Limited (CWSI), a subsidiary of Central Wealth Group Holdings Limited (00139.HK), offers a diverse range of trading assets, including online stock trading, margin accounts, and participation in Initial Public Offerings (IPOs).

However, there are regulatory setbacks, such as the revocation of its futures contracts license by the SFC of Hong Kong.

Pros and Cons

| Pros | Cons |

| Various financial products and services | Revoked and exceeded licenses of SFC |

| Transparent fee structures | No demo accounts |

| High minimum deposit |

Is CWSI Legit?

CWSI faces a considerable regulatory setback as its license for dealing in futures contracts has been revoked by the Securities and Futures Commission of Hong Kong (License No. BFW317).

Similarly, CWSI's regulatory status continues to be a cause for concern, having exceeded the standards set by the Securities and FuturesCommission of Hong Kong (License No. AVE583) in dealing with securities.

| Regulatory Status | Revoked |

| Regulated by | Securities and Futures Commission of Hong Kong (SFC) |

| Licensed Institution | Central Wealth Futures LImited |

| Licensed Type | Dealing in futures contracts |

| Licensed Number | BFW317 |

| Regulatory Status | Exceeded |

| Regulated by | Securities and Futures Commission of Hong Kong (SFC) |

| Licensed Institution | Central Wealth Securities Investment |

| Licensed Type | Dealing with securities |

| Licensed Number | AVE583 |

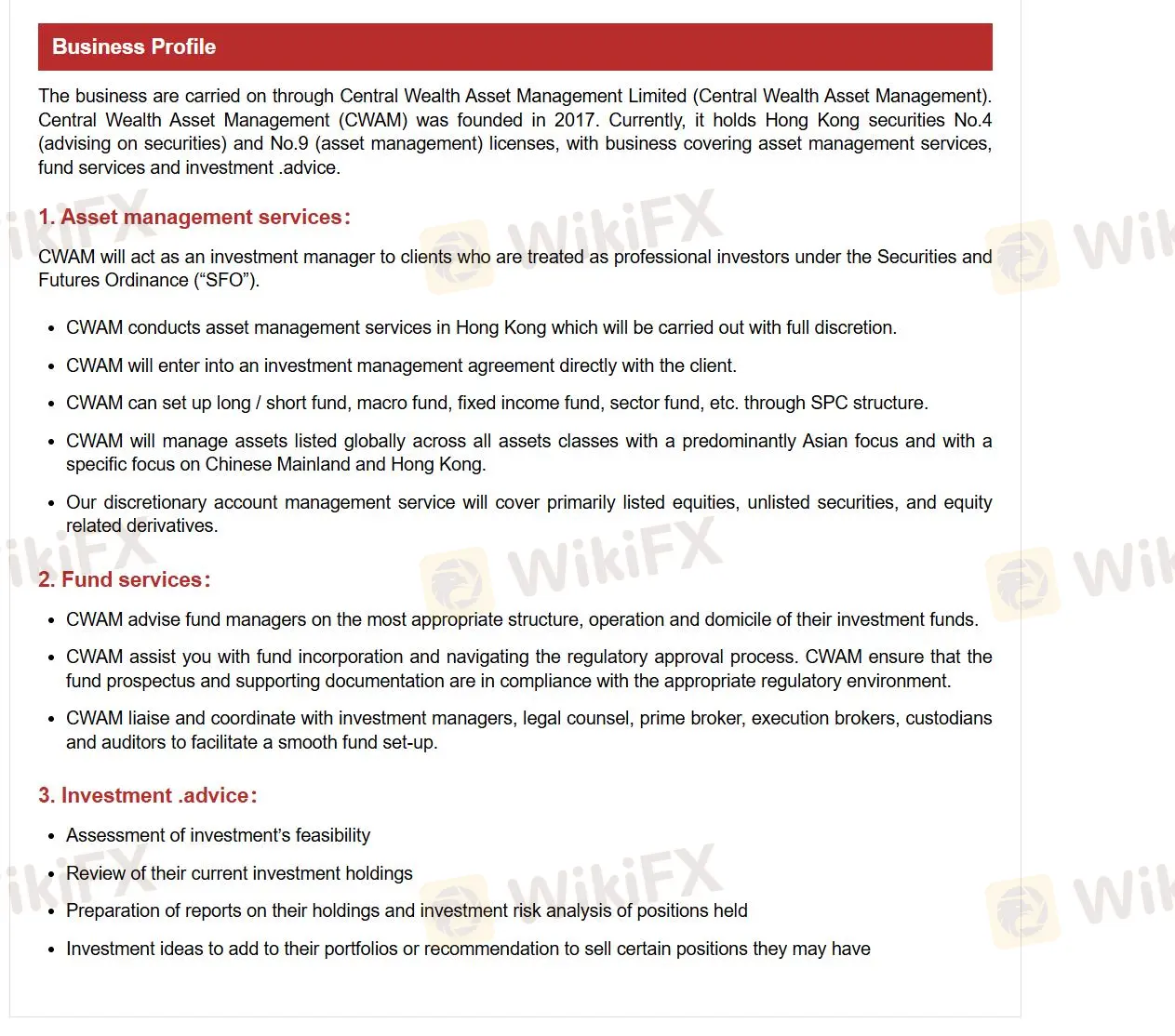

Products and Services

CWSIs businesses cover securities brokerage, securities underwriting, margin financing, securities research, asset management (private funds set-up and management), structured products, bonds, and other integrated financial services.

In their asset management sector, they mainly offers fixed-income funds, with an asset management scale nearing 1 billion US dollars.

The key products include:

- Investment Grade Bond Product: This product primarily invests in investment-grade US dollar bonds, covering regions like China and Hong Kong, and can be diversified globally based on investor preferences.

- High Yield Bond Product: Targeting high yield, this product invests in high-yield US dollar bonds, particularly from China and Hong Kong.

- Short-Term Bond Product: This product focuses on short-term US dollar bonds.

- Fixed Income Products: These products invest in fixed-income targets with specific maturity intervals.

In their sales and trading sector, they provide customers with sales and trading services of offshore derivatives including national bonds, financial bonds, and corporate bonds.

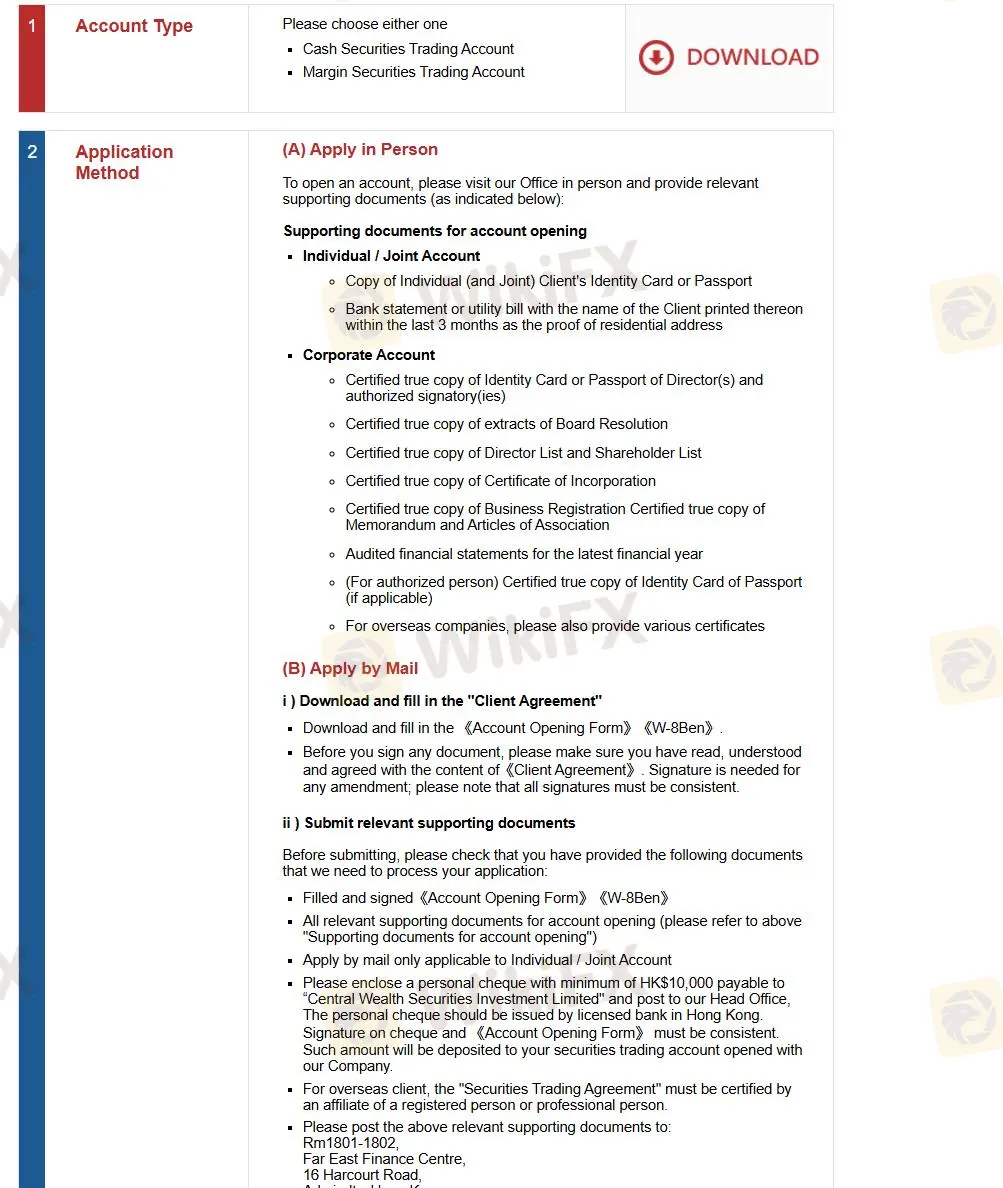

Account Type

CWSI offers Cash Securities Trading Account and Margin Securities Trading Account for individual/joint, and corporate traders. Demo accounts are available for both account types.

| Account Type | Cash Securities Trading Account | Margin Securities Trading Account |

| Minimum Deposit | HK$1,000 | HK$5,000 |

To open an account of CWSI, it is simple that you submit supporting document and verify information by phone. Client number and password will be sent to you by post or email.

Leverage

| Account Type | Cash Securities Trading Account | Margin Securities Trading Account |

| Leverage | / | Up to 10 times |

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spread and Commission

| Account Type | Cash Securities Trading Account | Margin Securities Trading Account |

| Spread | Variable, starting from 0.05% | Variable, starting from 0.10% |

| Commission | HK$0.01 per share | HK$0.02 per share |

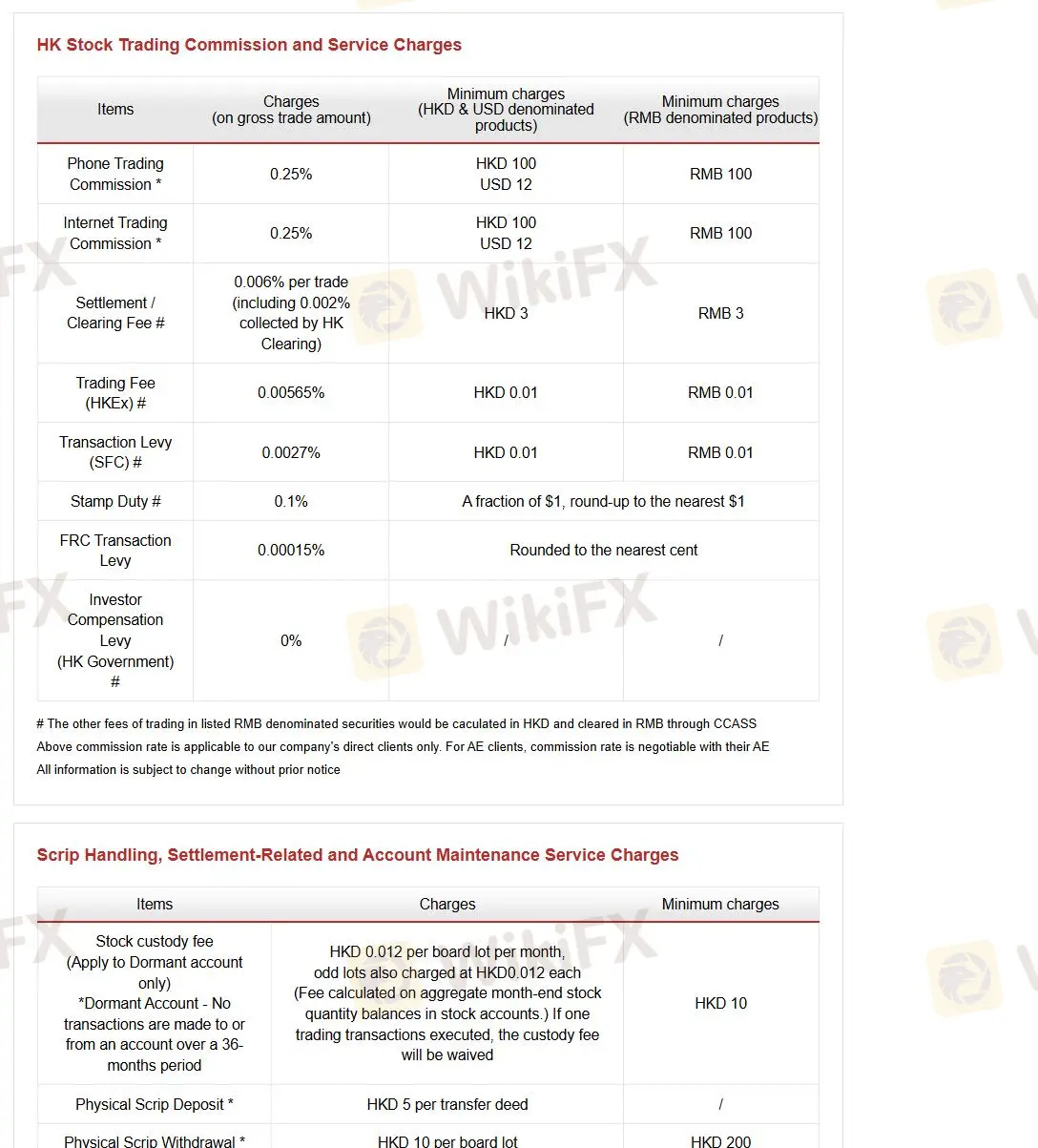

Other Fees

CWSI charges various fees for different products and services. Take HK stocking trading as an example:

| Items | Charges (on gross trade amount) | Minimum charges (HKD & USD denominated products) | Minimum charges (RMB denominated products) |

| Phone Trading Commission | 0.25% | HKD 100 / USD 12 | RMB 100 |

| Internet Trading Commission | |||

| Settlement / Clearing Fee | 0.006% per trade (including 0.002% collected by HK Clearing) | HKD 3 | RMB 3 |

| Trading Fee (HKEx) | 0.00565% | HKD 0.01 | RMB 0.01 |

| Transaction Levy (SFC) | 0.0027% | ||

| Stamp Duty | 0.1% | A fraction of $1, round-up to the nearest $1 | / |

| FRC Transaction Levy | 0.00015% | Rounded to the nearest cent | / |

| Investor Compensation Levy (HK Government) # | 0% | / | / |

More details on each trading products can be learned through the link: https://www.cwsi.com.hk/en/trade/charge

Trading Platform

CWSI offers stock trading systems including securitiessystems and mobile stock trading systems, available on IOS and Android.

Online trading enables customers to access real-time stock quotes and conveniently enter or modify their orders whenever they choose. This platform also allows clients to effortlessly monitor their account balances, stock holdings, and the status of their orders at any time.

Deposit and Withdrawal

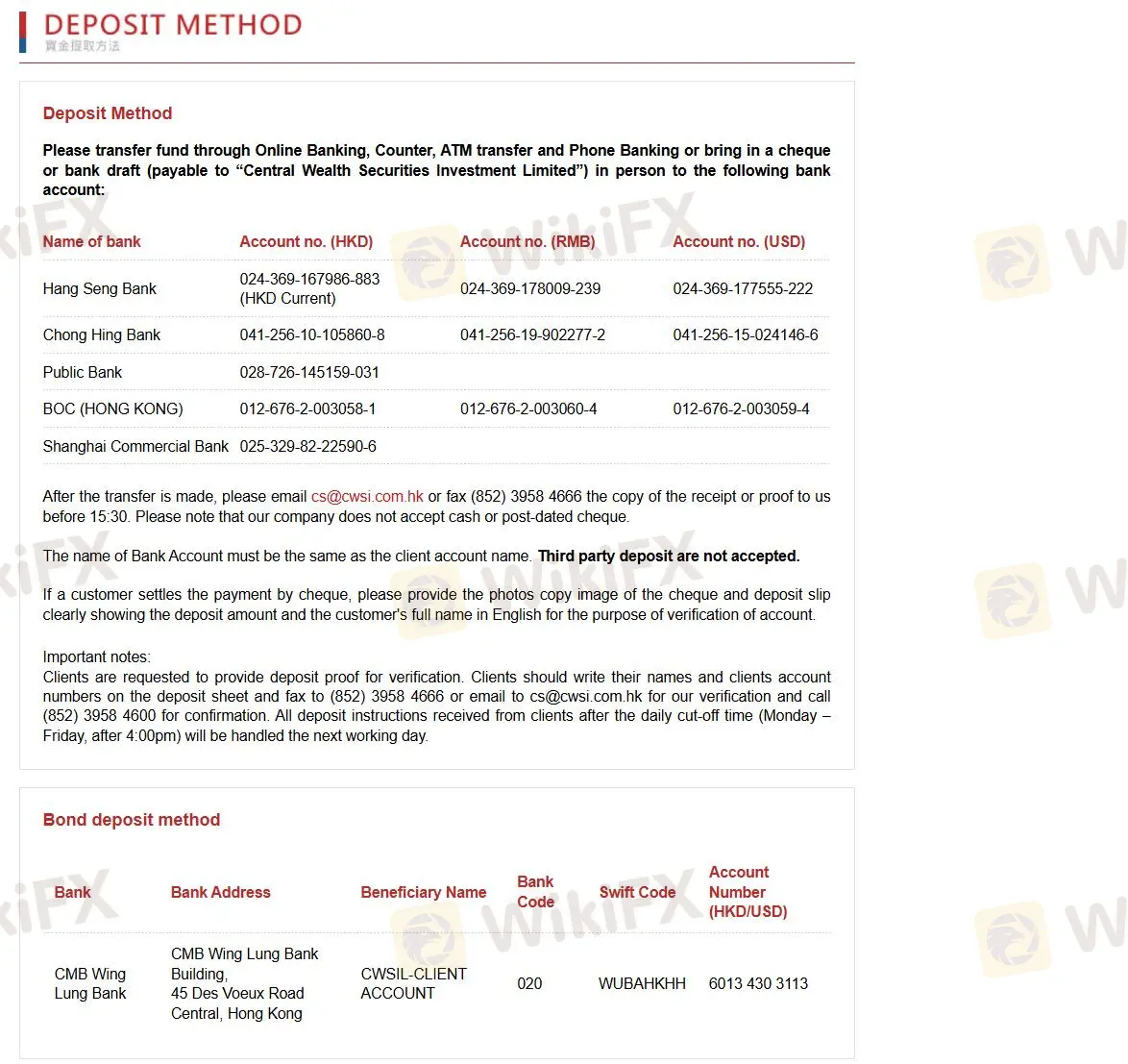

CWSI accepts transfer fund through Online Banking, Counter, ATM transfer and Phone Banking or bring in a cheque or bank draft (payable to “Central Wealth Securities Investment Limited”) . Third party deposit are not accepted.

Besides, clients should give their withdrawal instructions before the daily cut-off time (Trading day from Monday – Friday, on or before 11:00am) via their Sales and Customers Services Hotline at (852) 3958 4600.

熱點資訊

Gleneagle遭控為詐騙黑平台!出金申請成功卻未到帳,繳完稅金、保證金依舊沒下文

斐波那契女王 Carolyn Boroden專訪問答

什麼是交易中最重要的技能?

投資外匯有哪些風險?

外匯天眼正式啟動「Every Review Counts」交易商點評行動

外匯天眼聯合行業各方開啟 「Let Trust Be Seen|讓信任,被看見」系列活動

外匯天眼情人節寄語 | 安全交易,一路同行

為什麼你總在同一個位置被打掉?

參與外匯市場前要知道的10件事

匯率計算