GAD外匯交易平臺怎麽樣,正規靠譜嗎?

摘要:Founded in 2007, GAD International Holding Limited was established in Sydney, Australia, and in 2012, its London branch opened and started to conduct business in the United Kingdom. In 2015, this company's business line spreads in China and it began to enter markets in Germany, Latin American and the Middle East.

| GAD | Basic Information |

| Registered Country/Area | United Kingdom |

| Founded year | 1-2 years ago |

| Company Name | GAD International Holding Limited |

| Regulation | Suspicious Regulatory License |

| Minimum Deposit | Not mentioned |

| Maximum Leverage | 1:500 |

| Spreads | From 0.0 pips ( allegedly) |

| Trading Platforms | MetaTrader 4 |

| Tradable Assets | currency pairs, cryptocurrency, precious metals, indices. |

| Account Types | Not mentioned |

| Demo Account | Not mentioned |

| Islamic Account | Not mentioned |

| Customer Support | Email: info@gydforex.com |

| Payment Methods | Credit/Debit Card, Bank Wire Transfer |

| Educational Tools | No |

General Information

GAD International Holding Limited, a company registered in the United Kingdom, has made its presence known in the trading industry over the past one to two years. The regulatory license associated with GAD has been labeled as suspicious. Tradable assets on GAD comprise currency pairs, cryptocurrencies, precious metals, and indices, offering a diverse range of investment options.

Detailed information regarding account types, demo accounts, and Islamic accounts is regrettably absent, potentially limiting the level of customization and accessibility for traders with specific requirements. Considering the absence of information regarding the minimum deposit required, potential investors may find it challenging to gauge the financial commitment necessary to engage with the platform. The maximum leverage offered by GAD stands at 1:500, and the purported spreads, as claimed by GAD, start from 0.0 pips.

Support for GAD clients is available through email communication, facilitated by the address info@gydforex.com. Payment methods accepted by GAD include credit/debit cards and bank wire transfers.

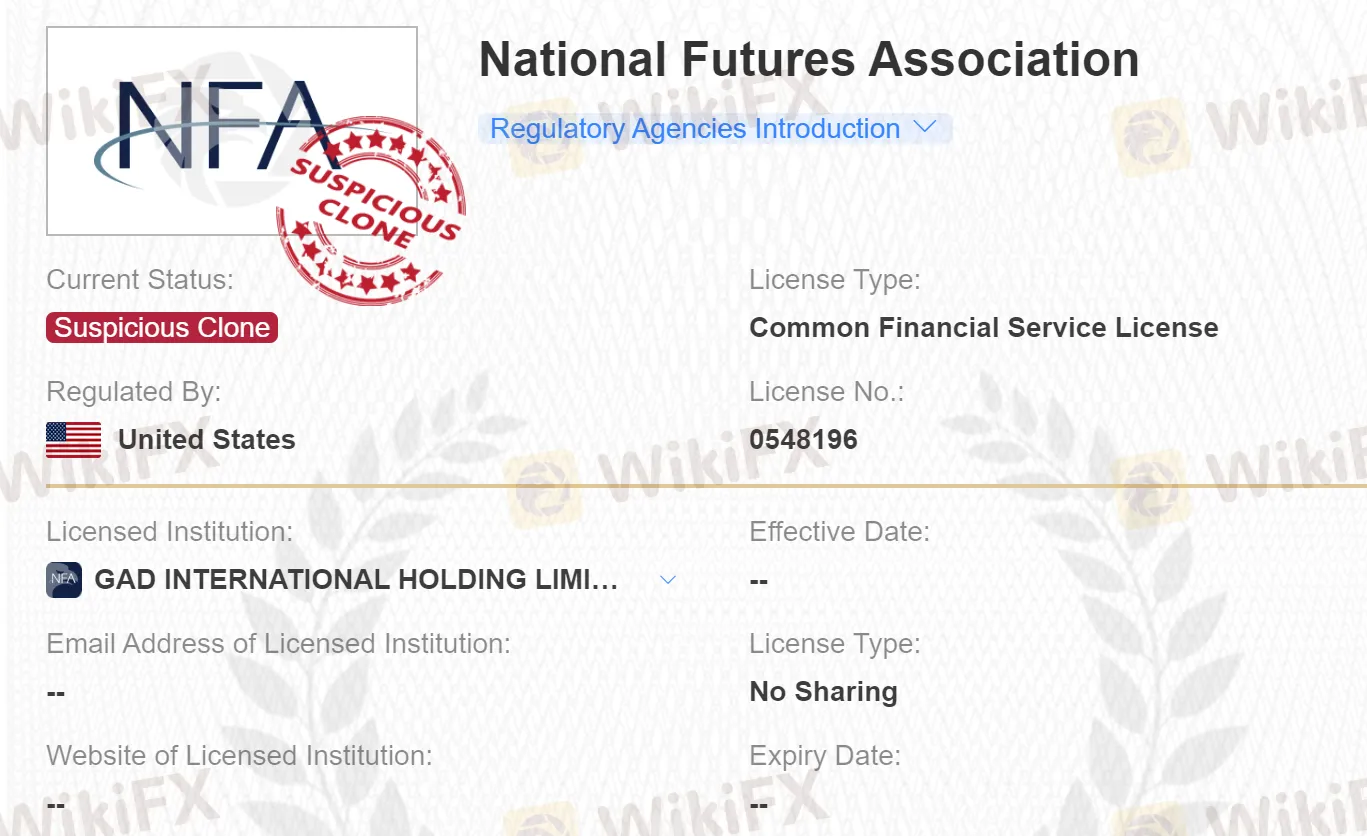

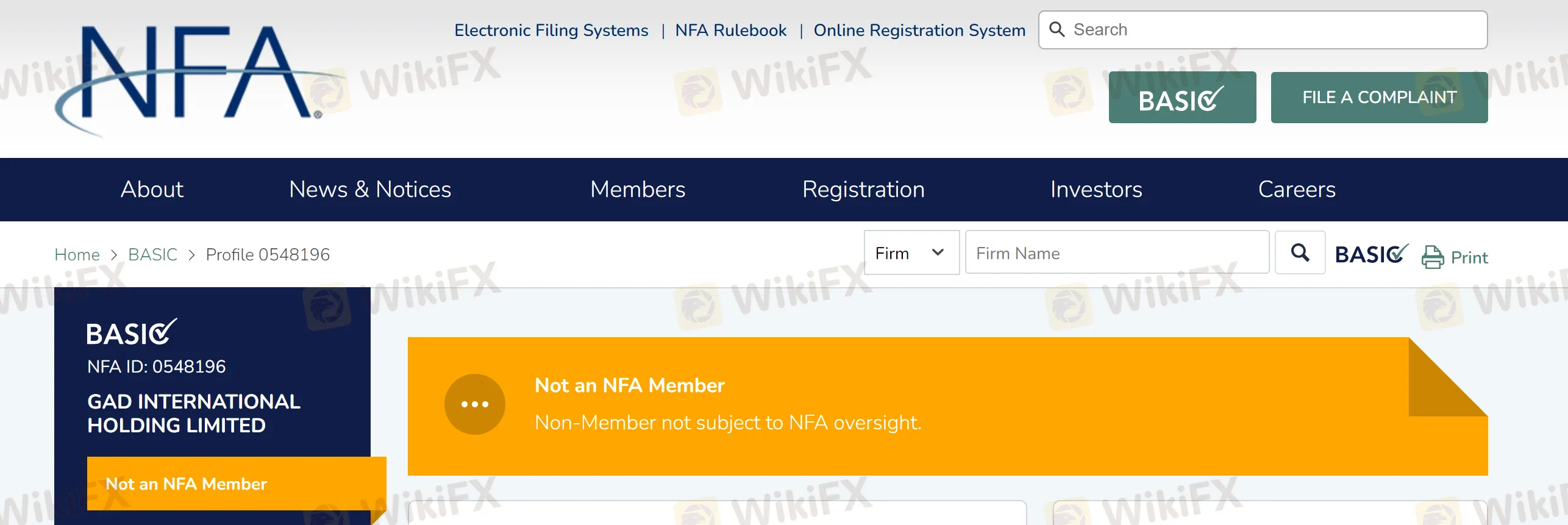

Is GAD legit or a scam?

According to GAD, they assert regulatory compliance with the National Futures Association (NFA) and hold a common financial service license, specifically license number 0548196.

However, upon conducting verification through the NFA website, it has come to light that GAD International Holding Limited is not a registered member of the NFA.

Pros and Cons

| Pros | Cons |

| Provides access to MetaTrader 4 trading platform | Operates as an unregulated broker, which may pose potential risks for traders. |

| Generous leverage up to 1:500 | The regulatory license of GAD is suspicious, raising concerns about its credibility and reliability. |

| Information about minimum deposit, account types, demo accounts, and Islamic accounts is not mentioned, which may indicate a lack of transparency. | |

| Lack of information regarding the responsiveness and quality of customer support. | |

| Limited payment methods available, with only credit/debit card and bank wire transfer options. | |

| No educational contents | |

| Trading platform only limited to MT4 |

Market Intruments

GAD International Holding Limited presents investors with a range of market instruments across four classes, covering currency pairs, cryptocurrency, precious metals, indices.

The first class of market instruments offered by GAD encompasses currency pairs. Forex trading, a cornerstone of global financial markets, involves the buying and selling of different currencies. In addition to currency pairs, GAD extends its offerings to the realm of cryptocurrency. Precious metals represent another integral asset class within GAD's market instruments. The fourth class of market instruments provided by GAD encompasses indices. Indices, such as the S&P 500 or the FTSE 100, track the performance of a specific group of stocks, serving as barometers for broader market trends.

Account Types

GAD International Holding Limited's approach to detailing its account types and minimum deposit requirements appears to be somewhat elusive. Regrettably, GAD does not provide explicit details about the various account types on offer, leaving potential traders in a state of uncertainty. Furthermore, GAD International Holding Limited does not disclose specific details regarding the minimum deposit requirements necessary to open an account.

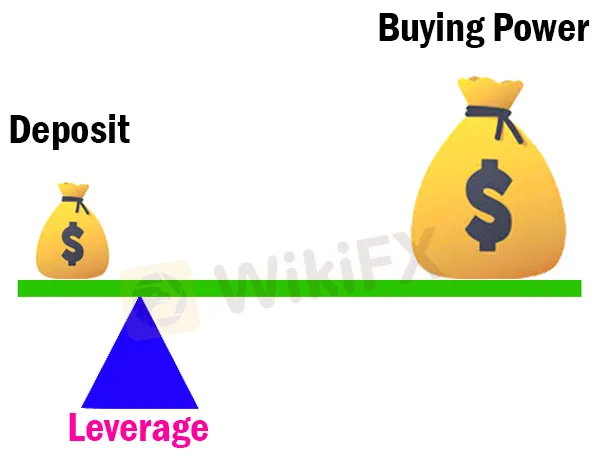

Leverage

By making leverage available up to a ratio of 1:400, GAD provides traders with the means to access greater market exposure relative to their available capital.

The option to utilize leverage of this magnitude may appeal to traders seeking to maximize their potential gains, albeit with a heightened level of risk. By enabling participants to trade with a ratio of 1:400, GAD acknowledges the desire for increased market exposure among certain traders and aims to satisfy their aspirations. However, it is vital to exercise prudent risk management when employing leverage in trading activities. Amplifying the size of positions intensifies the exposure to market fluctuations and increases the risk of potential losses.

Spreads & Commissions (Trading Fees)

GAD purports to offer its clients spreads starting from 0.0 pips, which implies tight pricing in the trading environment. However, there is no independent mechanism to objectively evaluate the accuracy of GAD's spread offerings given the absence of regulatory oversight. In addition to spreads, GAD's commissions structure also remains unclear, as the broker does not provide explicit details regarding commission rates and any associated charges.

Non-Trading Fees

GAD International Holding Limited imposes certain non-trading fees on its clients. It is important to approach this aspect of the broker's offering with objectivity, recognizing that, as an unregulated entity, the veracity of these fees cannot be independently verified. Clients of GAD may be subject to various non-trading fees, which encompass charges that are not directly tied to trading activities. These fees can comprise deposits and withdrawals, account maintenance, or inactivity charges, among others.

Trading Platform

GAD International Holding Limited offers the MetaTrader 4 (MT4) trading platform to its clients.

The MT4 trading platform provided by GAD is widely recognized and utilized in the financial industry. It is renowned for its robust and user-friendly interface, which appeals to both novice and experienced traders. The platform offers access to a range of financial instruments, including foreign exchange, commodities, and indices, facilitating diversified trading strategies.

Key features of the MT4 platform include real-time price quotes, advanced charting tools, and a comprehensive suite of analytical indicators. These tools enable traders to conduct in-depth technical analysis, aiding in the identification of market trends and potential trading opportunities. Additionally, the platform supports the execution of a variety of order types, including market, limit, and stop orders, providing flexibility and control over trading activities.

Deposit & Withdrawal

GAD International Holding Limited provides its clients with the option to make deposits and withdrawals through two widely utilized methods: Credit/Debit Card and Bank Wire Transfer. However, as an unregulated broker, the efficiency and reliability of the deposit and withdrawal processes offered by GAD cannot be independently verified.

Customer Support

GAD International Holding Limited offers customer support services to its clients mainly through the channel of email communication. Clients can communicate their questions, issues, or requests by sending an email to the designated address: info@gydforex.com. While email communication offers a written record of interactions, it is also essential to consider that it may not provide the immediacy and convenience of real-time support channels such as live chat or telephone

Educational Resources

At present, GAD does not offer any educational resources to its clients. This means that individuals who are seeking educational materials to enhance their knowledge and understanding of trading concepts, strategies, and the financial markets may need to explore alternative sources.

Is GAD suitable for beginners?

As an unregulated entity, GAD International Holding Limited may not be suitable for beginners due to the potential risks and lack of investor protection associated with trading with unregulated brokers.

The following points should be considered:

Regulatory Oversight: GAD operates as an unregulated broker, meaning that it does not fall under the supervision or oversight of any financial regulatory authority. This lack of regulation can potentially expose beginners to higher risks, as there may be no regulatory body to turn to for assistance or to ensure compliance with industry standards.

Educational Resources and Support: GAD does not currently provide educational resources to its clients. This absence of educational materials can be a disadvantage for beginners who typically rely on educational resources to acquire knowledge and develop their trading skills.

Poor customer Support: GAD offers customer support services through email communication. While this provides a means for beginners to seek assistance and address inquiries, the absence of real-time support channels, such as live chat or telephone, may limit the level of support available to them.

Is GAD suitable for experienced traders?

Similarly, experienced traders should be carefully assessed due to the potential risks associated with trading with unregulated brokers.

The following factors should be considered:

Regulatory Oversight: GAD operates as an unregulated broker, which means it does not fall under the jurisdiction and oversight of any financial regulatory authority. Experienced traders are generally aware of the potential risks involved in trading with unregulated brokers and may possess the knowledge and skills to navigate these risks effectively.

Execution and Liquidity: Experienced traders often require efficient trade execution and access to sufficient liquidity to execute their strategies effectively. Whereas it does not seem that GAD offers high liquidity to meet experienced traders' needs.

Poor customer support: Although experienced traders may require less hand-holding compared to beginners, prompt and reliable customer support is still important. Obviously, this broker does not provide dedicated customer support for experienced traders while trading.

Conclusion

After a thorough analysis of GAD, cautious consideration is warranted before trading in trading activities with this unregulated entity. The absence of regulatory oversight should be regarded as a potential risk factor for experienced traders, who typically seek a reliable and secure trading environment. Evaluating GAD's offerings, it is necessary to assess the comprehensiveness and sophistication of their trading tools, the efficiency of order execution processes, the availability of diverse instruments and markets, and the presence of tailored account types. Lastly, GAD frustrates traders by offered limited options of customer support, email only.

FAQs

Q: Is GAD International Holding Limited a regulated broker?

A: No, GAD operates as an unregulated broker.

Q: How efficient is the order execution process with GAD?

A: The efficiency of GAD's order execution process can vary.

Q: What financial instruments and markets can be traded with GAD?

A: GAD offers a range of tradable instruments, including currency pairs, cryptocurrency, precious metals, indices.

Q: How can I contact GAD?

A: GAD can only be reached through email: info@gydforex.com.

Q: What is the maximum trading leverage offered by GAD?

A: The maximum trading leverage offered by GAD is up to 1:500.

熱點資訊

BingX是否適合外匯投資人使用?平台評價、展業情況、潛在風險一次看

透過網路接觸到TOPWEALTH創富兆業,這家經紀商適合台灣投資人嗎?

做交易的四大核心理念

簡單易懂、追蹤趨勢的20EMA交易策略

IUX受澳洲ASIC與南非FSCA監管,為何整體評價不高?外匯天眼帶你了解平台詳細資訊與潛在風險

匯率計算