Sanabil Capital

摘要:Sanabil Capital is a brokerage company registered in the Seychelles and offers financial trading to global clients except for those come from United States, Belgium, Canada, and Singapore. Their products include forex, commodities, indices and stocks. The company offers demo account for practicing and the popular MT4 and MT5 trading platform for superior trading experience.

Sanabil Capital Information

Sanabil Capital is a brokerage company registered in the Seychelles and offers financial trading to global clients except for those come from United States, Belgium, Canada, and Singapore. Their products include forex, commodities, indices and stocks. The company offers demo account for practicing and the popular MT4 and MT5 trading platform for superior trading experience. Its tiered accounts cover the needs of a wide range of customer groups with different capital and experience levels. Moreover, The company features its own physical “Sanabil Capital Prepaid Card” which can be used for payment.

However, it should not be neglected that the broker currently operates without regulation from any authorities, degrading its credibility and reliability.

Pros and Cons

| Pros | Cons |

| Demo accounts | Offshore regulated |

| Tiered accounts | Do not serve clients in some countries |

| Affordable minimum deposit | Invalid MT4/5 trading platform |

| Innovative sanabil capital prepaid card | Limited payment methods |

| Fund segregation |

Is Sanabil Capital Legit?

Sanabil Capital is currently offshore regulated by FSA (The Seychelles Financial Services Authority) with license no.SD173. Offshore regulation usually does not guarantee full scope of supervision and resolve of diputes.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Status |

| FSA (The Seychelles Financial Services Authority) | SANABIL CAPITAL LTD | Retail Forex License | SD173 | Offshore regulated |

What Can I Trade on Sanabil Capital?

Sanabil Capital claims to offer over 100 assets for trading, these include forex, indices, commodities and stocks.

For forex, investors usually make profit or loss through price fluctuations of different currency pairs such as EURUSD, GBPJPY, GBPEUR, etc. While popular commidties are engery products like Brent Crude, WTI or precious metals such as gold and silver.

Indices allow traders to invest in many top companies without choosing individual stocks and traders can own fractional shares of global stocks such as Meta, Apple, Alibaba, etc.

One of the key principles of investing is never putting all eggs in one basket. Scatter your funds into several products to dilute risks and potential losses.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ❌ |

| Shares | ✔ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type (Minimum Deposit/Leverage/Spreads & Commissions)

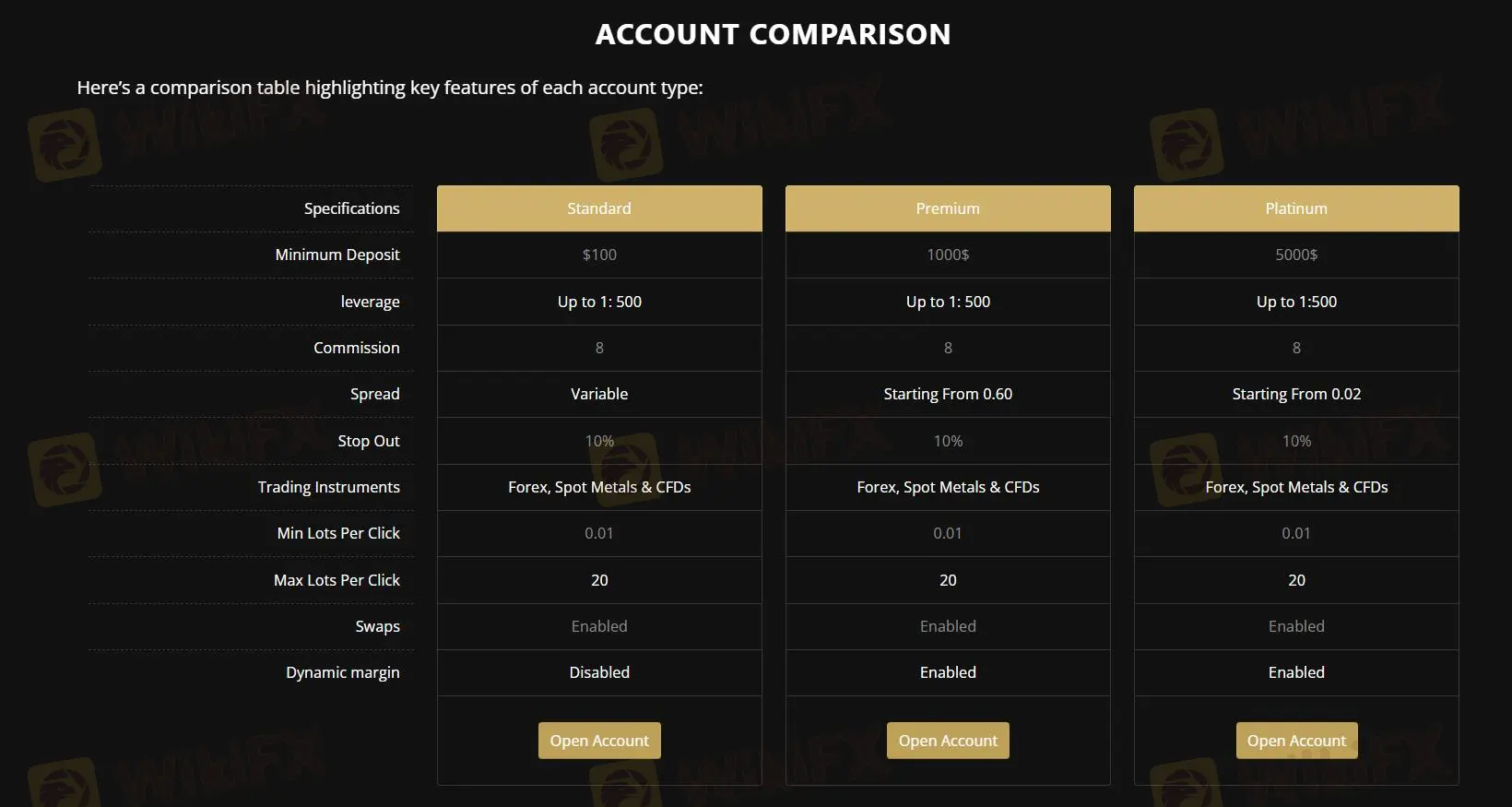

Except for a demo account which enable traders to get familiar to the platform first in risk-free environment, Sanabil Capital also offers 3 tiered live accounts.

- Standard Account: This accountis suitable for beginners who have just started their journey and do not have much initial capital.

- Premium Account: More experienced traders seeking enhanced features and competitive spreads can choose this account.

- Platinum Account: Seasoned traders and high-volume investors who requires superior trading conditions with tighter spreads will prefer this account which claims personalized customer support and exclusive perks.

| Acount Type | Min Deposit | Min Order | Max Leverage | Spread | Commission |

| Standard | $100 | 0.01 lot | Up to 1:500 | Variable | $0 |

| Premium | $1,000 | From 0.6 pips | Not specified | ||

| Platinum | $5,000 | From 0.02 pips | Not specified |

Trading Platform

Sanabil Capital claims to offer the powerful and versatile MT4 and MT5 trading platforms. MT5 is the upgraded version of MT4, both platforms are renowned for their user-friendly intuitive interface, robut performance advanced analysis tools and flexible customization. You can reach both platform on web, PC and mobile devices. But strangely, the download links of these two platforms on Sanabil website led to erro page. Seek clarification from the broker before stepping into real trading.

Except for the well-recognized MT4 and MT5 platforms, the broker also offers a proprietary Sanabil Capital moble App that can be downloaded from both iOS and Android devices.

Sanabil Capital Prepaid Card

Sanabil Capital distinguishes itself with a 3-year validity physical “Sanabil Capital Prepaid Card” which enables traders to fund their accounts, conduct trades, transfer funds and withdraw from their Sanabil wallet or an ATM machine. You can also make online payments or purchases via the card.

Deposit & Withdrawal

Sanabil Capital offers two payment methods: wire tranfer via bank card and coinsbuy via cryptocurrency.

Customer Support Options

If you want any help or support from Sanabil Capital, you can reach them through phone, email, social media, or visit them in person in their Seychelles office.

In addition to the above, you can also submit a contact ticket on their website and wait for callback or email from a representative.

Their customer support is available from 10:00 AM to 10:00 PM (GMT+4), Monday to Friday.

| Contact Options | Details |

| Phone | +2484325584 |

| info@sanabilcapital.com | |

| support@sanabilcapital.com | |

| Support Ticket System | ✔ |

| Online Chat | ❌ |

| Social Media | ✔ |

| Supported Language | English |

| Website Language | English |

| Registered Address | B11, First Floor, Providence Complex, Providence, Mahe, Seychelles |

| Physical Address | No. 20, Abis Centre Providence, Mahe, Seychelles |

The Bottom Line

Though the company is offshore regulated, it's still not a bad choice for clients in general perspective. The company implements fund segregation, seperating client funds from their operation account even when there's insolvency. Other measures such as risk control, data encryption and partnership with reputable banks further enhance customer protection. You can start with a demo account with the broker first.

But bear in mind, it's never too careful to be prudent with any investment activities.

FAQs

Is Sanabil Capital safe?

Though the broker is offshore regulated so far, it's still relatively safe due to its protection measures such as data encryption, fund segregation, risk control and partnership with reputable banks.

Is Sanabil Capital good for beginners?

Yes, the company offers demo account for practicing and affordable minimum capital from $100 for beginners.

What trading platform does Sanabil Capital have?

Sanabil Capital offers MT4/MT5 and its own Sanabil Capital Mobile App for trading. But be reminded that the MT4/MT5 download links on its website are currently not accessible.

Are there any regional restrictions on Sanabil Capital services?

Yes, the broker does not provide services to residents of the United States, Belgium, Canada, and Singapore.

Risk Warning

Online trading involves considerable risk, so it may not be suitable for every client. Please make sure that you totally understand the risks involved and notice that the information above provided in this review may be subject to alteration owing to the constant updating of the company's services and policies.

天眼交易商

热点资讯

监管变动预警:这个香港机构也是个老六

尼克斯打进东决!当家球星唐斯签约Hola Prime 你真的了解自营交易吗?

汇率计算