RannForex

摘要:RannForex, founded in 2013, is a brokerage registered in Seychelles. The trading instruments it provides cover 49 types of forex, 5 types of metals, 3 types of energies, 11 types of indices. It is regulated by Seychelles.

| RannForex Review Summary | |

| Founded | 2013 |

| Registered Country/Region | Seychelles |

| Regulation | FSA |

| Market Instruments | 49 types of forex, 5 types of metals, 3 types of energies, 11 types of indices |

| Account Type | MT5 PRO Account, MT5 ZERO Account |

| Demo Account | ✔ |

| Leverage | Up to 1:500 |

| Minimum trading set | 0.01 lots |

| Trading Platform | MT5 |

| Payment Method | Bank Wire, Crypto, Volet |

| Customer Support | Email: info@rann.forex |

| Physical Address: Block B, Global Village, Jivan's Complex, Mont Fleuri,Mahe, Seychelles. | |

RannForex Information

RannForex, founded in 2013, is a brokerage registered in Seychelles. The trading instruments it provides cover 49 types of forex, 5 types of metals, 3 types of energies, 11 types of indices. It is regulated by Seychelles.

Pros and Cons

| Pros | Cons |

| Regulated | No Islamic account |

| Wide range of trading instruments | No information about phone |

| Generous leverage up to 1:500 | Limited payment methods |

| MT5 supported | No MT4 supported |

| Demo account available | |

| Low min deposit | |

| High maximum leverage |

Is RannForex Legit?

RannForex is regulated by FSA in Seychelles. Its current status is offshore regulated.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| Seychelles | FSA | RannForex Limited | Retail Forex License | SD151 | Offshore Regulated |

What Can I Trade on RannForex?

RannForex offers traders 49 types of forex, 5 types of metals, 3 types of energies, 11 types of indices to trade.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Energies | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Commodities | ❌ |

| Stocks | ❌ |

| Futures | ❌ |

| Options | ❌ |

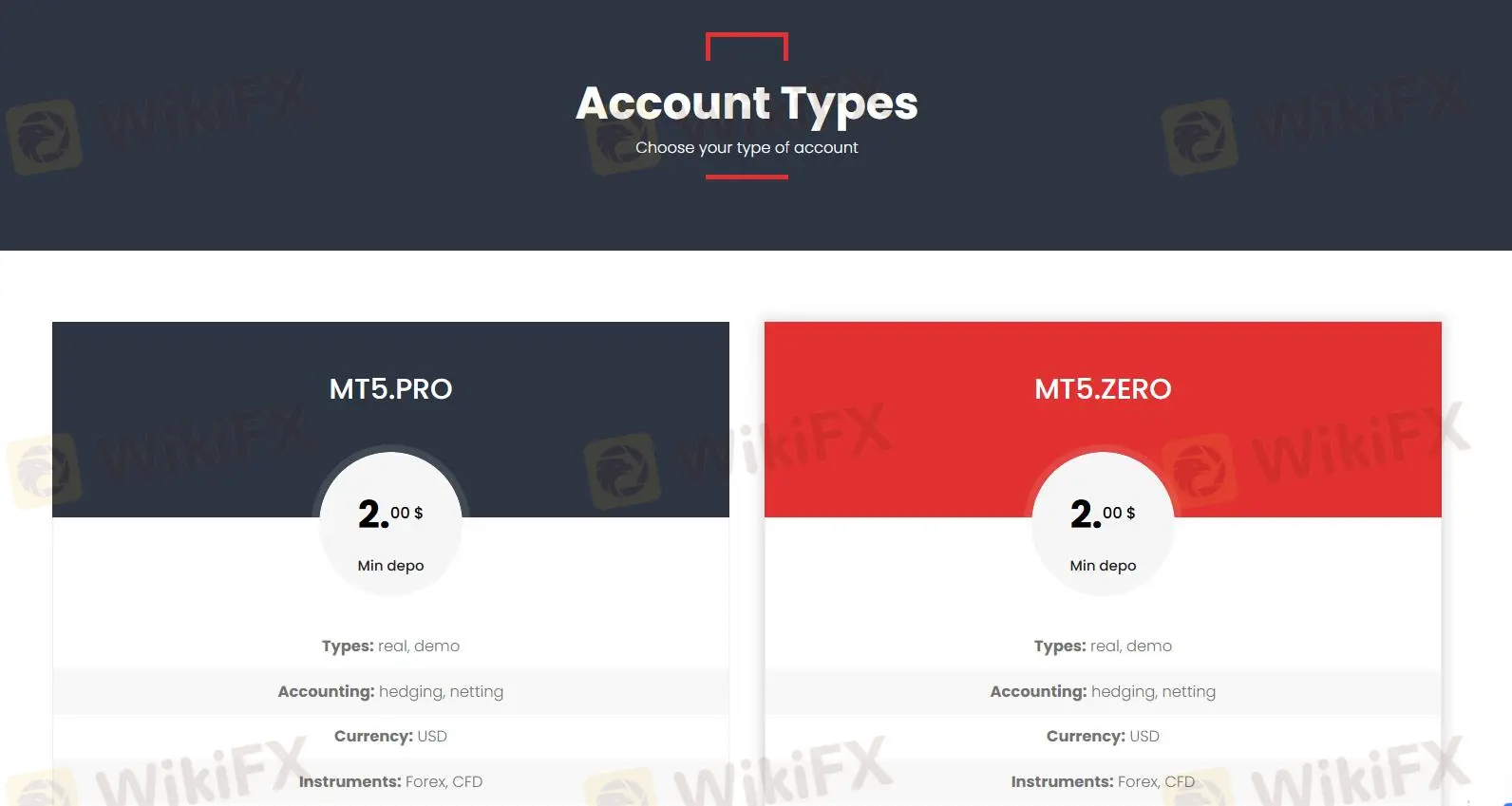

Account Types

RannForex offers 2 different types of accounts to traders - MT5 PRO Account, MT5 ZERO Account. It also provides demo accounts.

| Account Type | MT5 PRO Account | MT5 ZERO Account |

| Min Deposit | $2 | $2 |

| Minimum volume | 0.01 Lot | 0.01 Lot |

| Leverage | 1:500 | 1:500 |

| Locked margin | 50% | 50% |

| Commission | $20 per 1 million USD (for one side) around 4$ per lot | $0 (moved to spread) |

| Stop out | 60% | 60% |

| Demo Account | ✔ | ✔ |

RannForex Fees

RannForex charges $20 per 1 million USD (for one side) around 4$ per lot for MT5 PRO Account, $0 (moved to spread) for MT5 ZERO Account. RannForex's spreads are 0.1 - 976.6 pips.

Trading Platform

RannForex's trading platform is MT5, which supports traders on PC, Mac, iPhone and Android.

| Trading Platform | Supported | Available Devices |

| MT5 | ✔ | Web, Mobile |

| MT4 | ❌ |

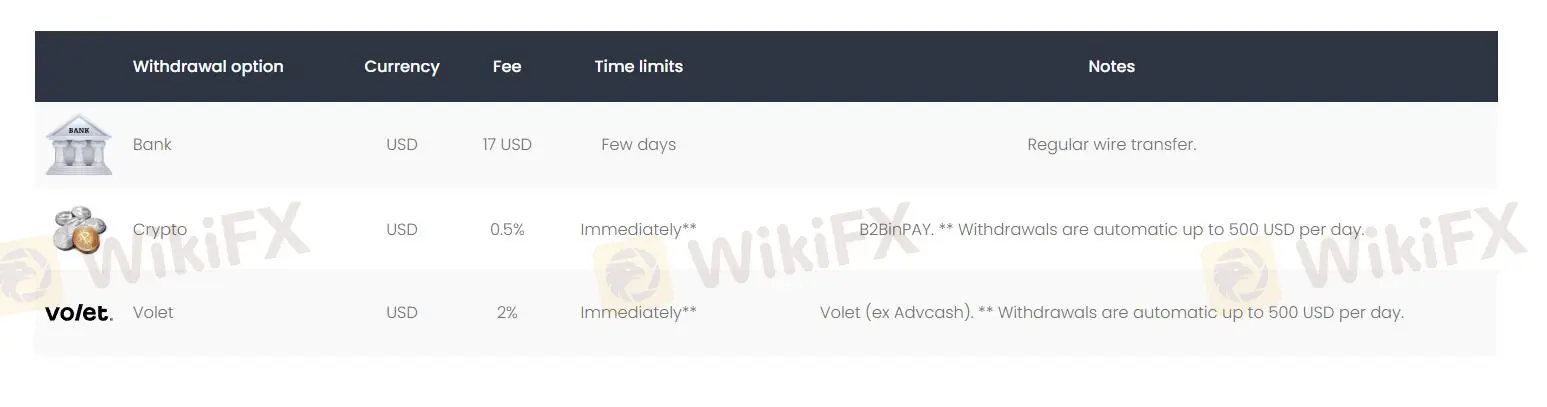

Deposit and Withdrawal

The broker supports provides 3 type of deposit and withdrawal methods - Bank Wire, Crypto, Volet. RannForex charges fees for deposits and withdrawals.

| Currency | Fee | Time limits | Notes | |

| Bank Wire | USD | 0% | Few days | Regular wire transfer |

| Crypto | USD | 0.5% | Immediately | B2BinPAY - Cryptocurrencies (USDT, BTC, ETH etc.) |

| Volet | USD | 1% | Immediately | Volet (ex Advcash) – popular payment system. |

| Currency | Fee | Time limits | Notes | |

| Bank Wire | USD | 0% | Few days | Regular wire transfer |

| Crypto | USD | 0.5% | Immediately | B2BinPAY - Cryptocurrencies (USDT, BTC, ETH etc.) |

| Volet | USD | 1% | Immediately | Volet (ex Advcash). ** Withdrawals are automatic up to 500 USD per day. |

天眼交易商

热点资讯

顶流外汇交易商被曝丑闻,当监管开始沉默,谁来阻止下一场投资灾难?

AGA产品暴雷、金丰来平台停服协助调查,AI交易系统是“天使守护”还是魔鬼收割?

汇率计算