SABLE

摘要:Sable FX, established in 2024 and registered in the United Kingdom, is a new entrant in the online trading industry. Sable operates its proprietary trading platform and provides a demo account for practice. However, it is not regulated.

| SABLE Review Summary | |

| Founded | 2024 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Forex, commodities, stock indexes and cryptos |

| Demo Account | ✅ |

| Leverage | Up to 1: 400 |

| Spread | / |

| Trading Platform | SABLE Trading Platform |

| Min Deposit | 0.4% of capital investment |

| Customer Support | Email: info@sablefx.com |

Sable FX, established in 2024 and registered in the United Kingdom, is a new entrant in the online trading industry. Sable operates its proprietary trading platform and provides a demo account for practice. However, it is not regulated.

Pros and Cons

| Pros | Cons |

| Various tradable products | Newly established |

| Demo accounts available | Unregulated status |

| Limited account types | |

| No MT4/5 | |

| Limited contact channels |

Is SABLE Legit?

No, SABLE lacks regulatory oversight. Please be aware of the risk!

What Can I Trade on SABLE?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Stock indexes | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

SABLE only offers an Electronic Communications Network (ECN) account with 0.4% of capital investment. Besides, demo accounts are also available.

Leverage

SABLE offers the maximum leverage of 1:400. Remember, high leverage can amplify potential profits, it also significantly increases risk.

Trading Platform

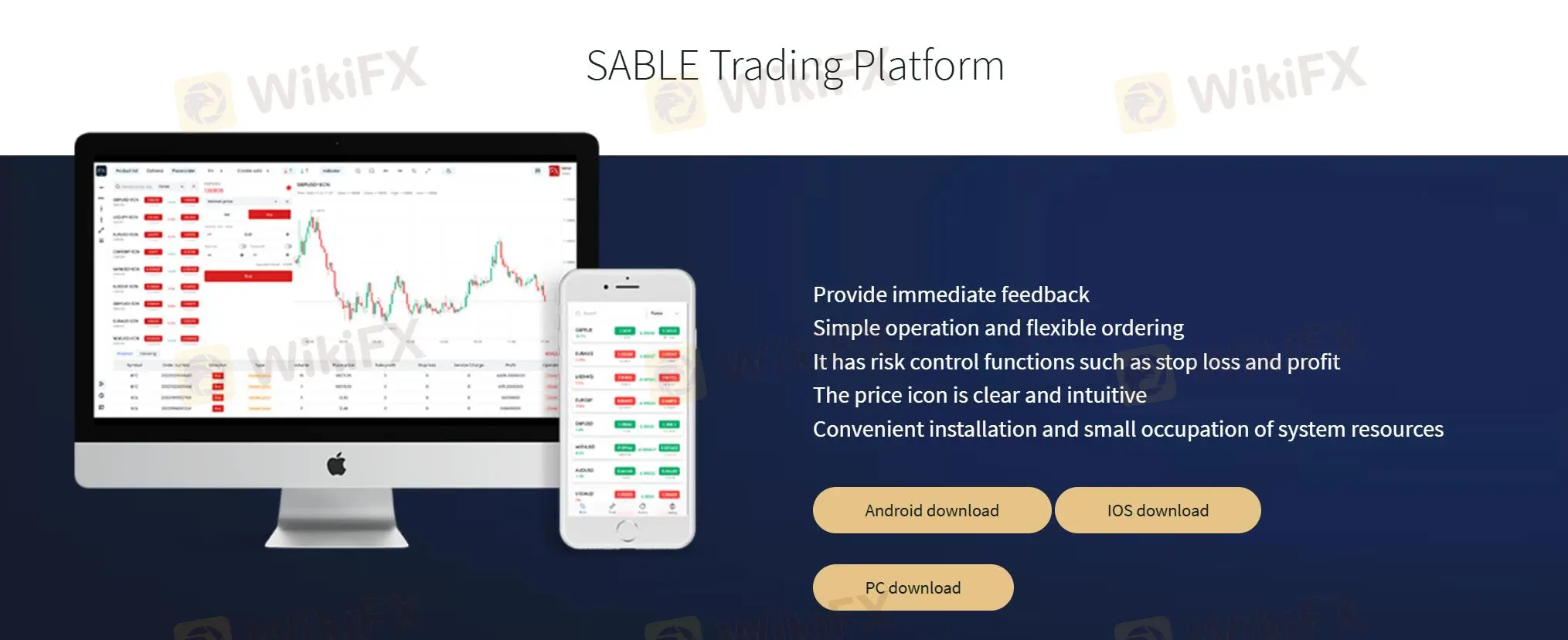

In the SABLE Trading Platform, it supports educational videos, immediate feedback, simple operations, and flexible ordering. Available for Android, iOS, and PC.

| Trading Platform | Supported | Available Devices | Suitable for |

| ABLE Trading Platform | ✔ | Android, iOS, PC | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

天眼交易商

热点资讯

还记得暴雷的TRI拓利吗? 合并后的NCE现在无法出金

警惕高回酬投资骗局:两名退休男子损失逾百万令吉

保命攻略|美联储大戏今夜将启 小心他们会这样搞你!

网络投资诈骗再现,砂拉越两男子共失27万令吉

大马炒汇用什么平台?当地网友:这题我会,刚还领了福利!

200万出金遭拒 香港券商全面收紧内地投资者开户

WikiFX天眼评分及评论真实性的重要声明

【官方公告】WikiFX维权服务始终免费,守护每一位投资者权益!

汇率计算