What Is VT Markets?

摘要:What is VT Markets? VT Markets is an award-winning online trading broker founded in 2015, positioning itself as a global multi-asset platform focused on "making trading simpler and more accessible" for traders of all experience levels. To date, it has gained over 3 million registered users, 600,000+ active clients, processes over 60 million trades monthly with a monthly trading volume exceeding $720 billion, and built a strong industry reputation through mature technical infrastructure and customer-centric services.

| VT Markets Review Summary | |

| Founded | 2017-12-18 |

| Registered Country/Region | Australia |

| Regulation | FSCA-Regulated, ASIC-General Registration |

| Market Instruments | Forex, Indices, Energies, Precious Metals, Cryptocurrencies, CFDs, Soft Commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | As low as 0 pips |

| Trading Platform | VT Markets App (Web/mobile), MT5 and MT4 (PC/mobile download), TradingView, WebTrader (Web-based, no download) |

| Min Deposit | $50 (Cent Account) |

| Customer Support | support@vtmarkets.com |

| + 27 101412968 | |

| Live Chat | |

| LinkedIn, Twitter, YouTube, Facebook, Instagram | |

VT Markets Information

What is VT Markets? VT Markets is an award-winning online trading broker founded in 2015, positioning itself as a global multi-asset platform focused on “making trading simpler and more accessible” for traders of all experience levels. To date, it has gained over 3 million registered users, 600,000+ active clients, processes over 60 million trades monthly with a monthly trading volume exceeding $720 billion, and built a strong industry reputation through mature technical infrastructure and customer-centric services.

It also has deep partnerships with sports entities like Premier League‘s Newcastle United Football Club and Maserati MSG Racing, provides client fund protection underwritten by Lloyds Insurance, holds membership in the Financial Commission, and offers multilingual support via email (support@vtmarkets.com), phone (+27 101412968), and live chat to meet global traders’ needs.

Pros and Cons

| Pros | Cons |

| Regulated | Small handling fee applies (no unified standard) |

| 1000+ tradable instruments (Forex/Indices/Crypto, etc.) | Crypto‘s Swap/expiration rules not clearly labeled |

| Standard STP/Cent/RAW ECN/PRO ECN/Swap-Free accounts available | Weak localized support in some European regions |

| Spread from 0.0 pips (RAW ECN) | |

| No commissions for Standard STP | |

| Free deposits | |

| Segregated custody + $1M insolvency protection | |

| Supports MT4/MT5/TradingView, award-winning VT Markets App |

Is VT Markets Legit?

VT Markets guarantees compliance and security via key measures: client funds are segregated, insured up to $1M by Lloyds, and it’s a Financial Commission member for dispute mediation. With 9+ years in operation, no major compliance issues, and transparent website disclosures (no hidden fees), it meets safety standards.

VT Markets is a legitimate and compliant broker, supported by the following key factors:

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| FSCA | Regulated | VT MARKETS (PTY) LTD | South Africa | Retail Forex License | 50865 |

| ASIC | General Registration | VT GLOBAL PTY LTD | Australia | Investment Advisory License | 516246 |

What Can I Trade on VT Markets?

The platform covers 8 asset classes and 1,000+ tradable instruments. Key products include:

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Energies | ✔ |

| Precious Metals | ✔ |

| Cryptocurrencies | ✔ |

| CFDs | ✔ |

| Soft Commodities | ✔ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

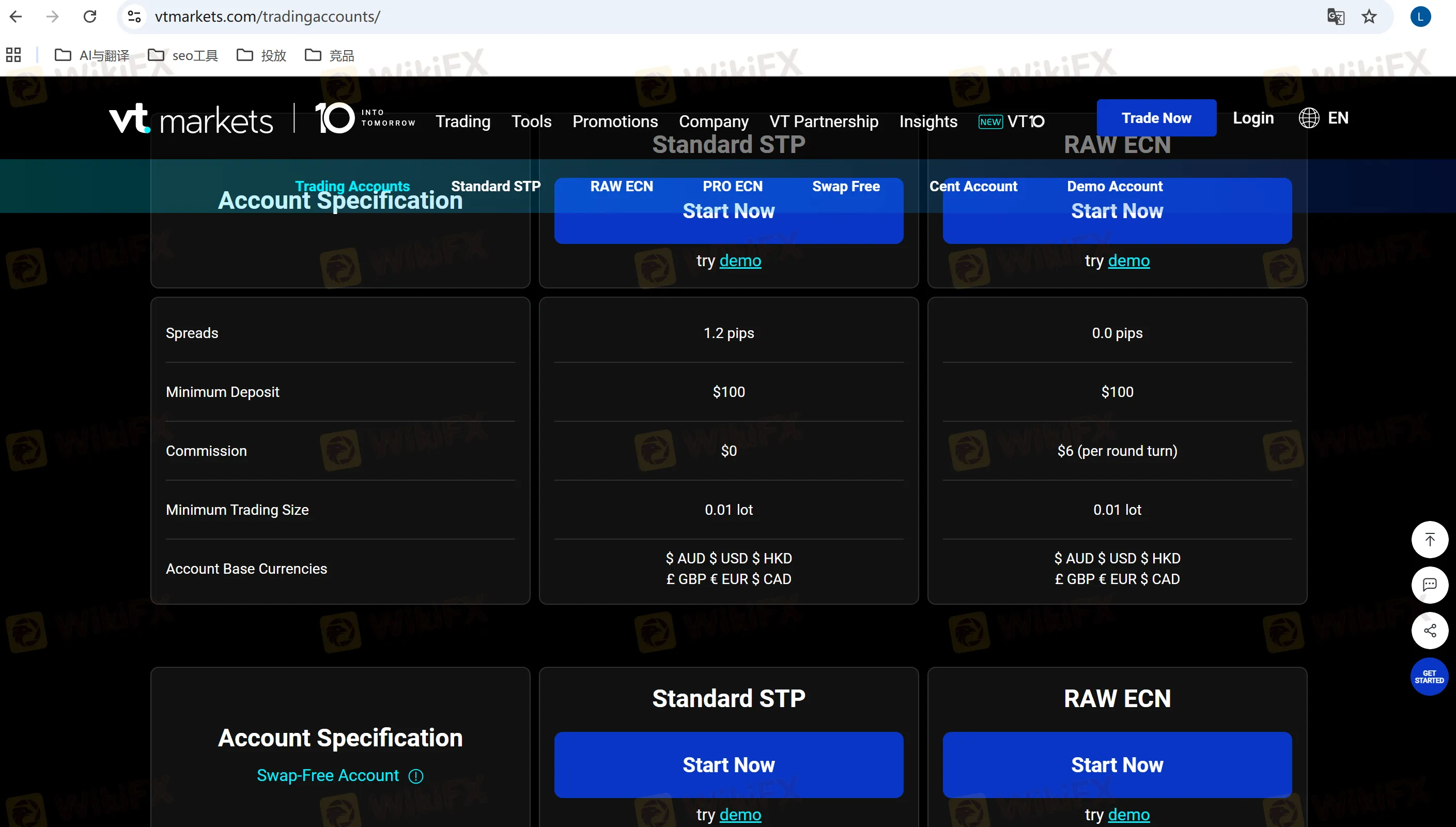

What account types does VT Markets offer? VT Markets offers 6 account types tailored to different traders needs. Key parameters are compared below:

| Feature | Standard STP | RAW ECN | PRO ECN | Swap-Free | Cent Account | Demo Account |

| Min. Deposit | $100 | $100 | Contact Support | $100 | $50 | $0 |

| Spreads From | 1.2 pips | 0.0 pips | 0.0 pips | 1.2 pips (STP)0.0 pips (ECN) | 1.1 pips (STP)0.0 pips (ECN) | Same as live accounts |

| Commission | $0 | $6 per lot(round turn) | Ultra-low(Contact) | $0 (STP)$6 (ECN) | $0 (STP)$6 (ECN) | $0 |

| Min. Trade Size | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

| Suitable For | BeginnersLow-volume traders | Active tradersScalpers | Professional tradersInstitutions | Muslim tradersLong-term holders | Complete beginnersPractice | All strategy testers |

VT Markets Fees

How about VT markets fees? The platform has a transparent fee structure, mainly divided into “trading fees” and “deposit/withdrawal fees,” with no hidden costs:

What are VT Markets Trading Fees Details?

| Fee Type | Account Type | Fee Details |

| Spreads | Standard STP | Floating, starting from 1.2 pips |

| RAW ECN / PRO ECN | Floating, starting from 0.0 pips (e.g., EURUSD can be near 0 pips) | |

| Commission | RAW ECN | $6 per round turn (per standard lot) |

| PRO ECN | Lower (Contact for specific rates) | |

| Standard STP / Cent | $0 | |

| Overnight Swap | All non-Islamic accounts | Applies to long/short positions (e.g., often $0 for shorting BTC; small fees for some long positions) |

| Swap-Free (Islamic) | $0 |

Can I Know VT Markets' Deposit and Withdrawal Fees

| Action | Method | Fee Details |

| Deposit | All Methods (Card, Wire, E-Wallet, etc.) | Free |

| Withdrawal | Bank Wire Transfer | Small handling fee (e.g., ~$10–$20 per transfer) |

| Cryptocurrency | Based on network miner fees | |

| E-Wallets/Others | A small fee may apply |

Leverage

What VT Markets leverage can I use? VT Markets offers flexible leverage options, with maximum leverage varying by account and instrument. Key rules include:

| Leverage | Applicable Instruments |

| Up to 1:1000 | Major Forex Pairs, Indices |

| ~1:10 | Cryptocurrencies (e.g., BTCUSD) |

| ~1:200 | Precious Metals (e.g., XAUUSD) |

| Adjustable (Min 1:1) | All Account Types (STP, ECN, Swap-Free) |

Trading Platform

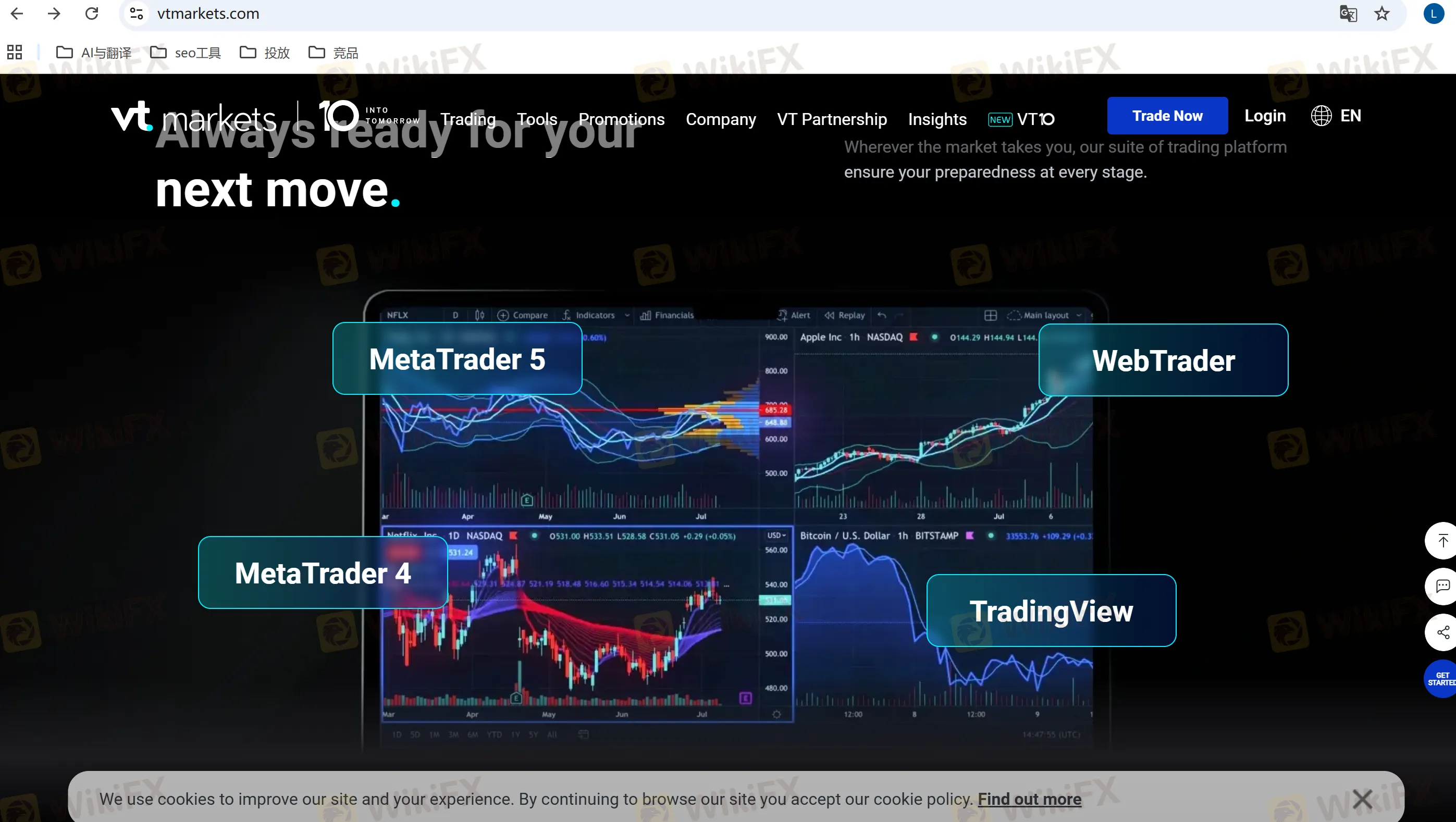

Does VT Markets provide MT4 and MT5? VT Markets integrates 5 mainstream platforms, covering “mobile, PC, and web” to meet diverse scenarios:

| Trading Platform | Supported | Available Devices | Suitable for |

| VT Markets App | ✔ | Mobile (iOS/Android) | On-the-go, fragmented-time trading |

| MetaTrader 5 (MT5) | ✔ | PC/mobile download | Beginners, multi-asset traders |

| MetaTrader 4 (MT4) | ✔ | PC/mobile download | Experienced traders, MT4 习惯 users |

| TradingView | ✔ | Web/mobile | Technical analysis, strategy development |

| WebTrader | ✔ | Web-based (no download) | Temporary trading, no download access |

Deposit and Withdrawal

How about VT Markets Deposit and Withdrawal? For VT Markets‘ deposit process, supported methods include credit cards (Visa/MasterCard), bank transfers, e-wallets (Neteller, Skrill), UnionPay, and Tasapay—with credit card deposits reflecting in minutes, e-wallets (like Neteller) taking under 10 minutes, and bank transfers 1–3 business days; minimum deposits are $100 for Standard STP/ECN Accounts and $50 for Cent Accounts, with no maximum limit. For withdrawals, methods correspond to deposits (following the “same-card/same-account” rule), processing times range from 2 minutes to 1 hour for crypto, same-day for Euro Instant Bank Transfers, and 1–3 business days for regular bank transfers, while there’s no minimum withdrawal amount (some methods may have a $10 floor) or daily frequency limit.

| Feature | Deposit | Withdrawal |

| Supported Methods | Credit/Debit Cards (Visa/Mastercard), Bank Wire Transfer, E-Wallets (Neteller/Skrill), UnionPay | Corresponds to deposit method (Same payment method principle), Bank Wire Transfer, E-Wallets |

| Processing Speed | Cards / E-Wallets: Usually within minutesBank Wire Transfer: 1-3 business days | Crypto: 2 mins - 1 hour (claimed)EUR Instant Transfer: Same day (claimed)E-Wallets: Usually fast (e.g., under 1 hour)Bank Wire Transfer: 1-3 business days |

| Minimum Amount | Cent Account: $50Standard Account: $100 | No minimum limit (Some methods may have a minimum, e.g., $10) |

| Fees | No fee from VT Markets | No fee for basic withdrawals (Fees may apply for specific conditions) |

| Limits | No maximum limit mentioned | No daily limit on the number of withdrawals |

Copy Trading

VT Markets has launched the “VTrade Copy Trading System,” tailored for beginners who want to trade without in-depth market knowledge by following professional traders. Its core features include: access to a “signal pool” where traders can check top performers‘ historical data (profit rate, maximum drawdown, trading frequency), one-click following to automatically replicate real-time order actions, full disclosure of signal providers’ trading records (profits, losses, held instruments) for transparency, and customizable risk controls (maximum follow lot size, stop-loss ratio) for followers to avoid heavy losses.

Bonus

Does VT Markets have a no-deposit bonus? offers two core promotions for new and existing users. Specific rules are subject to real-time platform disclosure (T&Cs apply—certain trading volume requirements must be met to withdraw bonuses):

New User First Deposit Bonus: New traders can enjoy a “maximum 50% bonus” on their first deposit (e.g., a $1,000 deposit earns a $500 bonus, boosting initial trading capital).

Regular Deposit Bonus: All users (including existing ones) receive a “20% bonus” on subsequent deposits, with a maximum bonus of $10,000 per deposit. Bonuses are credited within 1 business day of deposit.

天眼交易商

热点资讯

预测交易,正在成为传统外汇平台的新宠

10万美元天价域名背后的连环骗局 借“鸽子费”榨干投资者,USDT Ventures被官方警示后“借尸还魂”

汇率计算