Straits

摘要:Straits, founded in 2018 and headquartered in Hong Kong, is an unregulated trading company that specializes in providing platforms for trading mainly in commodities, such as agriculture, soft commodities, and metals. The company extends its trading platform services through “Straits direct” and “CQG desktop” and mandates a minimum deposit of $100, with the allure of spreads that can go as low as 0. Although it provides a range of account types to cater to individual traders, commercial hedgers, institutions, and family offices, it operates without official regulatory oversight. Despite this, it offers a spectrum of client support through avenues like phone and email, and also provides educational resources including market analyses and a trading calendar. Clients are offered various deposit and withdrawal options, including via banks, other licensed Carrying Brokers, the CME, or cash transactions. Furthermore, a demo account is available for those who wish to explore the platform w

| Company Name | Straits |

| Registered Country/Area | HongKong |

| Founded Year | 2018 |

| Regulation | Regulated by MAS |

| Minimum Deposit | $100 |

| Spreads | as low as 0 |

| Trading Platforms | Straits direct,CQG desktop |

| Tradable Assets | Mainly commodities (agriculture,soft,metal.etc) |

| Account Types | Individual, commercial hedgers, institutions, family offices |

| Demo Account | Available |

| Customer Support | Phone, email |

| Deposit & Withdrawal | Banks, other licensed Carrying Brokers, or the CME,cash |

Overview of Straits

Straits, founded in 2018 and headquartered in Hong Kong, is a regulated trading company that specializes in providing platforms for trading mainly in commodities, such as agriculture, soft commodities, and metals. The company extends its trading platform services through “Straits direct” and “CQG desktop” and mandates a minimum deposit of $100, with the allure of spreads that can go as low as 0.

Is Straits Legit or a Scam?

| Regulatory Agency | Securities and Futures Commission of Hong Kong | Monetary Authority of Singapore |

|---|---|---|

| Current Status | Revoked | Regulated |

| License Type | Dealing in futures contracts | Retail Forex License |

| Regulated By | Hong Kong | Singapore |

| License No. | BHT974 | Unreleased |

Pros and Cons

| Pros | Cons |

| Diverse Tradable Assets | Lack of Regulation |

| Accessible Trading Platforms | Limited Customer Support |

| Low Spreads | Restricted Deposit and Withdrawal Options |

| Demo Account Availability |

Market Instruments

Straits extends a selection of market instruments, affording traders an intricate trading milieu with a focus on diverse asset categories. Heres an insightful gaze into the available market instruments:

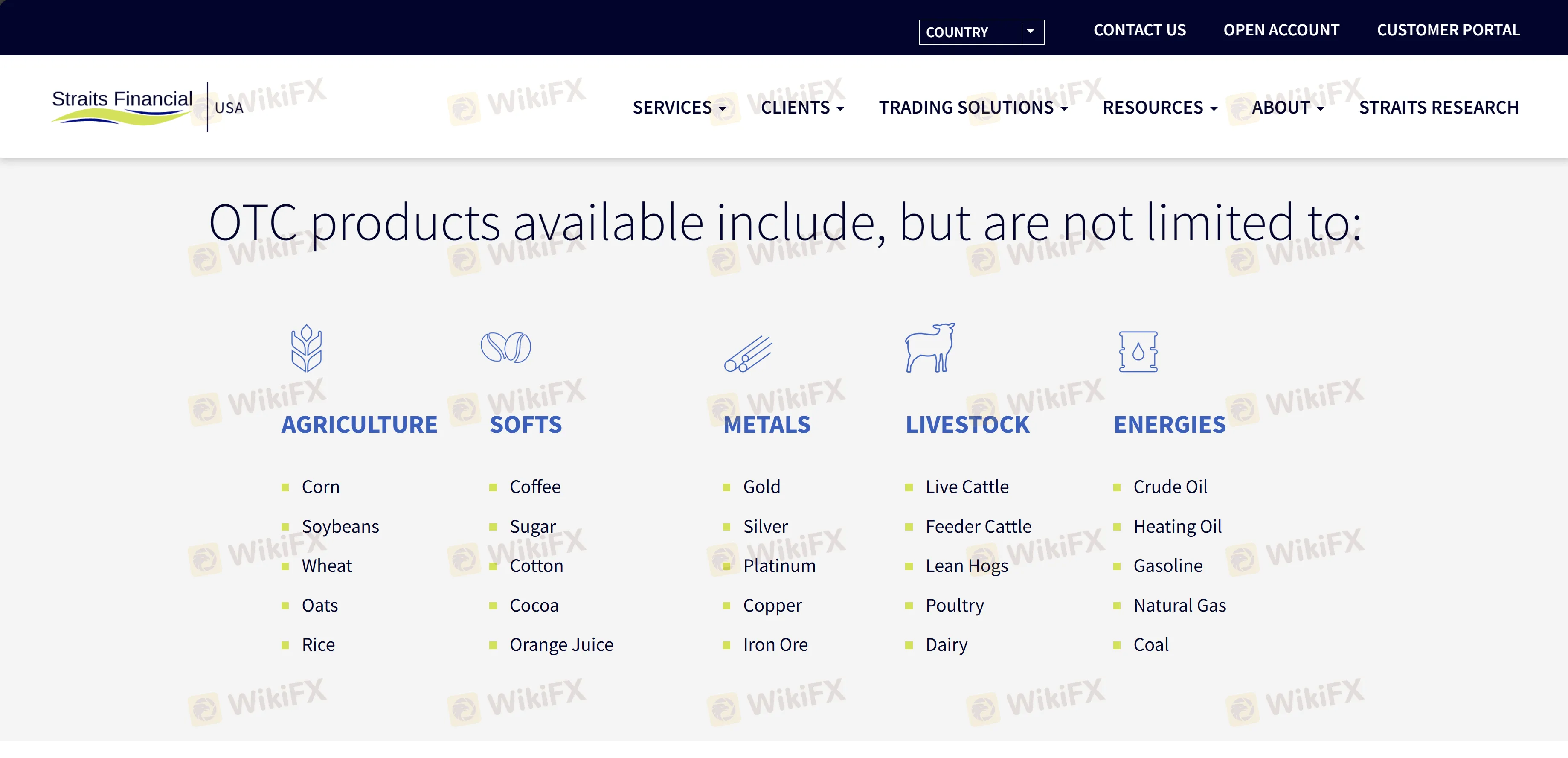

Commodities:

- Variety of Commodities: Straits predominantly provides a platform for commodities trading, enabling participants to delve into various sectors like agriculture, soft commodities, and metals. Traders can engage in speculation or hedge against market fluctuations across these diverse commodity classes.

- Agricultural Commodities: This may include products like grains, coffee, and other crop-based assets, thereby allowing traders to leverage opportunities within the agricultural markets.

- Soft Commodities: Including goods like sugar, cocoa, and others, offering opportunities to capitalize on market movements within this segment.

- Metals: Encompassing assets like gold, silver, and possibly other precious and industrial metals, providing a platform for traders to navigate through the metals market, which can often act as a hedge against inflation or market volatility.

Although Straits opens up a variety of trading opportunities within commodities and potentially safeguards for institutional entities, it is vital to underscore that trading invariably comes with inherent risks.

Account Types

Straits accommodates a diverse clientele by providing four tailored types of accounts to meet the varying needs and objectives of different traders and investors.

- Individual Account:

- Full Service: Ideal for newcomers, this account involves a close partnership with a Straits broker to develop a comprehensive trading plan, providing guidance throughout the learning process and transition to independence in trading as competence grows.

- Broker-Assist: Suitable for both novice and seasoned traders preferring a more hands-on approach, providing access to a broker for recommendations and advice.

- Self-Directed Online: Targeting experienced traders who prefer making autonomous trading decisions, offering various self-executed platforms, 24-hour trade desk service, and access to essential trading tools and resources.

- Commercial Hedgers Account:

Categorized into:

Straits assists diverse commercial hedging clients, including those in agriculture (like commercial farmers and ethanol producers), energies (such as oil refiners and fuel distributors), and metals (including metal dealers and suppliers), in managing commodity price risk through tailored hedging strategies and potentially advising on OTC product strategies for safeguarding against adverse risk exposures.

- Institutions Account:

- Institutional Asset Management: Professional money managers provide holistic asset management services.

- Institutional Trading Tools: Clients access a variety of trading software, quote systems, and real-time monitoring.

- Institutional Trading Services: A dedicated trading team assists in the efficient execution of trades and provides specialized trading support.

- Family Offices Account:

This division services various institutional entities, including fixed income customers, commodity trading advisors (CTAs), hedge fund clients, and financial institutions. Straits offers:

Straits plays a pivotal role in assisting family offices catering to ultra-high-net-worth investors, providing services that necessitate a collective approach from a professional team.

The support spans across various domains, such as cash management, risk management, financial planning, lifestyle management, generational education, business interests, estate planning, philanthropic activities, and tax planning services, aligning with the intricate and multifaceted needs of affluent family governance.

How to Open an Account?

Here's a generalized 5-step guide on how one might open an account with Straits:

- Visit the Official Website: Navigate to the official website of Straits and locate the option to create a new account or sign up. This could be a button or a link, typically located at the top right of the homepage.

- Choose Account Type:Select the appropriate type of account that aligns with your trading or investment objectives and preferences. Straits offers various account options like Individual, Commercial Hedgers, Institutions, and Family Offices. Ensure you select the one that suits your needs and eligibility.

- Complete the Application Form:Fill out the account application form with accurate details. This usually includes personal information (such as name, address, and date of birth), financial information, and potentially your trading experience and risk tolerance. Ensure all details are accurate to avoid any issues with account verification and future transactions.

- Submit Identification Documents:You may be required to provide identification documents to comply with regulatory requirements and for verification purposes. This could include a government-issued ID, proof of address, and potentially additional documents depending on your account type and regional regulations.

- Fund Your Account:Once your account is verified and approved, proceed to fund it using one of Straits accepted funding methods - banks, other licensed Carrying Brokers, or the CME, as per the previously provided information. Ensure you check the minimum deposit requirement and ensure your initial deposit meets this threshold.

Spreads & Commissions

The spreads in straits can be as low as 0. At Straits, traders might benefit from competitive spreads, starting as low as 0, which could provide an advantageous trading environment, especially for those engaged in high-frequency or low-margin trading strategies.

Trading Platform

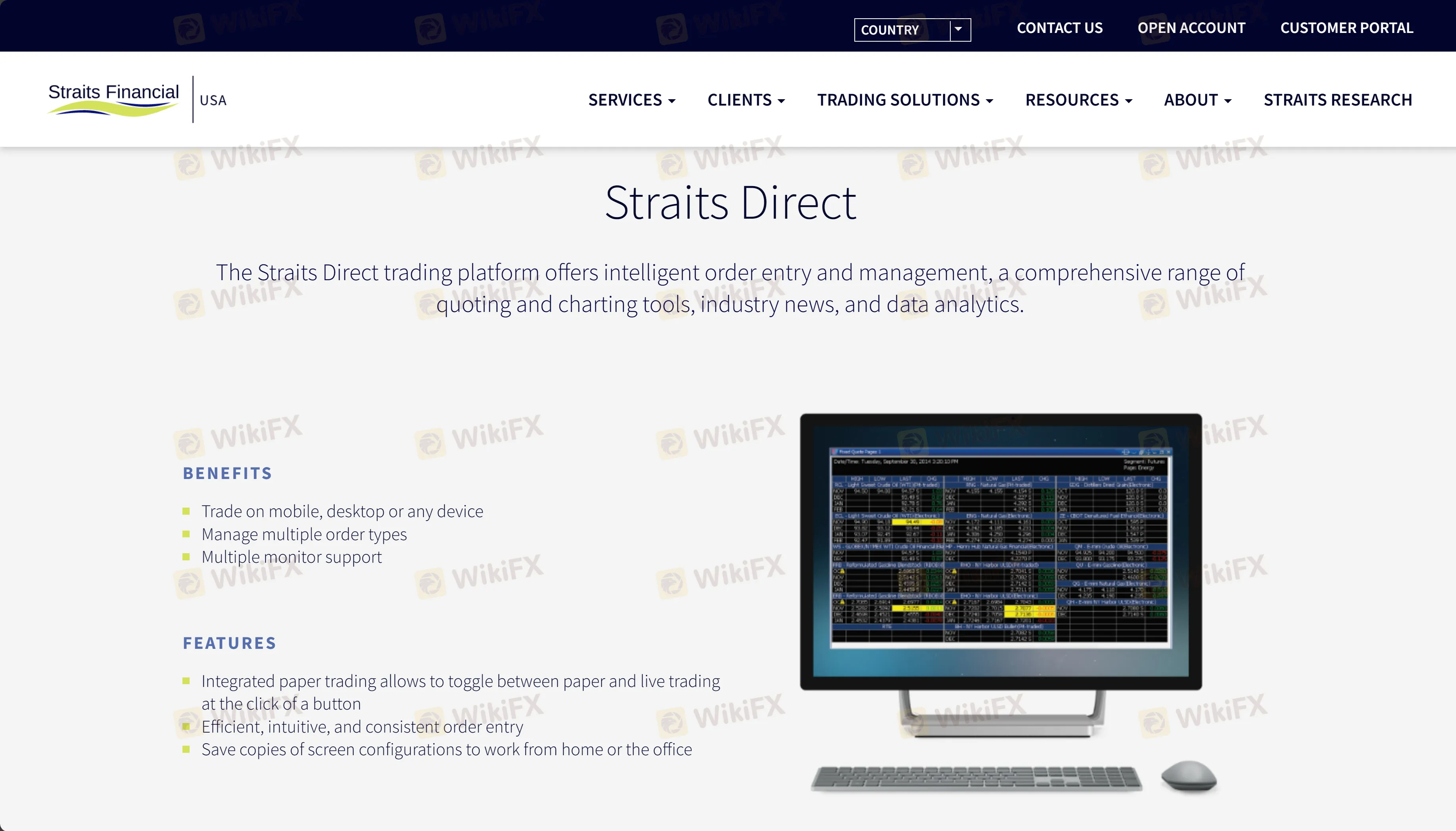

Straits provides its traders with an extensive array of trading platforms, each possessing distinctive features and benefits to cater to various trading needs and preferences.

- Straits Direct: Offering intelligent order entry and management, this platform boasts a plethora of quoting and charting tools, industry news, and data analytics. Its versatile across devices (mobile and desktop) and supports multiple order types with integrated paper trading, consistent order entry, and the convenience to save screen configurations for flexibility between work locations.

- CQG Desktop: Recognized as the next generation of trading and data visualization, it doesn't require a download due to its web-based nature and utilizes HTML 5 framework for seamless integration with other applications. It offers a variety of analytical tools, hybrid order tickets, and an RSS news feed, ensuring traders are well-equipped with essential market insights.

- Other trading platform:The selection includes CQG Integrated Client, CQG Mobile, CQG QTrader, CME Direct, CTS T4, TT New Generation, RITHMIC, and iBroker, each offering a unique blend of functionalities and technological capabilities. From robust charting, automated solutions, mobile compatibility, to real-time quotes and order management, these platforms cater to both novice and seasoned traders, ensuring a supportive trading environment across various market conditions and strategies.

Deposit & Withdrawal

Straits extends a range of deposit and withdrawal options for client convenience and efficiency in managing their trading finances. Clients have the ability to utilize banks, other licensed Carrying Brokers, or the CME to conduct their financial transactions, providing a degree of flexibility in how funds are managed and moved within the platform. Also, customers can deposit cash in straits.

Straits adheres to a $100 minimum deposit policy, creating an accessible entry for a spectrum of traders, from newcomers to the well-versed. For in-depth understanding of their financial policies, its advisable for traders to consult the Straits website or reach out to their customer support, ensuring clarity on transaction methods, potential fees, and processing timeframes.

Customer Support

Straits endeavors to maintain a robust and accessible customer support system to assist its global clientele effectively. Clients and interested traders can reach out to their support team via numerous contact numbers based on their geographical location: +65 6672 9669 (Singapore), +1 312 462 4499 (USA), and +62 21 5010 3599 (Indonesia), all offering assistance in English.

Additionally, queries, concerns, or any correspondence can be communicated through email atinfo@straitsfinancial.com. The company, known officially as Straits Financial Group and abbreviated simply as Straits, is registered in Hong Kong.

For further insights about the company, its policies, or any related updates, individuals may visit their official websitehttps://www.straitsfinancial.com/or engage with them on various social media platforms:Twitter,YouTube, andLinkedIn.

FAQs

How can I contact Straits Financial's customer support?

You can reach out to Straits Financial through their contact numbers available for different regions or email them atinfo@straitsfinancial.com.

What are the different trading platforms available under Straits?

Straits offers various platforms, including CQG Desktop, CQG Mobile, CME Direct, CTS T4, TT New Generation, RITHMIC, and iBroker.

Are there any mobile trading solutions available with Straits?

Yes, Straits provides mobile trading solutions through platforms like CQG Mobile and iBroker, ensuring users can trade on the go.

Where can I learn more about Straits' latest updates and news?

For the latest updates and news, you can follow Straits Financial on their official Twitter, YouTube, and LinkedIn profiles.

天眼交易商

热点资讯

67岁退休翁误信网络投资 3个月亏光RM170万积蓄

连转12次!华裔男子被骗RM14,000坠入骗局深渊

70岁货运经理误信网赚投资 血亏近RM70万

53岁马劳误信投资陷阱 痛失RM50万积蓄

e投睿各种费用大赏 清清白白进去,出来要脱层皮!

风险预警|开盘两年就收网?白屏、乱爆、摆烂……巨象金业正在敲响跑路警钟

汇率计算