Crypto Chain Group

摘要:Crypto Chain is an unregulated brokerage firm that offers a diverse range of trading instruments across various asset classes, including forex, commodities, shares CFDs, indices, and digital currencies. With different types of accounts such as Standard, Professional, and ELITE, Crypto Chain caters to traders of varying experience levels and investment capacities. The platform boasts the Crypto Chain Group Pro Wave trading platforms, which provide tools for analyzing market trends, executing trades, and managing portfolios.

Risk Warning

Online trading is dangerous, and you could potentially lose all of your investment funds. Not all investors and traders are suitable for it. Please understand that the information on this website is designed to serve as general guidance, and that you should be aware of the risks.

General Information

| Crypto Chain Group Review Summary | |

| Registered Country/Region | China |

| Regulation | No regulation |

| Market Instruments | forex, commodity, shares CFDs, indices, digital currencies |

| Leverage | 1:200 (Std) |

| Trading Platforms | Crypto Chain Group ProWave |

| Minimum Deposit | $10,000 (Std) |

| Customer Support | email, onine messaging |

What is Crypto Chain Group?

Crypto Chain is an unregulated brokerage firm that offers a diverse range of trading instruments across various asset classes, including forex, commodities, shares CFDs, indices, and digital currencies. With different types of accounts such as Standard, Professional, and ELITE, Crypto Chain caters to traders of varying experience levels and investment capacities. The platform boasts the Crypto Chain Group Pro Wave trading platforms, which provide tools for analyzing market trends, executing trades, and managing portfolios.

Pros & Cons

| Pros | Cons |

| • Diverse Range of Trading Instruments | • Lack of Valid Regulation |

| • Different Account Types for Various Needs | • Unclear Details on Fees and Processing Time |

| • High Initial Deposit Amount |

Crypto Chain Group Alternative Brokers

There are many alternative brokers to Crypto Chain Group depending on the specific needs and preferences of the trader. Some popular options include:

eToro - offers a user-friendly interface and a wide range of trading instruments, a good choice for beginners and those interested in social trading.

Interactive Brokers - With its advanced trading tools, competitive pricing, and extensive range of global markets, Interactive Brokers is recommended for experienced traders who require a robust and customizable trading platform.

TD Ameritrade - Known for its comprehensive research offerings, educational resources, and a user-friendly trading platform, TD Ameritrade is a solid choice for investors seeking a combination of investment guidance and self-directed trading options.

Is Crypto Chain Group Safe or Scam?

Given the absence of valid regulation, there are significant concerns about its safety and legitimacy. With the lack of regulatory oversight increases the risk of potential fraudulent activities or unethical practices, caution is strongly advised when considering Crypto Chain as a trading platform. The combination of no valid regulation and negative reports raises doubts about the platform's credibility and safety, prompting potential users to exercise extreme caution and explore alternative, regulated options to ensure the security of their investments and financial well-being.

Market Instruments

Crypto Chain is a brokerage firm that offers a diverse range of trading instruments across various asset classes. Here's a brief summary of the market instruments available at Crypto Chain:

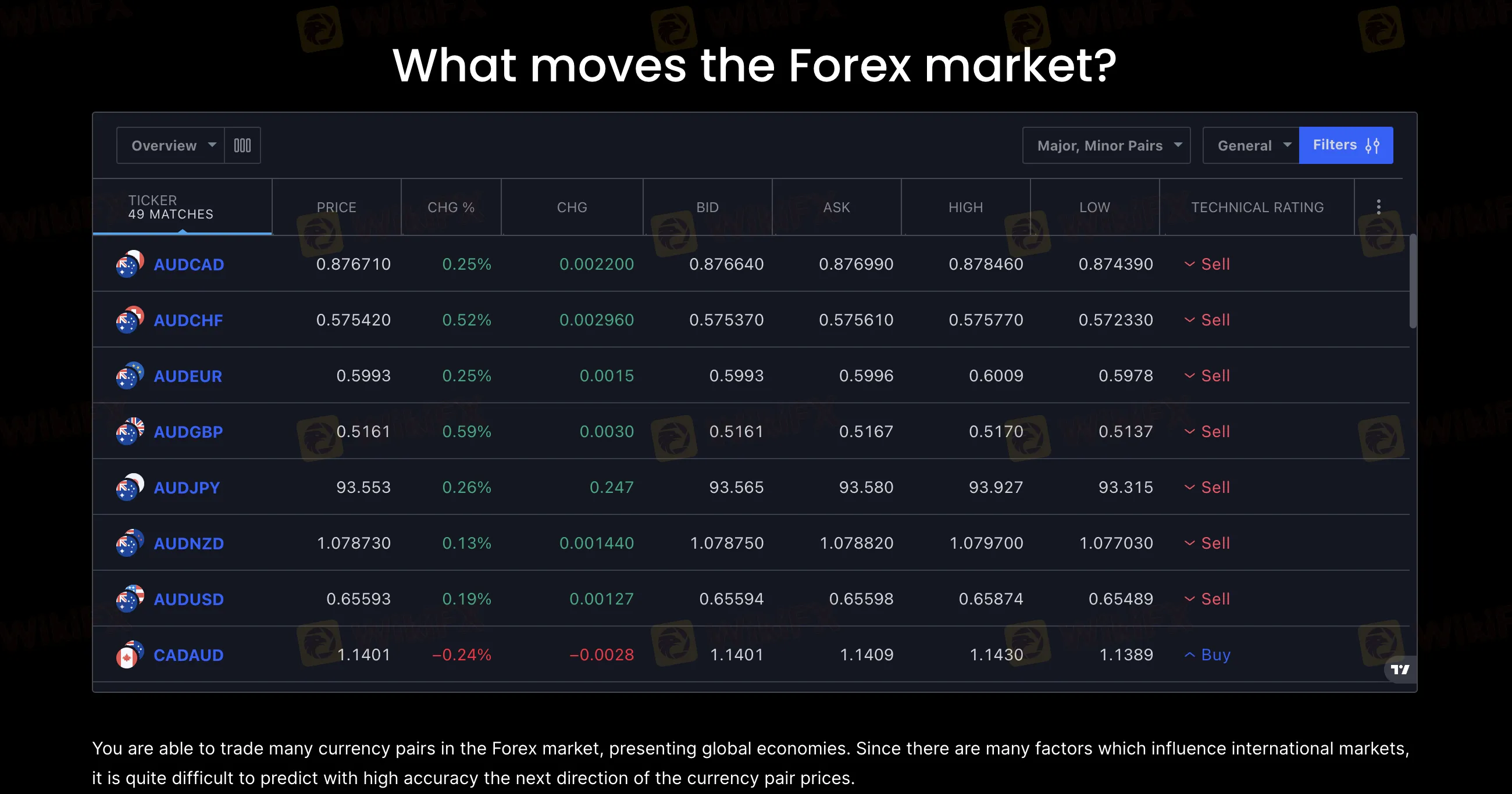

Forex (Foreign Exchange): Crypto Chain provides access to the forex market, where traders can speculate on the exchange rates between different currency pairs. This allows traders to take advantage of fluctuations in currency values.

Commodities: Traders on Crypto Chain can engage in trading commodities such as precious metals (gold, silver), energy resources (oil, natural gas), agricultural products (wheat, corn), and other raw materials.

Shares CFDs (Contracts for Difference): Crypto Chain offers the opportunity to trade Contracts for Difference (CFDs) on shares of various companies.

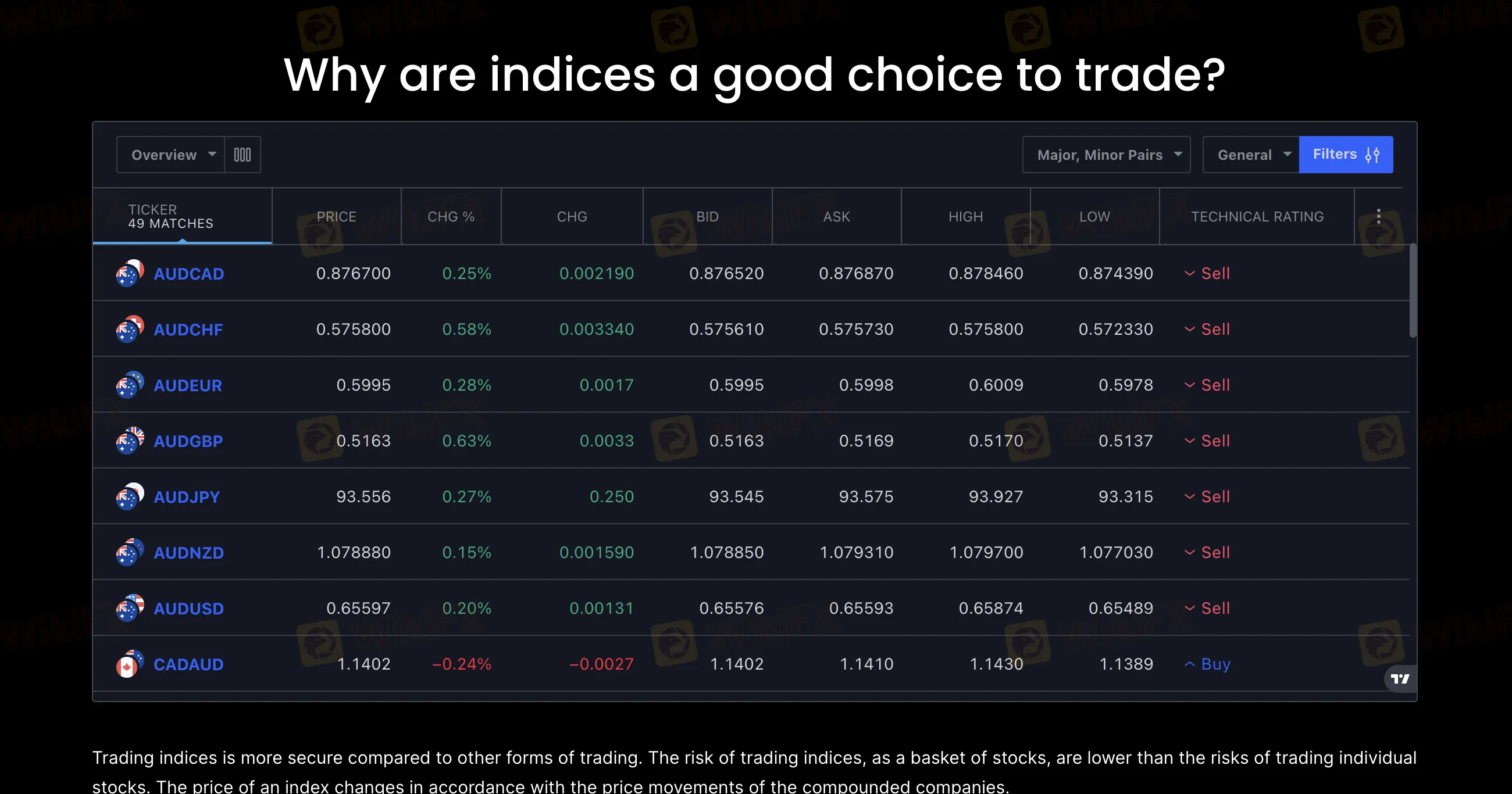

Indices: Traders can trade CFDs on market indices like the S&P 500, NASDAQ, Dow Jones, and other major global stock indices.

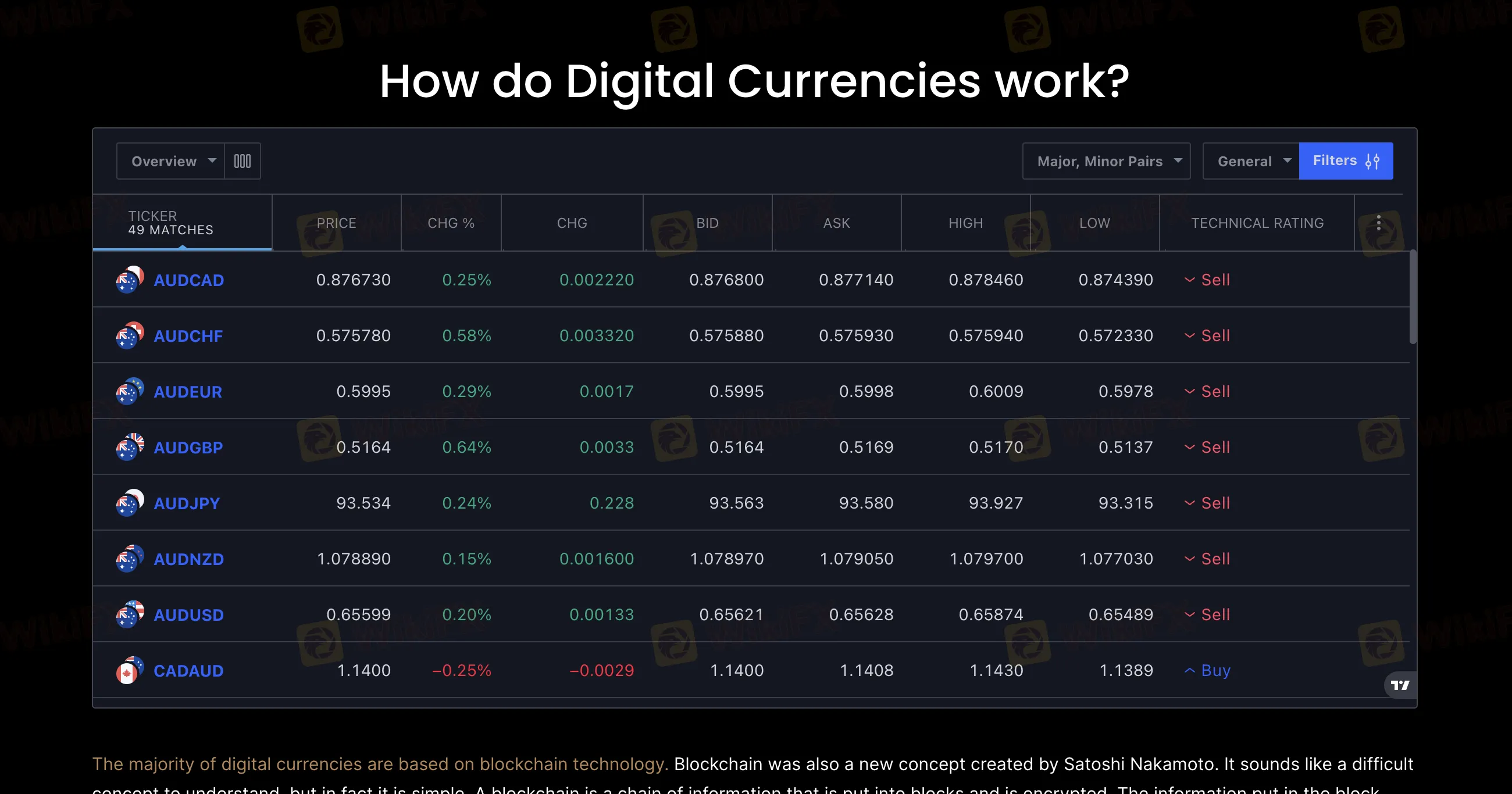

Digital Currencies: Crypto Chain provides access to the digital currency market, allowing traders to buy and sell cryptocurrencies like Bitcoin, Ethereum, and other altcoins.

Accounts

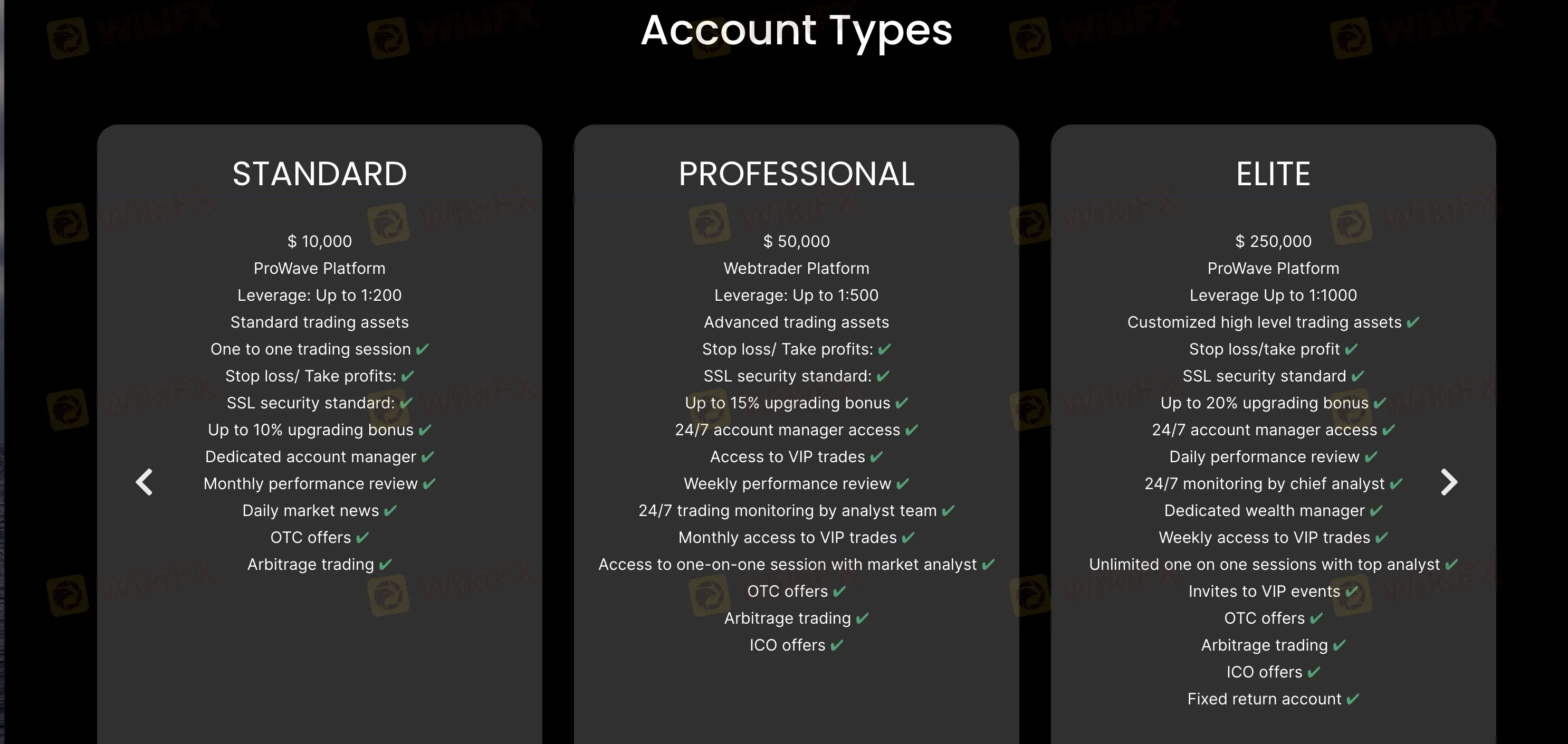

Crypto Chain provides a range of account options tailored to meet the diverse needs of traders. These account types include Standard, Professional, and ELITE accounts, each designed to cater to varying levels of experience and investment capital.

| Account Type | Minimum Deposit |

| Standard | $10,000 |

| Professional | $50,000 |

| ELITE | $250,000 |

The Standard account, requiring a minimum deposit of $10,000, offers an accessible entry point for traders looking to explore the platform's diverse trading instruments across different asset classes.

The Professional account, with a minimum deposit of $50,000, presents an attractive choice for experienced traders seeking advanced tools, potentially lower trading costs, and access to premium research.

For institutional and high-net-worth traders, the ELITE account demands a minimum deposit of $250,000 and provides an exclusive trading environment with personalized account management, institutional-grade insights, and potential cost advantages, making it an ideal option for those with significant trading aspirations and resources.

Leverage

Crypto Chain provides varying levels of leverage across its different account types to accommodate the preferences and risk tolerances of different traders.

| Types of Accounts | Maximum Leverage |

| Standard | 1:200 |

| Professional | 1:500 |

| ELITE | 1:1000 |

The Standard account offers a leverage of up to 1:200, enabling traders to potentially magnify their trading positions by 200 times.

For those with more experience and higher capital, the Professional account offers a higher leverage of up to 1:500, granting even greater control over their trades.

The ELITE account, designed for institutional and high-net-worth traders, provides the highest leverage of up to 1:1000, allowing for substantial market exposure.

It's important to note that while leverage can enhance potential profits, it also increases the risk of losses, making it crucial for traders to exercise prudent risk management strategies and carefully consider the appropriate leverage level for their trading style and financial situation.

Trading Platform

Crypto Chain offers its clients access to the Crypto Chain Group ProWave trading platforms, which are designed to provide a seamless and efficient trading experience. These platforms offer a range of features and tools that cater to both novice and experienced traders. The ProWave trading platforms are equipped with intuitive interfaces, real-time market data, advanced charting tools, and technical indicators, enabling traders to analyze market trends and make informed trading decisions.

Deposits & Withdrawals

Crypto Chain provides a flexible and convenient approach to funding and withdrawing from trading accounts through multiple payment methods. Clients can choose from options such as VISA, Mastercard, Bitcoin, and traditional bank transfers.

While specific details regarding fees and processing times are not currently available, it's important to note that regulated brokers typically offer transparent and comprehensive information about deposit and withdrawal procedures. Such transparency contributes to a trustworthy and client-focused trading environment, where traders can confidently manage their financial transactions and focus on their trading activities with the assurance of a regulated and accountable broker.

Customer Service

Clients can conveniently reach out to the support team through email at support@cryptochaingroup.com, allowing them to address inquiries, resolve issues, and receive timely responses.

Additionally, Crypto Chain provides the option of online messaging, enabling clients to engage in real-time conversations with knowledgeable representatives.

Conclusion

Despite its diverse trading offerings and accessible platforms, Crypto Chain's lack of valid regulation cast doubts on its safety and credibility. The absence of proper oversight and transparency regarding fees and customer support practices heightens the risk of potential fraudulent activities or unethical behavior. Traders are strongly advised to exercise caution and conduct thorough research before considering Crypto Chain as a trading platform. Given the combination of regulatory concerns and negative reports, it is prudent for potential users to prioritize regulated alternatives to safeguard their investments and financial interests effectively.

Frequently Asked Questions (FAQs)

Q1: What types of trading instruments are available at Crypto Chain?

A1: Crypto Chain offers a variety of trading instruments across different asset classes, including forex, commodities, shares CFDs, indices, and digital currencies.

Q2: What are the account types offered by Crypto Chain and their minimum deposit requirements?

A2: Crypto Chain offers Standard, Professional, and ELITE accounts with minimum deposit requirements of $10,000, $50,000, and $250,000 respectively.

Q3: What are the maximum leverage levels for each account type at Crypto Chain?

A3: The maximum leverage levels are 1:200 for Standard accounts, 1:500 for Professional accounts, and 1:1000 for ELITE accounts.

Q4: Is Crypto Chain a regulated brokerage firm?

A4: No, Crypto Chain currently lacks valid regulation.

天眼交易商

热点资讯

“挂羊头卖狗肉”的王者 特朗普与鲍威尔联合站台 CAPEX还不如赌场

黄金陷阱:黄金牛市热潮下诈骗激增

百万美元盈利导致外汇平台爆仓?PRC无法出金恶意欺诈中国投资者!

警惕“杀猪盘”骗局,守护投资安全

FTC重拳出击IM Mastery Academy诈骗案

巴菲特最新熊市投资课:稳健、耐心与现金为王

TR外汇最新动态 4Xhub停止运营 TR外汇142份判决书分析

汇率计算