用户评价

More

用户评论

5

条评论发布评价

2024-06-27 15:22

2024-06-27 15:22

2024-04-16 16:18

2024-04-16 16:18

天眼评分

影响力

添加交易商

对比

我要曝光

曝光

天眼评分

监管指数6.88

业务指数7.43

风控指数9.69

软件指数7.56

牌照指数6.90

单核

1G

40G

More

公司全称

PT Mentari Mulia Berjangka

公司简称

MENTARI MULIA

平台注册国家、地区

印尼

公司网址

X

脸书

公司简介

资金盘投诉

我要曝光

| Mentari Mulia Mulia评论摘要 | |

| 成立时间 | 2018 |

| 注册国家/地区 | 印度尼西亚 |

| 监管机构 | BAPPEBTI |

| 市场工具 | 外汇、股票指数、贵金属 |

| 模拟账户 | / |

| 杠杆 | / |

| 点差 | 从$0.3起 |

| 交易平台 | MT4 |

| 最低存款 | / |

| 客户支持 | 在线聊天 |

| 电话:(021) 252 7311;(021) 252 7310 | |

| 电子邮件:cs@mentarimulia.co.id | |

| 社交媒体:Facebook、Instagram、Twitter、Linkedin | |

| 总部地址:Graha Aktiva 6楼601套房和7楼HR Rasuna Said Street 区块 X-1 Kav. 03 East Kuningan, Setia Budi, South Jakarta | |

Mentari Mulia Mulia于2018年在印度尼西亚注册,提供与外汇、股票指数和贵金属相关的交易服务。它使用MT4作为其交易平台,并为客户支持提供各种渠道。此外,它在印度尼西亚受到良好的监管。然而,需要注意的是,它在其官方网站上没有提供足够的关于账户和交易流程的详细信息。

| 优点 | 缺点 |

| 受BAPPEBTI监管 | 缺乏透明度 |

| 分离账户 | 产品选择有限 |

| 支持MT4 | |

| 在线聊天支持 |

是的,Mentari Mulia Mulia受到印度尼西亚贸易部商品期货监管机构(BAPPEBTI)的监管。

| 监管机构 | 当前状态 | 监管国家 | 许可证类型 | 许可证号码 |

| 印度尼西亚贸易部商品期货监管机构(BAPPEBTI) | 受监管 | 印度尼西亚 | 零售外汇许可证 | 28/BAPPEBTI/SI/03/2013 |

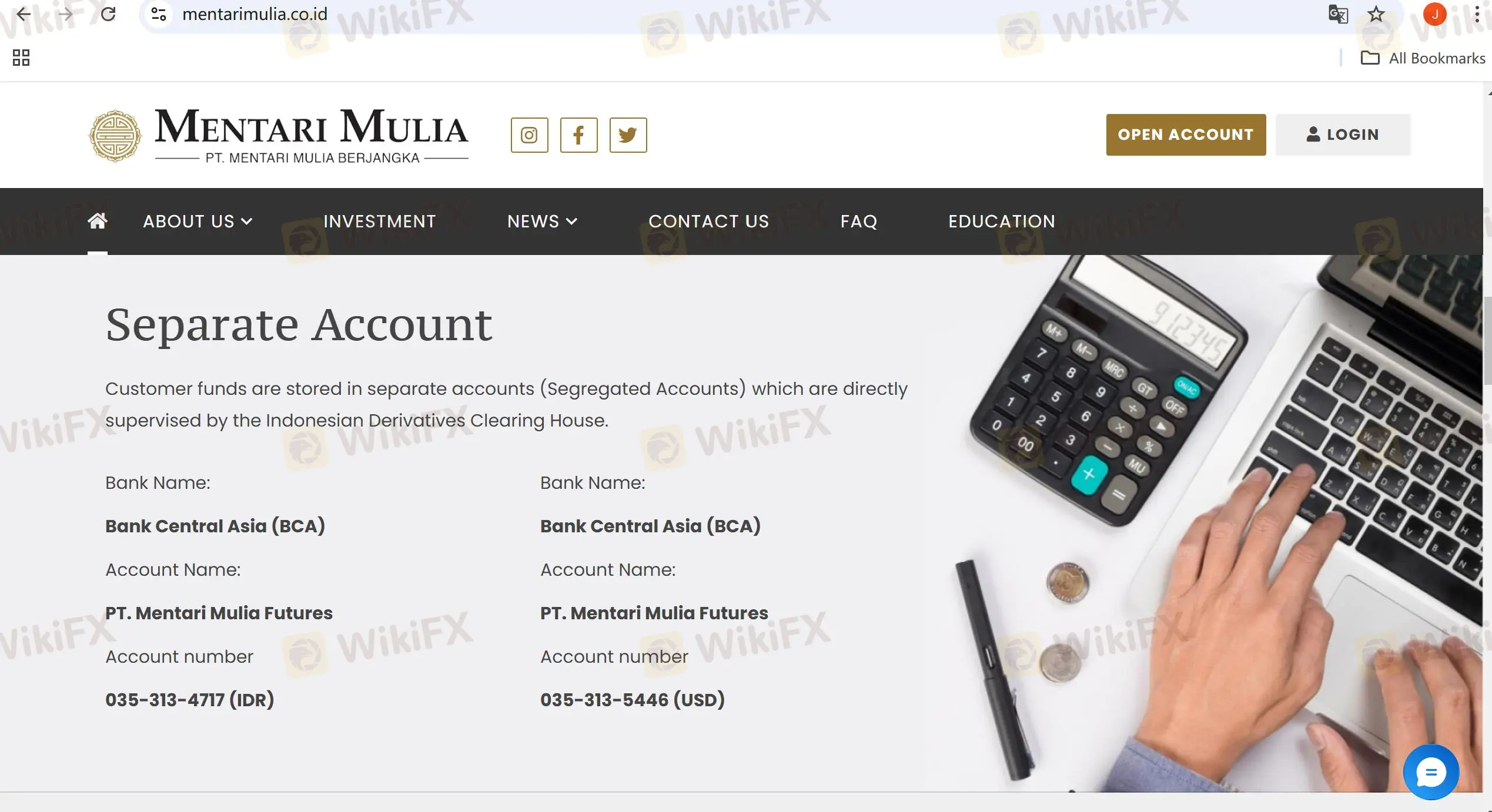

此外,它还采用一定的方法来保护客户的资产,分离账户服务就是一个例子。

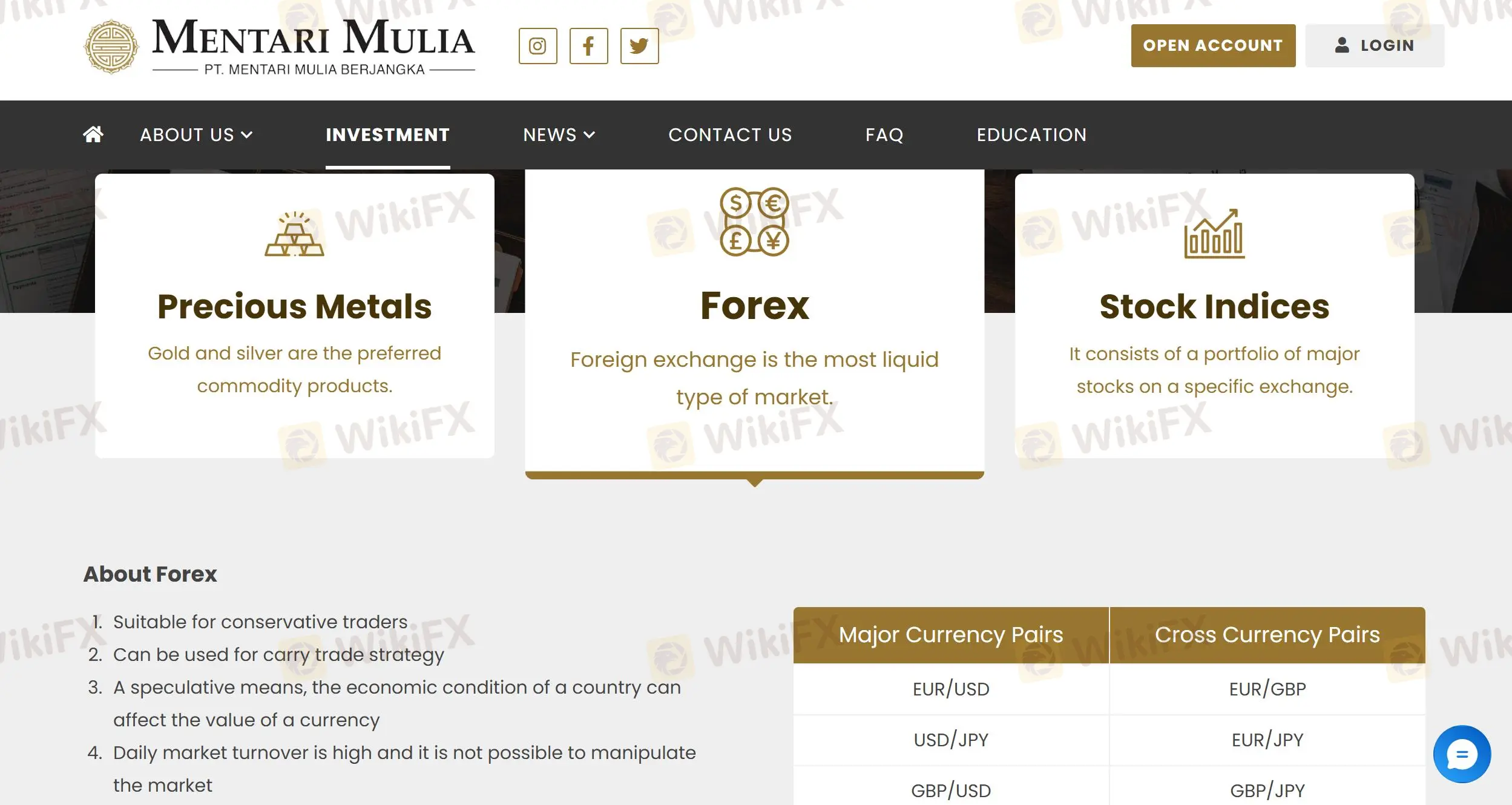

Mentari Mulia Mulia主要关注外汇、股票指数和贵金属等3种市场。

| 可交易工具 | 支持 |

| 外汇 | ✔ |

| 股票指数 | ✔ |

| 贵金属 | ✔ |

| 大宗商品 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 交易所交易基金 | ❌ |

Mentari Mulia Mulia使用MT4作为其交易平台。

| 交易平台 | 支持 | 可用设备 | 适用于 |

| MT4 | ✔ | PC、Web、移动设备 | 初学者 |

| MT5 | ❌ | / | 有经验的交易者 |

More

用户评论

5

条评论发布评价

2024-06-27 15:22

2024-06-27 15:22

2024-04-16 16:18

2024-04-16 16:18