Gold Breaks Down, Opening a New Downside Channel

Abstract:Major U.S. equity indices, along with gold and silver, declined in tandem. Short positions initiated over the past two sessions have begun to generate positive returns as the market moved lower.Lookin

Major U.S. equity indices, along with gold and silver, declined in tandem. Short positions initiated over the past two sessions have begun to generate positive returns as the market moved lower.

Looking ahead, we expect gold to remain biased toward consolidation with a downside tilt during the Lunar New Year period, with the probability of further declines outweighing upside potential.

A key development worth highlighting is the renewed “hot money” effect. The recent appreciation of both the Chinese yuan and Japanese yen has driven sovereign bond yields in the two countries lower, with part of the liquidity spilling over into equity markets. Liquidity-driven rallies often require little fundamental justification. This capital flow dynamic is likely to provide near-term support for Chinese, Japanese, and Korean equities, creating a short-term bullish impulse.

However, from a broader macro perspective, such hot money inflows are inherently unsustainable. A stronger currency typically weighs on corporate profitability unless productivity gains — potentially driven by AI-led innovation — significantly enhance efficiency. We believe achieving such structural gains remains challenging in the near term.

Investors should be cautious of a potential topping phase within the next one to two months. Once speculative capital retreats, equity markets may face corrective pressure.

In simple terms: when the music stops, dont be the last one left clearing the table.

Chart Analysis

(Chart 1: Corporate Earnings vs. A-Share Index | Source: MacroMicro)Purple Line: Corporate Earnings

Green Line: A-Share Index

As shown in Chart 1, a comparison between Chinese corporate earnings and the A-share market reveals a notable divergence. In 2015, liquidity-driven capital flows propelled a significant rally in A-shares, despite earnings failing to keep pace.

A similar pattern appears to be emerging in 2026, suggesting the current A-share rally may also be liquidity-driven rather than fundamentally supported. Investors should recognize the potentially unsustainable nature of this advance.

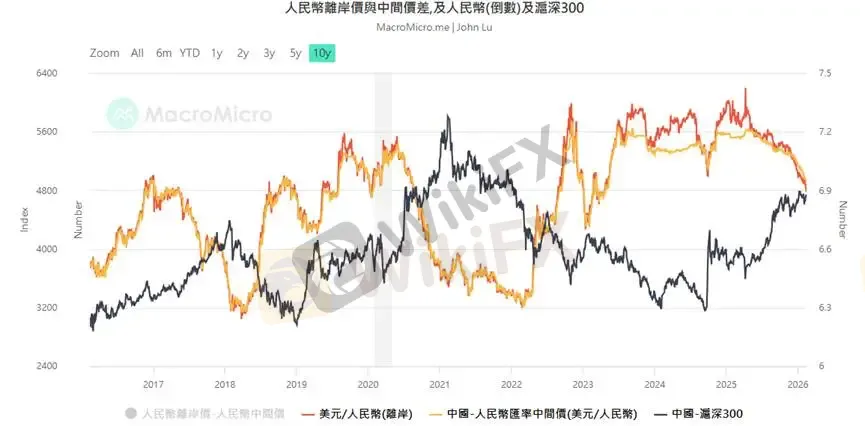

(Chart 2: USD/CNY vs. CSI 300 Index | Source: MacroMicro)

Chart 2 further reinforces the liquidity-driven narrative. The USD/CNY exchange rate appreciated from 7.4 to 6.9, coinciding with a strong rally in the CSI 300 Index.

This currency strength implies that Asian markets may outperform U.S. equities in the post-holiday period, as capital flows remain supportive in the short term.

Technical Analysis

After three consecutive sessions of sideways consolidation, the price broke below its range-bound structure during the U.S. session yesterday. The 5,000 level now risks becoming a near-term ceiling.

Tracking Bollinger Bands dynamics, the bands have shifted from contraction to expansion following yesterdays decline. Investors should closely monitor whether the bands begin expanding to the downside, which would signal the potential onset of a medium-term corrective phase.

From a momentum perspective, the hourly MACD histogram has turned negative and is expanding, supporting short positioning. Immediate overhead resistance should be monitored at the Bollinger middle band.

Strategy Outlook

Focus on resistance at the Bollinger middle band. If the hourly chart confirms a downside reversal with a bearish close, traders may consider adding to short positions.

Those without existing exposure may initiate light short positions.

Should price continue trending lower along the Bollinger middle band, each test of that resistance may present an opportunity to scale in. Investors are advised to trade with the prevailing trend and avoid bottom-fishing.

Key Levels

Resistance A: 5091

Support A: 4663

Support B: 4982

Risk Disclosure

The views, analyses, research, price data, or other information provided above are intended solely as general market commentary and do not represent the official position of this platform. Readers assume full responsibility for their investment decisions and associated risks. Please trade prudently.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc