INVESTIZO Review: Profit Cancellation Claims, Withdrawal Denials & Poor Customer Support

Abstract:Have you experienced illegitimate profit cancellations by INVESTIZO, a Saint Vincent and the Grenadines-based forex broker? Did the broker deduct unfair amounts in the name of a dividend or swap adjustment? Was your trading account frozen because the broker let someone trade on your behalf? Facing withdrawal blocks and no response from the customer support team to your queries? Many traders have highlighted these alleged forex trading activities online. It’s time we take a close look at some complaints through this INVESTIZO review article. Keep reading!

Have you experienced illegitimate profit cancellations by INVESTIZO, a Saint Vincent and the Grenadines-based forex broker? Did the broker deduct unfair amounts in the name of a dividend or swap adjustment? Was your trading account frozen because the broker let someone trade on your behalf? Facing withdrawal blocks and no response from the customer support team to your queries? Many traders have highlighted these alleged forex trading activities online. Its time we take a close look at some complaints through this INVESTIZO review article. Keep reading!

Overview of INVESTIZO - Markets, Trading Platforms & More Details

INVESTIGO claims itself to be one of the world‘s best online trading platforms, with its founders having a decade-plus trading expertise. From the broker’s official website, it is learnt that the company allows trading on 60+ currency pairs. Some popular currency pairs traded on the broker‘s platform include GBP/USD, USD/JPY, EUR/JPY, GBP/JPY, USD/CAD and GBP/JPY. As a trader, you can choose from MT4 Real ECN, MT4 Real Standard and MT4 Real Cent. The maximum leverage offered is 1:2000. With both MetaTrader 4 and MetaTrader 5, the company seems to advance traders’ experience. But does this play out the way traders want in real-time? From the complaints collected online, it does not seem so. Lets start examining the user complaints.

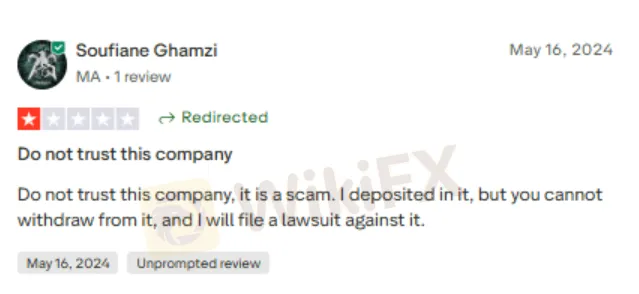

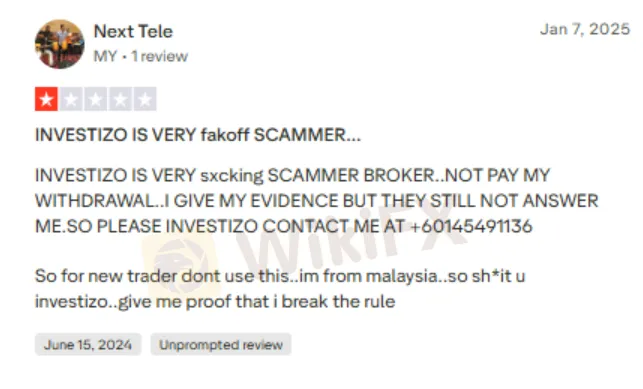

Examining the Top Complaints Against INVESTIZO

Investigating Long Pending Withdrawal Requests

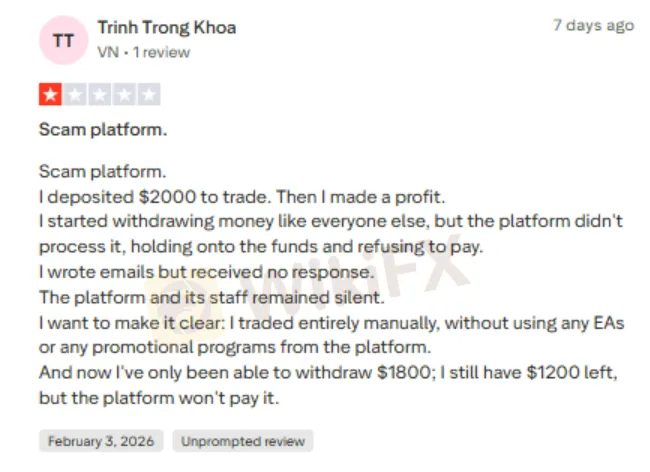

Several traders have reported on the long pending withdrawal requests and sheer silence from INVESTIZO. In one complaint, a client deposited $2000 to trade and made profits too. As the trader requested withdrawals, the delay game began as the platform did not process the request and refused to pay. Concerned by this, the trader emailed constantly but without any success. The trader claimed to have executed trading strategies without using EAs or any platform-sponsored promotional programs. After numerous follow-ups, the trader could only manage to withdraw $1,800, the rest $1,200 (including profit), as visible on the INVESTIZO login, was still not accessed by him at the time of writing the review.

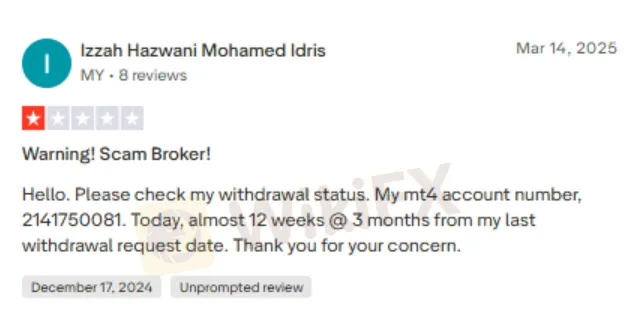

In a similar complaint, a trader urged the broker to reveal the withdrawal status after receiving no response to a fund access request made three months ago.

On the other hand, some just pointed out their withdrawal queries without much explanation.

Check out the multiple INVESTIZO reviews on the withdrawal issue.

The Profit Cancellation Claim

A Malaysian trader accused INVESTIZO of cancelling the profits earned on the platform. As per the trader, the broker gives reasons such as technical failure of the quoting mechanism to justify this seemingly illicit trading activity. Check out this small but critical INVESTIZO review.

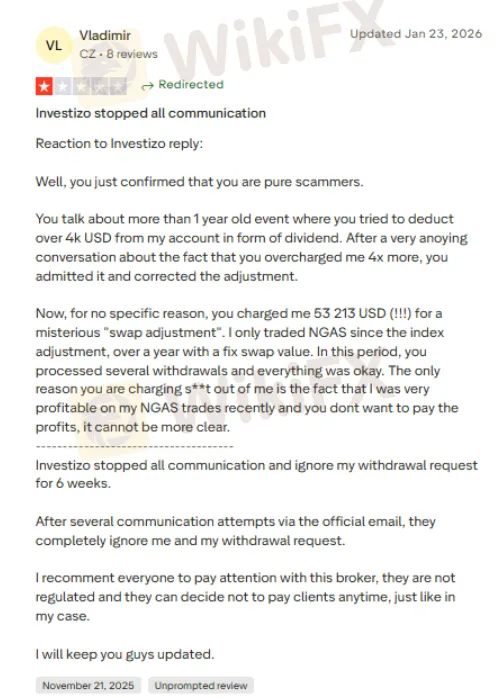

The Unfair Charge Allegation Against INVESTIZO

A Czech Republic-based trader recounted how the trading experience with INVESTIZO converted from good to bad over time. The journey started with an unfair charge exceeding USD 4,000 by the broker. The broker, however, made corrections later. After that, it was all good with timely withdrawal processing. As the trader started becoming profitable with NGAS trades, the broker charged a swap adjustment fee. The broker, as per the traders statement, did not answer this for six long weeks. During this period, INVESTIZO did not even process withdrawals. The review shared below will give further insight into the worsening trading relationships between the broker and the trader.

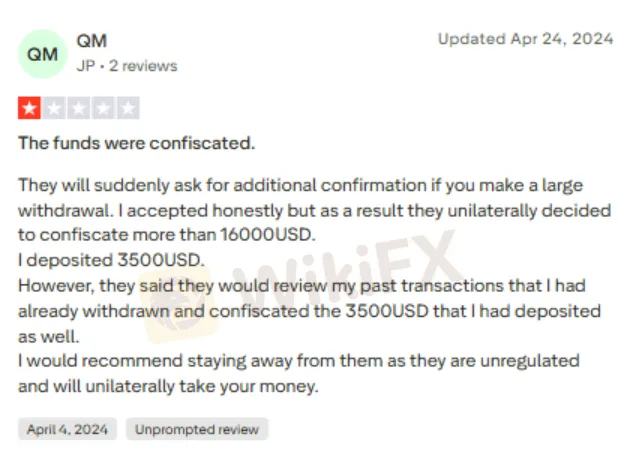

Alleged Reports of USD 16,000 Confiscation After Withdrawal Verification

A trader from Japan alleged that INVESTIZO confiscated funds without justification after requesting additional verification during a large withdrawal. Despite cooperating fully, over USD 16,000 was allegedly seized. The broker later claimed it reviewed previous withdrawal transactions and went on to confiscate the traders initial USD 3,500 deposit as well. The complainant warns that INVESTIZO is unregulated, imposes sudden compliance demands, and allegedly unilaterally seizes client funds, urging others to stay away.

For more details, check out this explosive INVESTIZO review.

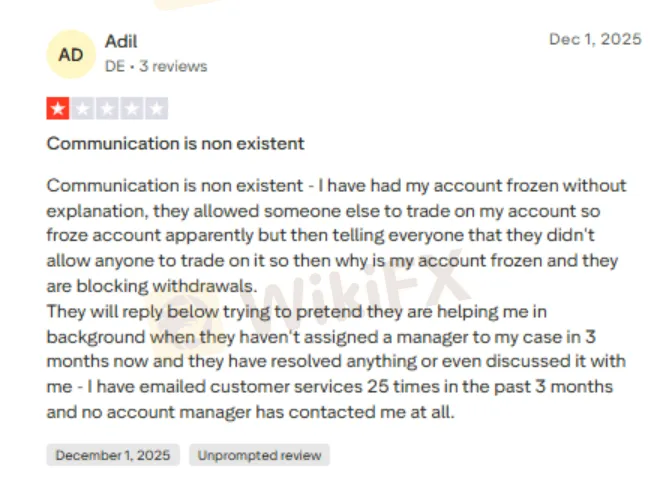

Examining the Account Freeze Claim

A Germany-based trader reported an account freeze by INVESTIZO without any explanation. The trader further alleged that the broker allowed someone else to trade on their behalf, which possibly led to the account freeze. While INVESTIZO refuted these allegations, the trader questioned the account freeze if the broker had not allowed others to trade. Further adding to the accusation, the trader went on to declare that there was no manager assigned to take care of his trading issue for three months. During this period, the trader emailed the INVESTIZO customer support team several times but did not receive any response.

Check out this screenshot, summing up the misery for the trader.

Is INVESTIZO‘s Registration Number a Symbol of Forex Regulation?

INVESTIZO carries a business registration number - 25432 BC 2019. However, it does not represent any form of financial regulation that can assure investors of their capital safety. On the other hand, firms registered in Saint Vincent and the Grenadines are either unregulated or offshore regulated. While the ’unregulated status is a direct threat to the investor's safety, offshore regulation, on the other hand, does not protect investors entirely either. Offshore regulated entities do not offer investment protection measures as wide and stringent as those offered by entities regulated by renowned financial authorities such as the FCA (UK) and ASIC (Australia).

Is INVESTIZO Regulated? Find Out in This WikiFX Review

Numerous complaints concerning INVESTIZO withdrawal access, fund scams and sheer lack of customer support made it imperative for the WikiFX team to investigate the brokers regulatory status. The team found no license for the broker, which made it clear that investing on the platform is fraught with risks for traders. Keeping all these in mind, WikiFX gave INVESTIZO a score of just 2.31 out of 10.

Read more

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Is your trading experience with MYFX markets full of fund withdrawal denials despite repeated communications with its customer support team? Has the broker deleted all your profits? Did the broker accuse you of false trading strategy implementation while deleting your profits? There have been many such instances reported by traders against these activities online. In this MYFX Markets review article, we have shared some complaints. Take a look!

Exfor Exposure: Investigating Alleged Withdrawal Denials, Illegitimate Account Closure & More

Exfor, a Malaysia-based forex broker, has allegedly been the centre of attention for all the wrong reasons. These include long-pending withdrawal denials, no communication or assistance from the broker’s customer support team, manipulated pricing upon a withdrawal request by the trader, and account blowups due to bonus-related issues. It’s the traders who allegedly bear the brunt of all these suspicious trading activities. A lot of them have criticized it on broker review platforms. We have highlighted some of their complaints in this Exfor review article. Take a look!

Axiory Exposed: Low WikiFX Score & Trader Complaints!

Axiory WikiFX score 1.5: Active Belize FSC license (no FX authorization), multiple complaints. Reports show withdrawal/support issues. Traders beware.

RCG Markets Exposed: License Verification & Trader Complaints

RCG Markets holds a valid FSCA license. Reports show withdrawal rejections & stop‑loss issues. Traders urged to verify details and exercise caution.

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Rate Calc