ACY Securities Review: $40k Profits Withheld in Singapore

Abstract:ACY Securities froze a Singapore trader’s $40k profits over “arbitrage.” Read the full case and check if your funds are safe. Learn more now.

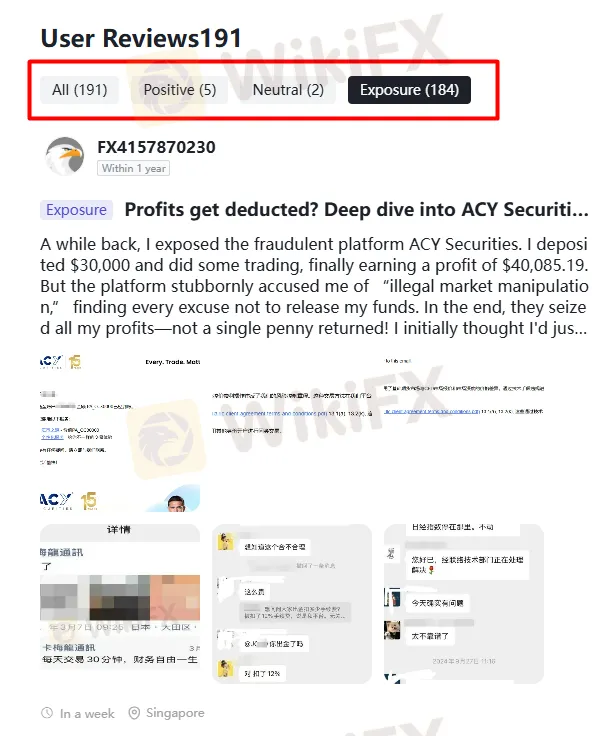

A Singapore trader reports that ACY Securities froze over 40,000 USD in profits and then confiscated the entire amount after accusing him of “market manipulation for arbitrage.” With 185 negative cases out of 191 public reports linked to this broker, the situation points to a broader pattern of dangerous risk for retail traders.

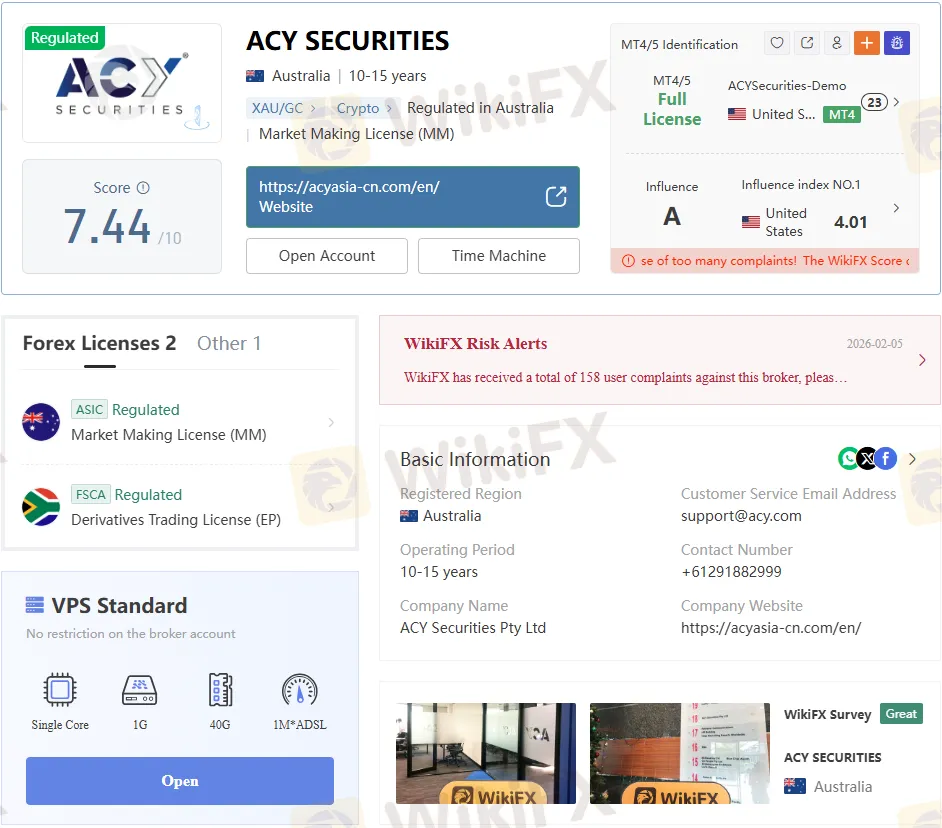

ACY Securities: Public Image vs Reported Reality

ACY Securities presents itself as an established forex and CFD broker, advertising global market access, multi‑asset trading, and regulated operations. On the surface, this image can easily convince new traders that their capital and profits will be handled fairly and transparently.

Behind that image, however, lies a worrying track record of complaints. Public exposure records list 191 user cases linked to ACY Securities, of which 185 are negative, involving serious issues such as withdrawal delays, profit deductions, and forced profit cancellations. For a broker that promotes itself as professional and client‑focused, this ratio is an unmistakable red flag.

Singapore Case: From $30,000 Deposit to Confiscated $40,085.19 Profit

In January 2026, a seasoned retail trader in Singapore deposited 30,000 USD into an ACY Securities account and manually traded during a favorable market environment. Through active position management, the trader generated a profit of 40,085.19 USD, a strong result for a retail account built on personal strategy and experience.

The problems started with withdrawal. After the trader attempted to withdraw funds, the request was denied; instead, an email stated that the account had “violated trading rules” and was “suspected of market manipulation for arbitrage.” The client, who was operating with tens of thousands—not millions—of dollars, viewed this accusation as completely unreasonable and as a justification for non‑payment.

Escalation: Partial Deduction Agreement Turned Into Total Seizure

Initially, ACY Securities notified the trader that 32,879.19 USD in profits would be deducted due to alleged violations. Although this meant sacrificing a large portion of legitimately earned gains, the trader reluctantly agreed, hoping to secure the remaining profits and, most importantly, preserve the principal.

Even after this painful compromise, the funds were not released. Withdrawals were reportedly stalled for nearly a month, leaving the trader in constant fear that the entire balance might be at risk.

After this delay, ACY Securities changed its stance yet again. The previous “settlement” was declared invalid, and a new decision was imposed: all 40,085.19 USD in profits would be confiscated, with only the original 30,000 USD deposit allowed to be returned. From the traders point of view, this sequence—partial deduction, long delay, then full confiscation—looked less like compliance work and more like a calculated effort to swallow the entire profit.

Arbitrage Accusations and a Profit-Triggered Freeze Pattern

In this case, the core justification was a claim of “market manipulation for arbitrage.” The trader states that all orders were placed manually and that no latency or technical exploit was used, and that the broker did not provide detailed trade logs that would clearly prove manipulation.

Other public reports describe a similar pattern tied to profitable accounts. Advisers report that once an accounts profit reaches a certain level, it may be tagged as “abnormal,” and trades are questioned. Withdrawals are delayed or rejected under labels such as “arbitrage” or “strategy violation.” One detailed write‑up explains that internal system settings can automatically mark accounts as problematic when profits exceed a threshold, triggering fund freezes and so‑called investigations.

When a broker consistently responds to successful trading with rule‑violation accusations and ACY Securities-style profit-confiscation actions, the underlying message to clients becomes simple: losing is tolerated, winning is punished. For the Singapore trader, this is exactly why he now labels the behavior a scam‑like practice and warns others that strong profits may be treated as a violation rather than a success.

Repeated Complaints: Withdrawals Blocked, Profits Cancelled, Reputation Managed

The Singapore case is not the only serious complaint recorded against ACY Securities.

Across multiple public reports, traders describe:

- Profits being wiped out or heavily reduced after extended review periods, with the broker later citing vague terms and conditions.

- Withdrawal requests are being delayed or blocked, especially when clients attempt to withdraw large amounts or quickly earned gains.

- Accounts are being re‑classified or subjected to new interpretations of trading rules only after they become substantially profitable.

- Attempts to manage reputation by downplaying, disputing, or trying to suppress negative feedback and critical reports online.

With 184 negative exposure cases out of 191 reports, these patterns cannot be brushed aside as isolated misunderstandings or rare technical disputes. Rather, they suggest that ACY Securities withdrawal blockages and ACY Securities fund-freeze complaints are recurring issues that traders should treat as serious warnings.

Warning for Singapore Traders and Global Retail Clients

For traders in Singapore, the January 2026 case is a clear signal that even experienced, disciplined trading does not guarantee a fair outcome when dealing with ACY Securities. 30,000 USD deposit and 40,085.19 USD in profits ended not in a celebratory withdrawal but in accusations, delays, and the complete confiscation of profits.

Anyone considering this broker should:

- Review public exposure data and case records before depositing any funds, especially noting the 185 negative cases out of 191 reports.

- Understand that regulatory registrations and polished branding do not automatically protect you from ACY Securities withdrawal blocked incidents or sudden ACY Securities arbitrage accusation disputes.

- Keep meticulous records: screenshots of trades, balance history, emails, and chat logs, so you have evidence if profits are questioned or reversed later.

- Seek formal help promptly—through regulators or legal professionals—if your account is frozen, your profits are suddenly re‑classified as “illegal,” or you face unexplained deduction decisions.

For those already affected, sharing experiences and filing official complaints can help build a documented trail of how disputes are handled and whether patterns of abuse exist. Staying silent, hoping the situation will resolve quietly, often only benefits the broker when profit confiscation appears systematic.

Conclusion

The Singapore case, where traders 40,085.19 USD in profits was ultimately seized after a month of stalling and shifting justifications, is a stark example of how quickly trading success with ACY Securities can turn into a nightmare. When this case is viewed alongside 185 negative reports out of 191 total exposures, repeated stories of cancelled gains, and ACY Securities profit confiscation disputes, a deeply troubling pattern emerges.

Although ACY Securities promotes itself as a professional, well‑regulated broker, the accumulation of cases involving ACY Securities withdrawal blockages, fund-freezing complaints, and scam-warning calls in Singapore seriously questions its reliability. Traders in Singapore and worldwide should think very carefully before entrusting this broker with significant capital, and those who do proceed should do so only with extreme caution, full documentation, and a clear understanding of the risks highlighted by these exposure cases.

Read more

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Is your trading experience with MYFX markets full of fund withdrawal denials despite repeated communications with its customer support team? Has the broker deleted all your profits? Did the broker accuse you of false trading strategy implementation while deleting your profits? There have been many such instances reported by traders against these activities online. In this MYFX Markets review article, we have shared some complaints. Take a look!

Exfor Exposure: Investigating Alleged Withdrawal Denials, Illegitimate Account Closure & More

Exfor, a Malaysia-based forex broker, has allegedly been the centre of attention for all the wrong reasons. These include long-pending withdrawal denials, no communication or assistance from the broker’s customer support team, manipulated pricing upon a withdrawal request by the trader, and account blowups due to bonus-related issues. It’s the traders who allegedly bear the brunt of all these suspicious trading activities. A lot of them have criticized it on broker review platforms. We have highlighted some of their complaints in this Exfor review article. Take a look!

Axiory Exposed: Low WikiFX Score & Trader Complaints!

Axiory WikiFX score 1.5: Active Belize FSC license (no FX authorization), multiple complaints. Reports show withdrawal/support issues. Traders beware.

RCG Markets Exposed: License Verification & Trader Complaints

RCG Markets holds a valid FSCA license. Reports show withdrawal rejections & stop‑loss issues. Traders urged to verify details and exercise caution.

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Rate Calc