Kudotrade Exposed: A Risky, Unregulated Broker Targeting New Traders

Abstract:Kudotrade’s flashy promises hide real risks for new traders. Learn why this unregulated broker isn’t safe before you invest—protect your funds today.

What Is Kudotrade Really Offering?

Kudotrade presents itself as a “pioneer in international financial trading services” with a modern platform and global ambitions. The broker offers features such as copy trading, a custom web-based trading platform, and access to more than 250 tradable assets. We see how this kind of positioning can easily attract inexperienced traders who are impressed by innovation and variety but may overlook regulatory and structural risks.

From the brokers own page, we can already tell that the main selling points revolve around:

- A Mauritius FSC licence claim

- Registration in Saint Lucia under Kudo Trade Ltd

- Copy trading tools are marketed as “revolutionising investment opportunities.”

- A custom WebTrader inside the client portal

- “Over 250” tradable instruments on an “innovative & advanced” platform

When we put these pieces together, Kudotrade looks less like a mature, well-regulated broker and more like a very new, lightly regulated operation that aggressively targets new traders with buzzwords.

A New Broker With Questionable Foundations

Kudotrade has been operating for less than a year, which already places it in the high‑risk category for us. The broker is registered in Saint Lucia and uses the trading name Kudo Trade Ltd, a structure commonly seen with offshore or loosely supervised entities. When a platform is this young, there is no long-term history of handling client funds, no proven track record of dispute resolution, and no reliable pattern of behavior during volatile markets.

We find it especially concerning that Kudotrade is introduced as a “relatively new player” while the same page admits it faces “significant challenges that prospective traders should be aware of.” This is essentially an internal warning that the broker remains unproven and may lack the systems, controls, or financial stability that experienced traders look for. For us, that is a red flag, not a minor footnote.

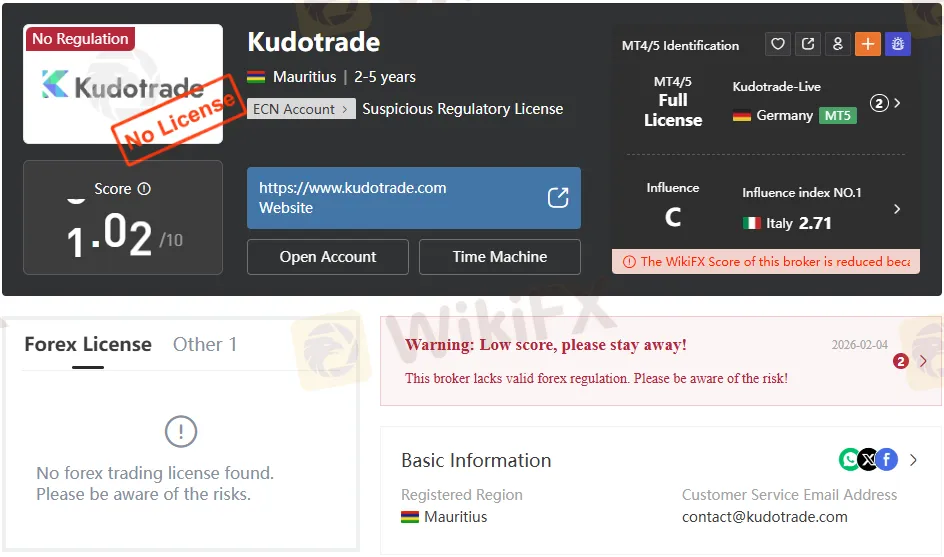

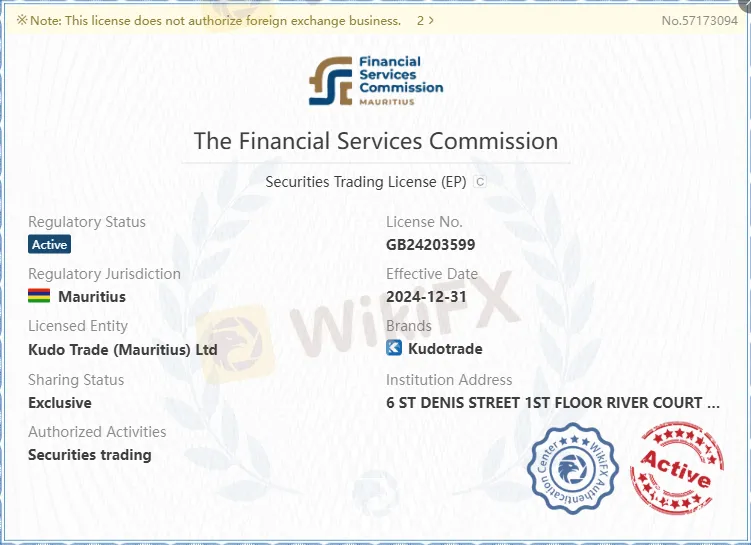

The Mauritius Licence Claim – Weak Comfort for Traders

Kudotrade heavily highlights that the Financial Services Commission (FSC) of Mauritius has awarded it a licence, and the wording suggests this is “prestigious.” On the surface, this sounds reassuring, but in practice, a licence in Mauritius does not offer the same level of protection or oversight as top‑tier regulators in stricter jurisdictions.

We also see that Kudotrade is still registered in Saint Lucia, which is not known for strong investor protection or strict enforcement in the forex and CFD industry. This combination—offshore registration plus reliance on a relatively lenient regulator—means traders must accept weaker safeguards than those offered by brokers regulated in tightly controlled markets. For us, calling this “weakly regulated” is fair: it looks more like a marketing bullet than a solid safety net.

Flashy Features Designed to Lure New Traders

Kudotrade heavily markets its tools and “innovations,” and this is where we see the platform deliberately speaking to inexperienced traders. The broker promotes its Kudo Copy Trader as “revolutionising investment opportunities,” promising an easy path to profit by following other traders. It has also launched its own custom WebTrader integrated into the client portal, positioning this as a modern alternative to common third‑party platforms.

The page also boasts “over 250 tradable assets” on an “innovative & advanced trading platform,” language clearly crafted to create excitement rather than explain actual trading conditions or risks. From our perspective, this focus on flashy features, apps, and buzzwords, without transparent details on regulation, fees, and execution quality, is a classic sign of a broker targeting beginners rather than serious professionals.

Why Kudotrade Poses Real Risk to Your Funds

When we assess Kudotrade solely on its broker page, we see several risk layers piling up against trader safety.

- Very short operating history (less than a year), meaning no proven long‑term reliability

- Registration in Saint Lucia is a jurisdiction frequently associated with weak oversight for forex brokers.

- Heavy reliance on a Mauritius FSC licence, which offers less investor protection than top‑tier regulators

- Strong emphasis on marketing claims and “innovation” instead of clear disclosure of risks

- Acknowledged “significant challenges” that prospective traders must watch out for

Because of these factors, we believe new traders face a high probability of encountering issues such as poor dispute resolution, unclear fund protection, and limited recourse if something goes wrong. When a brokers own exposure section warns of challenges, we take that seriously and encourage you to do the same.

How Kudotrade‘s Messaging Targets Inexperienced Traders

The overall presentation of Kudotrade feels engineered to appeal to traders who are still learning how the industry works. We see emotional language such as “revolutionising investment opportunities” and “innovative & advanced trading platform” used to overshadow the broker’s lack of history and its soft regulatory position.

New traders are especially vulnerable to this kind of messaging because they often equate high‑tech design and marketing with safety. In our view, Kudotrade is using features such as copy trading and a sleek web platform as hooks to draw in clients who might not ask deeper questions about regulation, withdrawal processes, or legal protections. This is exactly why we treat Kudotrade as a risky, unregulated‑style operation in practical terms, even when it points to a licence in Mauritius.

Our Verdict: Proceed With Extreme Caution

Bringing all of this together, our assessment is that Kudotrade is not a broker we would trust with our own funds. The combination of offshore registration, reliance on a weaker regulatory framework, a very short operating history, and self‑acknowledged “significant challenges” paints a picture of a platform that is far from secure.

If you are a new trader, we strongly recommend stepping back and comparing Kudotrade to more established, tightly regulated brokers before making any deposit. We believe that no amount of copy trading features, custom web platforms, or promises of 250+ assets can make up for the lack of strong, proven protection around your money. In our experience, choosing safety and transparency over hype is the smartest move you can make.

Read more

Fake FP Markets Exposure: Allegations of Fund Withdrawal Denials & Trade Manipulation

Did you experience a surprise cancellation of the profits made on the Fake FP Markets trading platform? Did you face more losses than what’s mentioned on your stop-loss order? Did you lose all your capital invested through a supposedly introducing broker? Failed to receive access to the FP Markets withdrawal despite a long delay from the application date? You are not alone! In this Fake FP Markets review article, we have investigated some complaints concerning withdrawal denials and trade manipulation. Read on as we share updates below.

CMTrading Review: Is It Legit or a Scam? Check It Out Now!

Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

Sheer Markets Review: Broker Legit or Not?

CySEC #395/20 regulates Sheer Markets as a Market Maker for MT5 CFDs, but 1:30 leverage, inactivity fees, and the lack of e-wallets raise questions about reliability. Read a neutral review before depositing $/€200.

NinjaTrader Review: Platforms & Risks (2026)

NinjaTrader offers strong futures/forex platforms but faced a $250K NFA fine for AML lapses. Regulated status holds. Read the full 2026 review.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc