Mazi Finance Scam Exposure: A Warning to Indian Traders

Abstract:Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

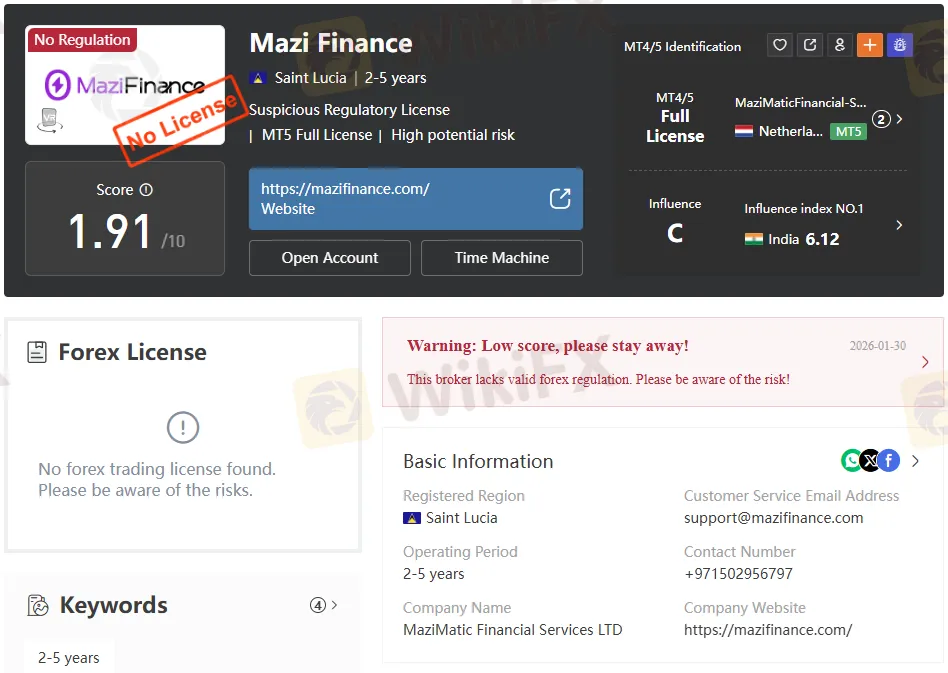

Mazi Finance is an unregulated broker that has been aggressively targeting Indian traders. Despite being registered in Saint Lucia, the company lacks any valid regulatory oversight, making it a high-risk platform for unsuspecting investors. The absence of regulation means there is no protection for traders, no accountability, and no guarantee of fair practices. Engaging with Mazi Finance exposes traders to fraudulent activities, withdrawal issues, and the risk of financial ruin.

Case Studies & User Complaints

Numerous traders have reported serious issues with Mazi Finance:

Execution Failure on XAUUSD Orders: One trader placed a Buy Limit order on XAUUSD with sufficient margin, yet the order was never executed. Despite clear evidence that the market price had reached its limit, Mazi Finance falsely claimed there was an “insufficient balance.” No server logs or proof were provided, resulting in a missed opportunity worth approximately $675.

Withdrawal Issues: Multiple users have complained that Mazi Finance blocked or denied withdrawals. Funds remained trapped in accounts, with support offering no resolution. One victim reported that despite having a live trading balance, the broker refused to process withdrawals, effectively stealing their money.

False Excuses & Lack of Transparency: Traders who contacted support received generic explanations and misleading excuses. Requests for detailed proof were ignored, and communication often ceased after initial responses.

Individuals Linked to the Scam: Reports have named Ibrahim Shaikh, Vineet Miskin, and Sumit as masterminds behind Mazi Finances fraudulent operations. Victims warn others to stay away from these individuals and their associated companies.

Regulatory Red Flags

Mazi Finance operates without regulation, relying on suspicious and misleading licenses to appear legitimate. Unlike trusted brokers regulated by authorities such as SEBI (India), FCA (UK), or ASIC (Australia), Mazi Finance offers no investor protection. The platform has a WikiFX score of just 1.91/10, signaling extreme risk. Traders should note that regulated brokers provide transparency, audited financials, and dispute resolution mechanisms—none of which Mazi Finance offers.

Website & Marketing Tactics

The official website, mazifinance.com, employs deceptive marketing strategies:

False Claims of Zero Spreads & Binance Association: Mazi Finance advertises “zero spreads” and claims to be “trusted by Binance.” These are false associations designed to mislead traders into believing the platform is reputable.

Aggressive Marketing: Promises of lightning-fast payouts, a global community, and cutting-edge technology are used to lure inexperienced traders. In reality, users report blocked withdrawals and poor customer support.

Illusion of Legitimacy: The website highlights features such as MT5 support and multiple account types, but these are superficial offerings meant to mask a lack of regulation and fraudulent practices.

Company Summary & Operations

- Founded: 2023

- Registered Country: Saint Lucia

- Regulation: None

- Market Instruments: Forex, Metals, Cryptos, Commodities, Stocks, Indices

- Minimum Deposit: $50

- Leverage: Up to 1:400

- Trading Platform: MT5 (no demo account)

- Customer Support: Limited to live chat and email, often unresponsive

While Mazi Finance offers a wide range of instruments and account types, the lack of regulation and transparency makes these features meaningless. Traders risk losing their deposits and profits due to fraudulent operations.

Risks for Indian Traders

India has been identified as a major target market for Mazi Finance, with an Influence Index of 6.12. The broker exploits retail traders by offering high leverage and false promises. Indian traders face:

- Loss of Funds: Deposits and profits are often blocked or denied during withdrawal attempts.

- Fake Customer Service: Support provides misleading excuses and fails to resolve issues.

- High Leverage Traps: While leverage up to 1:400 may seem attractive, it can magnify losses and increase risk.

The combination of aggressive marketing, unregulated operations, and fraudulent practices makes Mazi Finance particularly dangerous for Indian traders.

Conclusion & Call to Action

Mazi Finance is a scam broker operating without regulation, using deceptive tactics to exploit traders. With a history of execution failures, withdrawal issues, and false claims, the platform poses a severe risk to investors.

Final Warning: Stay away from Mazi Finance to protect your money and future. Always choose licensed, regulated brokers that provide transparency, investor protection, and reliable customer support.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Rate Calc