Olymptrade Review: Why Traders in Indonesia Should Beware

Abstract:Read our Olymptrade Review: 57 complaints, offshore license, no regulation. Protect your funds—avoid risky brokers. Click to learn more!

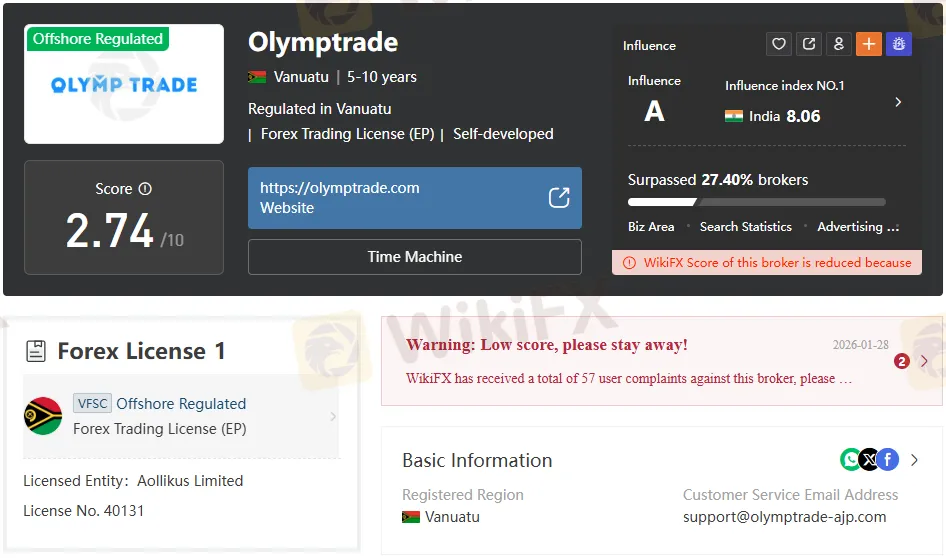

Olymptrade, a broker promising easy access to forex and stock trading, has drawn sharp scrutiny from Indonesian traders. With 57 documented complaints, an offshore Vanuatu VFSC license, and no oversight from reputable regulators, Olymptrade poses serious risks. This review explains why protecting funds requires avoiding such platforms—offshore setups often mean weaker investor safeguards.

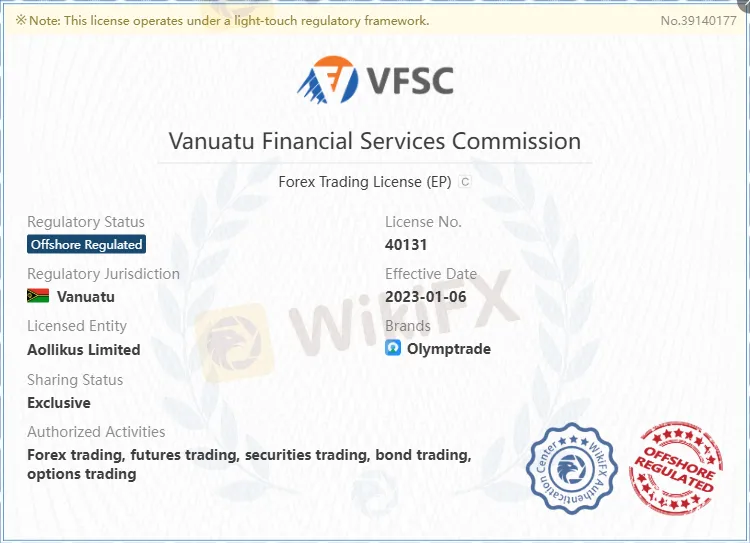

Olymptrades Offshore Regulation Exposed

Olymptrade operates under a Vanuatu Financial Services Commission (VFSC) license numbered 40131, issued to Aollikus Limited in 2023. This offshore regulation falls under a light-touch framework, allowing trading in forex, futures, securities, bonds, and options, but offering minimal client protections compared to bodies like the FCA or ASIC. Indonesian traders face heightened vulnerability without recourse to local regulatory authorities.

The broker's physical address at 1276 Govant Building, Kumul Highway, Port Vila, Vanuatu underscores its distance from major markets. Critics note that VFSC licenses are often linked to unresolved disputes, amplifying concerns for users in regulated jurisdictions such as Indonesia.

57 Complaints Signal Major Red Flags

WikiFX records show 57 user complaints against Olymp Trade, including delays in withdrawals, account freezes, and execution issues. Traders report funds being locked after profits, with support unresponsive despite promises of 24/7 availability via email at support@olymptrade.com or by phone at +356 2034 1634. These patterns suggest systemic problems rather than isolated errors.

Indonesian users, attracted by low entry barriers, frequently cite similar ordeals in online forums, though official tallies remain at 57 verified cases. The broker's low score of 2.74 out of 10 reinforces warnings to stay away.

Vanuatu License: Weak Investor Shield

Vanuatu‘s VFSC provides offshore regulation that prioritizes broker licensing over stringent client fund segregation or compensation schemes. Olymptrade’s license permits broad trading activities but lacks audits or capital requirements comparable to those of top-tier regulators. For Indonesians, this means no access to ombudsman services or insurance during disputes.

Historical data on VFSC entities reveal higher complaint volumes than onshore peers, with light oversight enabling practices such as high leverage without risk disclosures. Traders beware: offshore status often correlates with operational opacity.

Low Deposits Lure, But Risks Loom Large

Olymptrade markets a $10 minimum deposit, appealing to novice Indonesian traders via bank cards, crypto, or e-wallets. Withdrawals start at the same threshold, yet complaints highlight prolonged verifications and rejections. This low barrier masks deeper issues, drawing in users unprepared for potential losses.

Demo accounts offer $10,000 virtual funds for practice, alongside Islamic swap-free options, but transitioning to live trading exposes the gaps. Minimums this low often signal aggressive marketing over sustainable practices.

Platform Promises Fall Short in Practice

Olymptrades' proprietary platform supports desktop, mobile apps, and PWA for iOS/Android, targeting beginners with simple interfaces. It lacks MT4/MT5 integration, limiting advanced tools, and covers forex, stocks, cryptos, indices, commodities, bonds, ETFs, futures, and options—over 100 assets. Spreads from 0 pips with 0.6 pip commissions on forex, zero open-trade fees on stocks, sound competitive on paper.

Reality diverges: users decry slippage, requotes, and platform freezes during volatile sessions, fueling the 57 complaints. No third-party bridge to standard platforms raises concerns about manipulation.

| Feature | Olymptrade Claim | User-Reported Issue |

| Spreads | From 0 pips | Frequent widening in practice |

| Apps | iOS, Android, PWA | Connectivity drops on mobile |

| Assets | 100+ including forex/stocks | Limited depth in exotics |

| Support | 24/7 email/phone | Delayed responses, unresolved |

Inactivity Fees Drain Dormant Accounts

Accounts inactive for 180 days incur a $10 monthly fee (or equivalent) charged against the balance; zero-balance accounts are exempt from debt. This policy, buried in non-trading rules and KYC/AML docs, catches casual traders off guard. Indonesians testing the waters with small deposits risk erosion without notice.

Such fees, common in low-regulation brokers, incentivize unnecessary trades, potentially leading to losses. Transparency is lacking, as history is hidden only in transaction logs.

Indonesia's Traders Hit Hardest. Why?

Though Olymp Trade claims top influence in India (index 8.06), Indonesian traders flock to it for its rupiah-friendly $10 entry and local promotions. No BAPPEBTI license exposes locals to unenforceable contracts under Indonesian law. Complaints spike from Jakarta and Surabaya users facing hurdles with rupiah conversions for withdrawals.

Social media buzz on Telegram, Instagram, and TikTok amplifies hype, but ignores the Vanuatu-based jurisdictional disconnect. Regional targeting without compliance spells trouble.

Withdrawal Woes Fuel Frustrations

Deposits flow easily via cards/crypto/e-systems, but withdrawals demand account verification, often stalling for weeks. The minimum $10 payout mirrors deposits, yet 57 complaints cite rejections for “policy violations” post-profits. Crypto options aid anonymity but complicate dispute tracing.

Journalistic probes reveal patterns: small wins paid off, larger ones were blocked, eroding trust among Indonesian users.

Hidden Fees and Commission Traps

Zero commission on trade opens, but closing profitable positions incur a 11% fee? Wait, clarification needed—forex at 0.6 pips post-zero spread, stocks zero open, but inactivity bites. These structures favor the house, especially when resources are limited.

Indonesian traders, sensitive to costs, overlook fine print amid flashy ads. True expenses mount via spreads and fees.

Pros Dont Offset Serious Cons

- Demo accounts aid learning.

- 24/7 support promised.

- Spreads from 0 pips, low deposit of $10.

Yet cons dominate: no regulation, vague account types, no MT4/5, limited instruments, 57 complaints. Leveraging undisclosed public raises abuse fears.

Legitimacy Questioned Domain Deep Dive

Domain olymp-trade.com registered on 2014-04-14, expires on 2026-04-14, AWS-hosted, with a transfer lock. Longevity suggests stability, but ties to an unregulated Vanuatu entity undermine it. No major hacks reported, but complaint volume questions operational integrity.

Alternatives for Indonesian Traders

Stick to BAPPEBTI-licensed brokers that offer MT4, segregated funds, and local support. Verify via official registries before depositing. Prioritize FCA/ASIC for global safety.

Bottom Line

Olymp Trades has 57 complaints, its VFSC offshore license (40131), and the lack of robust regulation screams caution for Indonesian traders. Low deposits lure, but withdrawal issues, fees, and platform gaps risk funds. Avoid entirely—verify brokers via BAPPEBTI, demand segregated accounts, and report suspicions to authorities. Protect capital with regulated alternatives; the urgency is real.

Read more

Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Pemaxx Review: Fund Scams & No Withdrawals, Say Traders

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Fortune Prime Global Exposure: Withdrawal Denials & Profit Cancellations Frustrate Traders

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET Analysis Report

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.

WikiFX Broker

Latest News

New AI laws to arrest deepfakes

Global Macro: Real Wage Growth Expected to Return by 2026

XAU/USD: Gold Rally Signals 'Paradigm Shift' as Middle East Tensions Simmer

BoC Preview: Macklem to Hold at 2.25% Amidst Trade Anxiety

MONAXA Review 2026: Comprehensive Safety Assessment

Fed Holds Rates as Political Storm Intensifies; Trump to Name New Chair Imminently

Gold Smashes $5,600 Record on Shutdown Fears; Analysts Flash Crash Warning for Silver

FxPro Enhances MetaTrader 5 Execution with New LD4 Cross-Connect

Meta and Samsung Fuel AI Capex Boom, Keeping Risk Sentiment Alive

Fed Holds Rates Amidst Political Siege; Dollar Sinks to Four-Year Lows

Rate Calc