Founder Scandal Explodes as Trive Broker Leaves Employees Unpaid

Abstract:As employees of Trive broker continue to report months of unpaid salaries, a far more explosive controversy has now erupted around the Trive broker itself. The firm’s founder, Kasım Garipoğl has been publicly named in a major criminal investigation in Turkey.

The timing has intensified scrutiny. While staff across multiple regions claim they are still waiting for wages and statutory contributions, the man behind the Trive brand is now linked to a sweeping drug and financial crime investigation that has rocked Turkish media and social circles.

Kasım Garipoğlu is not a peripheral figure. He is the founder of Trive, a financial services group that emerged from his larger Global Kapital Group, where he serves as Chairman. Trive Investment BV and Trive Financial Holding BV were established around 2016, consolidating earlier brands such as GKFX and GKPro. Following a major restructuring in 2022, these entities were folded under the Trive name, positioning the Trive broker as a global trading and institutional services provider.

Now, that carefully built image is under severe pressure.

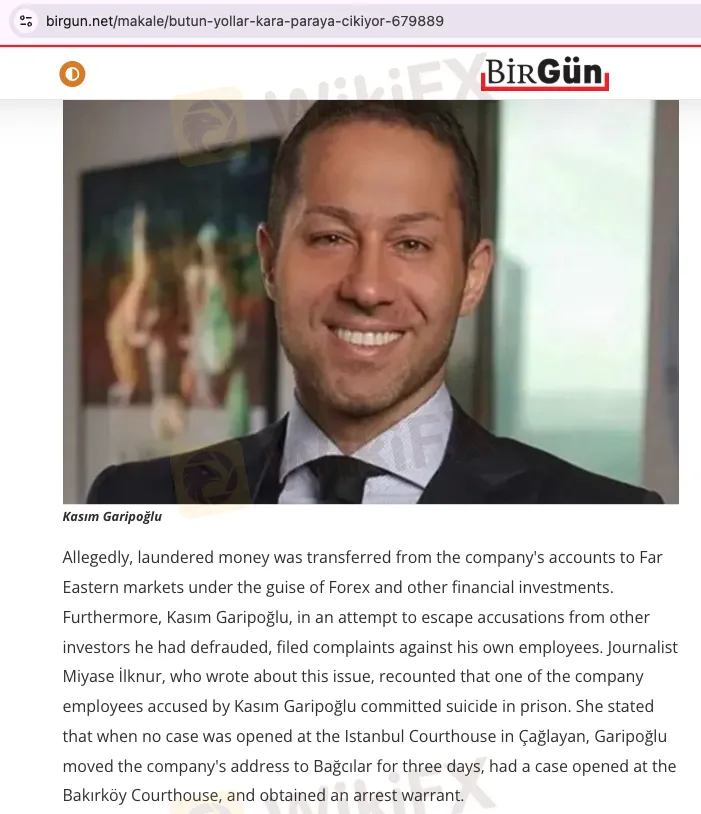

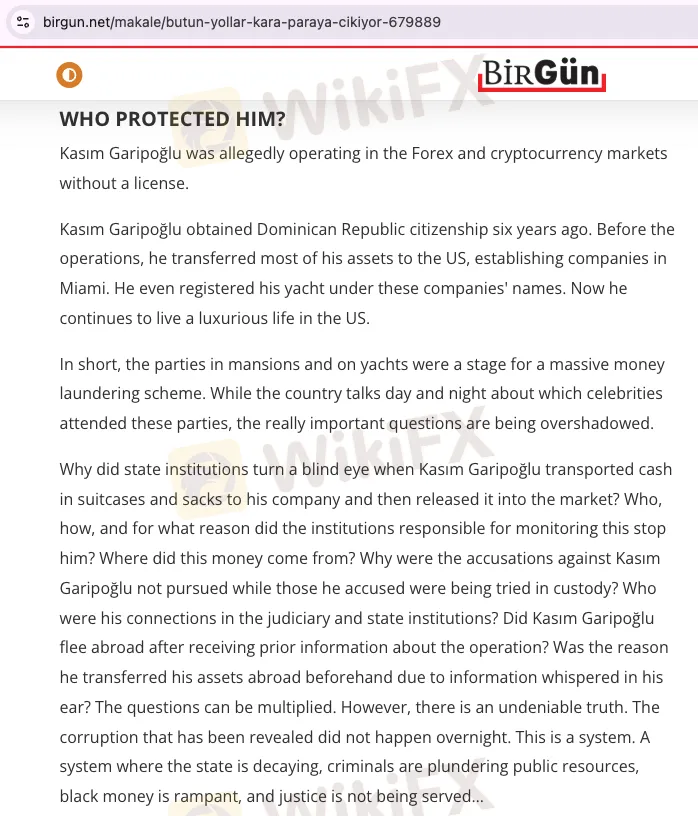

According to an official statement from the Istanbul Chief Public Prosecutors Office, the assets of seven individuals, including Kasım Garipoğlu and social figure Mert Vidinli, have been seized as part of an ongoing investigation into drug trafficking and money laundering. Prosecutors confirmed that the seizures were carried out under charges related to laundering assets derived from crime.

The investigation, led by the Smuggling, Narcotics and Economic Crimes Investigation Bureau, has already resulted in the arrest of at least 23 people. Garipoğlu and Vidinli are reportedly fugitives and are believed to be abroad. On December 28, authorities conducted a simultaneous operation across Istanbul targeting 34 establishments, including entertainment venues and hotels, resulting in multiple high profile arrests.

A follow up statement released by prosecutors confirmed asset seizure decisions against Kasım Garipoğlu, Fatih Garipoğlu, Burak Ateş, Ayşegül Şeynova, Gökmen Kadir Şeynova, Mert Vidinli, and Ezgi Fındık. Prosecutors also disclosed that this was not the first time Garipoğlus assets had been seized, noting earlier decisions tied to allegations of providing narcotic substances, facilitating their use, and personal usage.

The scope of the investigation is vast and continues under strict confidentiality. It has expanded beyond business figures to include celebrities, models, influencers, television anchors, and nightlife operators. Names linked to the probe have dominated headlines, with raids, arrests, travel bans, and forensic testing fuelling public fascination and outrage.

Against this backdrop, the situation at Trive has taken on a far darker tone.

Employees who have already accused the Trive broker of failing to pay salaries and retirement contributions are now asking uncomfortable questions. How can a broker operate normally when its founders assets are seized? What does this mean for internal finances, liquidity, and governance? And why are employees left unpaid while such a serious investigation unfolds?

Read this article here:

For traders, this is no longer just gossip. It is a convergence of warning signs.

A broker‘s stability depends not only on market execution and branding, but on leadership, compliance culture, and financial transparency. The founder of the Trive broker being publicly named in a criminal investigation involving narcotics and asset laundering is a reputational shock that cannot be separated from the firm’s ongoing payroll controversies.

Industry observers note that when founders face legal and financial restrictions, the effects often ripple quickly through corporate operations. Asset seizures, legal defence costs, frozen accounts, and heightened regulatory attention can strain even well-capitalised firms. For a broker already accused of failing to pay staff, the implications are particularly alarming.

Social media discussion around Trive has intensified rapidly, with traders and former employees sharing screenshots, court statements, and news clippings. The narrative spreading online is blunt and unsettling: while employees wait for salaries, the Trive brokers founder is fighting one of the most serious criminal probes in recent Turkish memory.

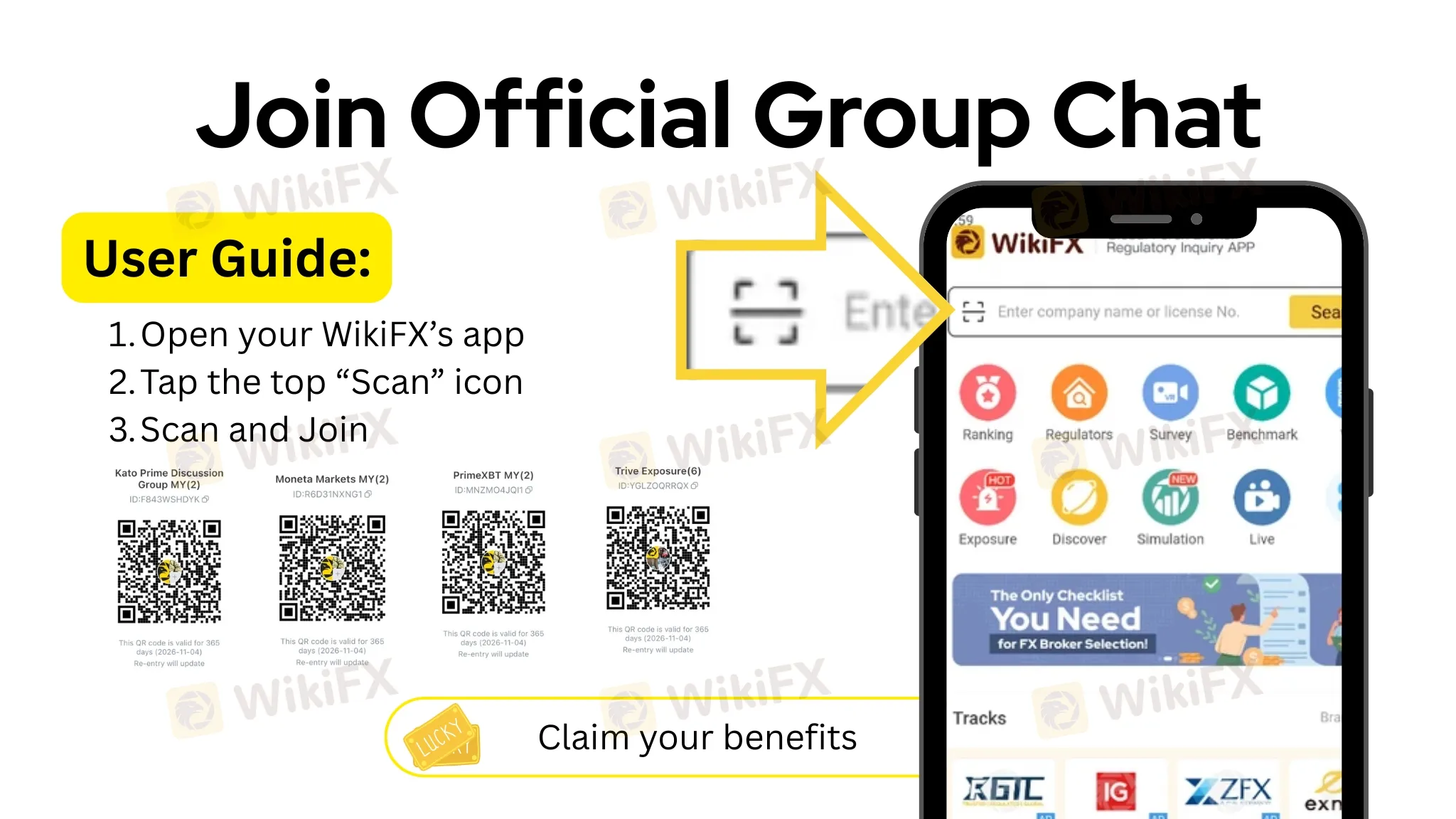

WikiFX stresses that this investigation is ongoing and that allegations have not yet been tested in court. However, the public actions taken by prosecutors, including repeated asset seizures, mark a significant escalation that traders should not dismiss.

As a global broker regulatory query platform, WikiFX remains committed to tracking and reporting developments that may impact trader safety. When internal payroll failures intersect with founder-level scandals, the risk profile of a broker changes dramatically and often without warning.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

Is Alpari safe or scam? What You Need to Know

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Rate Calc