The Profit Trap: Inside the Systematic Erasure at FBS

Abstract:FBS operates a dual-faced scheme where top-tier regulatory badges mask a predatory environment characterized by systematic profit erasure and 'Balance Fixed' operations that target successful traders. The data reveals a broker that facilitates losing trades with ease but weaponizes AML checks and price feed manipulation to trap funds the moment a client becomes profitable.

FBS presents itself as a titan of the brokerage world, boasting regulatory credentials from CYSEC and ASIC like a shield of legitimacy. But shields can also be used to hide what's happening behind the scenes. Our investigation into recent data and 170 customer complaints reveals a disturbing pattern: FBS isn't just a broker; its an ecosystem designed to punish success.

The “Balance Fixed” Slaughter

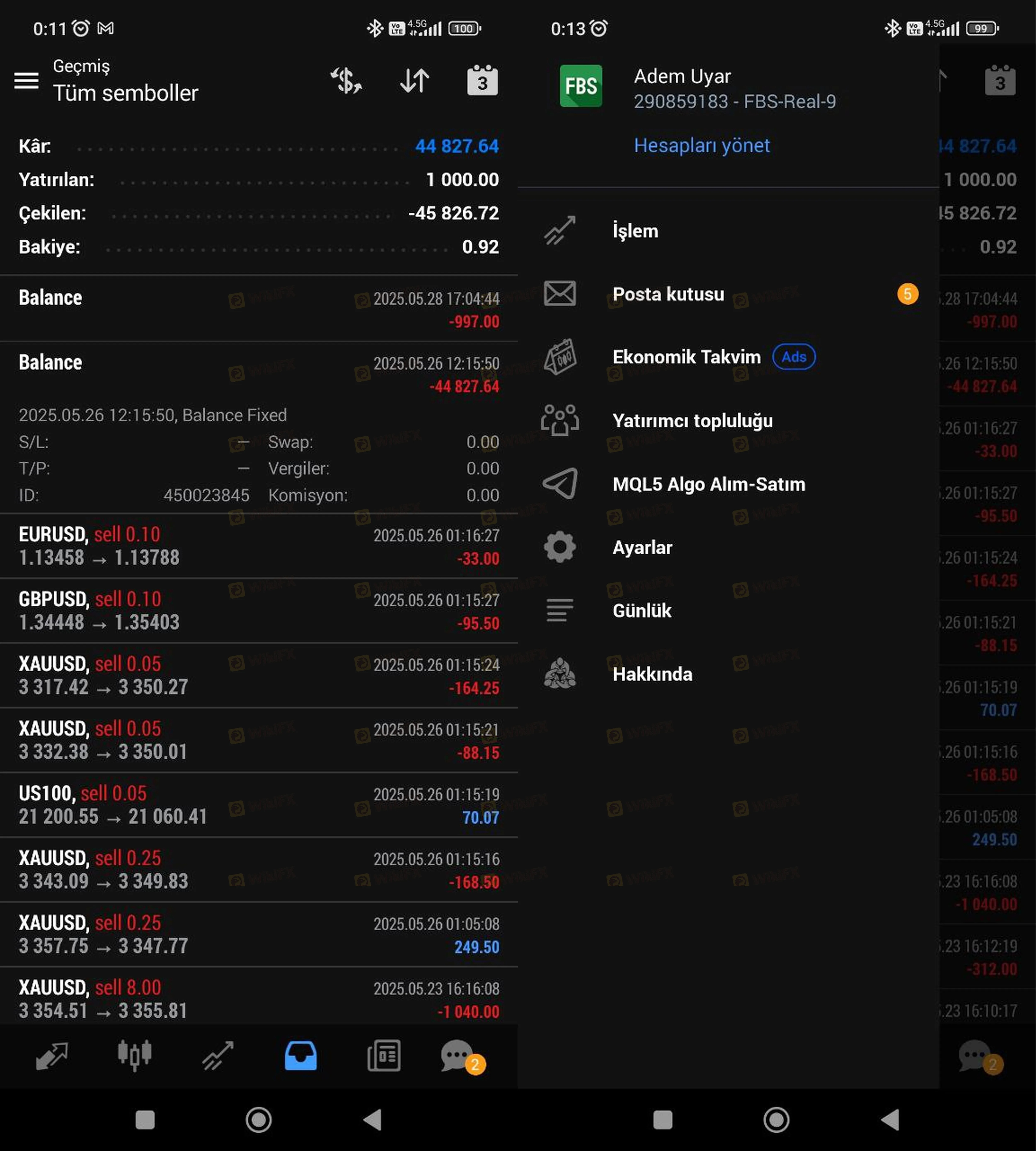

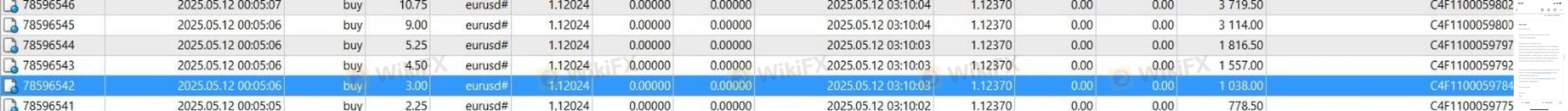

The most chilling evidence against FBS is the recurring “Balance Fixed” operation. When traders hit substantial profits—especially during high-volatility events like the CPI announcement—FBS doesn't congratulate them. Instead, they activate an internal adjustment that deletes thousands of dollars from the client's account. One trader in India reported the arbitrary removal of over $586 after a legitimate GBP/USD trade, while a Turkish client saw a staggering $44,827 vanished under the same “Balance Fixed” label. This isn't a technical glitch; it is a manual override of market reality.

Regulatory Reality Audit: The Global Discrepancy

While FBS flashes its European and Australian licenses, its operational shadow extends into jurisdictions where it has no right to be. The Malaysian Securities Commission (SCM) has explicitly blacklisted FBS for unauthorized activities.

| Regulator | License Type | Status |

|---|---|---|

| Cyprus Securities and Exchange Commission (CYSEC) | Investment Firm License | Regulated (331/17) |

| Australian Securities & Investments Commission (ASIC) | Investment Advice License | Regulated (426359) |

| Securities Commission Malaysia (SCM) | Unlicensed Activity | Warning/Investor Alert |

Investors often mistake “regulated” for “safe.” However, the 170 complaints in the last three months prove that a license in Nicosia doesn't stop a broker from manipulating feeds in Asia or the Middle East.

Feeds of Fiction: Phantom Candles and Stop-Loss Hunting

The data highlights a recurring nightmare for retail traders: price feeds that exist only on the FBS platform. Cases from Turkey and Iraq detail USD/TRY and XAU/USD candles that never touched market prices on global exchanges like TradingView or other major brokers. One investigator's report showed a silver (XAGUSD) position closed on a phantom drop to $18.667—a price unseen by the rest of the world.

In Germany, a high-volume trader noted a 400-point execution difference on EUR/USD compared to XM and FXOpen. FBS's excuse? “Different Liquidity Providers.” In the world of ECN trading, a 400-point gap isn't a difference in liquidity; it's a heist.

The KYC Weaponization Strategy

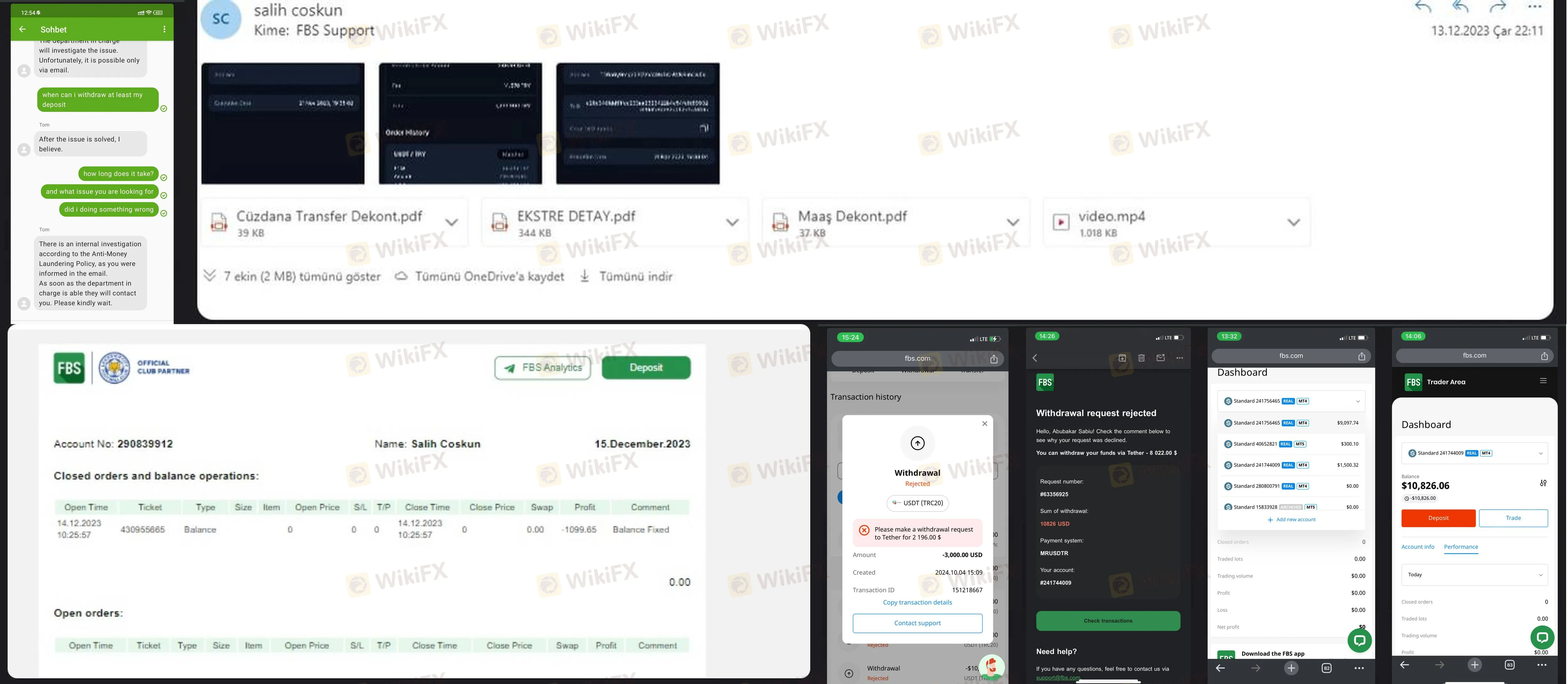

The most sinister tactic identified is the “KYC Blockade.” Our audit of cases from South Africa, India, and Hong Kong shows a clear trend: deposits are instant and require minimal friction. However, once a withdrawal request for profit is made, FBS suddenly discovers “AML concerns.”

Traders are forced to provide an absurd gauntlet of documentation—video selfies with IDs, bank statements for every crypto purchase made years ago, and “proof of fund origin” that is never deemed sufficient. While the trader is trapped in this bureaucratic loop, their account is often disabled or wiped clean. One user reported that after submitting all documents, FBS simply deactivated the account and deleted the entire transaction history.

Execution Malice and Arrogant Support

The trading environment, rated “A” by some metrics, hides a “C” grade in cost and a “B” in slippage. Max slippage has been clocked at a predatory 29.0 points. When these “errors” occur, the customer service experience transitions from “long wait times” to outright arrogance. Victims from South Africa and the Philippines describe agents who are dismissive, vague, or replaced entirely by AI when actual money is at stake.

Risk Verdict: The Predator in the Suit

FBS is a broker that welcomes losers and suffocates winners. If you are a novice blowing accounts, you will find their system seamless. The moment you develop a winning strategy, you enter the “Balance Fixed” danger zone. Between the phantom price candles and the weaponized AML checks, your capital is never truly yours once it crosses into an FBS account.

Anonymity & Risk Warning: Trading with a broker flagged by multiple investor alerts and high (customer complaints) is equivalent to gambling in a rigged house. WikiFX urges extreme caution. Your “regulated” status may not protect you from the “Balance Fixed” button.

WikiFX Broker

Latest News

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Eurozone Economy Stalls as Demand Evaporates

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Nigeria Outlook: FX Stability Critical to Growth as Fiscal Revenue Surges

AUD/JPY Divergence: Aussie Service Boom Contrasts with Japan's Fiscal "Truss Moment"

ZarVista Regulatory Status: A Deep Look into Licenses and High-Risk Warnings

KODDPA Review: Safety, Regulation & Forex Trading Details

Rate Calc