Capital.com Exposed: When 'Regulatory Safety' Becomes a Withdrawal Trap

Abstract:Our investigation exposes a critical 'pay-to-withdraw' spiral where traders are forced to pay exorbitant 'margin' fees to access their own funds. Despite holding top-tier licenses, Capital.com displays severe red flags including revoked regulatory statuses and 32 urgent complaints alleging withdrawal blockades in the last three months.

The promise of a global, multi-regulated broker usually brings peace of mind. But for dozens of traders reporting to WikiFX in late 2025, that peace has turned into panic.

Our investigation into Capital.com uncovers a disturbing disconnect between its polished reputation and the gritty reality faced by its users. While the brand flaunts an “AA” ranking, the ground-level data tells a story of frozen accounts, demands for “security deposits,” and revoked licenses.

The Trap: “Pay More to Get Your Money Back”

It starts simply: You hit withdraw. The money doesn't move.

Then comes the demand.

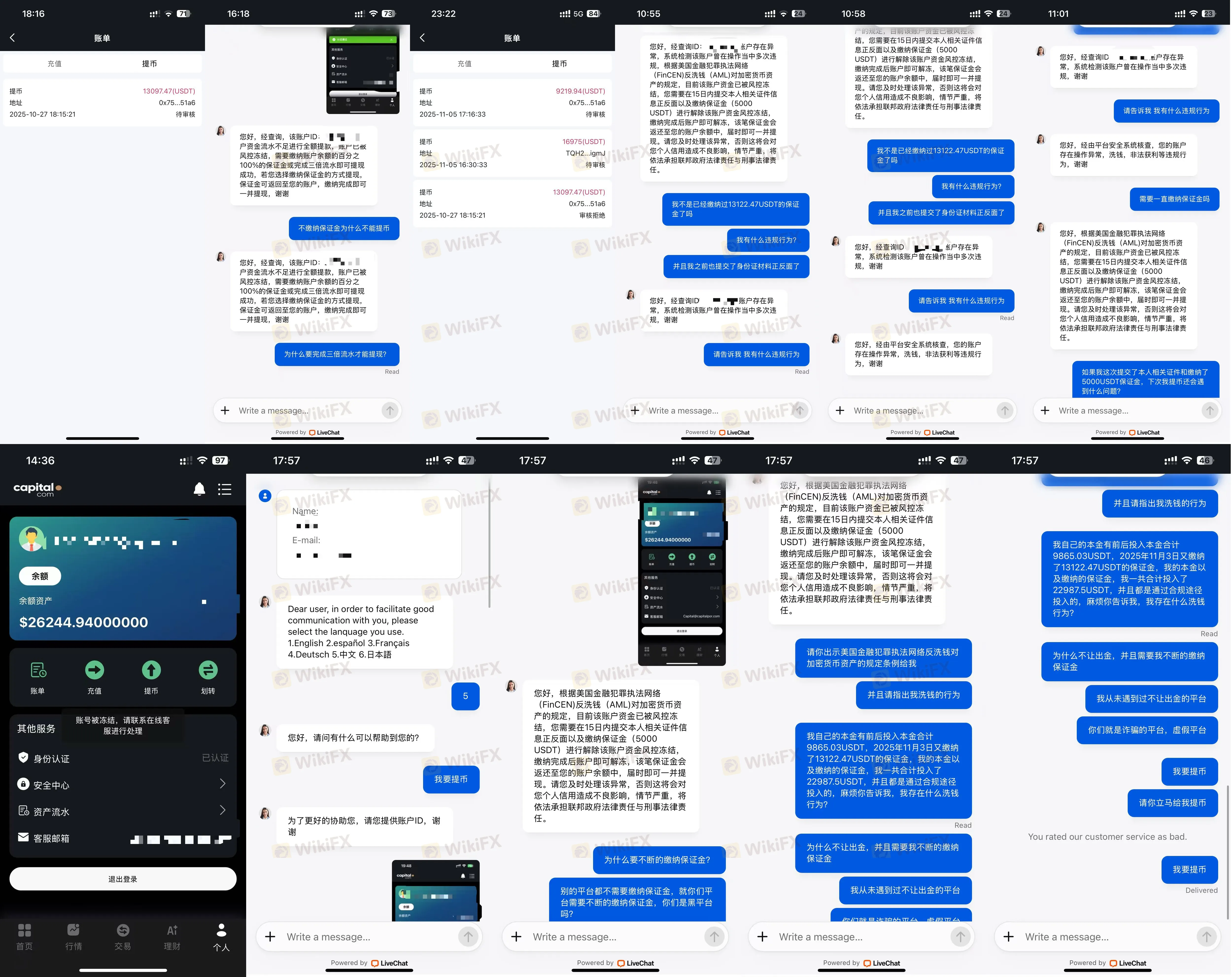

According to a harrowing report from November 13, 2025 (Case #2), a trader with a balance of over $13,000 was blocked from withdrawing due to “insufficient turnover.” The platform's solution? Deposit another $13,000.

> “I paid the 100% margin as requested within the time limit... Then I tried to withdraw the total $26,244. Now they are asking for another $5,000 within 15 days or my account will be permanently frozen.” — WikiFX User Complaint (ID: Case 2)

This is not standard industry practice. This is a classic extortion tactic known as a “recovery trap.” And it is not an isolated incident. Another user (Case #1) reported similar coercion on November 14, 2025, being asked to pay 5,000 USDT to clear a “money laundering” flag after already investing over 22,000 USDT.

Visual Evidence: The Withdrawal Blockade

Below are snapshots provided by users showing the paralysis of their funds.

Regulatory Reality Audit

Capital.com relies heavily on its image as a safe, regulated entity. However, our audit of the regulatory data reveals significant cracks in this shield. While they hold valid licenses in the UK and Australia, other jurisdictions show severe instability.

| Regulator | Region | License Status |

|---|---|---|

| NBRB (National Bank of Republic of Belarus) | Belarus | 已撤销 (Revoked) |

| FSA (Financial Services Authority) | Seychelles | 已撤销 (Revoked) |

| SCM (Securities Commission) | Malaysia | Unauthorized (Investor Alert) |

| CySEC | Cyprus | 监管中 (Regulated) |

| FCA | UK | 监管中 (Regulated) |

| ASIC | Australia | 监管中 (Regulated) |

Critical Warning: The Malaysia Securities Commission (SCM) explicitly listed Capital.com on its Investor Alert List for “carrying on capital market activities of dealing in securities without a license.” Furthermore, the revocation of licenses in Belarus and Seychelles suggests a retreat from certain regulatory frameworks or a failure to maintain compliance standards in those regions.

Anatomy of the Complaints

In the last 90 days alone, WikiFX has received 32 complaints. They follow three distinct patterns of failure:

- The “Turnover” Loophole: Users are told they haven't traded enough volume to withdraw their own principal (Cases 1 & 2). Legitimate brokers rarely lock principal deposits behind turnover walls; this is usually reserved for bonus credits.

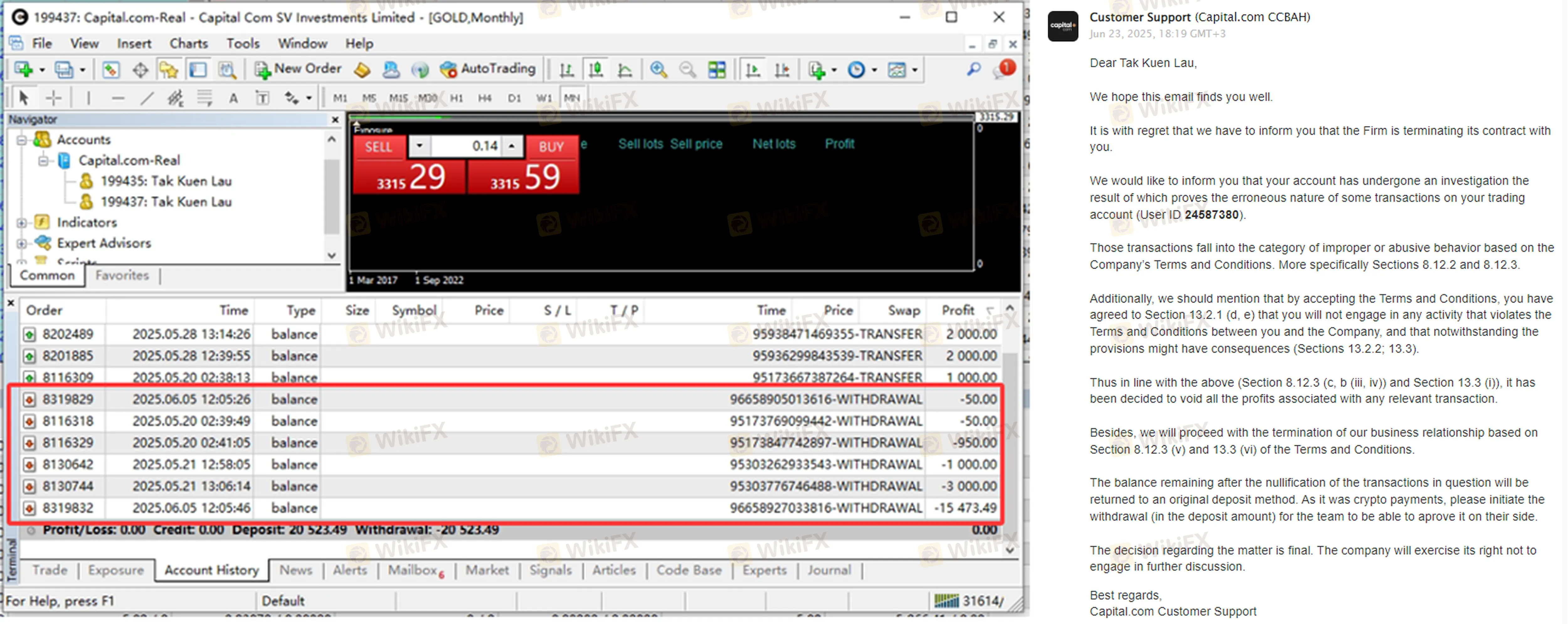

- The “Profit Cancellation” Clause: A user from Hong Kong (Case #8) reported that losses were treated as normal, but profitable trades were flagged as “abnormal,” leading to a rejection of an $18,523 withdrawal.

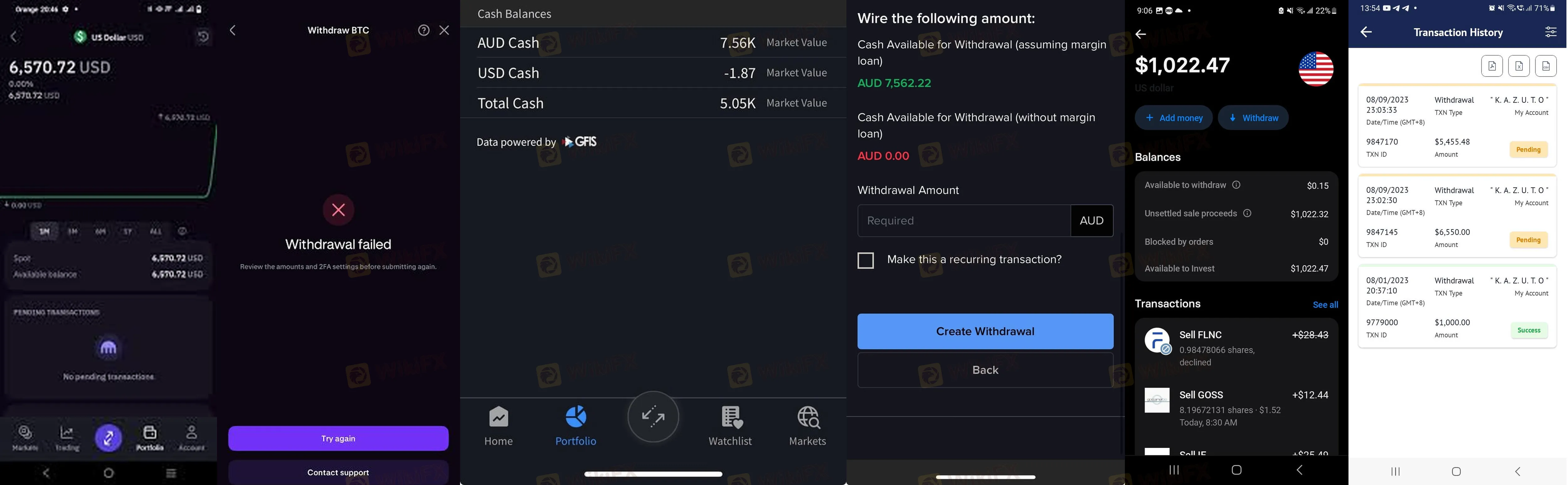

- Technical Stonewalling: U.S. traders (Cases 3, 4, 5, 6) report a wave of system errors—invalid name errors, pending statuses lasting 15+ days, and an inability to withdraw even with positive cash balances.

Verdict: High-Risk Anomalies Detected

While Capital.com possesses high-level regulatory paper in the UK and Australia, the user experience reported to WikiFX directly contradicts the safety implied by these licenses.

The presence of “pay-to-withdraw” demands (Case 1, Case 2) is the single biggest red flag in online trading. Whether these users have fallen victim to a clone site or are experiencing severe malpractice from the main entity, the risk to your capital is currently critical.

WikiFX Recommendation:

1. Do NOT Pay Margin to Withdraw: If a broker asks for a deposit to release funds, stop immediately. You will not get that money back.

2. Verify the URL: Ensure you are not on a phishing site, as the “Margin Trap” is a hallmark of clone firms.

3. Halt Trading: Given the 32 recent complaints and the Malaysia warning, we advise suspending all deposits until these withdrawal hurdles are publicly resolved.

WikiFX Broker

Latest News

ECB Minutes: Service Inflation and Wage Spikes Kill Rate Cut Speculation

Trade War Averted: Euro Rallies as US Withdraws Tariff Threats

Yen Volatility Spikes: PM Takaichi Calls Snap Election Amid BoJ 'Hawkish Pause'

Sticky US Inflation Data Dashes Near-Term Fed Rate Cut Hopes

Yen Fragility Persists: Inflation Miss Cements BoJ 'Hold' Expectation

BoJ "Politically Paralyzed" at 0.75% as Takaichi Calls Snap Election

'Bond Vigilantes' Return: JGB Rout Sparks Contagion Fears for US Treasuries

ZarVista User Reputation: Looking at Real User Reviews to Check Is ZarVista Safe or Scam?

Gold Fun Corporation Ltd Review 2025: Is This Forex Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

Rate Calc