Yorker Capital Markets Review 2025: Is This Broker Safe or a Scam?

Abstract:Yorker Capital Markets is a Forex and CFD broker headquartered in the United Arab Emirates (UAE). Established in 2023, the brokerage offers digital account opening and trading via the MetaTrader 5 (MT5) platform. Despite its modern interface and versatile account types, the broker currently holds a dangerously low WikiFX score of

Yorker Capital Markets is a Forex and CFD broker headquartered in the United Arab Emirates (UAE). Established in 2023, the brokerage offers digital account opening and trading via the MetaTrader 5 (MT5) platform. Despite its modern interface and versatile account types, the broker currently holds a dangerously low WikiFX score of 1.37.

This low score is primarily due to a lack of regulatory oversight and a significant volume of investor complaints regarding withdrawals. In this review, we analyze Yorker Capital Markets' regulatory status, trading conditions, and user feedback to determine if your funds are safe.

Is Yorker Capital Markets Legit? Regulatory Status

The most critical factor in validating a broker is its regulatory license. Brokers regulated by Tier-1 authorities (such as the FCA or ASIC) are required to segregate client funds and adhere to strict auditing standards.

According to current data, Yorker Capital Markets is not regulated by any financial authority.

| License Type | Regulator | Status |

|---|---|---|

| None | No Regulator | Unregulated |

While the broker claims to be based in the UAE, there is no evidence of a license from the DFSA (Dubai Financial Services Authority) or any other recognized regulatory body. This means that clients have no legal protection or recourse if the broker becomes insolvent or refuses to release funds. The “Safety” analysis explicitly states that no valid regulation has been found, classifying the broker as high-risk.

Scam Exposure: Complaints Against Yorker Capital Markets

A major red flag for Yorker Capital Markets is the high volume of user complaints. In the last three months alone, there have been 15 reported complaints, indicating serious operational issues. Analyzing the available user reports reveals a disturbing pattern of alleged misconduct.

Common Complaint Themes:

- Withdrawal Failures: The majority of users report that their withdrawal requests are ignored or pending for extended periods. One user from India stated, “My capital amount has been blocked,” while another from Romania warned, “I have 2 delays pending since the beginning of the month.”

- Account Blocking: Several traders reported that after requesting a withdrawal, their administrative access was revoked. One complaint specifically mentioned, “Admin blocked my ID... neither withdrawal is happening nor is the capital accessible.”

- MLM and “Ponzi” Allegations: Multiple reports describe the broker's operations as a “Ponzi scheme” or “MLM (Multi-Level Marketing) scheme.”

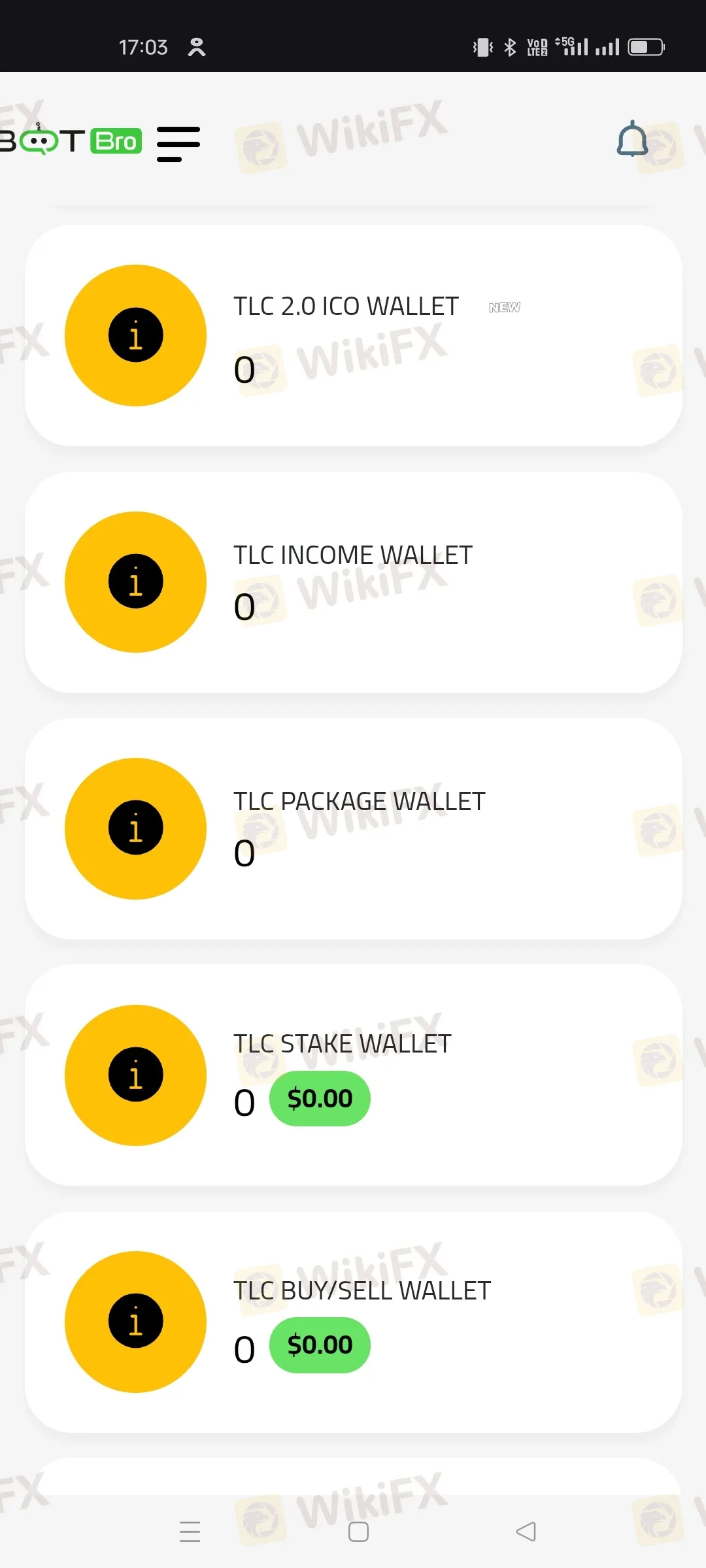

- Botbro Connection: Certain complaints claim a link between Yorker Capital Markets and “Botbro,” alleging that the owners are the same and that trade data in MT5 is manipulated (“fake trade in MT5”).

Recent Case Examples:

- February 2025: A user labeled the broker a “Very big scam” and urged others to avoid what they termed an “MLM scheme.”

- December 2024: A trader reported that despite investing a significant sum, withdrawals were not processed, calling it a “100% scam.”

- November 2024: Another user claimed their capital was held hostage, with customer support demanding an additional deposit (“125$”) to “activate” the ID for withdrawal—a classic tactic often associated with fraudulent platforms.

While there is one isolated positive review from March 2024 claiming efficient withdrawals, it is heavily outweighed by a flood of accusations regarding seized funds and unresponsive support.

Trading Conditions and Fees

For traders who look past the regulatory warnings, Yorker Capital Markets offers competitive trading conditions on the MetaTrader 5 (MT5) platform.

Account Types

The broker offers five distinct account types to cater to different levels of capital:

1. Standard Account: Requires a minimum deposit of only $10. It offers high leverage up to 1:1000 with spreads starting from 1.5 pips.

2. Classic Account: Minimum deposit $500, leverage up to 1:500, spreads from 1.2 pips.

3. Premium Account: Minimum deposit $2000, leverage up to 1:200, spreads from 1.0 pips.

4. Swap Free Account: Minimum deposit $3000, mostly for Islamic traders, with leverage capped at 1:200 and spreads from 1.5 pips.

5. ECN Account: The professional tier requiring $5000. Offers raw spreads provided from 0.0 pips with leverage up to 1:500.

Platform and Leverage

- Platform: Users trade solely on MT5, which supports Expert Advisors (EAs) and scalping.

- Leverage: The maximum leverage reaches 1:1000 on the Standard account. While high leverage can multiply profits, it significantly increases the risk of rapid capital loss, especially with an unregulated entity.

Pros and Cons of Yorker Capital Markets

Pros:

- Offers the advanced MT5 Trading Platform.

- Very low minimum entry ($10 for Standard Account).

- Extremely high leverage available (up to 1:1000).

- Multiple account types including Swap-Free options.

Cons:

- Score of 1.37 (High Danger).

- Not regulated by any financial authority.

- High number of unresolved complaints regarding withdrawals.

- Allegations of operating as an MLM/Ponzi scheme.

- Customer support reported as unresponsive by users with withdrawal issues.

Final Verdict: Can You Trust Yorker Capital Markets?

Based on the available data, Yorker Capital Markets is not a safe broker.

The combination of zero regulatory oversight, a WikiFX score of 1.37, and a specific pattern of complaints involving blocked withdrawals and “fee-to-withdraw” demands suggests a high risk of capital loss. The allegations linking the broker to MLM schemes and manipulated trade data add to the severity of the warning.

Traders are strongly advised to avoid unregulated entities and prioritize brokers with licenses from Tier-1 jurisdictions.

Stay protected against potential scams. Use the WikiFX app to verify broker licenses and read real-time exposure details before depositing funds.

WikiFX Broker

Latest News

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Geopolitical Risk: Iran Accuses West of Inciting Domestic Unrest

Oil Markets Tighten: OPEC+ leans towards extending output pause into March

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Wall Street Giants Pivot: The "Reflation Trade" Returns

Geopolitical Risk: US Carrier Deploys as Iran Eyes Hormuz

Rate Calc