U.S. Employment Data Delivers a Positive Surprise

Abstract:U.S. ADP employment data for December showed a gain of 41,000 jobs, signaling early signs of a rebound in the labor market. According to the report, job growth was primarily driven by education and he

U.S. ADP employment data for December showed a gain of 41,000 jobs, signaling early signs of a rebound in the labor market. According to the report, job growth was primarily driven by education and health services, as well as the leisure and hospitality sector.

However, ADP Chief Economist Dr. Nela Richardson noted that while small businesses recovered from the wave of layoffs seen in November and resumed active hiring toward year-end, large enterprises continued to scale back recruitment.

(Figure 1: U.S. ADP Employment Report for December | Source: ADP Report)

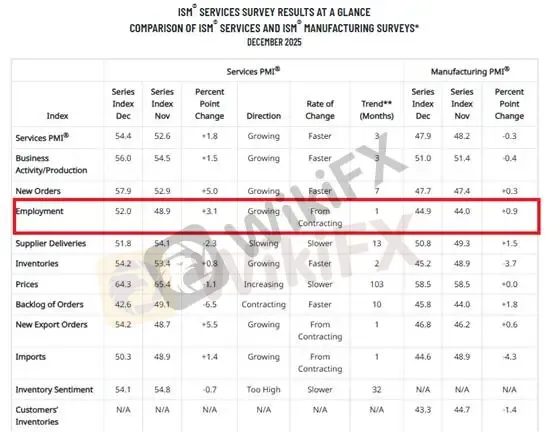

Alongside the ADP release, December ISM Non-Manufacturing Index (NMI) data were also published yesterday (Jan 8). A comparison of employment sub-indices shows improvement across both sectors:

Manufacturing employment rose from 48.9 to 52.0

Services employment increased from 44.0 to 44.9

The simultaneous improvement suggests a seasonal rebound in year-end consumer demand, helping offset underlying structural softness in the labor market.

The U.S. Dollar Index (DXY) reacted positively to the data, rebounding and reclaiming the 98 level, which in turn exerted short-term downward pressure on precious metal prices.

(Figure 2: ISM Employment Components | Source: ISM Report)

The encouraging employment data provide a constructive start to the new year and support expectations for a gradual recovery in end-market consumption. From a monetary policy perspective, the outlook remains consistent with a gradual and orderly rate-cutting path by the Federal Reserve, alongside a moderating inflation environment. This aligns with our prior assessment of a disinflationary growth trajectory.

Diverging Views on Inflation: Investors vs. Consumers

At present, a noticeable divergence exists between macroeconomic researchers and consumer sentiment regarding inflation.

From an investors perspective, attention is focused on headline indicators such as CPI and PCE, which continue to trend lower. This reinforces the view that inflationary pressures are easing. Furthermore, stable wage growth helps prevent a wage-price spiral and may gradually reduce the burden on end consumers.

By contrast, consumers inflation perceptions are shaped by the reality that wage growth has not kept pace with price increases, leading to a faster erosion of perceived disposable income.

In essence, one perspective is forward-looking and expectation-based, while the other is grounded in present-day purchasing power.

Turning to Figure 3, which tracks ADP median wage growth, job switchers typically serve as a leading indicator when labor market conditions improve. A clear inflection point has emerged, with median wage growth rising from 6.30% to 6.60%, supporting a more constructive outlook for future wage and price dynamics.

In other words, prices continue to decelerate, while wages are beginning to trend higher at a measured pace.

(Figure 3: ADP Median Wage Growth | Source: MacroMicro / M²)

Overall, the U.S. labor market is showing early signs of improvement. This may reflect seasonal factors, but it also suggests that the effects of the Feds easing cycle are gradually transmitting into the real economy.

Gold: Technical Analysis

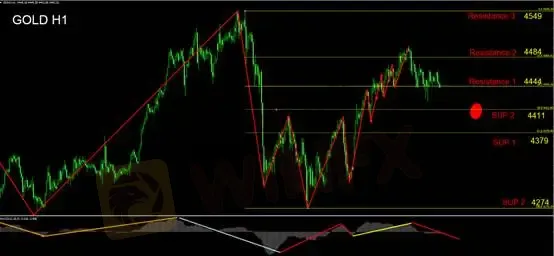

From an operational standpoint, we maintained a neutral (no-position) stance yesterday, primarily waiting for a pullback to establish long positions.

However, stronger economic data have supported the U.S. dollar, increasing downside pressure on precious metals. While the broader technical structure for gold remains constructive, investors should remain alert to the possibility of a trend shift from bullish to bearish in the short term.

Price action has yet to reach the key support level at USD 4,411 per ounce. Intraday price behavior suggests a higher probability of a pullback toward this level, making it a critical area to monitor.

Momentum indicators show that the MACD histogram has fallen below the zero line, with no clear rebound momentum at this stage. Intraday long positions should only be considered if both conditions are met:

A pullback to USD 4,411/oz, and

The MACD histogram turning positive and reclaiming the zero line.

Support Levels

SUP1: 4,379

SUP2: 4,274

Resistance Levels

Resistance 1: 4,444

Resistance 2: 4,484

Resistance 3: 4,549

Risk Disclaimer

Failure to meet either condition weakens the long setup. A decisive break below USD 4,411/oz would shift focus toward potential short opportunities.

Suggested Stop Loss: USD 20

The above views, analysis, research, price levels, and related information are provided for general market commentary only and do not represent the position of this platform. All readers assume full responsibility for their own investment decisions. Please trade with caution.

WikiFX Broker

Latest News

ECB Minutes: Service Inflation and Wage Spikes Kill Rate Cut Speculation

Trade War Averted: Euro Rallies as US Withdraws Tariff Threats

Yen Volatility Spikes: PM Takaichi Calls Snap Election Amid BoJ 'Hawkish Pause'

Sticky US Inflation Data Dashes Near-Term Fed Rate Cut Hopes

Yen Fragility Persists: Inflation Miss Cements BoJ 'Hold' Expectation

BoJ "Politically Paralyzed" at 0.75% as Takaichi Calls Snap Election

'Bond Vigilantes' Return: JGB Rout Sparks Contagion Fears for US Treasuries

ZarVista User Reputation: Looking at Real User Reviews to Check Is ZarVista Safe or Scam?

Gold Fun Corporation Ltd Review 2025: Is This Forex Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

Rate Calc