JFD Review: Pros, Cons and Regulation

Abstract:JFD review covers pros, cons, and regulation. Learn about CySEC and VFSC licenses, trading platforms, fees, and broker safety for global traders.

JFD Review Overview

Founded in 2011, JFD Brokers (operating as JFD Group Ltd and JFD Overseas Ltd) positions itself as a multi-asset brokerage with a regulatory footprint in both Europe and offshore jurisdictions. Headquartered in Cyprus, the broker has expanded its services to cover forex, commodities, stocks, indices, cryptocurrencies, and ETFs/ETNs, offering more than 1,500 tradable instruments.

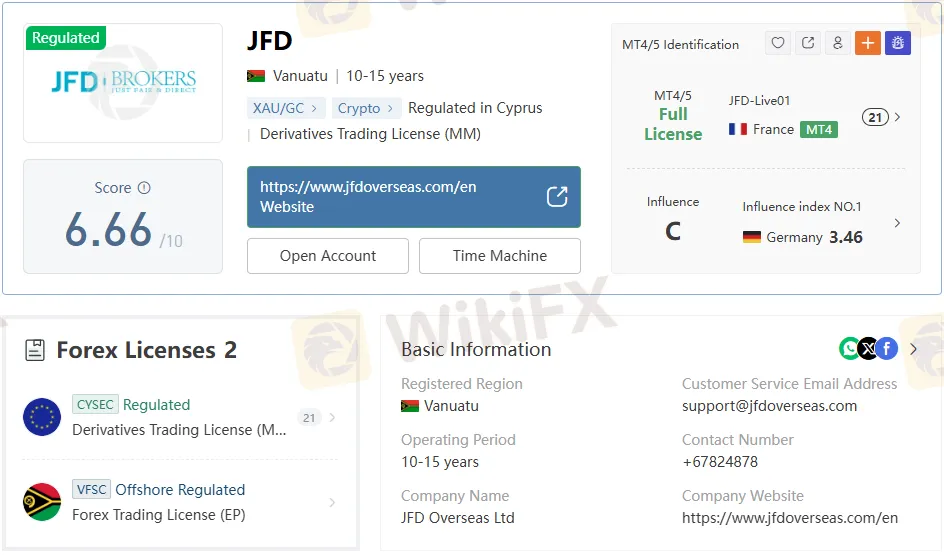

This JFD review examines the brokers regulatory standing, trading platforms, fees, and overall safety profile. With CySEC oversight in Cyprus and a VFSC license in Vanuatu, JFD operates under a dual framework that blends EU regulatory standards with offshore flexibility.

JFD Regulation and Safety

CySEC License

JFD Group Ltd holds a Cyprus Securities and Exchange Commission (CySEC) license (No. 150/11), effective since August 2011. This license authorizes activities including derivatives trading, investment consulting, asset management, and securities trading. Importantly, CySEC regulation allows JFD to passport services across 20 EU member states, reinforcing its legitimacy within Europe.

VFSC License

JFD Overseas Ltd also holds a Vanuatu Financial Services Commission (VFSC) license (No. 17933), issued in January 2023. While this provides authorization for forex, futures, securities, bonds, and options trading, it is categorized as offshore regulation. Offshore licenses typically operate under lighter frameworks, which may raise questions about investor protection compared to EU standards.

Transparency and Domain Registration

The brokers primary domain, jfdbrokers.com, was registered in September 2011 and is set to expire in September 2025. Domain records confirm active status with restrictions on transfer and renewal, signaling operational continuity.

Trading Platforms and Technology

JFD supports MetaTrader 4+ (MT4+) and MetaTrader 5+ (MT5+), alongside Stock3, a German social trading platform.

- MT4: Enhanced with exclusive JFD add-ons, suitable for beginners.

- MT5: Advanced features for experienced traders, supporting desktop, web, and mobile.

- Stock3: Web-based, designed for traders seeking community-driven insights.

Execution speed averages 187 milliseconds, with multiple servers in Cyprus ensuring stability. Leverage options extend up to 1:400 for professional clients, while retail accounts are capped at lower levels under EU rules.

Instruments Available

JFD offers access to nine asset classes:

- Forex

- Commodities

- Stocks

- Cryptocurrencies

- Precious metals

- Indices

- ETFs/ETNs

- Bonds

- Mutual funds

This breadth of instruments places JFD in line with larger competitors, though some brokers may offer broader derivatives coverage.

Account Types and Features

JFD operates a single account system with the following conditions:

- Minimum deposit: 500 EUR/USD/GBP/CHF

- Margin call level: 100%

- Stop-out level: 50%

- Negative balance protection: Available for EU accounts, not for offshore accounts

- Segregated funds: Client money held in top-tier institutions

A demo account is available for testing strategies and platform functionality.

JFD Fees and Costs

Trading Commissions

- CFDs, FX & Metals: Commission-based structure

- US stocks: $0.05 per share, minimum $3

- EU stocks: 0.15% of order volume, minimum €3

- Spanish stocks: 0.20% of order volume, minimum €6

Financing and Swaps

Overnight financing applies to CFDs on stocks and cash indices, calculated at 3.25% plus the benchmark rate.

Deposit and Withdrawal Fees

- Bank transfer (Sofort): 1.8% + fixed fee

- Online payments (Skrill, Neteller): 0.25 EUR + 1.7–3.25%

- Credit cards: 1.95–2.95%

- Withdrawals: Credit card refunds incur €0.25 authorization + €2 refund fee; Skrill/Neteller withdrawals cost 1–2% (capped at $30).

Inactivity Fee

Accounts inactive for three months incur a €20 monthly fee.

Compared to competitors, JFDs fees are higher than discount brokers but remain competitive against mid-tier European firms.

JFD Pros and Cons

| Pros | Cons |

| Regulated by CySEC | Offshore VFSC license offers weaker investor protection |

| Over 1,500 instruments across 9 asset classes | Restrictions in China and the United States |

| MT4+/MT5+ with exclusive add-ons | High deposit/withdrawal fees (up to 3.25%) |

| Segregated client funds | Inactivity fee of €20 after 3 months |

Competitor Context

Compared to brokers like Pepperstone or IC Markets, JFDs regulatory standing in Cyprus provides credibility, but its reliance on VFSC for offshore operations may deter risk-averse traders. Fee structures are heavier than low-cost competitors, though JFD compensates with platform enhancements and broader asset coverage.

Bottom Line

This JFD review highlights a broker that blends European regulation with offshore flexibility, offering a wide range of instruments and established trading platforms. While fees are relatively high and offshore licensing may concern cautious investors, CySEC oversight and segregated client funds provide a measure of safety.

For traders seeking access to multiple asset classes under a regulated EU framework, JFD presents a legitimate option. However, cost-sensitive traders may find better value with competitors offering lower commissions and fees.

Read more

Angel Broking Review 2026: Is Angel Broking a Safe Broker or a High-Risk Platform?

When choosing a forex or CFD broker, regulation and transparency are critical factors. In this Angel Broking review, we take a close look at the broker’s background, regulatory status, trading conditions, and potential risks. According to WikiFX, Angel Broking has received a low score of 1.57/10, which raises serious concerns for traders.

BDFX Exposure: Alleged Misleading Market Advice & Poor Withdrawal Management

Do BDFX officials mislead you with poor market advice that leads to capital losses? Do you feel they themselves cannot trade the risk management analysis perfectly? Did the Comoros-based forex broker close your forex trading account and steal your funds? Did your numerous fund withdrawal requests go in vain? These are potential forex investment scams. Many traders have highlighted these trading issues on broker review platforms. Check out some of their complaints in this BDFX review article.

PURE MARKET Review: Investigating Deposit Credit Failures & Withdrawal Complaints

Did PURE MARKET stop processing payments after receiving deposits on the trading platform? Do you get a sense of a Ponzi scheme when trading with PURE MARKET? Does the broker intentionally delay your fund withdrawals? Have you faced a profit deduction on account of a wrong, arbitrary claim by the broker? Does the broker change the spread frequently to cause you losses? In this PURE MARKET review article, we have investigated these complaints against the Vanuatu-based forex broker. Keep reading!

24Five Scam Alert: No License, High Risk Trading

24Five Scam Alert exposes suspicious practices, a lack of a license broker, and hidden risks. Protect your money with key insights today.

WikiFX Broker

Latest News

China Holds Rates Steady After Hitting 5% Growth Target, Easing Expected in Q1

JPY Volatility Ahead: PM Takaichi Calls Snap Election Amid Rate Hike Speculation

Is Forex Still Worth It in 2026? Global Central Banks Are Splitting

The Fed on Trial: Markets Brace for Supreme Court Showdown Over Central Bank Independence

Trade War 2.0: Trump’s Greenland Ultimatum Rattles Transatlantic Alliance

Euro Stabilizes as France Forces 2026 Budget; Bond Spreads Narrow

JPY Volatility Spikes as PM Takaichi Calls Snap Election and Fiscal Gamble

JGB Yields Breach 4% as PM Takaichi's Fiscal Gambit Triggers 'Sell-Off'

Scrolled, Clicked, Lost RM166,000: Factory Worker Trapped by Online Investment Scam

China Macro: Liquidity Trap Signals Persist Despite Credit Bump

Rate Calc