OneRoyal Trust Score: A Complete Look at Whether It's Real or Fake

Abstract:When traders ask, "Is OneRoyal legit or a scam?" The answer isn't simply yes or no. OneRoyal is a trading company that has been running for almost twenty years and has important licenses from top financial authorities. This background puts it far away from typical quick scam operations. However, questions about whether it's trustworthy are reasonable and often come from its complicated business structure, the use of overseas companies, and a pattern of specific, serious complaints from users. This article aims to go beyond marketing claims and provide a fact-based analysis of OneRoyal's trustworthiness.

When traders ask, “Is OneRoyal legit or a scam?” The answer isn't simply yes or no. OneRoyal is a trading company that has been running for almost twenty years and has important licenses from top financial authorities. This background puts it far away from typical quick scam operations. However, questions about whether it's trustworthy are reasonable and often come from its complicated business structure, the use of overseas companies, and a pattern of specific, serious complaints from users. This article aims to go beyond marketing claims and provide a fact-based analysis of OneRoyal's trustworthiness.

We will examine whether it's legitimate by looking at four main areas:

· Its licenses from multiple countries and regulatory oversight.

· Its long history of operations and worldwide presence.

· How competitive and realistic its trading conditions are.

· The type and seriousness of user-reported “scam” claims.

Understanding OneRoyal's Regulatory Framework

A broker's regulatory status is the most important factor in determining if it's legitimate. OneRoyal operates through multiple companies, which has both advantages and disadvantages for trader safety. Understanding the difference between its top-level and offshore licenses is essential for any potential client doing research.

Top-Level Regulation

The foundation of OneRoyal's claim to being legitimate comes from its licenses from two of the world's most respected financial regulators: the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC).

· CySEC: The company Royal Financial Trading (Cy) Ltd holds a license number 312/16. This gives access to the European market and makes the broker follow strict EU-wide MiFID II rules.

· ASIC: The company Royal Financial Trading Pty Ltd holds an Australian Financial Services Licence (AFSL) number 420268. ASIC is known for its tough enforcement and consumer protection standards.

Protections under these top-level regulators are significant. They require that client funds be kept separate from the companys operating funds, ensuring that client capital cannot be used for business expenses. They also provide access to investor compensation programs in case the broker goes out of business.

Offshore Regulation Details

Along with its top-level licenses, OneRoyal also operates companies registered in offshore locations. These include Royal CM Limited, licensed by the Vanuatu Financial Services Commission (VFSC), and Royal ETP LLC, registered with the Financial Services Authority (FSA) of St. Vincent & the Grenadines.

It's important to understand that these locations offer very little regulatory oversight and protection. The FSA in St. Vincent, for example, is a registration body and does not regulate forex brokerage activities. Traders whose accounts are registered under these offshore companies do not get the same protections as those under CySEC or ASIC, such as access to compensation funds or strict fund separation rules. The key question for any trader is to find out the specific company* their account will be opened under, as this single factor determines their level of security.

The FinaCom Safety Net

As an additional layer of protection, OneRoyal is a member of the Financial Commission (FinaCom). FinaCom is an independent, external dispute resolution organization for the forex industry. This membership gives traders access to a neutral third party to help resolve disputes. A key benefit is access to FinaCom's Compensation Fund, which covers judgments up to €20,000 per client. This offers valuable help for traders, especially those who may be under a company with weaker local regulations.

Regulatory Verdict and Verification

OneRoyal's regulatory framework is strong on paper, supported by its CySEC and ASIC licenses. However, the presence of offshore companies adds complexity that requires careful attention by the trader.

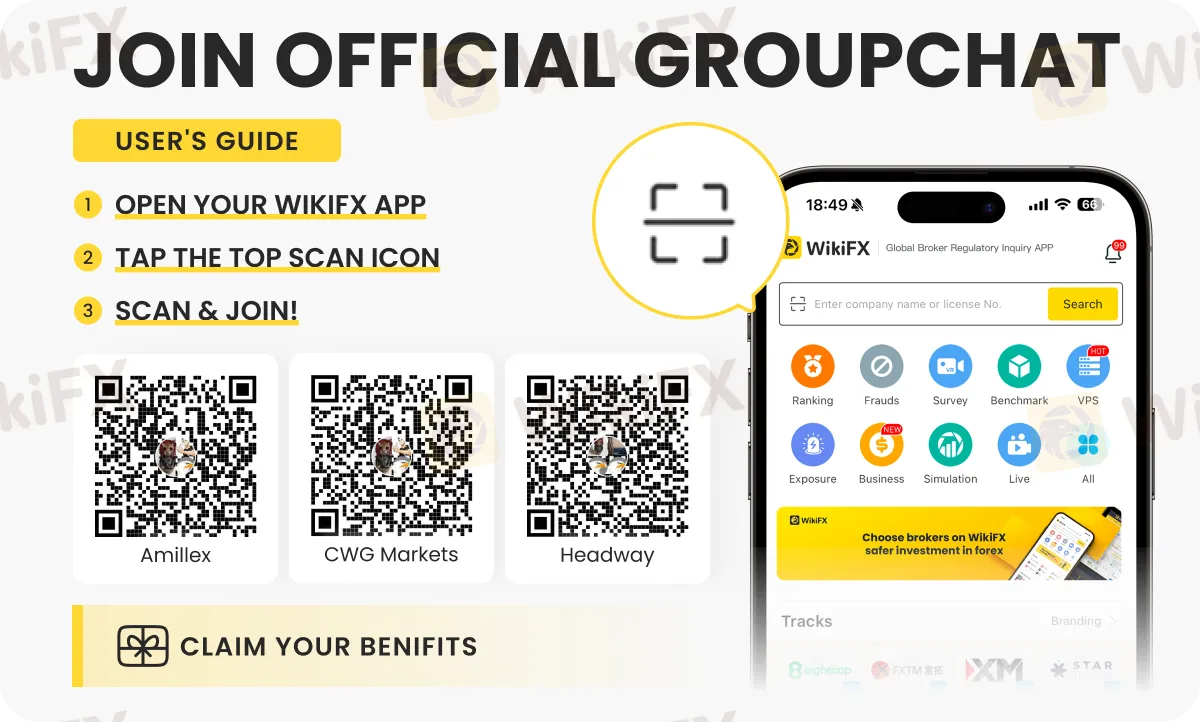

Understanding a broker's complex regulatory claims can be challenging. Before proceeding, we strongly advise traders to use an independent verification tool. Platforms, such as WikiFX, can help confirm the current status of these licenses and provide updated regulatory information, ensuring you are not relying on old data.

| Regulator | Entity Name | License/Registration No. | Regulatory Tier | Key Protections |

| CySEC | Royal Financial Trading (Cy) Ltd | 312/16 | Tier-1 | Segregated Funds, Investor Compensation |

| ASIC | Royal Financial Trading Pty Ltd | AFSL 420268 | Tier-1 | Segregated Funds, Strict Compliance |

| VFSC | Royal CM Limited | 700284 | Offshore | Lower Oversight |

| FSA | Royal ETP LLC | 149LLC2019 | Registration | Minimal Regulatory Oversight |

Company History and Footprint

How long a broker has been operating is a strong sign of whether it is legitimate. Scam operations are typically short-lived, designed to disappear quickly. OneRoyal's history, spanning nearly two decades as of 2025, shows a sustained business operation.

A Timeline of Growth

The brand's development shows a strategic global expansion supported by obtaining key licenses. This history points to a long-term business plan rather than a temporary fraudulent scheme.

· 2006: The OneRoyal brand is established.

· 2008: Expansion into the Middle East begins with an office in Beirut and a license from the Capital Markets Authority (CMA) of Lebanon.

· 2014: The company opens its Sydney office, securing the prestigious ASIC license.

· 2016: European operations are strengthened with the CySEC license in Cyprus.

· 2020: The broker diversifies its regulatory portfolio with a VFSC license in Vanuatu and an FSA registration in St. Vincent & the Grenadines.

· 2022: A new office is opened in Lagos, Nigeria, showing a focus on the African market.

This timeline, combined with a physical presence in locations, such as Sydney, Limassol and Lagos, establishes OneRoyal as a real global company, not an anonymous web-based operation.

Analyzing Trading Conditions

A common warning sign for scam brokers is offering conditions that are “too good to be true.” We analyzed OneRoyal's account types, leverage, and costs to determine if they align with industry standards or present unrealistic promises. Overall, their offerings are competitive and structured for a wide range of traders.

A Range of Accounts

OneRoyal provides a tiered account structure, serving everyone from complete beginners to professional high-frequency traders. The low minimum deposit of $5* for both the Classic and ECN accounts makes the platform highly accessible.

| Account Type | Minimum Deposit | Spreads From | Commissions | Best For |

| Classic | $5 | 1.4 pips | None | Beginners |

| ECN | $5 | 0.0 pip | $3.5 / round turn lot | Experienced Traders |

| Prime | $5,000 | 0.0 pip | $1.75/ round turn lot | Professional Traders |

The High Leverage Double-Edged Sword

OneRoyal offers leverage up to 1:1000, a major draw for certain trading strategies. However, this is a double-edged sword. While it can increase profits, it can just as quickly increase losses, leading to rapid account depletion.

Importantly, this high leverage is only available to clients registered under the offshore companies (e.g., VFSC or FSA). Clients under the strict oversight of CySEC and ASIC are subject to regulatory leverage caps—typically 1:30 for major forex pairs. This again highlights the critical importance of knowing the regulatory company governing your account, as it directly impacts your trading conditions and risk exposure.

Asset Diversity and Platforms

The broker provides access to over 2000+ trading instruments, including a wide range of forex pairs, indices, stocks, and cryptocurrencies. This diverse offering is delivered on the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

Furthermore, OneRoyal enhances the standard MT4 experience with the “MT4 Accelerator,” a suite of 12 add-on tools for improved trade management and analysis. The integration of reputable third-party tools like Trading Central and social trading via Myfxbook is a further sign of a developed, service-oriented brokerage, not a basic scam setup.

Breaking Down “Scam” Claims

No analysis of OneRoyal's legitimacy is complete without directly addressing the negative user feedback that leads to the “OneRoyal scam” search queries. While the broker holds a respectable 3.5/5 rating on Trustpilot from over 500 reviews, a pattern of specific, serious complaints exists on various forums and review sites that cannot be ignored.

The Critical Complaint: Slippage

The most common and concerning claim against OneRoyal relates to execution quality, specifically abnormal stop-loss slippage. Multiple users have reported instances where their stop-loss orders were triggered at prices significantly worse than requested, sometimes appearing to be hunted or triggered too early, especially during periods of low liquidity or high volatility.

Slippage is a normal market phenomenon where the execution price differs from the requested price. However, repeated, one-sided slippage (where it consistently works against the trader) is a major red flag. It raises serious questions about a broker's liquidity providers, execution engine, and overall transparency. For any trader, but especially for scalpers and day traders, consistent execution quality is essential. This pattern of complaints is the single most significant risk factor identified in our analysis of user feedback.

Analyzing Withdrawal Issues

While less frequent than slippage complaints, there are reports concerning withdrawal delays or complications. More severe claims, visible on some watchdog platforms, include allegations of “AI trading fraud” and accounts being blocked when withdrawal requests are made.

It's important to put these claims in context. They represent a minority of user experiences. However, any complaint involving the inability to access one's funds is extremely serious. A legitimate broker's primary function is to safeguard and return client funds upon request. Even a small number of such complaints can damage trust significantly.

Understanding User Feedback

Every broker with a large client base will accumulate some negative reviews. The key is to differentiate between isolated incidents and consistent patterns. While a single bad review could be due to user error or misunderstanding, a recurring theme of complaints about stop-loss execution across multiple platforms and points to a potential systematic issue over time.

Individual reviews can be subjective, but a pattern of similar complaints across a large user base is a powerful indicator. Aggregator platforms, such as WikiFX, are designed to collect and display user reviews and exposure claims, offering a broader, crowd-sourced view that can help you gauge the severity and frequency of these issues.

Final Verdict: The Scorecard

To summarize our findings, we have rated OneRoyal across four key areas of trust. This scorecard provides a detailed verdict that moves beyond a simple “legit” or “scam” label.

The Scorecard

· Regulation & Security: 8/10

Strong score due to top-tier CySEC and ASIC licenses, backed by FinaCom membership. Points are deducted for the complex structure and the inclusion of high-risk offshore companies that can confuse clients.

· Trading Conditions & Costs: 8/10

Competitive offerings with low minimum deposits, raw spread ECN accounts, and a wide variety of choices for different trader levels. High leverage is a plus for some, though risky.

· Platform & Tools: 8/10

Use of industry-standard MT4/MT5 platforms is solid. The addition of valuable tools like MT4 Accelerator and Trading Central shows investment in the client experience.

· Trust & Transparency: 6/10

This score is significantly lowered due to the serious and recurring user complaints regarding stop-loss execution and excessive slippage. These issues directly undermine a broker's perceived fairness and transparency, which is the foundation of trust.

· Overall Trust Score: 7.5/10

Final Conclusion

OneRoyal is, by all objective measures, a legitimate and long-standing brokerage. It is not a scam. Its foundation is built on nearly 20 years of operation and powerful licenses from CySEC and ASIC. It offers attractive trading conditions with robust platforms.

However, a critical risk exists that cannot be overlooked: persistent and serious user complaints regarding execution quality, particularly stop-loss slippage. This is a fundamental concern that could make the broker unsuitable for traders prioritizing precise execution and absolute trust in their broker's order handling. The complex regulatory structure also places a heavy burden on the trader to ensure they are operating under a top-tier company to receive maximum protection.

Your Final Verification Step

This article has provided a deep analysis based on available data, but the financial markets are dynamic. Broker statuses, user experiences, and regulatory details can change. No single review can replace your own personal research. Therefore, performing an independent check is the final and most crucial step in any OneRoyal scam check or OneRoyal legit investigation.

Before opening an account or depositing funds with any broker, including OneRoyal, your final step should always be to use a comprehensive third-party verification service.

We strongly recommend visiting WikiFX to check the latest, real-time data on OneRoyal's licenses, read the most recent user reviews, and see any exposure claims filed by other traders. This independent check is your best safeguard in making a final, informed decision.

For more exciting forex updates, keep following us on any of these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G.

Read more

Effective Stop Loss Trading Strategies

In a forex market where fundamental and technical factors impact the currency pair prices, volatility is expected. If the price volatility acts against the speculation made by traders, it can result in significant losses for them. This is where a stop-loss order comes to their rescue. It is one of the vital investment risk management tools that traders can use to limit potential downside as markets get volatile. Read on as we share its definition and several strategies you should consider to remain calm even as markets go crazy.

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

80% Plunge In Immigration Is Reshaping Labor Market Math, But AI Wildcard Looms: Goldman

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Rate Calc