Year-End SRF Usage Hits a Record High

Abstract:The Federal Reserves Standing Repo Facility (SRF) saw its usage surge to USD 74.6 billion on the final trading day of 2025, marking an all-time high. At first glance, such a figure may trigger concern

The Federal Reserves Standing Repo Facility (SRF) saw its usage surge to USD 74.6 billion on the final trading day of 2025, marking an all-time high. At first glance, such a figure may trigger concerns about tightening liquidity conditions. However, when viewed in the context of year-end timing, interest rate dynamics, and recent changes to the policy framework, this episode appears less like a stress event and more like a routine, market-initiated pressure test that the Fed successfully absorbed.

First, this development does not point to structural stress within the financial system. Funding conditions typically tighten toward year-end as financial institutions manage regulatory assessments, balance sheet constraints, and year-crossing settlements. In this environment, banks naturally increase their demand for cash. Elevated SRF usage simply reflects a rational liquidity choice: when a readily available facility offers funding at a more attractive price, institutions will use it.

From an interest rate perspective, the surge was not driven by forced borrowing, but by clear arbitrage incentives. As general collateral repo rates climbed to around 3.9%, above the SRF‘s fixed rate of 3.75%, banks predictably shifted toward the Fed. This underscores that the SRF has effectively become a ceiling anchor for short-term rates, validating the Fed’s multi-year effort to redesign its monetary policy operating framework.

More importantly, this episode highlights a structural shift in the Feds role. The central bank is increasingly evolving from a traditional “lender of last resort” into a standing liquidity provider for money markets. In prior cycles, reliance on central bank facilities was often interpreted as a sign of stress. Today, policymakers actively encourage regular and normalized use of the SRF to prevent excessive volatility in market rates. This marks a fundamental change in market psychology, one in which dependence on central bank liquidity support is becoming institutionalized.

That said, risks have not disappeared entirely. Repeated record-high SRF usage, alongside the Feds ongoing short-term Treasury purchases (RMP), also reveals a growing structural reliance by banks on high-quality liquid assets and central bank facilities. Should the Fed materially tighten its balance sheet in the future or reduce its tolerance for liquidity operations, the stability of the front end of the yield curve could once again be tested.

Overall, this “surge” in SRF usage should be viewed as a technical year-end fluctuation, proactively utilized by the market and effectively absorbed by the policy framework, rather than a systemic warning signal. It reinforces a broader message: in a world of high debt and elevated volatility, the Federal Reserve is unlikely to fully exit money markets. Instead, it is increasingly acting as a de facto market maker, a shift with far-reaching implications for rate levels, dollar liquidity, and the pricing of risk assets.

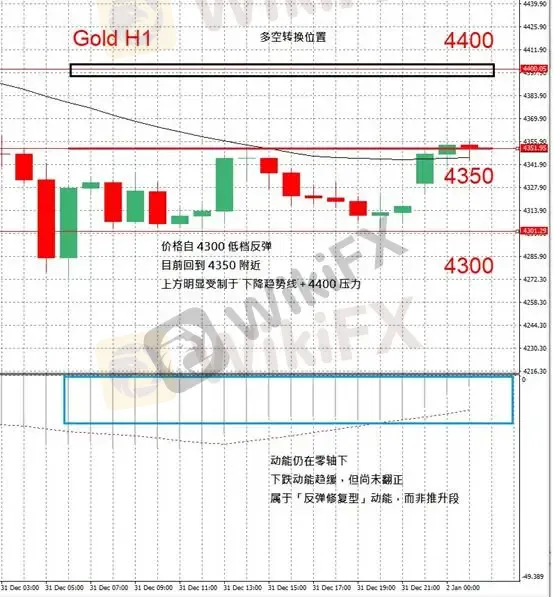

Gold Technical Analysis

The bullish impact of the Feds rate-cut decision has already been largely priced in during the prior advance. In the short term, gold has failed to extend a one-directional rally and has instead entered a consolidation and structural repair phase, where technical factors dominate price action. On the H1 timeframe, the market is clearly in a post-event digestion phase.

H1 Price Structure

Price rebounded from the 4,300 support zone

Currently trading around 4,350

Upside remains capped by a descending trendline and the 4,400 resistance level

MACD Analysis

Momentum remains below the zero line

Bearish momentum is slowing, but has not yet turned positive

This reflects a corrective rebound, not the start of a new impulsive leg higher

Rate cuts set the direction, but price action determines timing.

At this stage, gold is not initiating a new uptrend. It is digesting bullish expectations and rebuilding its technical structure.

Resistance: 4,400 USD/oz

Support: 4,350 / 4,300 USD/oz

Risk Disclosure

The above views, analyses, research, price levels, and other information are provided solely as general market commentary and do not represent the position of this platform. All readers assume full responsibility for their own risk. Please trade with caution.

WikiFX Broker

Latest News

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

SGFX Review 2026: A Trader's Warning on Spectra Global

Is UEXO Legit or a Scam? 5 Key Questions Answered (2025)

Oil Markets: Saudi Price War Signals Oversupply Amidst Venezuelan Chaos

Commodities Super-Cycle: Copper hits Records as Gold Flashes Warning Signs

Velocity Trade Review 2025: Institutional Audit & Risk Assessment

Fed Minutes Expose Policy Rifts: Rare Split Vote Signals Bumpy Path for Dollar

Rate Calc