ZForex Review: Is It Safe for Traders?

Abstract:ZForex Review highlights the lack of regulation, risky leverage, and withdrawal issues reported by traders worldwide.

ZForex Review Overview

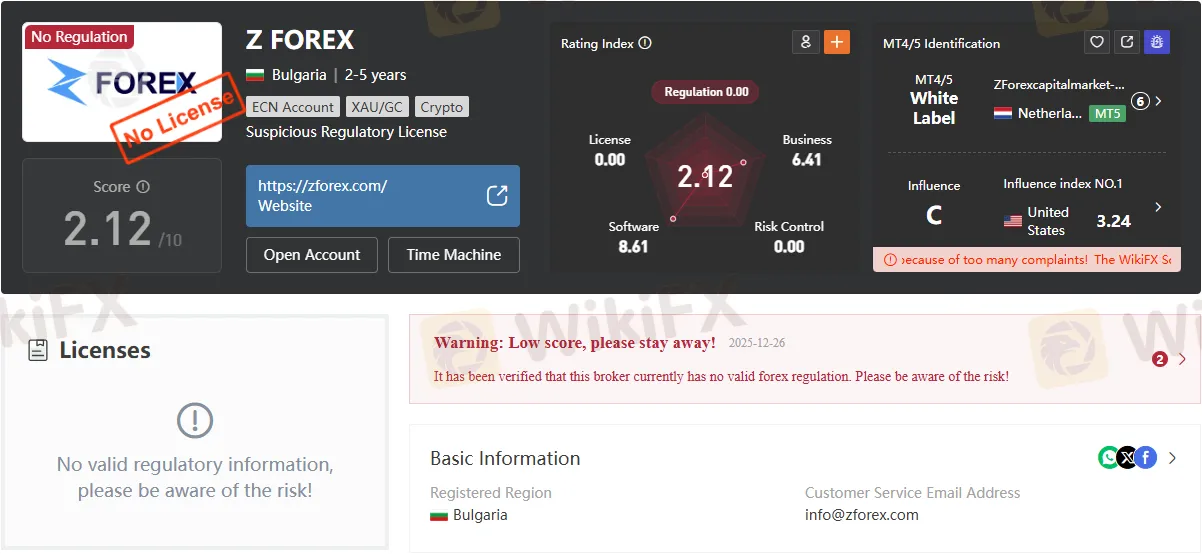

ZForex, founded in 2006 and registered in Bulgaria, presents itself as a multi-asset broker offering forex, stocks, indices, commodities, metals, and cryptocurrencies. Despite its longevity in the market, the broker operates without valid regulatory oversight, a fact confirmed by multiple independent sources. This absence of regulation raises immediate red flags for traders concerned about transparency, fund safety, and dispute resolution.

The brokers official domains include zforex.com and zglobaltrade.com, with servers hosted in the United States and the United Kingdom. While ZForex promotes advanced trading platforms such as MetaTrader 5 (MT5) and cTrader, its operational framework is undermined by questionable licensing claims and a WikiFX score of just 2.12/10, signaling high risk.

Regulation and Licensing Concerns

The most pressing issue in this ZForex Review is the brokers unregulated status. According to WikiFX data “No valid regulatory information, please be aware of the risk!” Traders should note that ZForex has been flagged for suspicious regulatory licenses and operates without oversight from any recognized financial authority.

- Registered Country: Bulgaria

- Regulation: None

- WikiFX Score: 2.12/10

- Risk Control Index: 3.24

In contrast, reputable competitors such as XTB or IG Markets hold licenses from tier-one regulators like the FCA (UK) or CySEC (Cyprus), offering far greater investor protection. ZForexs lack of regulation means clients have no recourse in cases of fraud, withdrawal disputes, or platform manipulation.

Trading Instruments and Platforms

ZForex claims to provide access to a wide range of instruments:

- Forex pairs

- Stocks

- Indices

- Commodities

- Metals

- Cryptocurrencies

- Bonds, options, funds, ETFs

The broker supports MetaTrader 5 (MT5) and cTrader, both recognized platforms in the industry. However, it reveals that ZForex operates white-label servers, which often lack the stability and technical support of fully licensed MT4/MT5 providers. Average execution speed is listed at 184 ms, but without regulatory audits, these figures remain unverifiable.

Account Types and Fees

ZForex offers three live accounts alongside a demo option:

| Account Type | Minimum Deposit | Leverage | Commission | Spread |

| Standard | $10 | 1:1000 | $0 | 1.2 pips |

| ECN | $10 | 1:1000 | $7 Forex / $15 Metals | From 0 pips |

| Swap-Free | $2,500 | 1:500 | $10 Forex / $15 Metals | 0.7 pips |

- Leverage: Up to 1:1000, with dynamic adjustments based on equity tiers.

- Margin Call: 100%

- Stop Out: 30% (50% for Swap-Free accounts)

While the low minimum deposit of $10 may attract beginners, the extremely high leverage exposes traders to significant risk. Competitor brokers typically cap leverage at 1:30 (EU) or 1:50 (US), aligning with regulatory standards to protect retail investors.

Deposits and Withdrawals

The broker advertises same-day withdrawals and multiple payment methods, including credit cards, wire transfers, e-wallets (SticPay, Jeton, Fasapay), and cryptocurrencies. However, user reports series of claims:

- Case 1: A trader reported ZForex withheld $4,000, marking withdrawals as “pending” indefinitely.

- Case 2: Another user stated $3,200 in withdrawals were deducted without explanation.

- Case 3: A Hong Kong-based trader claimed withdrawals had been on hold since October 2024, with accusations of “abuse” used as a pretext to deny payouts.

These cases highlight a pattern of withdrawal issues, undermining ZForexs credibility. By comparison, regulated brokers are required to segregate client funds and process withdrawals transparently.

Pros and Cons

Pros:

- Wide range of trading instruments

- MT5 and cTrader platforms supported

- Low minimum deposit ($10)

- Multiple contact channels (live chat, phone, email, social media)

Cons:

- Unregulated broker with suspicious licensing claims

- High leverage (up to 1:1000) increases risk exposure

- Documented withdrawal disputes and complaints

- Commission fees on ECN and Swap-Free accounts

- Regional restrictions (USA, Turkey, Iran, DPRK, Myanmar)

Domain and Transparency Check

- Primary Domains: zforex.com, zglobaltrade.com

- IP Hosting: United States (23.106.37.153), United Kingdom (104.21.89.108)

- Company Address: Sofia, Bulgaria, Olimpiyska str., SiteGround, Sofia Park, fl. 4, No: 2, post code: 1756

Despite listing a Bulgarian address, the brokers lack of regulatory registration in Bulgaria or the EU raises transparency concerns. Competitors like RaiseFX or Assexmarkets provide verifiable licensing details, which ZForex fails to match.

User Complaints and Exposure Cases

Based on the reported cases recieved, 59 user reviews, with multiple exposures highlighting serious issues:

- Funds withheld despite evidence provided by clients.

- Accounts closed after withdrawal requests.

- Accusations of abuse without proof, used to deny payouts.

These cases align with common warning signs of unregulated brokers: delayed withdrawals, lack of communication, and arbitrary account closures.

Bottom Line: Should Traders Trust ZForex?

This ZForex Review underscores a broker operating outside regulatory frameworks, with a history of withdrawal disputes and unverified licensing claims. While the platform offers attractive features such as MT5 support, diverse instruments, and low entry deposits, these benefits are overshadowed by serious risks.

Traders seeking security and transparency should consider regulated alternatives. Brokers licensed by authorities such as the FCA, ASIC, or CySEC provide far stronger safeguards, including fund segregation, compensation schemes, and audited operations. ZForex, by contrast, remains a high-risk choice with limited accountability.

Final Verdict: ZForex is not safe for traders. The lack of regulation, risky leverage, and repeated withdrawal complaints make it unsuitable for anyone prioritizing fund security and fair trading conditions.

Read more

BlackBull Markets User Reputation: Looking at Real User Reviews and Common Problems to Judge Trust

When traders ask, "Is BlackBull Markets safe or a scam?", they want a simple answer to a hard question. The facts show two different sides. The broker began operating in 2014 and has a strong license from New Zealand's Financial Markets Authority (FMA). It also has an "Excellent" rating on review sites such as Trustpilot. But when searching for "BlackBull Markets complaints," you find many negative user stories, including withdrawal issues and poor trading conditions. This article goes beyond simple "safe" or "scam" labels. We want to carefully look at both the good reviews and common problems, comparing them with how the broker actually works and its licenses. This fact-based approach will give you the full picture of its user reputation, helping you make your own smart decision.

Is BlackBull Markets Legit? An Unbiased 2026 Review for Traders

Is BlackBull Markets legit? Are the "BlackBull Markets scam" rumors you see online actually true? These are the important questions every smart trader should ask before exposing capital to markets. The quick answer isn't just yes or no. Instead, we need to look at the facts carefully. Our goal in this review is to go beyond fancy marketing promises and do a complete legitimacy check. We will examine the broker's rules and regulations, look at its business history, break down common user complaints, and check out its trading technology. This step-by-step analysis will give you the facts you need to make your own smart decision about whether BlackBull Markets is a good and safe trading partner for you.

A Clear BlackBull Markets Review: Trading Conditions, Fees & Platforms Explained

This article gives you a detailed, fair look at BlackBull Markets for 2026. It's written for traders who have some experience and are looking for their next broker. Our goal is to break down what this broker offers and give you facts without taking sides. We'll look at the important things that serious traders care about: how well they're regulated, what trading actually costs, what types of accounts you can get, and how good their technology is. We're not here to tell you to use this broker - we want to give you the facts so that you can decide if it fits your trading style and how much risk you're comfortable with. Making a smart choice means checking things yourself. Before you pick any broker, you need to do your own research. We suggest using websites, such as WikiFX, to check if a broker is properly regulated and see what other users say about it.

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc