Common Questions About InstaForex: Safety, Fees, and Risks (2025)

Abstract:Finding a reliable broker is the most critical step in a trader's journey. With so many platforms promising high returns and low costs, it can be difficult to separate legitimate opportunities from dangerous traps. You are likely here researching InstaForex because their marketing caught your eye, but you want to ensure your capital is safe before depositing 1 cent.

Finding a reliable broker is the most critical step in a trader's journey. With so many platforms promising high returns and low costs, it can be difficult to separate legitimate opportunities from dangerous traps. You are likely here researching InstaForex because their marketing caught your eye, but you want to ensure your capital is safe before depositing 1 cent.

To give you an unbiased look at their current operations, we analyzed the data available on the WikiFX database. Unfortunately, the indicators are worrying. With a low WikiFX Score of 2.31 out of 10, InstaForex is currently flagged with significant trust issues that every potential user needs to understand before opening an account.

Is InstaForex actually regulated?

No, InstaForex does not have a verified, active regulatory license.

According to the latest regulatory data, InstaForex (operating as InstaFinance Ltd) claims to be domiciled in the Virgin Islands, but their status with the Virgin Islands Financial Services Commission (FSC) is listed as “Not Verified” or unauthorized.

Why does “Not Verified” matter?

Regulation is the only safety net a trader has. When a broker is regulated by a competent authority, they are legally required to segregate client funds from company operational funds. This means if the broker goes bankrupt, your money should theoretically remain safe.

An “Unverified” or unregulated status implies:

- No Fund Segregation: The broker could potentially use your deposits to pay their own bills or debts.

- No Dispute Resolution: If they refuse to process a withdrawal, you have no government ombudsman to complain to.

- Operation Risks: Without oversight, the broker makes their own rules regarding slippage, spreads, and leverage abuse.

Official Government Warnings

The regulatory situation for InstaForex is further complicated by official warnings. The Indonesian regulatory body, BAPPEBTI, has placed this entity on a warning list/blocklist (Disclosure code: 202305090812161898). The regulator specifically flagged entities like this for operating without a license and, in some cases, conducting operations that resemble “gambling under the guise of trading.” When a national government blocks a broker's domain to protect its citizens, it is a red flag that international traders should take very seriously.

What problems are users reporting?

While marketing materials often paint a perfect picture, user feedback tells the real story. We have analyzed recent complaints from verified users, and a disturbing narrative has emerged regarding withdrawal refusals and poor trading conditions.

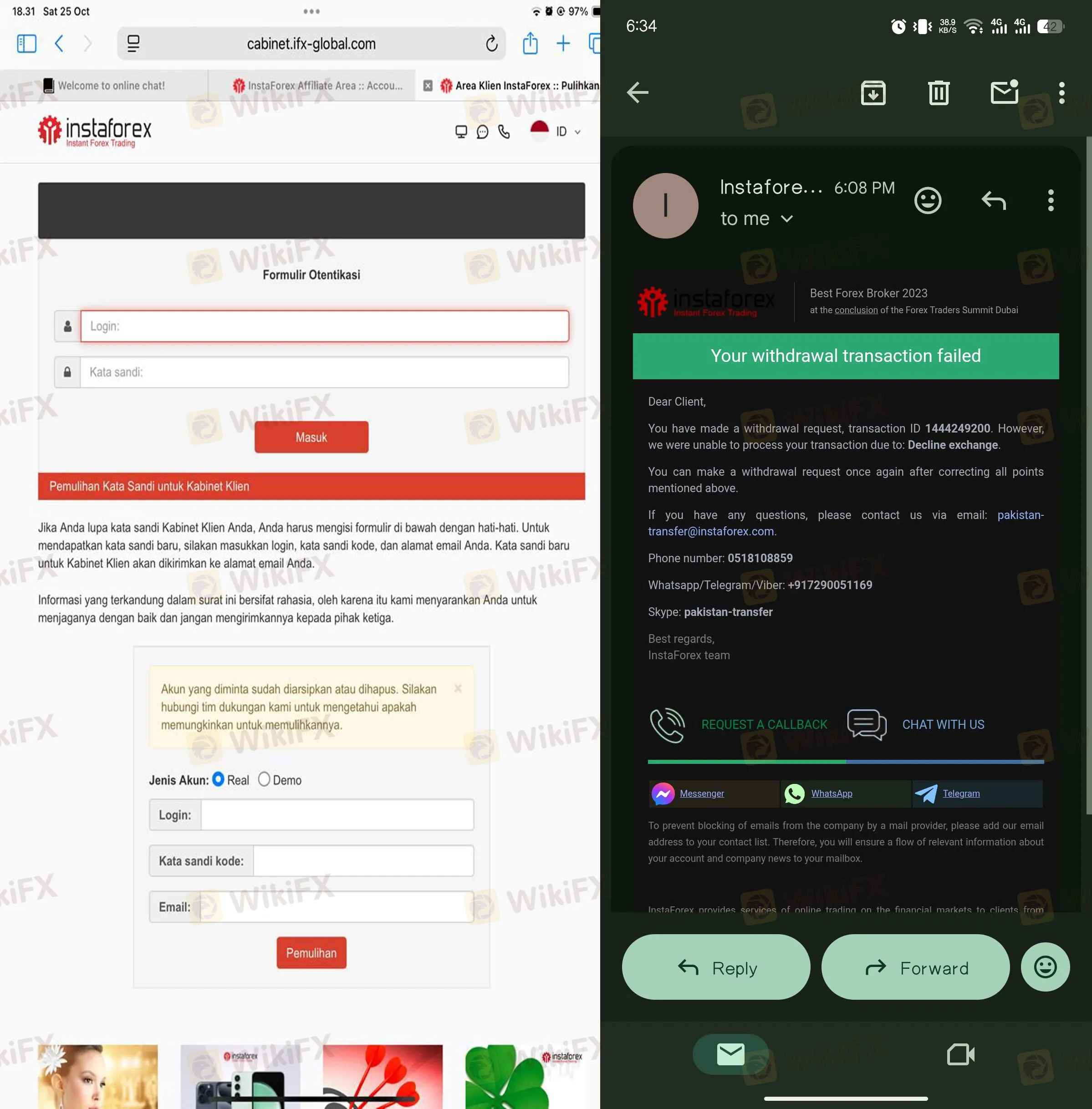

The “Deleted Account” & Withdrawal Nightmare

One of the most concerning reports comes from a user in Indonesia who attempted to use a “No Deposit Bonus” (NDB). After meeting all the lot size requirements and submitting a withdrawal request for $20, the request was canceled. When the user attempted to log in again to resolve the issue, they found their account had been deleted and archived without explanation.

This is a classic tactic used by unreliable platforms: they lure traders in with bonuses, but when it comes time to pay out profits, they simply sever the connection.

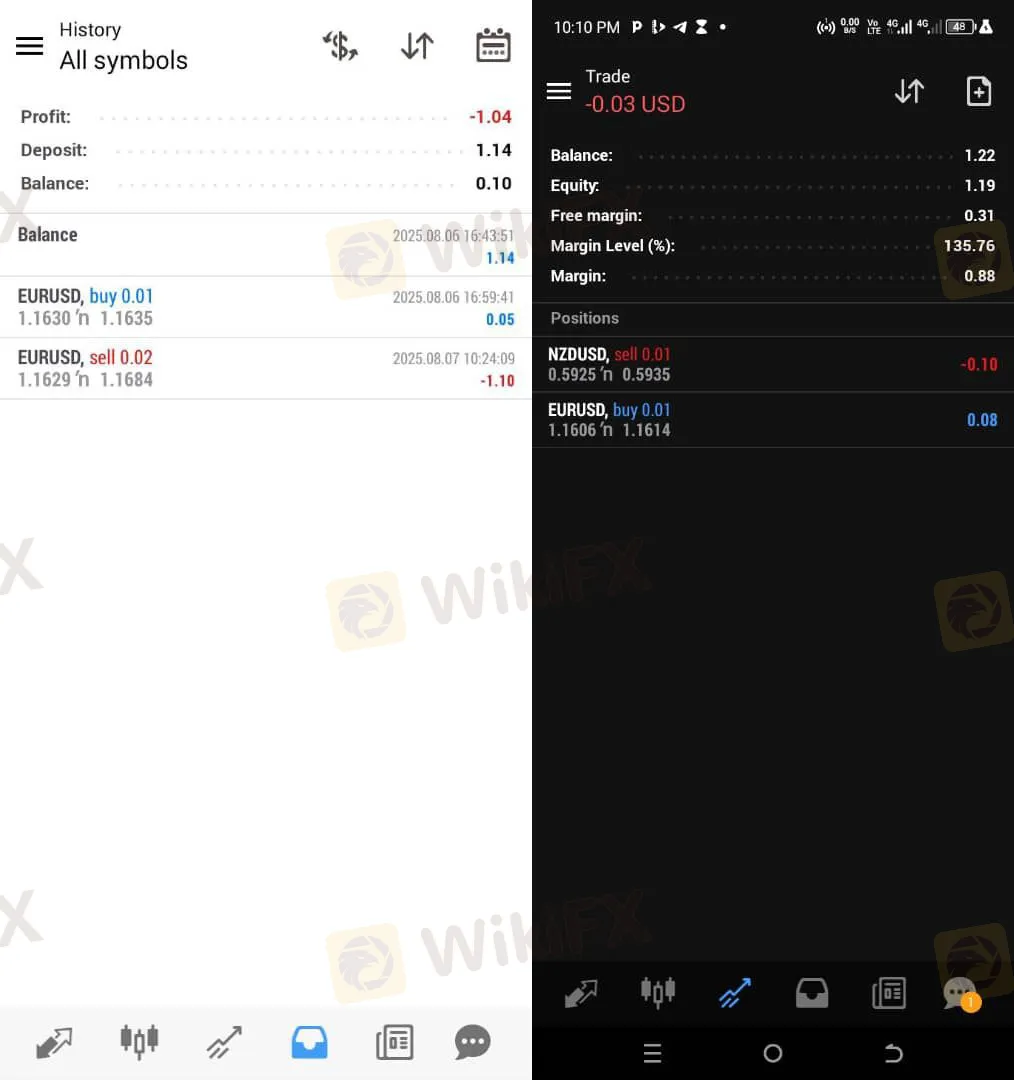

Unusable Spreads and Interfaces

Multiple users from the UK have reported that the trading conditions—specifically the spreads—make it nearly impossible to turn a profit. Traders noted that the spreads were so large that they faced immediate losses upon opening positions. One user mentioned they couldn't even hold a trade for “more than 5 minutes” before the costs ate their equity.

When spreads are artificially high, it suggests the broker might be profiting from your losses (acting as a “B-Book” market maker) rather than genuinely connecting you to the market.

Support That Ghosts You

Feedback from South Africa and New Zealand highlights a “terrible support experience.” Users reported receiving arbitrary decisions without logical explanations. In one instance, a response took 30 minutes in an “emergency” situation, which is unacceptable in the fast-paced world of Forex where seconds can mean the difference between profit and a margin call.

What trading conditions does InstaForex offer?

If you are willing to overlook the safety warnings, it is important to understand the mechanical risks of trading with InstaForex. Their trading conditions are structured in a way that encourages high-risk behavior.

Critical Leverage Risks

InstaForex offers leverage up to 1:1000.

While high leverage is often marketed as a tool to “get rich quick” with a small deposit, visually it functions more like a loan that can wipe out your account instantly. Legitimate regulators (like the FCA in the UK or ASIC in Australia) typically cap leverage at 1:30 for retail traders to protect them. A 1:1000 ratio means a 0.1% move against you can liquidate your entire balance. This level of leverage is almost exclusively found in offshore, unregulated brokerages.

Software and Accessibility

The broker utilizes the MT4 platform and lists a proprietary “self-developed” software. They offer multiple account types, including “Cent.Standard” and “Insta.Raw,” with entry barriers as low as $1.

However, there is a user experience gap here. The system summary notes a regret that the platform does not fully support iOS, Windows, or MacOS applications natively in some contexts, relying heavily on Android or web interfaces. For professional traders who rely on stable desktop environments, this lack of cross-platform robustness is a limitation.

Cost Structure

Although they advertise spreads “from 0” on certain accounts, the user complaints cited earlier suggest the reality is different. The “Standard” accounts show spreads starting from roughly 0.6 pips (or potentially higher depending on market volatility), but the user feedback about “large spreads” suggests that during live trading, these costs may balloon significantly.

Bottom Line: Should you trust InstaForex?

Based on the evidence, we do not recommend trading with InstaForex at this time.

The combination of a low 2.31 score, an unverified regulatory status in the Virgin Islands, and active government blocklists in Indonesia creates a high-risk environment for your funds. The specific user reports of accounts being deleted upon withdrawal requests are particularly damning.

There are hundreds of brokers who hold valid licenses from top-tier authorities like the FCA or ASIC, ensuring your funds are segregated and protected. There is simply no need to take the risk with an unregulated entity.

Markets change fast. Licenses can be revoked or reinstated overnight. To verify the current license status of this broker or to find safer alternatives, search for InstaForex on the WikiFX App.

Read more

TAG MARKETS Review 2026: Allegations of Withdrawal Denials & Trading Glitches

Did your good trading experience with TAG MARKETS reverse when applied for fund withdrawals at the Mauritius-based forex broker? Besides withdrawal denials, did you also witness account blocks or deletions by the broker? Did the broker’s customer support team fail to provide you a proper reason for these trading activities? Have you also witnessed glitches on deposit bonus? These allegations have only grown further in 2026. Read on as we share these allegations in this TAG MARKETS review article.

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Is your trading experience with MYFX markets full of fund withdrawal denials despite repeated communications with its customer support team? Has the broker deleted all your profits? Did the broker accuse you of false trading strategy implementation while deleting your profits? There have been many such instances reported by traders against these activities online. In this MYFX Markets review article, we have shared some complaints. Take a look!

Exfor Exposure: Investigating Alleged Withdrawal Denials, Illegitimate Account Closure & More

Exfor, a Malaysia-based forex broker, has allegedly been the centre of attention for all the wrong reasons. These include long-pending withdrawal denials, no communication or assistance from the broker’s customer support team, manipulated pricing upon a withdrawal request by the trader, and account blowups due to bonus-related issues. It’s the traders who allegedly bear the brunt of all these suspicious trading activities. A lot of them have criticized it on broker review platforms. We have highlighted some of their complaints in this Exfor review article. Take a look!

Axiory Exposed: Low WikiFX Score & Trader Complaints!

Axiory WikiFX score 1.5: Active Belize FSC license (no FX authorization), multiple complaints. Reports show withdrawal/support issues. Traders beware.

WikiFX Broker

Latest News

Najm Capital Ltd: Regulated Forex Broker Strengthens Its Presence in the MENA Online Forex Market

HEADWAY Rebate Service Review 2026: Is this Forex Broker Legit or a Scam?

UAE SCA Rebrands as CMA: What It Means for Forex and CFD Brokers?

OmegaPro Review 2026: Is This Forex Broker Safe?

Legal Headwinds for Tariffs: US States Sue to Block Trump's Trade Agenda

Is Malaysia Losing Control of the Online Scam Economy?

FINRA Fines Altruist Financial $150,000 for Supervisory Failures in Securities Lending Program

Angel One Exposure Review: Low Score & Unregulated Forex Broker Risks

A Complete Xlibre Review: High Leverage and Major Warning Signs to Consider

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Rate Calc