SparkFX Review 2025: Unverified Dubai Claims and Rising Risks in the Arab Market

Abstract:An in-depth review of SparkFX (Score 1.82) investigating claims of a Dubai license, expansion into Arabic markets, and reports of unfair account bans.

Targeting the Arab World Through Aggressive Marketing

In recent months, SparkFX (operating via spkfx.com) has aggressively ramped up its promotional activities, with a noticeable strategic pivot toward Arabic-speaking regions. A review of their social media presence, particularly on Facebook and Telegram, reveals a steady stream of Arabic content designed to attract investors from the Middle East.

However, a significant disconnect exists between this polished marketing façade and the broker's fundamental safety metrics. According to the latest assessment by WikiFX, SparkFX holds a comprehensive score of just 1.82 out of 10. This rating places it firmly in the “Danger” category, signaling that the platform lacks the robust compliance infrastructure required to ensure the safety of client funds.

The Reality Behind the Dubai License Claims

One of the primary selling points for brokers targeting the MENA region is local licensure, which usually offers traders a layer of security and legal recourse. Reports suggest that SparkFX has been positioning itself as a licensed entity in Dubai to gain credibility with its new audience.

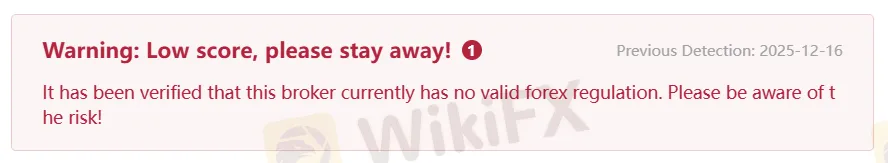

Verification efforts paint a concerning picture. There are no public records linking SparkFX to a valid license from the Dubai Financial Services Authority (DFSA) or other reputable UAE regulatory bodies. WikiFX data reinforces this by showing a score of 0.00 for both the Regulation and License indices. The system has issued a specific warning stating that the broker currently has “no valid forex regulation,” suggesting that any claims of Dubai licensure are unsubstantiated and effectively leave investors without legal protection.

Account Suspensions Caused by Multiple Device Usage

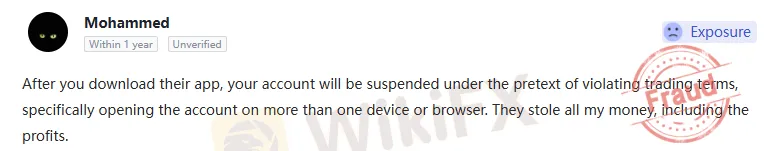

Beyond the regulatory vacuum, the practical experience of traders on the platform raises serious questions about operational fairness. A particularly troubling complaint comes from a user named Mohammed, whose experience highlights how restrictive terms can be used to freeze capital.

Mohammed reported that his trading account was suspended shortly after he downloaded the broker's app. When he sought an explanation, SparkFX support cited a violation of trading terms, specifically accusing him of “opening the account on more than one device or browser.” In the modern financial landscape, accessing a trading account via both a smartphone and a laptop is a standard practice for nearly every trader. Using such a common workflow as a justification to suspend an account—and seize both the principal and profits—indicates a trading environment where the odds may be stacked against the client.

Final Verdict and Safety Recommendations

The evidence surrounding SparkFX paints a clear picture of a high-risk entity. The combination of a low safety score, lack of verifiable regulation, and documented instances of unfair account closures suggests significant danger for retail investors.

Traders are strongly advised to approach this platform with extreme caution. The risk of capital loss due to regulatory loopholes or arbitrary policy enforcement is high. The safest course of action is to choose brokers that hold verified licenses from recognized Tier-1 authorities to ensure your funds are protected by law.

Read more

BlackBull Markets User Reputation: Looking at Real User Reviews and Common Problems to Judge Trust

When traders ask, "Is BlackBull Markets safe or a scam?", they want a simple answer to a hard question. The facts show two different sides. The broker began operating in 2014 and has a strong license from New Zealand's Financial Markets Authority (FMA). It also has an "Excellent" rating on review sites such as Trustpilot. But when searching for "BlackBull Markets complaints," you find many negative user stories, including withdrawal issues and poor trading conditions. This article goes beyond simple "safe" or "scam" labels. We want to carefully look at both the good reviews and common problems, comparing them with how the broker actually works and its licenses. This fact-based approach will give you the full picture of its user reputation, helping you make your own smart decision.

Is BlackBull Markets Legit? An Unbiased 2026 Review for Traders

Is BlackBull Markets legit? Are the "BlackBull Markets scam" rumors you see online actually true? These are the important questions every smart trader should ask before exposing capital to markets. The quick answer isn't just yes or no. Instead, we need to look at the facts carefully. Our goal in this review is to go beyond fancy marketing promises and do a complete legitimacy check. We will examine the broker's rules and regulations, look at its business history, break down common user complaints, and check out its trading technology. This step-by-step analysis will give you the facts you need to make your own smart decision about whether BlackBull Markets is a good and safe trading partner for you.

A Clear BlackBull Markets Review: Trading Conditions, Fees & Platforms Explained

This article gives you a detailed, fair look at BlackBull Markets for 2026. It's written for traders who have some experience and are looking for their next broker. Our goal is to break down what this broker offers and give you facts without taking sides. We'll look at the important things that serious traders care about: how well they're regulated, what trading actually costs, what types of accounts you can get, and how good their technology is. We're not here to tell you to use this broker - we want to give you the facts so that you can decide if it fits your trading style and how much risk you're comfortable with. Making a smart choice means checking things yourself. Before you pick any broker, you need to do your own research. We suggest using websites, such as WikiFX, to check if a broker is properly regulated and see what other users say about it.

SGFX User Reputation: Is it Safe or a Scam? A Detailed Look at User Complaints

The most important question any trader can ask is whether a broker is legitimate. Recently, SGFX, also called Spectra Global, has been mentioned more often, leading to many questions: Is SGFX Safe or Scam? Is it a safe platform for your capital, or is it another clever online scam? This article will give you a clear, fact-based answer to that question. Read on!

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc