GFS Exposed: The "Australian" Broker Trap Draining Traders' Capital

Abstract:In the complex world of online trading, a broker's regulatory status is the only safety net standing between a trader and financial ruin. Our investigation into GFS reveals a disturbing disconnect between its marketing claims and its operational reality. With a WikiFX Score of only 1.55/10, GFS lacks valid regulation and has been flagged for severe issues ranging from exorbitant hidden fees to the sudden deletion of client accounts. This report exposes the mechanisms used to trap investor funds.

Abstract

In the complex world of online trading, a broker's regulatory status is the only safety net standing between a trader and financial ruin. Our investigation into GFS reveals a disturbing disconnect between its marketing claims and its operational reality. With a WikiFX Score of only 1.55/10, GFS lacks valid regulation and has been flagged for severe issues ranging from exorbitant hidden fees to the sudden deletion of client accounts. This report exposes the mechanisms used to trap investor funds.

Disclaimer

All cases cited in this report are based on authentic user complaints and regulatory data recorded by WikiFX. To protect the privacy of the individuals involved, the identities of the traders have been anonymized.

The “Cost of Business”: A Mathematical Trap

Complaints from traders in Malaysia and China have highlighted a systematic “fee trap.” One investor detailed a harrowing experience where the cost of trading made profitability mathematically impossible. According to the user's report, GFS charged a staggering $50 USD commission per lot. Furthermore, the spread—the difference between the buy and sell price—was inflated to 0.07 basis points (roughly 7 pips on major pairs, whereas the industry standard is often below 1.5 pips).

The financial damage is compounded by questionable exchange rates. Another trader reported depositing via USDT (Tether), only to find that GFS had disabled USDT withdrawals, forcing a conversion to local currency. This authorized conversion applied an exchange rate 7.6% below the market rate, effectively seizing a significant portion of the principal immediately. When these hidden costs are combined with the high spreads, traders are effectively starting every position with a massive deficit.

The “Maintenance” Excuse: Withdrawal Paralysis

While high fees are damaging, the complete inability to access funds is the most critical risk factor identified in our investigation. A pattern has emerged across multiple regions—including Vietnam, South Africa, and Malaysia—where GFS utilizes technical “maintenance” as a pretext to withhold funds.

A striking case from a South African trader illustrates this tactic perfectly. The trader deposited funds using Neteller without issue. However, when attempting to withdraw via the same method, the option was removed. Customer support claimed that Neteller withdrawals were “temporarily suspended due to maintenance,” yet the platform continued to accept deposits via Neteller. This one-way street—where money flows in easily but cannot flow out—is a classic hallmark of high-risk platforms.

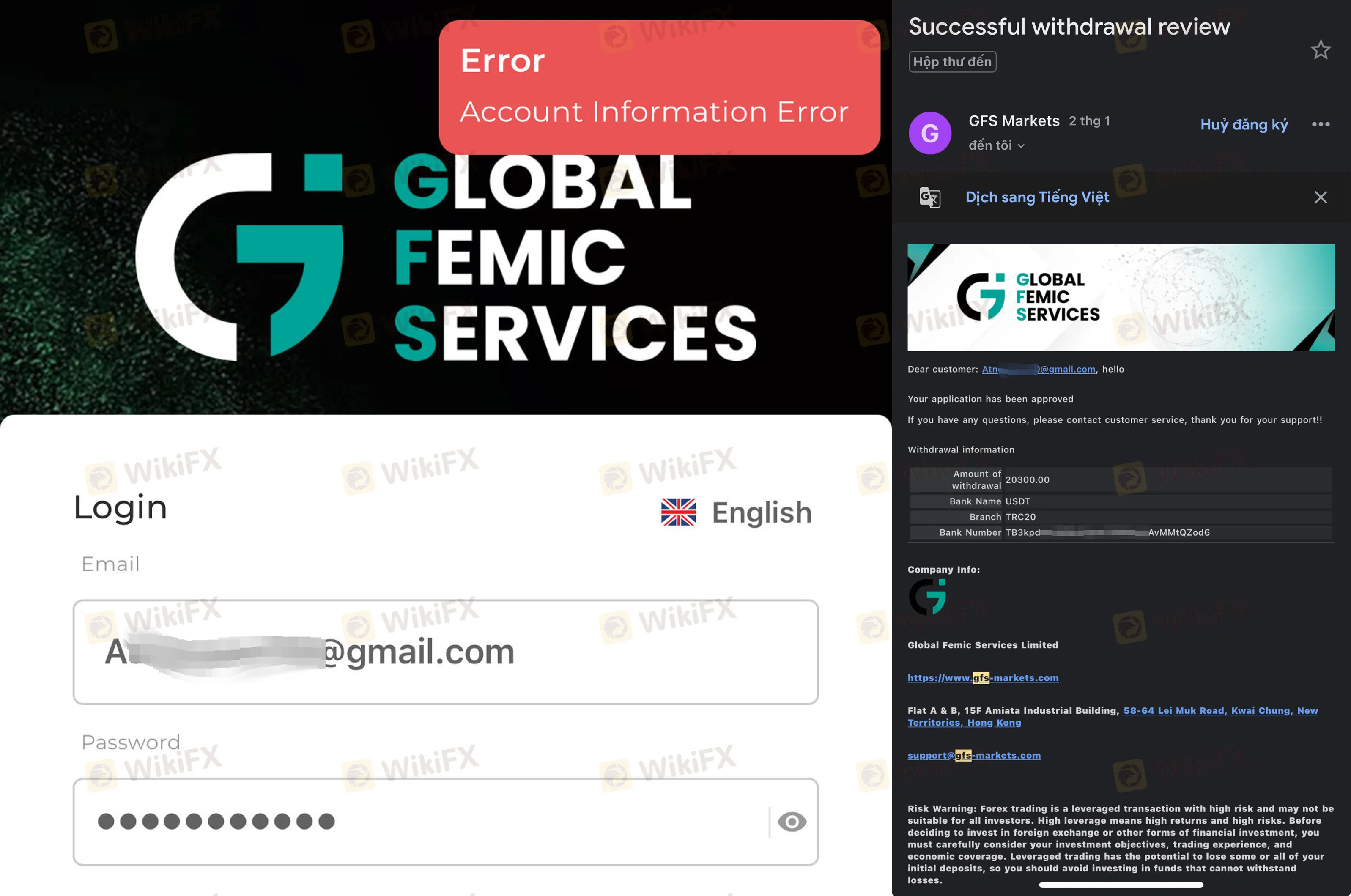

In Vietnam, the situation is equally grim. One user received an official notification from the GFS team stating that their withdrawal had been “successfully processed.” However, the blockchain data tells a different story: the USDT never arrived in the user's wallet. When pressed, the broker shifted the narrative, blaming the delay on the Lunar New Year holiday. Weeks passed after the holiday concluded, yet the funds remained missing, and emails to support went unanswered.

The Silence Protocol: Deletion and Denial

Perhaps the most alarming behavior exhibited by GFS is its reaction to scrutiny. Legitimate financial institutions have dispute resolution processes; GFS appears to have a “deletion protocol.”

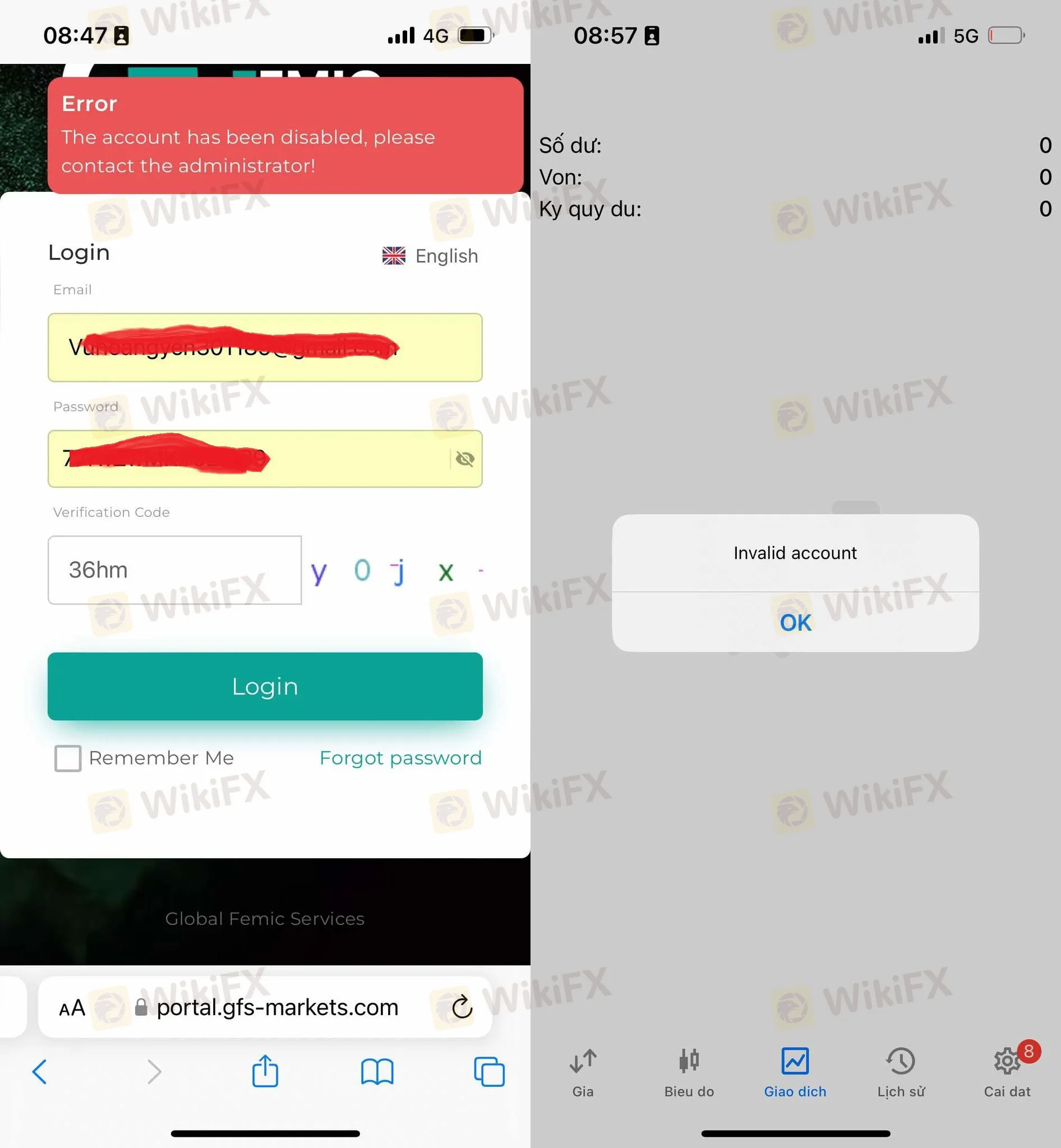

A trader from Norway reported a chilling experience after questioning the platform's integrity. After experiencing connection issues with the MetaTrader 5 (MT5) platform, the user contacted customer service. Frustrated by the lack of response, the user explicitly asked if the platform was a scam. The following day, without warning or explanation, their account was deactivated and locked. This retaliation effectively severed the trader's access to their invested capital.

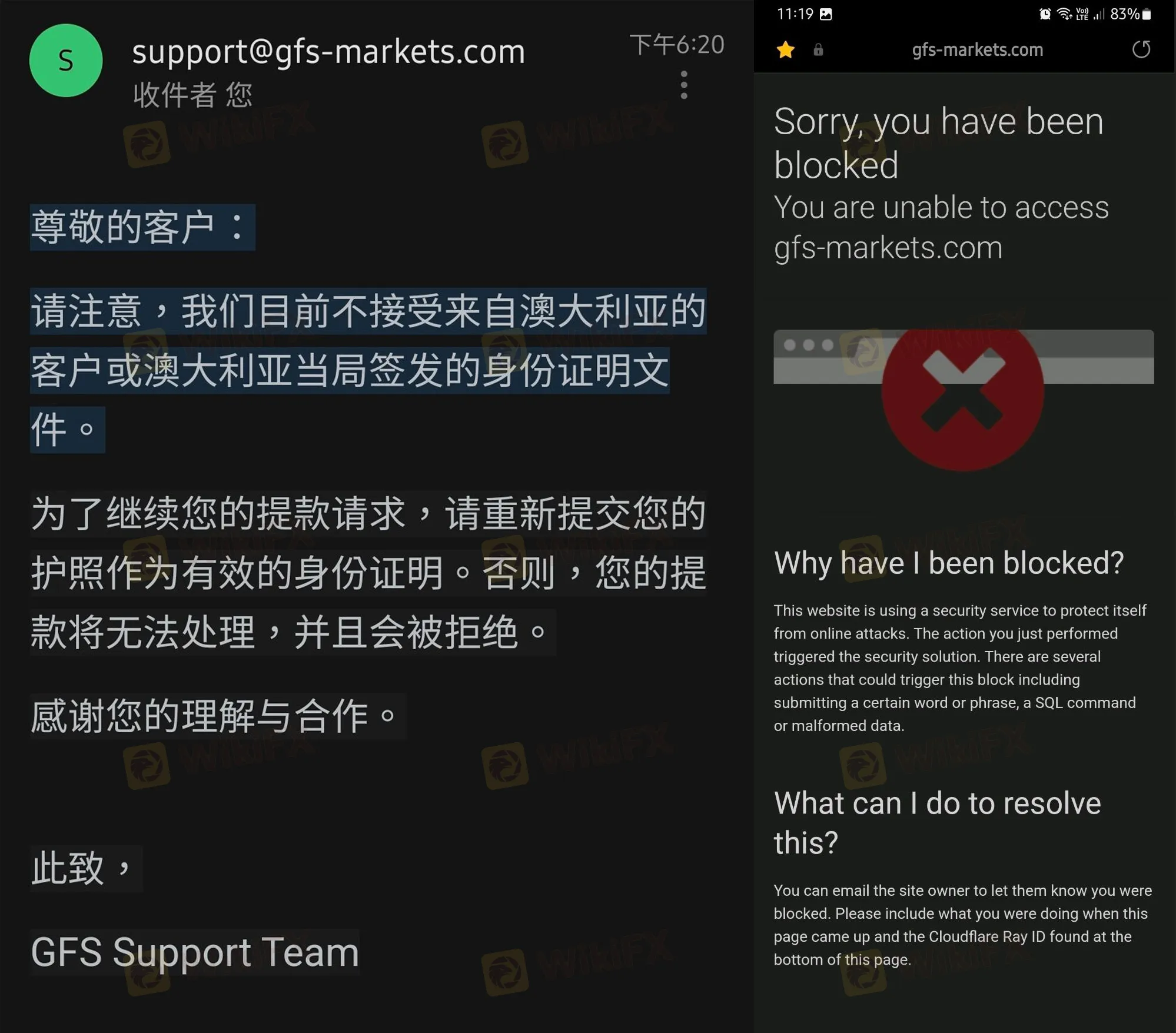

Ironically, despite claiming to be an Australia-based broker, GFS has begun blocking Australian users. A trader based in Australia reported that the website became inaccessible, and support claimed they “currently do not accept Australian KYC documents.” This is highly irregular for a company that lists its headquarters in Australia. It strongly suggests that GFS is attempting to avoid the scrutiny of the Australian Securities and Investments Commission (ASIC) by purging clients who fall under that jurisdiction.

The “Introduction” Scam: Fake Gurus and Signal Groups

Our analysis of the complaint text reveals a coordinated effort to lure inexperienced traders into the GFS ecosystem. Multiple reports from Asia describe “competitions” and “training classes” hosted by so-called investment teachers (referred to as “Jingcheng,” “Qingyun,” and “Jianghe”).

These figures urge followers to vote for them in trading competitions and eventually funnel them into opening GFS accounts. Once inside, followers are given trading signals that often lead to heavy losses or liquidation (margin calls). The combination of bad advice and the previously mentioned high commissions ($50/lot) suggests that these “teachers” may be acting as Introducing Brokers (IBs) who profit from the confused traders' trading volume or losses.

Regulatory Reality Check

Marketing materials often use vague language to imply safety. GFS claims to be founded in 2019 and headquartered in Australia. However, for a broker to operate legally from Australia, it must hold an Australian Financial Services License (AFSL) issued by ASIC.

WikiFXs database confirms that GFS holds no such license.

Below is the verified regulatory status of GFS:

| Regulator Name | License Type | Current Status |

|---|---|---|

| None | N/A | Unregulated / No License |

| Australia (Claimed) | N/A | Unregulated |

The data confirms that GFS is an unregulated entity. It is not overseen by the FCA (UK), ASIC (Australia), or any tier-1 regulatory body. This means that when GFS blocks a withdrawal or deletes an account, traders have no legal recourse and no government ombudsman to appeal to.

Conclusion

The evidence against GFS is multifaceted and damning. From the manipulative “maintenance” excuses preventing withdrawals in South Africa to the retaliatory account closures in Europe and the predatory fee structures in Asia, the pattern is consistent.

GFS appears to operate with a singular goal: the absorption of client funds with no intention of returning them. The platforms low WikiFX score of 1.55 reflects this reality. We strongly advise all traders to avoid depositing funds with GFS. For those already involved, immediate withdrawal attempts are recommended, though the likelihood of success may be low given the documented behavior.

WikiFX Risk Warning

Trading forex and leveraged financial instruments involves a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your initial investment.

Data and regulatory status mentioned in this article are accurate as of the time of publication based on the WikiFX database.

Read more

Tradeview Markets Investigation: The "Negative Balance" Raid and Coercive Tactics Uncovered

In the world of online trading, trust is the currency that matters most. However, recent data aggregation by WikiFX has signaled a "level red" alert regarding Tradeview Markets. Between July and November 2025, our support center was flooded with complaints alleging that the broker unilaterally wiped out account balances under the guise of "negative balance reversal," while simultaneously employing "account deletion" tactics in Asian markets. This report investigates the alarming patterns behind these complaints and analyzes why existing regulations failed to protect these traders.

Is ZarVista Legit? A Critical Review of Its Licenses and Red Flags

For traders asking, "Is ZarVista legit?", the evidence points to a clear and strong conclusion: ZarVista operates as a high-risk broker. While it shows a modern interface and different account types, these features are overshadowed by major weaknesses in how it is regulated, a history of legal problems, and many user complaints. This article will break down these issues to give you a complete view of the risks involved. Our analysis shows that the chance of losing capital when dealing with ZarVista is very high. The combination of weak overseas licensing and documented problems creates a situation where trader funds are not properly protected.

FIBOGROUP Investigation: When Revoked Licenses Meet Malicious Liquidation

In the high-stakes world of forex trading, regulatory status and execution quality are the bedrock of trust. However, our latest investigation into FIBOGROUP reveals a troubling disconnect between their marketing claims and the reality faced by traders. With key licenses from the UK’s FCA and Cyprus’s CySEC currently listed as Revoked, and a surge in complaints regarding malicious liquidations and vanishing withdrawal options, the safety of client funds is in question. This report dissects the evidence to determine if FIBOGROUP remains a viable option for investors.

Titan Capital Markets: The "Token" Trap Hiding Behind a Forex Mask

Titan Capital Markets presents itself as a sophisticated Australian Forex broker offering AI-driven trading. However, a deep dive into recent trader activity exposes a disturbing pivot: the forced conversion of liquid funds into illiquid "tokens," aggressive demands for "tax" payments to unlock withdrawals, and a severe regulatory blacklisting from the Philippines Securities and Exchange Commission (SEC). This report uncovers why funds deposited here may never come back.

WikiFX Broker

Latest News

Titan Capital Markets: The "Token" Trap Hiding Behind a Forex Mask

Stop Trading: Why "Busy" Traders Bleed Their Accounts Dry

Stop Chasing Green Arrows: Why High Win Rate Strategies Are Bankrupting You

Should You Delete Every Indicator from Your Charts? Let’s Talk Real Trading

Is ZarVista Legit? A Critical Review of Its Licenses and Red Flags

Scam Victims Repatriated: Malaysia Thanks Thailand’s Crucial Help

Why You’re a Millionaire on Demo but Broke in Real Life

Cabana Capital Review 2025: Safety, Features, and Reliability

XTB Review 2025: Pros, Cons and Legit Broker?

The Copycat Trap: Why You Lose Money Using a "Winning" Strategy

Rate Calc